Market Brief 31/10/2023

VIETNAM STOCK MARKET

1,028.19

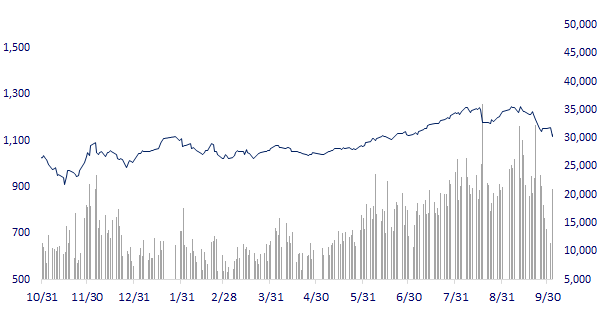

1D -1.36%

YTD 2.10%

1,039.38

1D -0.79%

YTD 3.40%

206.17

1D -2.45%

YTD 0.42%

80.93

1D -1.64%

YTD 12.95%

382.63

1D 0.00%

YTD 0.00%

17,325.94

1D 44.98%

YTD 101.09%

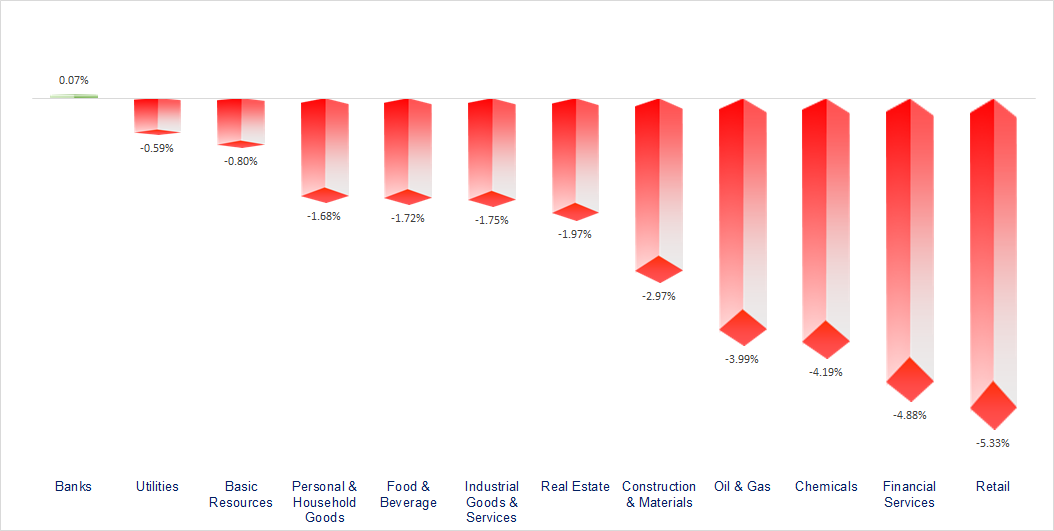

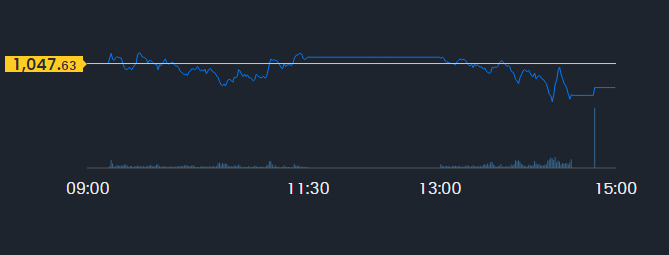

The market fluctuated around the reference level throughout almost the entire session and as usual after 2:00 pm, the market began to decline sharply. The most negative were financial services, industrial park real estate and retail. The rare bright spot today is banking stocks, which is the pillar that helps VN-Index avoid falling deeper.

ETF & DERIVATIVES

18,300

1D -0.11%

YTD 5.60%

12,300

1D -0.97%

YTD 3.19%

13,570

1D 1.34%

YTD 8.73%

15,700

1D -1.26%

YTD 11.74%

17,250

1D -0.81%

YTD 20.21%

23,600

1D -0.25%

YTD 5.36%

13,980

1D -0.14%

YTD 7.95%

1,040

1D -0.02%

YTD 0.00%

1,037

1D -0.29%

YTD 0.00%

1,040

1D 0.16%

YTD 0.00%

1,031

1D -0.62%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

30,858.85

1D 0.53%

YTD 18.26%

3,018.77

1D -0.09%

YTD -2.28%

9,863.80

1D -0.65%

YTD -10.46%

17,112.48

1D -1.69%

YTD -13.49%

2,277.99

1D -1.41%

YTD 1.86%

63,997.73

1D -0.04%

YTD 5.19%

3,067.74

1D 0.05%

YTD -5.65%

1,381.83

1D -1.00%

YTD -17.27%

87.00

1D -1.29%

YTD 1.27%

1,996.71

1D 0.02%

YTD 9.34%

Asian stocks continued to be mixed today while waiting for central banks' decision to raise interest rates this week. Hang Send Index fell sharply mainly due to pressure from the weak Q3 business results of the banking sector.

VIETNAM ECONOMY

0.85%

1D (bps) -15

YTD (bps) -412

5.10%

YTD (bps) -230

2.31%

1D (bps) 14

YTD (bps) -248

2.79%

1D (bps) 8

YTD (bps) -211

24,737

1D (%) 0.01%

YTD (%) 4.11%

26,940

1D (%) 0.56%

YTD (%) 4.99%

3,428

1D (%) -0.03%

YTD (%) -1.64%

This morning (October 31), world gold prices dropped sharply, losing the 2,000 USD/ounce mark. Accordingly, the domestic SJC gold price decreased by 350,000 VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Da Nang attracts investment capital increasing by more than 500% over the same period in 2022;

- Ho Chi Minh City's economy continues to maintain positive growth;

- Increasing electricity prices, EVN still makes heavy losses;

- India's historic droughts drive up sugar and cotton prices;

- Manufacturing activity in China weakened in October, signaling an uncertain economic outlook;

- Biden issues executive order to create A.I. safeguards.

VN30

BANK

86,800

1D 1.05%

5D 0.93%

Buy Vol. 1,849,539

Sell Vol. 2,297,861

40,200

1D -1.95%

5D -2.66%

Buy Vol. 1,014,817

Sell Vol. 1,228,391

27,700

1D 0.18%

5D -6.10%

Buy Vol. 5,089,131

Sell Vol. 4,599,103

27,700

1D -1.42%

5D -11.64%

Buy Vol. 11,610,338

Sell Vol. 9,038,183

20,000

1D 0.50%

5D -4.99%

Buy Vol. 13,390,163

Sell Vol. 13,955,784

17,100

1D 0.59%

5D -4.47%

Buy Vol. 12,495,679

Sell Vol. 10,287,610

17,200

1D 0.00%

5D -1.99%

Buy Vol. 10,819,254

Sell Vol. 12,578,683

15,800

1D -1.25%

5D -5.95%

Buy Vol. 6,414,545

Sell Vol. 5,738,569

27,000

1D 0.00%

5D -10.00%

Buy Vol. 50,700,690

Sell Vol. 68,302,162

17,900

1D 1.70%

5D -3.24%

Buy Vol. 7,847,683

Sell Vol. 6,477,560

21,400

1D 0.47%

5D -2.28%

Buy Vol. 10,595,063

Sell Vol. 6,873,384

10,100

1D -0.49%

5D -4.72%

Buy Vol. 23,362,682

Sell Vol. 23,463,687

25,800

1D 1.78%

5D 0.00%

Buy Vol. 1,330,849

Sell Vol. 1,459,947

MBB: In the first 9 months of 2023, MB's consolidated pre-tax profit reached more than VND20,000 billion (+10% yoy). The parent bank reported a profit of VND18,866 billion (+15% yoy), showing steady growth in the bank's business activities.

OIL & GAS

10,600

1D 0.00%

5D -5.36%

Buy Vol. 9,059,503

Sell Vol. 11,372,870

31,900

1D -2.30%

5D -10.14%

Buy Vol. 1,414,738

Sell Vol. 1,754,992

40,500

1D -2.89%

5D -6.79%

Buy Vol. 9,111,061

Sell Vol. 11,655,022

GAS: In the third quarter, PV GAS's net profit decreased by 22% compared to the same period last year but still exceeded 38% of the year's profit target after 9 months.

VINGROUP

39,000

1D -2.41%

5D -12.56%

Buy Vol. 11,941,092

Sell Vol. 13,264,281

22,200

1D -0.51%

5D -16.54%

Buy Vol. 8,421,872

Sell Vol. 10,339,904

68,000

1D -3.90%

5D -3.27%

Buy Vol. 3,495,355

Sell Vol. 3,757,281

VHM: VHM is a stock that was strongly net sold by foreign investors today with a value of VND258 billion.

FOOD & BEVERAGE

58,200

1D 0.59%

5D -13.00%

Buy Vol. 4,013,612

Sell Vol. 4,272,763

56,700

1D 0.34%

5D -17.95%

Buy Vol. 1,307,704

Sell Vol. 1,380,720

58,600

1D -6.74%

5D -7.57%

Buy Vol. 344,755

Sell Vol. 399,000

VNM: In the third quarter, Vinamilk recorded that gross profit margin continued to improve and was the highest in the last 7 quarters.

OTHERS

38,900

1D -1.51%

5D -4.54%

Buy Vol. 597,363

Sell Vol. 766,955

38,900

1D -0.64%

5D -4.54%

Buy Vol. 597,363

Sell Vol. 766,955

99,000

1D 1.02%

5D -4.44%

Buy Vol. 1,544,074

Sell Vol. 1,611,764

83,000

1D -2.35%

5D -9.78%

Buy Vol. 5,549,796

Sell Vol. 5,252,183

37,700

1D -6.91%

5D -12.33%

Buy Vol. 17,552,801

Sell Vol. 20,557,110

16,900

1D -6.11%

5D -17.36%

Buy Vol. 4,045,568

Sell Vol. 5,155,890

25,750

1D -6.36%

5D -17.07%

Buy Vol. 60,156,586

Sell Vol. 61,270,364

23,000

1D 0.00%

5D -4.17%

Buy Vol. 36,152,323

Sell Vol. 39,533,785

VJC: VJC recorded revenue of VND13,548 billion (separate) and VND14,235 billion (consolidated) in the third quarter of 2023, an increase of 32% and 23% over the same period. Separate and consolidated profit after tax reached VND579 billion and VND55 billion, respectively, an increase of 175% and 30% compared to the third quarter of 2022.

Market by numbers

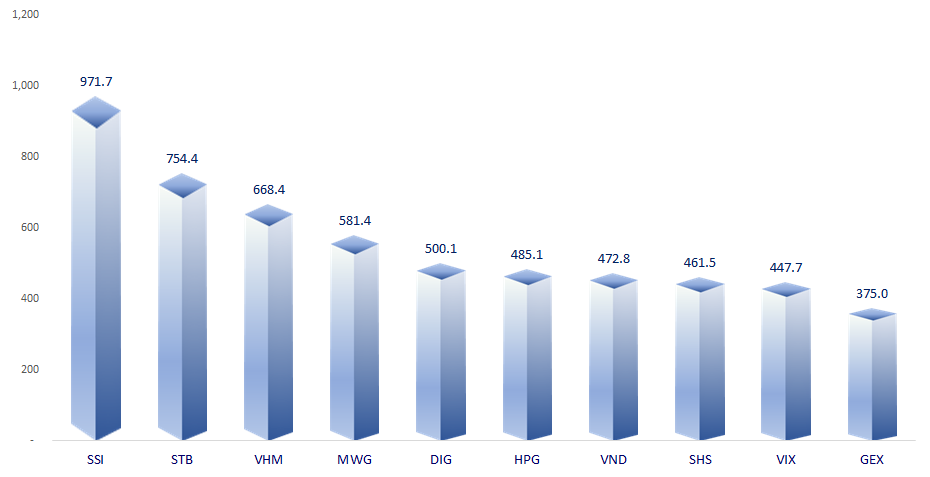

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

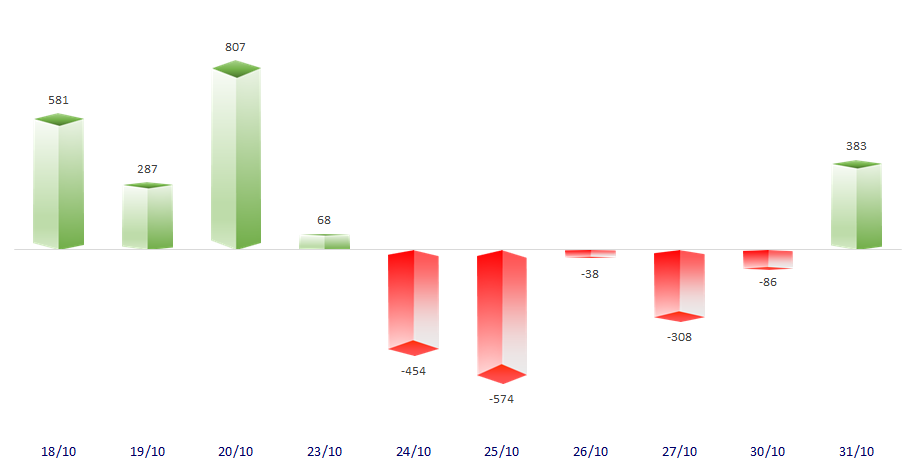

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

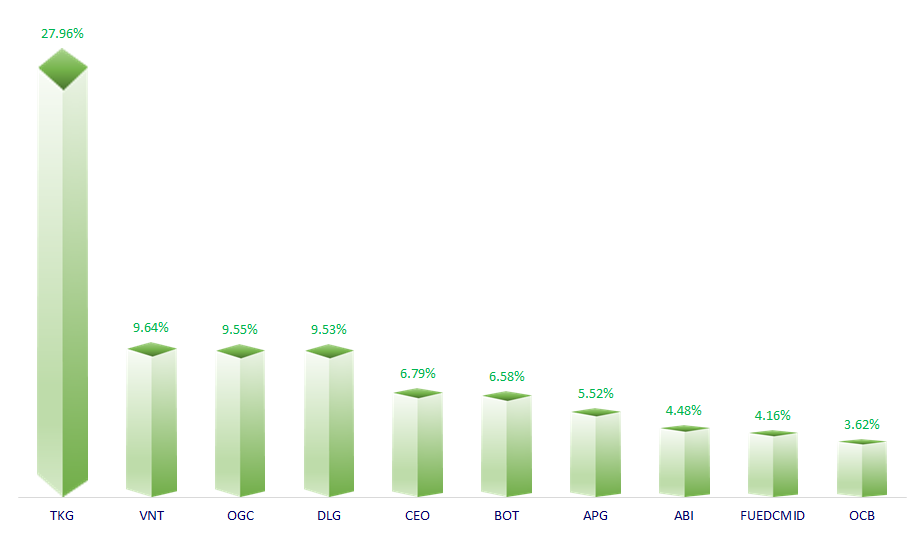

TOP INCREASES 3 CONSECUTIVE SESSIONS

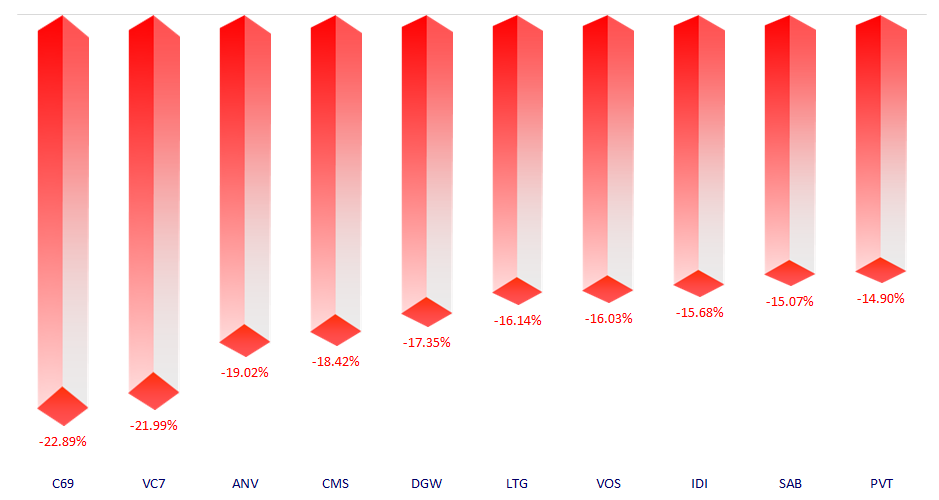

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.