Market brief 17/08/2023

VIETNAM STOCK MARKET

1,233.48

1D -0.79%

YTD 22.48%

1,247.82

1D -0.73%

YTD 24.14%

249.97

1D -1.03%

YTD 21.75%

92.74

1D -0.99%

YTD 29.43%

60.28

1D 0.00%

YTD 0.00%

29,059.14

1D 21.01%

YTD 237.27%

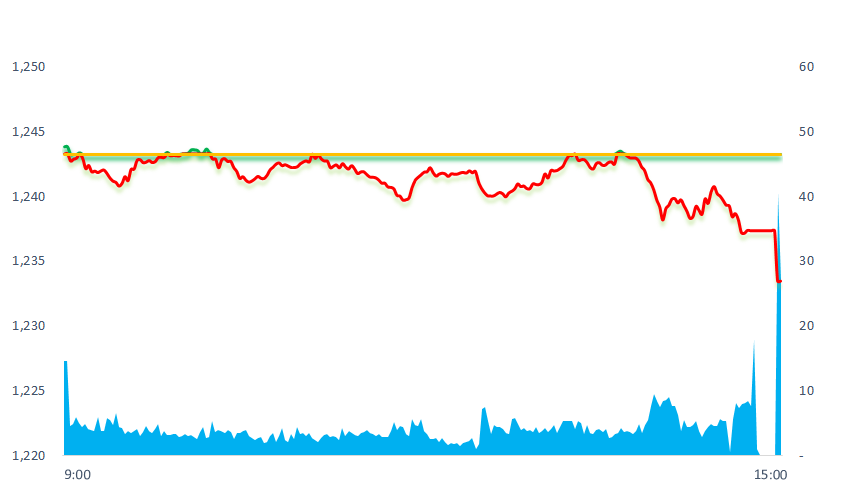

The stock market opened slightly lower. The divergence in large-cap stocks caused the market to struggle. Only after 14:00, the selling force continuously poured into the market, causing the VNIndex to begin to fall deeply. Market liquidity increased strongly with volume and trading value reaching over 1.1 million shares and VND25,500 billion, respectively (on HOSE).

ETF & DERIVATIVES

21,460

1D 0.19%

YTD 23.83%

14,770

1D -0.54%

YTD 23.91%

15,450

1D 0.06%

YTD 23.80%

18,920

1D 0.11%

YTD 34.66%

19,300

1D -0.41%

YTD 34.49%

26,430

1D 0.27%

YTD 17.99%

16,350

1D -0.43%

YTD 26.25%

1,254

1D -0.14%

YTD 0.00%

1,247

1D -0.46%

YTD 0.00%

1,243

1D -0.72%

YTD 0.00%

1,242

1D -0.59%

YTD 0.00%

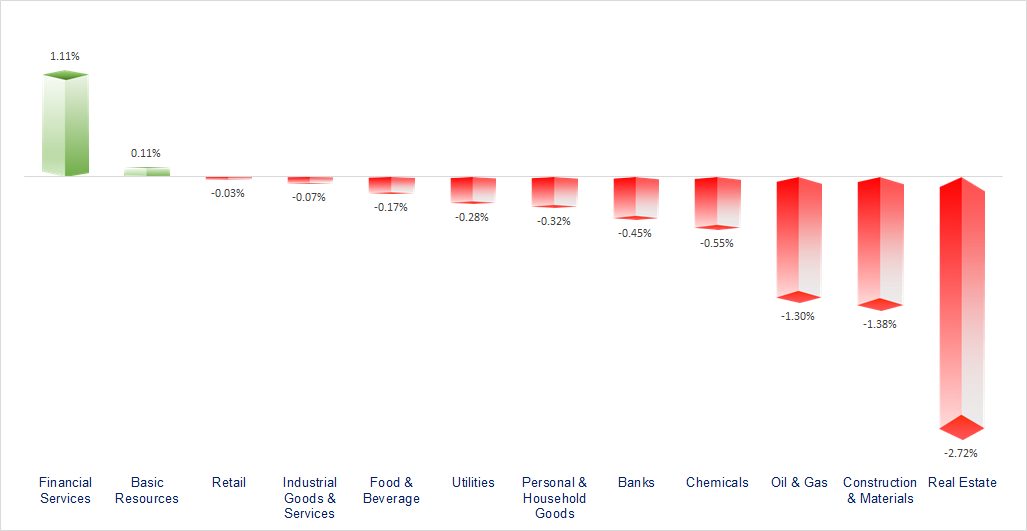

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

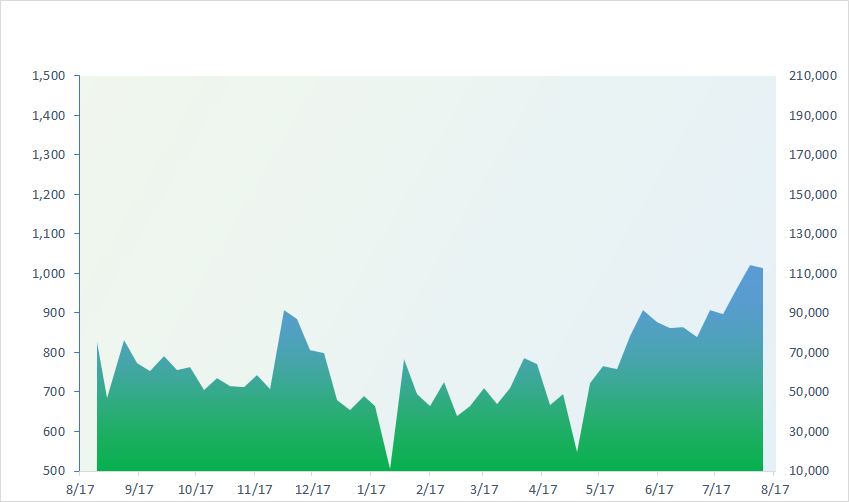

VNINDEX (12M)

GLOBAL MARKET

0

1D 31626

YTD -0.004432927

0

1D 3163.74

YTD 0.004320457

0

1D 10644.52

YTD 0.006140142

0

1D 18326.63

YTD -0.000145668

0

1D 2519.85

YTD -0.002292488

0

1D 65151.02

YTD -0.005926204

0

1D 3196.75

YTD -0.00523715

0

1D 1528.81

YTD 0.006087288

0

1D 84.06

YTD 0.009608455

0

1D 1896.39

YTD 0.002521648

Asian stock markets were mixed on Thursday after policy signals from the Fed sent technology shares plunging. Tech-biased indexes like Hong Kong's Hang Seng Index slipped 0.01%, while South Korea's KOSPI fell 0.23%. While China's Shenzhen and Shanghai indexes rose 0.61% and 0.43%, respectively, ending the previous four consecutive sessions.

VIETNAM ECONOMY

0.22%

1D (bps) -1

YTD (bps) -475

6.30%

YTD (bps) -110

1.78%

YTD (bps) -301

2.54%

1D (bps) 5

YTD (bps) -236

24,060

1D (%) -0.23%

YTD (%) 1.26%

26,398

1D (%) -1.32%

YTD (%) 2.88%

3,345

1D (%) -0.18%

YTD (%) -4.02%

The central exchange rate announced by the State Bank this morning was at 23,951VND/USD, up VND33 compared to the previous session. The reference rate at the State Bank's Transaction Office for buying and selling is currently at: 23,400 - 25,063VND/USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank strongly pushed the USD price to a new milestone;

- HOSE held a meeting to discuss the implementation of the KRX system;

- Korean investors poured capital heavily into Vietnamese securities;

- Japanese investors are pouring money into US bonds;

- The Fed warned that interest rates could be raised, saying that the fight against inflation was far from over;

- Yields on US Treasuries rose to a 15-year record.

VN30

BANK

89,400

1D 0.22%

5D 1.02%

Buy Vol. 3,466,951

Sell Vol. 3,253,824

47,100

1D -0.84%

5D 1.29%

Buy Vol. 2,341,095

Sell Vol. 3,083,581

32,600

1D 0.77%

5D 3.00%

Buy Vol. 12,936,564

Sell Vol. 18,693,630

34,700

1D -1.70%

5D 3.58%

Buy Vol. 7,586,526

Sell Vol. 10,263,147

22,150

1D -1.12%

5D 0.91%

Buy Vol. 22,804,305

Sell Vol. 39,584,235

18,850

1D -0.79%

5D -0.26%

Buy Vol. 14,634,863

Sell Vol. 18,961,281

17,150

1D 0.00%

5D -0.29%

Buy Vol. 5,991,956

Sell Vol. 6,401,722

18,850

1D -1.31%

5D 1.89%

Buy Vol. 9,402,589

Sell Vol. 13,954,136

32,350

1D -1.67%

5D 5.89%

Buy Vol. 22,925,185

Sell Vol. 29,633,112

20,700

1D 0.24%

5D 0.24%

Buy Vol. 8,095,452

Sell Vol. 9,513,366

22,700

1D -0.87%

5D -0.87%

Buy Vol. 15,222,768

Sell Vol. 22,729,553

12,850

1D -0.39%

5D -0.77%

Buy Vol. 31,215,426

Sell Vol. 39,810,341

29,400

1D -0.34%

5D -2.00%

Buy Vol. 2,016,177

Sell Vol. 2,336,457

VPB: SMBC Bank (Japan) is allowed to buy 1.19 billion newly issued shares of VPBank. After buying these 1.19 billion shares, SMBC's holding ratio accounts for 15% of the capital in VPBank. The number of shares purchased by SMBC is restricted to transfer for 5 years. VPBank is expected to collect VND35,904 billion to bring total equity to nearly VND140,000 billion

OIL & GAS

100,000

1D -0.20%

5D -1.96%

Buy Vol. 913,266

Sell Vol. 996,441

14,000

1D 0.72%

5D 1.45%

Buy Vol. 35,656,386

Sell Vol. 34,802,228

39,750

1D -1.24%

5D -2.57%

Buy Vol. 2,482,523

Sell Vol. 3,533,661

POW: Nhon Trach 3 & 4 Power Plant has completed ground leveling and 71% of pile pressing volume for the project.

VINGROUP

71,900

1D -4.89%

5D 5.89%

Buy Vol. 31,494,284

Sell Vol. 40,518,963

61,000

1D -3.02%

5D 0.66%

Buy Vol. 7,145,731

Sell Vol. 9,885,772

30,600

1D -2.86%

5D 1.83%

Buy Vol. 14,207,277

Sell Vol. 17,596,950

VIC: VinFast shares dropped by nearly 19% on August 16. Capitalized from USD84 billion to USD69 billion, VinFast's value is now below Mercedes-Benz, BMW and Volkswagen.

FOOD & BEVERAGE

73,600

1D 0.68%

5D 0.68%

Buy Vol. 8,197,245

Sell Vol. 8,058,291

82,100

1D 0.37%

5D -1.08%

Buy Vol. 4,672,734

Sell Vol. 2,947,088

155,700

1D -1.02%

5D -3.05%

Buy Vol. 538,250

Sell Vol. 590,821

AB: SAB approved the implementation of the plan to issue nearly 641.3 million shares to existing shareholders to increase charter capital. Execution ratio is 1:1

OTHERS

46,500

1D -0.85%

5D -1.06%

Buy Vol. 1,289,120

Sell Vol. 1,442,840

46,500

1D -0.85%

5D -1.06%

Buy Vol. 1,289,120

Sell Vol. 1,442,840

100,000

1D -0.79%

5D -0.70%

Buy Vol. 1,188,755

Sell Vol. 1,271,818

86,000

1D 1.06%

5D 4.62%

Buy Vol. 5,275,861

Sell Vol. 5,663,042

53,900

1D 0.19%

5D 3.65%

Buy Vol. 11,236,949

Sell Vol. 15,358,816

21,300

1D -0.23%

5D -0.70%

Buy Vol. 4,993,333

Sell Vol. 5,065,536

29,950

1D 3.81%

5D 6.58%

Buy Vol. 111,188,351

Sell Vol. 99,123,972

28,100

1D 0.54%

5D 2.74%

Buy Vol. 73,591,859

Sell Vol. 84,284,435

FPT: In 7 months of the year, the technology sector (domestic IT services and foreign IT services) brought in VND16,918 billion in revenue and VND2,371 billion in pre-tax profit, an increase of 26% over the same period. In general, technology is still the main contributor, accounting for 59% of the revenue structure and 47% of the group's pre-tax profit.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

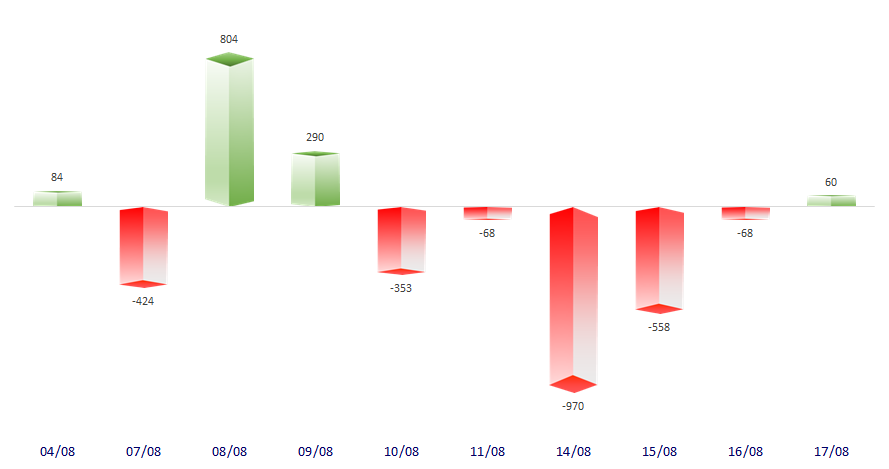

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

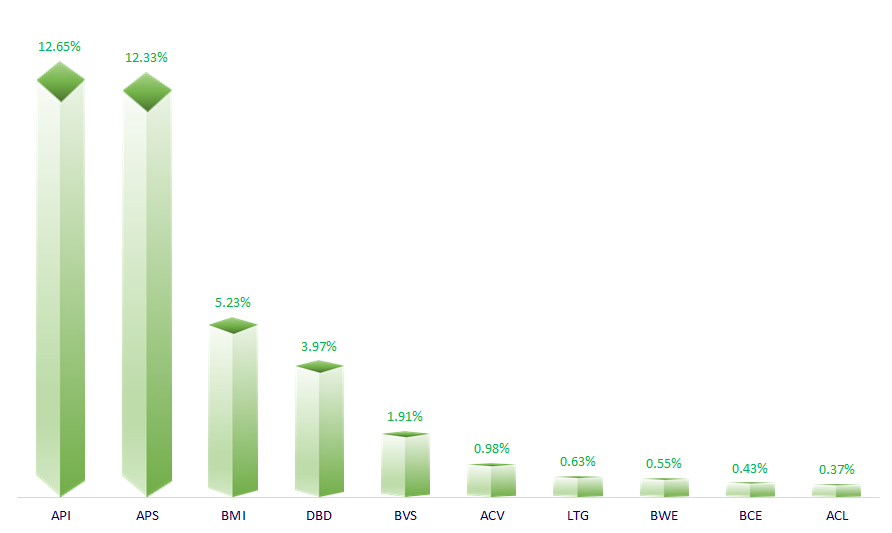

TOP INCREASES 3 CONSECUTIVE SESSIONS

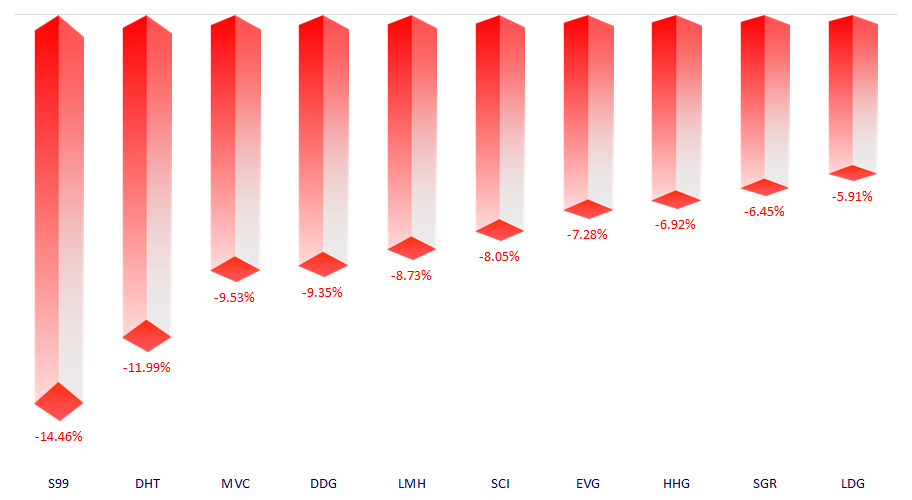

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.