Market brief 01/08/2023

VIETNAM STOCK MARKET

1,217.56

1D -0.44%

YTD 20.90%

1,222.18

1D -0.70%

YTD 21.59%

239.35

1D -0.08%

YTD 16.58%

90.21

1D 0.96%

YTD 25.90%

-1,456.69

1D 0.00%

YTD 0.00%

32,446.72

1D 18.78%

YTD 276.59%

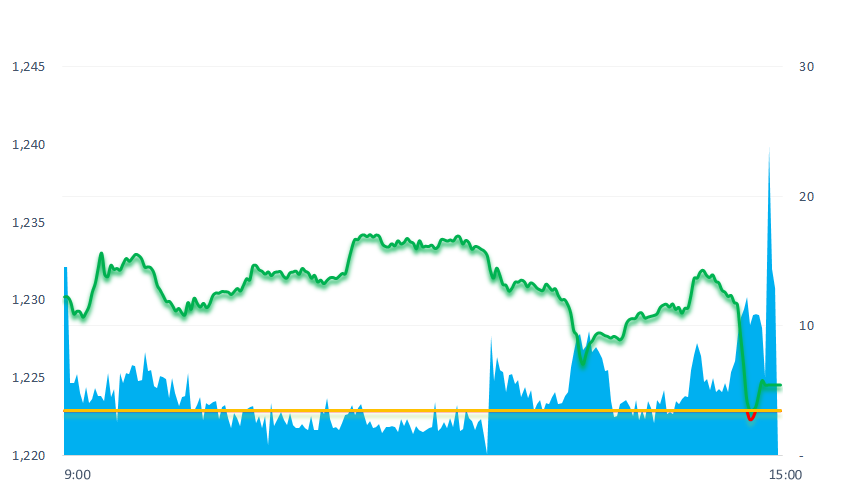

Today, the stock market continued to gain in excitement during most of the session. However, after 14:30, selling pressure suddenly increased, pulled the index down and closed in red. Market liquidity remained high with trading volume and value of 1.3 billion shares and VND26,400 billion on HSX, respectively.

ETF & DERIVATIVES

21,020

1D -0.85%

YTD 21.29%

14,450

1D -0.96%

YTD 21.22%

15,110

1D -0.72%

YTD 21.07%

19,150

1D -0.78%

YTD 36.30%

18,790

1D 0.00%

YTD 30.94%

26,310

1D -2.16%

YTD 17.46%

15,990

1D 0.44%

YTD 23.47%

1,220

1D -1.15%

YTD 0.00%

1,225

1D -0.45%

YTD 0.00%

1,221

1D -0.74%

YTD 0.00%

1,216

1D -0.52%

YTD 0.00%

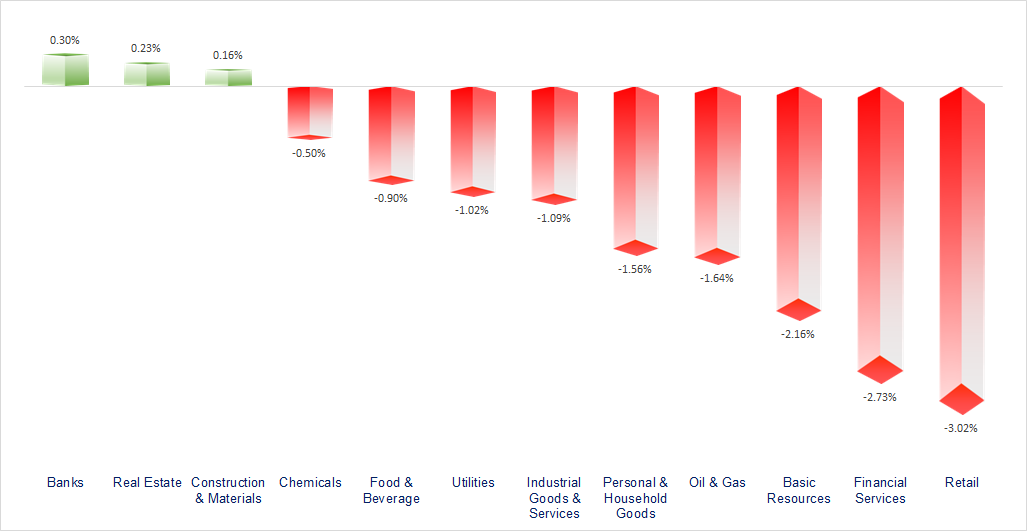

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

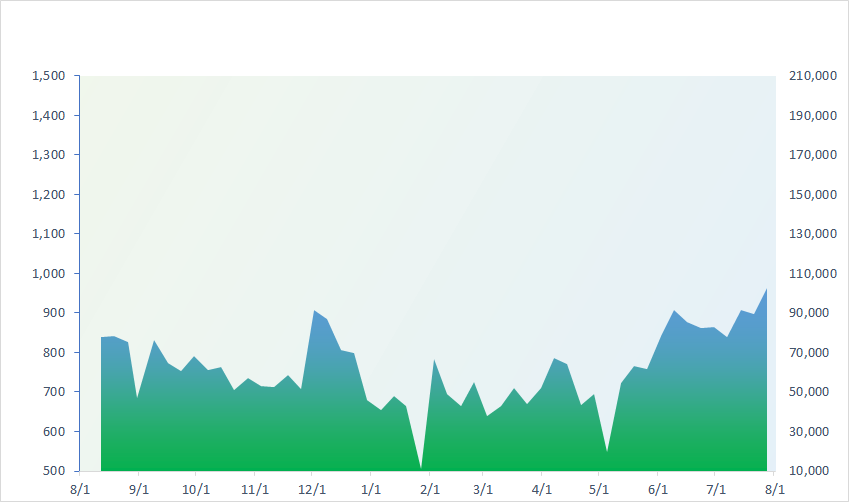

VNINDEX (12M)

GLOBAL MARKET

0

1D 33466.5

YTD 0.00787532

0

1D 3290.95

YTD -2.7347E-05

0

1D 11143.23

YTD -0.003637368

0

1D 20011.12

YTD -0.003377668

0

1D 2667.07

YTD 0.013101216

0

1D 66530.5

YTD 0.002370234

0

1D 3371.33

YTD -0.001199865

0

1D 1556.06

YTD 0.000939148

0

1D 85.19

YTD 0.009599431

0

1D 1956.69

YTD -0.003163686

Asian stocks were mixed, the Hangsheng and Shenzhen indexes fell slightly by 0.3-0.4% when the PMI was released. China's PMI improved in July, rising slightly to 49.3 from 49.0 in June but still below the 50, indicating that the economy is still in decline.

VIETNAM ECONOMY

0.22%

1D (bps) -2

YTD (bps) -475

6.30%

YTD (bps) -110

1.85%

1D (bps) -29

YTD (bps) -294

2.42%

1D (bps) -1

YTD (bps) -248

23,860

1D (%) 0.01%

YTD (%) 0.42%

26,728

1D (%) -0.12%

YTD (%) 4.17%

3,375

1D (%) -0.32%

YTD (%) -3.16%

According to S&P Global, Vietnam PMI rose to 48.7 points in July, compared with 46.2 points in June. This result shows that operating conditions have declined for the fifth consecutive month.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- PMI in July 2023: New orders improved over June but still at a low level;

- The Ministry of Industry and Trade proposes to buy and sell electricity directly, not through EVN;

- Hanoi attracted nearly USD2.3 billion of FDI in 7 months;

- Eurozone economy ends negative growth streak;

- Korea urgently prevents the crisis related to real estate credit;

- Canada: Immigration policy creates the illusion of economic prosperity.

VN30

BANK

91,200

1D -0.44%

5D -0.55%

Buy Vol. 1,827,777

Sell Vol. 2,140,224

48,200

1D 2.12%

5D 2.23%

Buy Vol. 7,731,502

Sell Vol. 7,436,182

30,400

1D 1.33%

5D 1.67%

Buy Vol. 24,182,842

Sell Vol. 26,325,405

34,000

1D -0.87%

5D 1.49%

Buy Vol. 12,484,528

Sell Vol. 14,266,604

21,950

1D -0.90%

5D 0.46%

Buy Vol. 35,208,934

Sell Vol. 43,481,620

18,850

1D 0.00%

5D 0.27%

Buy Vol. 21,452,643

Sell Vol. 30,639,489

17,550

1D 1.15%

5D 2.03%

Buy Vol. 5,892,224

Sell Vol. 8,469,348

18,800

1D 0.27%

5D -1.05%

Buy Vol. 27,001,541

Sell Vol. 32,117,111

28,950

1D 0.00%

5D 1.58%

Buy Vol. 73,102,219

Sell Vol. 74,251,748

20,650

1D -0.72%

5D -1.43%

Buy Vol. 8,503,892

Sell Vol. 11,235,623

22,850

1D -0.44%

5D 2.47%

Buy Vol. 19,838,834

Sell Vol. 27,184,430

MBB: MBB's consolidated pre-tax profit in the second quarter of 2023 reached VND6,223 billion, up 4% over the same period. In 6 months, MBB's consolidated profit reached VND12,735 billion, up 7%. With this result, MBB ranked the third in terms of profit, after BIDV (VND13,862 billion), Vietcombank (VND20,499 billion) and ahead of VietinBank (VND12,531 billion).

REAL ESTATE

17,800

1D -5.57%

5D 9.88%

Buy Vol. 89,836,964

Sell Vol. 104,915,798

79,000

1D -2.47%

5D 1.28%

Buy Vol. 372,494

Sell Vol. 611,181

20,850

1D -3.92%

5D -2.34%

Buy Vol. 26,105,651

Sell Vol. 24,441,654

NVL: At the end of Q2/2023, NVL recorded a 54% decrease in cash and cash equivalents from VND8,923 billion to VND4,082 billion compared to the beginning of the year.

OIL & GAS

100,700

1D -0.89%

5D 1.92%

Buy Vol. 914,257

Sell Vol. 1,445,686

13,450

1D -1.82%

5D 1.51%

Buy Vol. 27,208,350

Sell Vol. 37,239,353

41,000

1D -1.20%

5D 1.74%

Buy Vol. 4,145,229

Sell Vol. 7,203,490

PLX: Q2/2023, PLX recorded a 22% decrease in net revenue over the same period to VND65,752 billion. Thus, on average, every day in the second quarter, Petrolimex collected more than VND720 billion.

VINGROUP

58,900

1D 6.90%

5D 14.37%

Buy Vol. 24,320,314

Sell Vol. 14,753,076

62,800

1D -0.32%

5D 7.17%

Buy Vol. 9,987,580

Sell Vol. 11,327,957

29,100

1D -1.85%

5D 0.34%

Buy Vol. 10,581,282

Sell Vol. 16,805,581

VIC: VinFast's registration form F-4 was announced effective on July 28 by the US Securities Commission and VinFast is expected to list in August this year according to the set schedule.

FOOD & BEVERAGE

76,000

1D -2.56%

5D 2.01%

Buy Vol. 7,652,377

Sell Vol. 10,668,614

86,700

1D -0.69%

5D 3.96%

Buy Vol. 2,894,976

Sell Vol. 2,933,978

158,400

1D 1.02%

5D 0.25%

Buy Vol. 407,719

Sell Vol. 408,681

VNM: At the end of Q2/2023, VNM's cash and cash equivalents recorded VND21,464 billion. As a result, Vinamilk collected VND708 billion of interest on bank deposits in the first half of the year.

OTHERS

47,250

1D -1.87%

5D 0.75%

Buy Vol. 2,198,678

Sell Vol. 2,785,885

101,200

1D -0.78%

5D 4.22%

Buy Vol. 1,240,006

Sell Vol. 1,220,634

84,500

1D -1.29%

5D 3.94%

Buy Vol. 1,901,524

Sell Vol. 2,431,093

51,700

1D -3.72%

5D -2.62%

Buy Vol. 10,715,713

Sell Vol. 13,075,003

22,000

1D -1.57%

5D 0.92%

Buy Vol. 4,794,475

Sell Vol. 6,044,793

28,800

1D -2.87%

5D 0.00%

Buy Vol. 25,163,544

Sell Vol. 27,978,287

27,500

1D -2.48%

5D -2.65%

Buy Vol. 43,365,803

Sell Vol. 47,676,164

MWG: After about 5 years of operation, An Khang chain is still showing "struggling" in finding profit. In 2022, An Khang drugstore chain lost more than VND300 billion, the first half of 2023 continued to lose more than VND150 billion. As of June 30, 2023, An Khang recorded a cumulative loss of more than VND 469billion.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

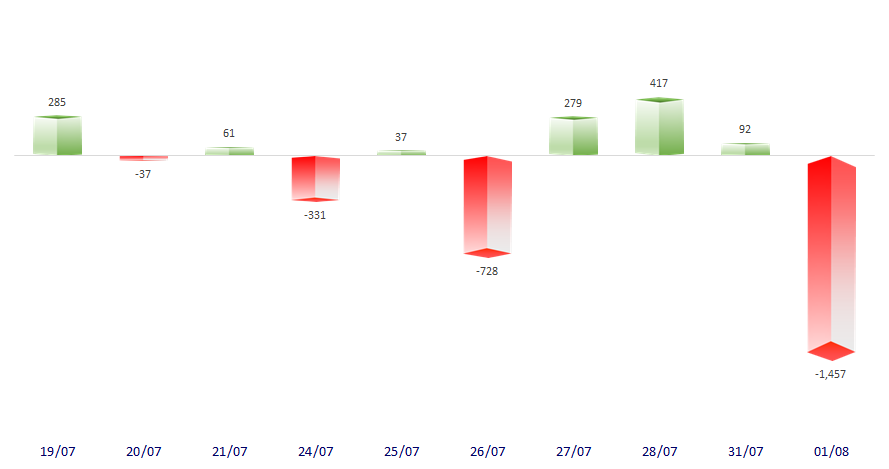

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

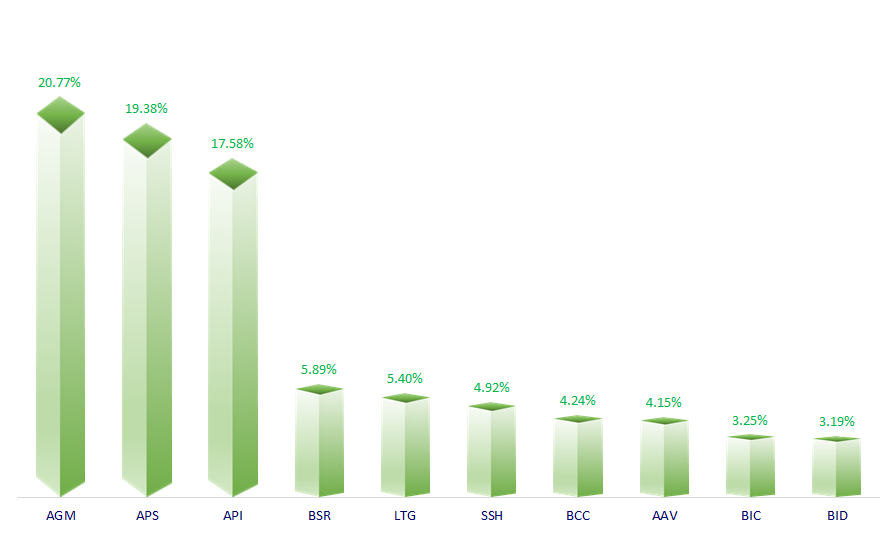

TOP INCREASES 3 CONSECUTIVE SESSIONS

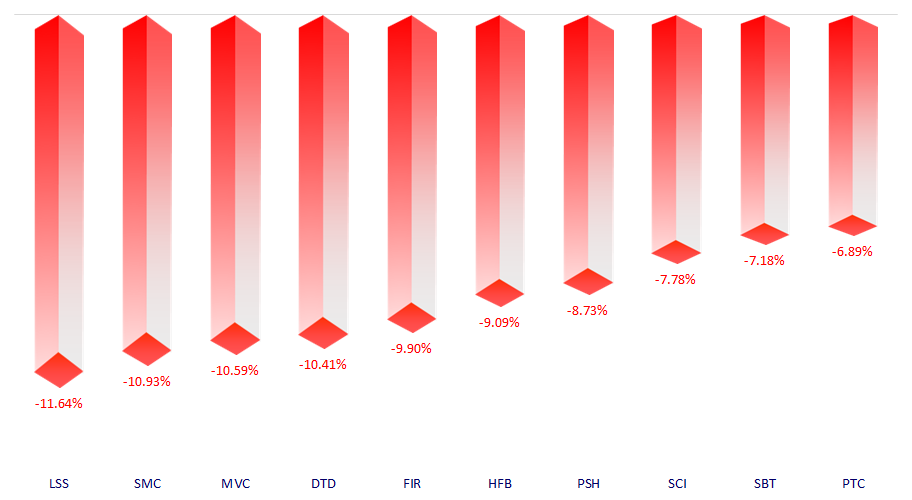

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.