Market brief 14/08/2023

VIETNAM STOCK MARKET

1,236.84

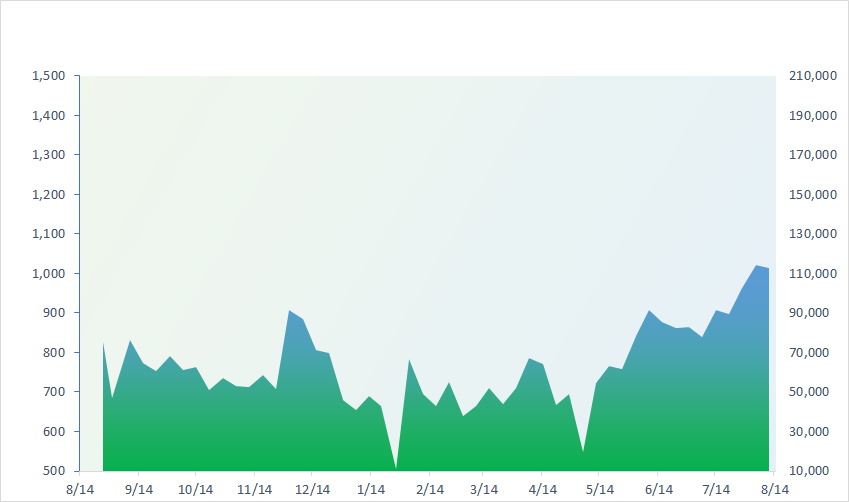

1D 0.38%

YTD 22.81%

1,243.43

1D 0.21%

YTD 23.70%

250.44

1D 2.12%

YTD 21.98%

93.46

1D 0.19%

YTD 30.44%

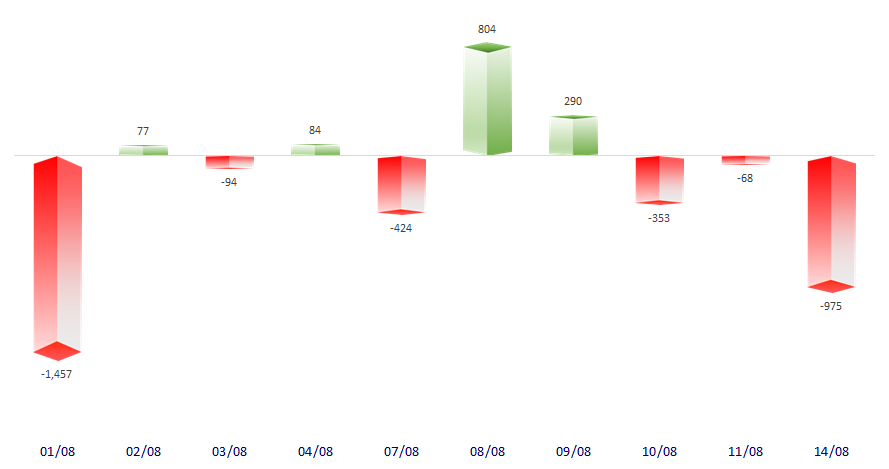

-974.78

1D 0.00%

YTD 0.00%

27,100.37

1D 10.80%

YTD 214.54%

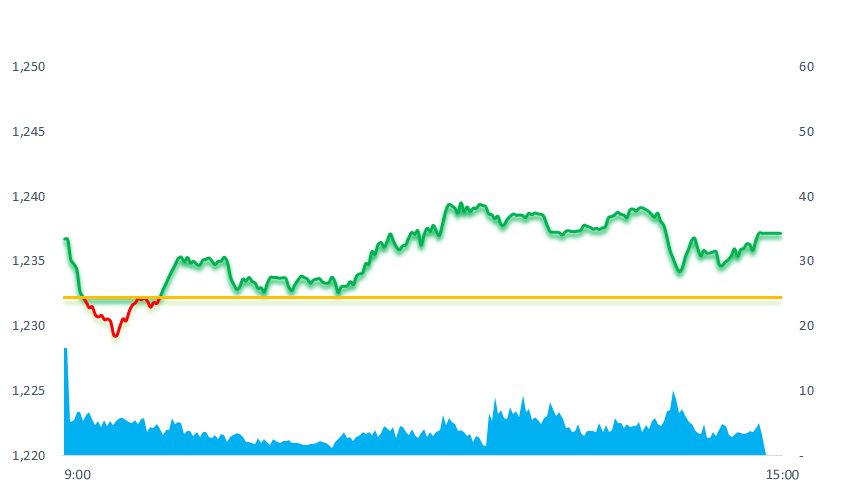

Today, the stock market opened in green. After that, although VN-Index dropped slightly below the reference level, with the optimism of investors, the index quickly recovered. Market liquidity continued to be at a high level with trading volume of more than 1.1 million shares and trading value of USD1 billion USD (for HOSE only).

ETF & DERIVATIVES

21,210

1D 0.00%

YTD 22.39%

14,690

1D 0.14%

YTD 23.24%

15,200

1D 0.07%

YTD 21.79%

18,500

1D -2.63%

YTD 31.67%

19,010

1D 0.21%

YTD 32.47%

26,140

1D 0.54%

YTD 16.70%

16,220

1D 1.06%

YTD 25.25%

1,239

1D -0.03%

YTD 0.00%

1,241

1D 0.06%

YTD 0.00%

1,240

1D 0.27%

YTD 0.00%

1,234

1D -0.15%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

0

1D 32059.91

YTD -0.012740791

0

1D 3178.43

YTD -0.003392647

0

1D 10755.14

YTD -0.004970917

0

1D 18773.55

YTD -0.015813211

0

1D 2570.87

YTD -0.007868759

0

1D 65401.92

YTD 0.001213515

0

1D 3247.7

YTD -0.01413966

0

1D 1535.16

0

1D 86.56

YTD 0.000925069

0

1D 1913.96

YTD 0.001716666

Most Asian stocks fell on Monday, with Chinese stock indexes leading the decline on lingering concerns about slowing economic growth. China's Shenzhen and Shanghai indexes fell 0.5% and 0.34%, respectively. Hong Kong's Hang Seng Index fell 1.58%, driven by declines in technology shares and the real estate sector.

VIETNAM ECONOMY

0.21%

YTD (bps) -476

6.30%

YTD (bps) -110

1.78%

1D (bps) -39

YTD (bps) -301

2.44%

1D (bps) -6

YTD (bps) -246

23,998

1D (%) 0.28%

YTD (%) 1.00%

26,818

1D (%) 0.36%

YTD (%) 4.52%

3,352

1D (%) -0.03%

YTD (%) -3.82%

The central exchange rate announced by the State Bank on August 14 is 23,848 VND/USD. With a margin of +/-5%, the floor and ceiling rates applied to commercial banks are 22,655-25,040 VND/USD. The reference rate at the SBV's Exchange is 23,400 – 24,990 VND/USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Credit at the end of July grew by 4.3% compared to the beginning of the year;

- The Ministry of Finance wants to collect emissions fees;

- Vietnam spent nearly USD1.87 billion importing CBU cars;

- Korean banks lift blockade of Iranian assets;

- Yuan is about to set a new bottom in 2023;

- China overtook Japan to become the world's largest auto exporter.

VN30

BANK

89,000

1D -1.55%

5D -1.98%

Buy Vol. 2,399,734

Sell Vol. 2,414,416

47,600

1D 1.93%

5D -2.56%

Buy Vol. 3,330,705

Sell Vol. 3,244,967

32,300

1D 0.62%

5D -0.92%

Buy Vol. 13,163,179

Sell Vol. 12,482,076

33,800

1D 0.45%

5D -1.60%

Buy Vol. 8,918,629

Sell Vol. 7,607,693

21,950

1D -0.23%

5D -3.09%

Buy Vol. 19,840,593

Sell Vol. 20,572,661

18,950

1D 0.26%

5D -2.07%

Buy Vol. 16,680,746

Sell Vol. 16,974,996

17,150

1D 0.59%

5D -1.15%

Buy Vol. 4,167,630

Sell Vol. 4,886,015

18,650

1D 0.00%

5D -3.37%

Buy Vol. 12,622,056

Sell Vol. 11,365,614

31,900

1D 0.16%

5D 6.16%

Buy Vol. 42,352,810

Sell Vol. 30,857,758

20,700

1D 0.73%

5D -3.27%

Buy Vol. 8,066,394

Sell Vol. 8,219,333

23,050

1D 0.66%

5D -2.95%

Buy Vol. 21,317,531

Sell Vol. 20,921,100

12,950

1D 0.00%

5D -3.72%

Buy Vol. 45,807,535

Sell Vol. 43,927,046

29,750

1D -2.14%

5D -1.65%

Buy Vol. 1,752,059

Sell Vol. 2,816,936

A survey of interest rates listed on the websites of 34 domestic banks and 4 foreign banks on August 14 showed that the highest deposit interest rate listed is 8.3%/year. Accordingly, this interest rate is being applied by DongA Bank for a term of 13 months with a deposit of 1 billion or more. Most small private banks are listing the highest interest rates in the range of 7.2 - 7.6%/year. In the group of large private banks, the highest interest rates mainly fluctuate in the range of 6.4 - 6.9%/year such as, SHB (6.9%), Sacombank (6.8%), MB (6.9%), VPBank (6.8%), ACB (6.6%), Techcombank (6.4%).

OIL & GAS

100,600

1D -0.89%

5D -0.30%

Buy Vol. 903,361

Sell Vol. 959,805

13,750

1D 0.73%

5D 0.36%

Buy Vol. 16,810,554

Sell Vol. 20,300,386

40,550

1D -0.25%

5D 0.12%

Buy Vol. 2,613,820

Sell Vol. 2,442,151

POW: In July, PVOW recorded electricity output of about 1,266 million kWh, exceeding 3% monthly plan. Total accumulated electricity output in 7 months is 9,608 million kWh.

VINGROUP

73,300

1D 0.96%

5D 14.71%

Buy Vol. 21,884,905

Sell Vol. 21,766,239

61,200

1D 0.49%

5D -2.70%

Buy Vol. 8,127,706

Sell Vol. 9,591,130

30,300

1D -1.46%

5D 2.36%

Buy Vol. 11,233,846

Sell Vol. 10,018,285

VRE: VRE's 6-month net profit margin from shopping mall leasing reached 76%, up 4 percentage points over the same period last year

FOOD & BEVERAGE

73,400

1D -0.14%

5D -2.00%

Buy Vol. 4,986,511

Sell Vol. 5,887,120

82,200

1D -2.72%

5D -6.80%

Buy Vol. 3,987,201

Sell Vol. 3,889,615

158,000

1D -0.94%

5D -1.86%

Buy Vol. 278,996

Sell Vol. 320,866

VNM: Currently, 13 Vinamilk's farms and 10 factories have installed solar energy, in parallel promoting green energy such as Biomass, CNG (at the factory), Biogas (on the farm).

OTHERS

46,900

1D 0.43%

5D -2.29%

Buy Vol. 1,391,396

Sell Vol. 1,303,273

46,900

1D 0.43%

5D -2.29%

Buy Vol. 1,391,396

Sell Vol. 1,303,273

100,200

1D -0.89%

5D -1.67%

Buy Vol. 1,401,750

Sell Vol. 1,346,715

82,600

1D 0.73%

5D -2.25%

Buy Vol. 1,773,466

Sell Vol. 1,734,981

54,200

1D 1.69%

5D 0.74%

Buy Vol. 14,368,942

Sell Vol. 17,882,033

21,550

1D 2.13%

5D -5.07%

Buy Vol. 4,036,074

Sell Vol. 4,742,600

29,150

1D 3.55%

5D -1.85%

Buy Vol. 49,591,510

Sell Vol. 55,954,907

28,150

1D 1.62%

5D 2.18%

Buy Vol. 71,636,743

Sell Vol. 80,321,115

MWG: In the latest update, MWG estimated revenue of VND9,800 billion in July 2023, down 11% compared to the same period last year. In which, the revenue of The Gioi Di Dong and Dien May Xanh reached VND6,700 billion, a slight increase of 1% compared to the previous month.

Market by numbers

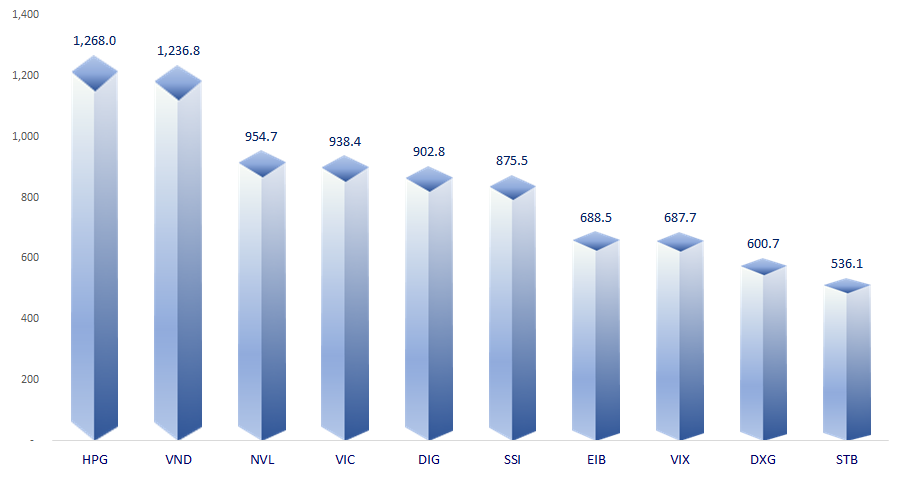

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

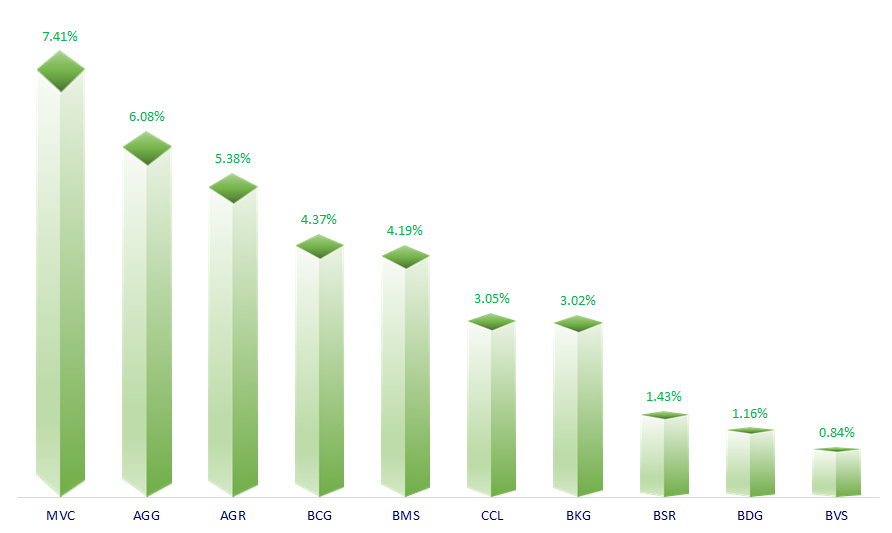

TOP INCREASES 3 CONSECUTIVE SESSIONS

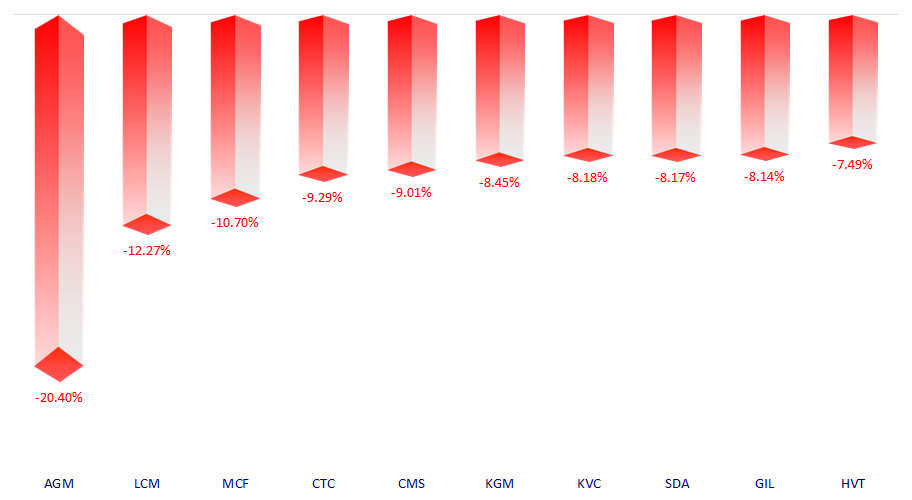

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.