Market brief 26/07/2023

VIETNAM STOCK MARKET

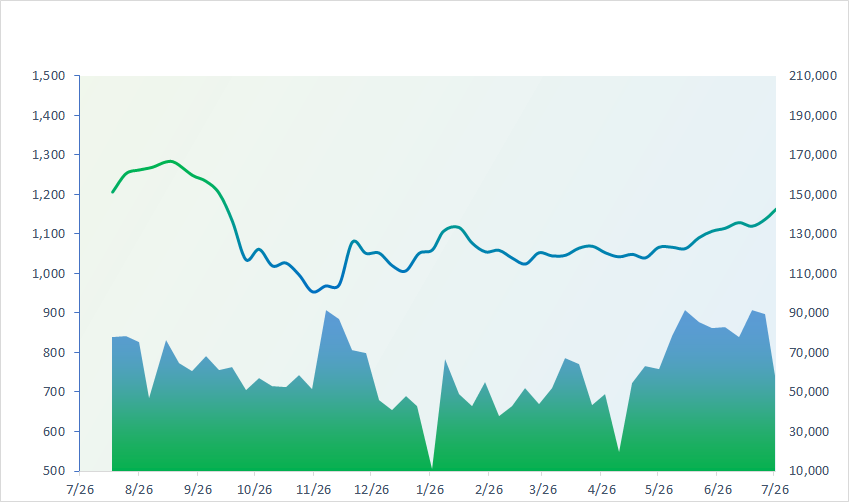

1,200.84

1D 0.41%

YTD 19.24%

1,201.43

1D 0.29%

YTD 19.52%

236.20

1D -0.31%

YTD 15.05%

88.60

1D 0.02%

YTD 23.66%

398.54

1D 0.00%

YTD 0.00%

21,041.80

1D -8.03%

YTD 144.22%

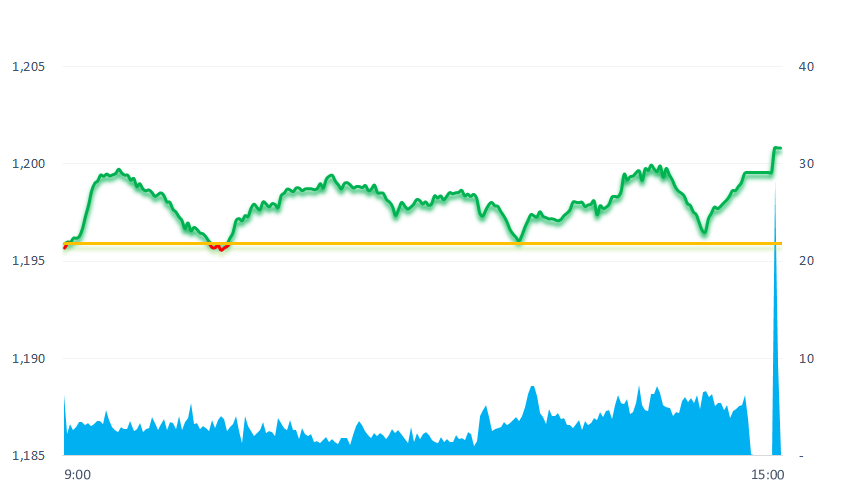

Today, the stock market had an optimistic session when it continued to open in green. During the session, there was a time when the market struggled and pulled the index below reference level but the cash inflow helped the index recover and reach 1,200 points.

ETF & DERIVATIVES

20,550

1D 0.24%

YTD 18.58%

14,200

1D 0.07%

YTD 19.13%

14,750

1D 0.20%

YTD 18.19%

18,280

1D 0.44%

YTD 30.11%

18,450

1D 0.38%

YTD 28.57%

26,100

1D 0.04%

YTD 16.52%

15,600

1D 0.06%

YTD 20.46%

1,197

1D 0.25%

YTD 0.00%

1,195

1D 0.08%

YTD 0.00%

1,185

1D 0.01%

YTD 0.00%

1,183

1D 0.07%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

0

1D 32652.5

YTD 9.1885E-05

0

1D 3223.03

YTD -0.002627247

0

1D 10968.98

YTD -0.004746268

0

1D 19365.14

YTD -0.00333865

0

1D 2592.36

YTD -0.016726975

0

1D 66707.2

YTD 0.005297057

0

1D 3304.96

YTD 0.005720963

0

1D 1524.59

YTD -0.001120356

0

1D 82.75

YTD -0.00072455

0

1D 1971.15

YTD 0.003916555

Asian stocks continued to be mixed when the US Federal Reserve (Fed) is expected to announce the results of its meeting later today. Optimism about more stimulus measures in China seems to have passed, as markets suffered profit-taking after yesterday's strong rally.

VIETNAM ECONOMY

0.24%

1D (bps) -1

YTD (bps) -473

6.30%

YTD (bps) -110

1.90%

YTD (bps) -289

2.43%

1D (bps) -3

YTD (bps) -247

23,885

1D (%) 0.17%

YTD (%) 0.53%

26,677

1D (%) -0.97%

YTD (%) 3.97%

3,380

1D (%) -0.03%

YTD (%) -3.01%

Deputy Governor of the State Bank (SBV) Dao Minh Tu said that credit growth in the first six months of the year was lower than the same period in previous years, reaching about VND12.5 million billion, up 4.73% compared to the end of 2022.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Deputy Governor: The bank still has excess money and will further reduce interest rates;

- Singapore's National Investment Fund wants to pour more capital into Vietnam;

- The US Department of Commerce has concluded that Vietnamese auto tire exporters do not receive subsidies from the Government;

- Germany spends 20 billion euros on the chip industry;

- The US wants to "open up" the aluminum and steel agreement with the EU;

- Putin plans to visit China in October.

VN30

BANK

93,400

1D 1.85%

5D 3.58%

Buy Vol. 1,826,064

Sell Vol. 1,531,813

47,350

1D 0.42%

5D 2.38%

Buy Vol. 3,844,729

Sell Vol. 4,645,600

29,800

1D -0.33%

5D -0.33%

Buy Vol. 9,125,988

Sell Vol. 12,889,037

33,450

1D -0.15%

5D 3.56%

Buy Vol. 7,494,365

Sell Vol. 7,915,543

21,850

1D 0.00%

5D 5.81%

Buy Vol. 28,714,816

Sell Vol. 33,081,824

18,750

1D -0.27%

5D 1.90%

Buy Vol. 11,169,159

Sell Vol. 17,898,024

17,200

1D 0.00%

5D 2.08%

Buy Vol. 4,797,954

Sell Vol. 4,804,067

18,800

1D -1.05%

5D 0.53%

Buy Vol. 10,284,643

Sell Vol. 14,646,925

28,300

1D -0.70%

5D 0.18%

Buy Vol. 27,547,114

Sell Vol. 31,029,099

20,800

1D -0.72%

5D 1.22%

Buy Vol. 4,445,720

Sell Vol. 6,684,657

22,300

1D 0.00%

5D 1.36%

Buy Vol. 11,298,612

Sell Vol. 16,962,059

TCB: By the end of June, TCB's total assets reached VND732,500 billion, up 1.2% compared to the end of last year. Credit and deposit growth reached 8.5% and 6.6% respectively compared to the beginning of the year. CAR according to Basel II was at 15.1%. Customer's deposit balance reached VND381,900 billion, up 18.8% over the same period last year. In which, CASA balance reached VND133,400 billion, up 7.5% QoQ, and up 12.6% YoY in 2022.

REAL ESTATE

17,200

1D 6.17%

5D 17.01%

Buy Vol. 175,444,343

Sell Vol. 131,252,091

78,400

1D 0.51%

5D -2.12%

Buy Vol. 251,047

Sell Vol. 169,951

21,550

1D 0.94%

5D 14.63%

Buy Vol. 41,744,405

Sell Vol. 28,562,871

NVL: NVL proposed to research, make planning ideas and report on investment proposals for Dak Long Thuong lake project with a scale of about 30,000ha, total investment of about USD10 billion.

OIL & GAS

98,200

1D -0.61%

5D -0.71%

Buy Vol. 842,186

Sell Vol. 816,409

13,550

1D 2.26%

5D 1.88%

Buy Vol. 65,155,292

Sell Vol. 53,290,085

40,500

1D 0.50%

5D 1.00%

Buy Vol. 1,932,583

Sell Vol. 2,893,571

Oil prices rose to a three-month high on Tuesday (July 25), as signs of tight supply and the Chinese government's pledge to revive the economy boosted market sentiment.

VINGROUP

51,000

1D -0.97%

5D -2.11%

Buy Vol. 6,491,113

Sell Vol. 6,910,302

59,000

1D 0.68%

5D 0.85%

Buy Vol. 4,093,000

Sell Vol. 4,370,167

28,900

1D -0.34%

5D 3.40%

Buy Vol. 5,277,051

Sell Vol. 9,398,844

VIC: On July 25, 2023, Vingroup signed a MOU to invest in resort, entertainment and entertainment complex projects in Long An province.

FOOD & BEVERAGE

75,000

1D 0.67%

5D 3.31%

Buy Vol. 5,842,998

Sell Vol. 6,057,738

84,600

1D 1.44%

5D 4.70%

Buy Vol. 2,949,978

Sell Vol. 3,206,294

161,600

1D 2.28%

5D 5.76%

Buy Vol. 552,995

Sell Vol. 542,219

VNM: VNM's CEO said that changing the brand identity is an effort to reposition, marking the first step in the process of modernizing the user experience and creating a breakthrough in the future.

OTHERS

46,650

1D -0.53%

5D -0.53%

Buy Vol. 1,685,474

Sell Vol. 1,598,114

96,500

1D -0.62%

5D -0.21%

Buy Vol. 1,039,157

Sell Vol. 1,204,824

82,700

1D 1.72%

5D 5.35%

Buy Vol. 2,163,611

Sell Vol. 2,078,200

52,600

1D -1.87%

5D 8.45%

Buy Vol. 9,547,291

Sell Vol. 10,073,262

21,600

1D -0.92%

5D -0.46%

Buy Vol. 3,894,111

Sell Vol. 4,555,388

29,000

1D 0.69%

5D 1.75%

Buy Vol. 24,964,155

Sell Vol. 25,645,450

28,400

1D 0.53%

5D 3.65%

Buy Vol. 36,823,573

Sell Vol. 37,467,350

VJC: VJC has just approved the bond issuance plan. Accordingly, VJC will issue 20,000 bonds with a par value of VND100 million/bond, equivalent to the total issuance value of VND2,000 billion. The purpose of the issuance is to implement the program to pay operating expenses for fuel, port, flight management, engineering, salary, insurance, aircraft deposit payment and other expenses.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

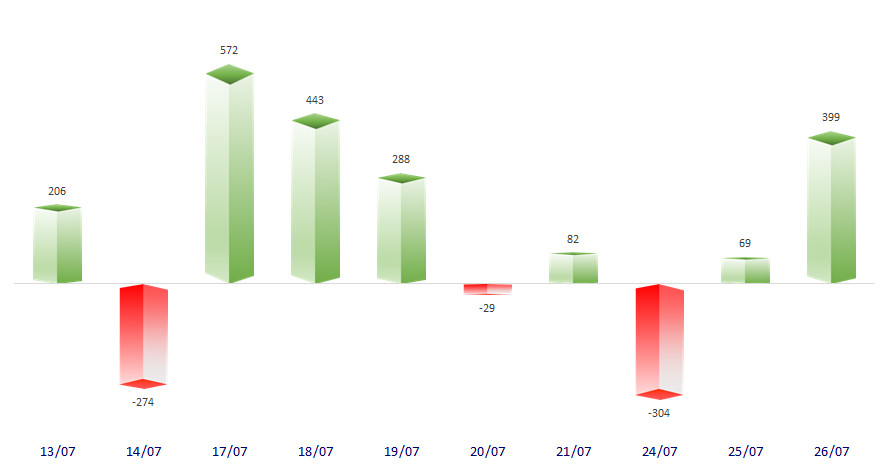

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

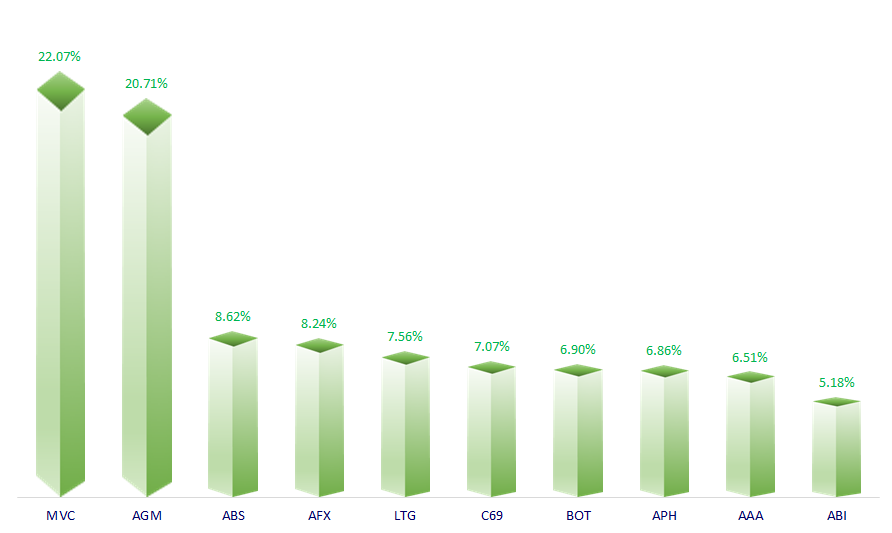

TOP INCREASES 3 CONSECUTIVE SESSIONS

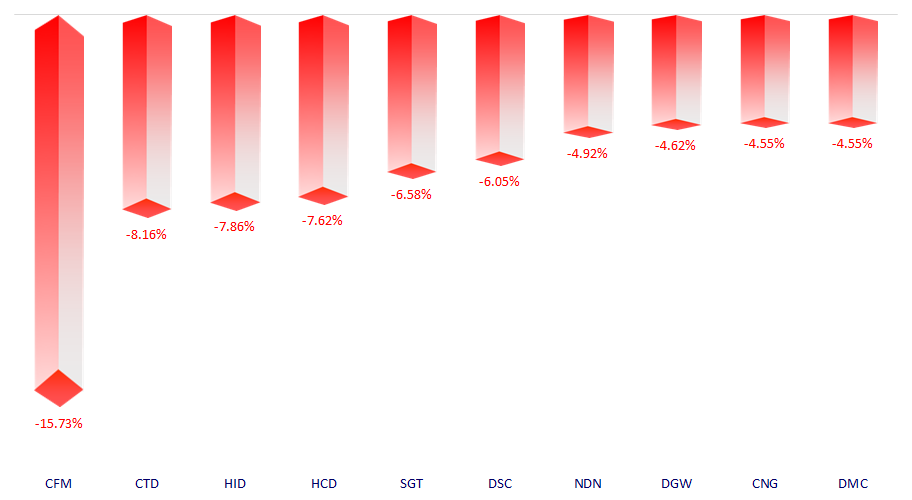

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.