Market brief 08/11/2023

VIETNAM STOCK MARKET

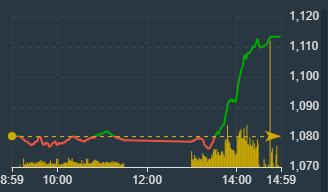

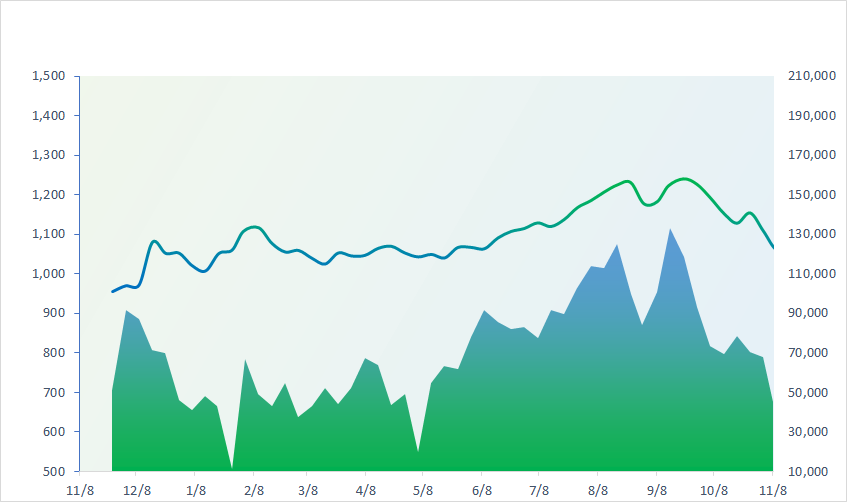

1,113.43

1D 3.07%

YTD 10.56%

1,129.95

1D 3.41%

YTD 12.41%

227.03

1D 4.00%

YTD 10.58%

86.17

1D 1.84%

YTD 20.27%

-212.84

1D 0.00%

YTD 0.00%

21,533.26

1D 43.53%

YTD 149.92%

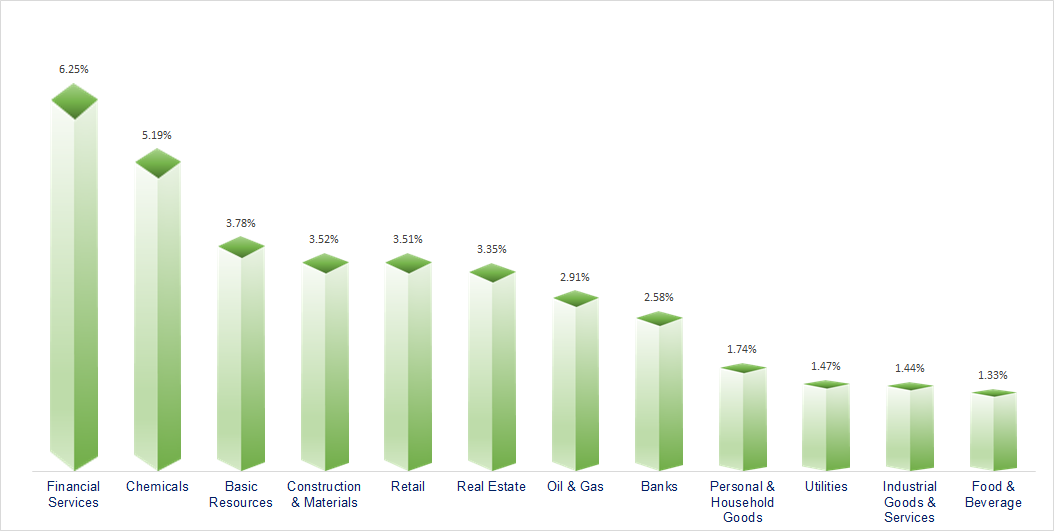

The stock market had a booming session in both scores and liquidity after a series of gloomy trading days. Financial services is the most positive sector today, followed by chemical and industrial zone.

ETF & DERIVATIVES

19,400

1D 2.75%

YTD 11.94%

13,350

1D 3.01%

YTD 12.00%

13,880

1D 1.91%

YTD 11.22%

16,670

1D 1.65%

YTD 18.65%

18,270

1D 3.34%

YTD 27.32%

25,160

1D 2.95%

YTD 12.32%

15,040

1D 3.16%

YTD 16.14%

1,134

1D 3.52%

YTD 0.00%

1,133

1D 3.67%

YTD 0.00%

1,129

1D 3.37%

YTD 0.00%

1,125

1D 3.65%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

32,166.48

1D -0.33%

YTD 23.27%

3,052.37

1D -0.16%

YTD -1.19%

10,052.09

1D -0.04%

YTD -8.75%

17,568.46

1D -0.58%

YTD -11.19%

2,421.62

1D -0.91%

YTD 8.28%

64,923.93

1D -0.03%

YTD 6.71%

3,129.72

1D -1.39%

YTD -3.74%

1,413.92

1D 0.40%

YTD -15.35%

81.76

1D 0.53%

YTD -4.83%

1,967.65

1D -0.02%

YTD 7.75%

Asian stock markets slid today as investors awaited more information from Fed this week. In Japan, bank stocks fell sharply, as falling bond yields dampened expectations of higher profits among investors. The Chinese market had its second consecutive decline.

VIETNAM ECONOMY

0.86%

1D (bps) -16

YTD (bps) -411

5.10%

YTD (bps) -230

2.28%

1D (bps) -3

YTD (bps) -251

2.73%

1D (bps) 2

YTD (bps) -217

24,540

1D (%) 0.14%

YTD (%) 3.28%

26,740

1D (%) -0.05%

YTD (%) 4.21%

3,418

1D (%) 0.15%

YTD (%) -1.92%

This morning (November 8), SJC gold price is currently close to the 70 million VND/tael mark after 2 days of unusual increases and decreases.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Prime Minister: Strive to complete at least 3,000 km of highways by the end of his term;

- Ministry of Transport: Disbursement of public investment capital is more than twice the same period;

- Vietnam is on the US currency monitoring list;

- OPEC+ expects the global economy to overcome challenges;

- China tightens controls on rare earth exports;

- The Reserve Bank of Australia raised interest rates to a 12-year high.

VN30

BANK

89,500

1D 1.36%

5D 1.94%

Buy Vol. 1,656,815

Sell Vol. 2,237,247

42,900

1D 2.63%

5D 7.25%

Buy Vol. 2,471,115

Sell Vol. 1,572,555

29,250

1D 2.45%

5D 6.75%

Buy Vol. 5,585,715

Sell Vol. 4,620,912

31,800

1D 3.92%

5D 12.77%

Buy Vol. 5,989,369

Sell Vol. 5,730,126

21,350

1D 3.14%

5D 7.83%

Buy Vol. 24,641,108

Sell Vol. 27,253,496

18,350

1D 3.09%

5D 6.69%

Buy Vol. 21,399,556

Sell Vol. 17,127,047

18,800

1D 4.44%

5D 8.99%

Buy Vol. 15,247,382

Sell Vol. 14,071,058

17,250

1D 4.23%

5D 9.18%

Buy Vol. 22,472,963

Sell Vol. 13,561,600

30,000

1D 3.45%

5D 8.50%

Buy Vol. 42,948,125

Sell Vol. 32,034,623

19,400

1D 3.74%

5D 7.78%

Buy Vol. 9,895,257

Sell Vol. 5,761,801

22,800

1D 3.17%

5D 5.56%

Buy Vol. 12,055,015

Sell Vol. 12,850,885

11,350

1D 4.61%

5D 9.66%

Buy Vol. 47,494,073

Sell Vol. 39,948,666

24,950

1D 2.25%

5D -3.67%

Buy Vol. 1,659,985

Sell Vol. 1,979,503

MBB: MBBank's bad debt ratio has increased significantly from 1.44% in the second quarter of 2023 to 1.89% in the third quarter of 2023. However, group 2 debt (debt that needs attention) of this bank has shown signs of peaking when it decreased by more than 14% compared to the second quarter of 2023.

OIL & GAS

11,500

1D 1.52%

5D 7.48%

Buy Vol. 10,567,914

Sell Vol. 9,219,142

34,200

1D 3.14%

5D 5.88%

Buy Vol. 1,724,379

Sell Vol. 1,470,103

43,000

1D 3.17%

5D 6.44%

Buy Vol. 7,900,336

Sell Vol. 8,939,309

Crude oil prices in the US dropped sharply in Tuesday's trading session to below 78 USD/barrel and hit their lowest level since July.

VINGROUP

41,000

1D 2.26%

5D 6.63%

Buy Vol. 12,520,685

Sell Vol. 11,264,267

23,700

1D 2.50%

5D 4.41%

Buy Vol. 10,686,865

Sell Vol. 8,133,451

71,400

1D 2.38%

5D 1.42%

Buy Vol. 3,910,084

Sell Vol. 4,142,686

VIC: VFS shares traded around 6.16 USD/share, up 0.41% compared to the previous session. With the current market price, VinFast Auto's capitalization is at USD14.37 billion.

FOOD & BEVERAGE

63,800

1D 0.85%

5D 7.23%

Buy Vol. 3,615,469

Sell Vol. 3,534,546

65,100

1D 2.90%

5D 13.41%

Buy Vol. 1,711,843

Sell Vol. 1,490,663

59,600

1D 0.00%

5D 2.76%

Buy Vol. 550,327

Sell Vol. 457,310

VNM: While domestic revenue is under pressure by overall industry, Vinamilk surprised when reporting third quarter net revenue increased by 5% yoy in the export segment.

OTHERS

41,000

1D 2.41%

5D 5.13%

Buy Vol. 762,767

Sell Vol. 624,493

41,000

1D 1.49%

5D 5.13%

Buy Vol. 762,767

Sell Vol. 624,493

113,000

1D 6.60%

5D 8.24%

Buy Vol. 1,332,425

Sell Vol. 1,267,307

92,600

1D 4.87%

5D 8.43%

Buy Vol. 5,709,277

Sell Vol. 4,489,984

39,600

1D 3.66%

5D 12.82%

Buy Vol. 34,208,375

Sell Vol. 27,053,848

19,700

1D 6.78%

5D 13.87%

Buy Vol. 5,198,457

Sell Vol. 4,250,869

30,300

1D 6.88%

5D 11.60%

Buy Vol. 67,232,280

Sell Vol. 45,111,587

26,950

1D 4.46%

5D 12.53%

Buy Vol. 59,871,604

Sell Vol. 53,986,604

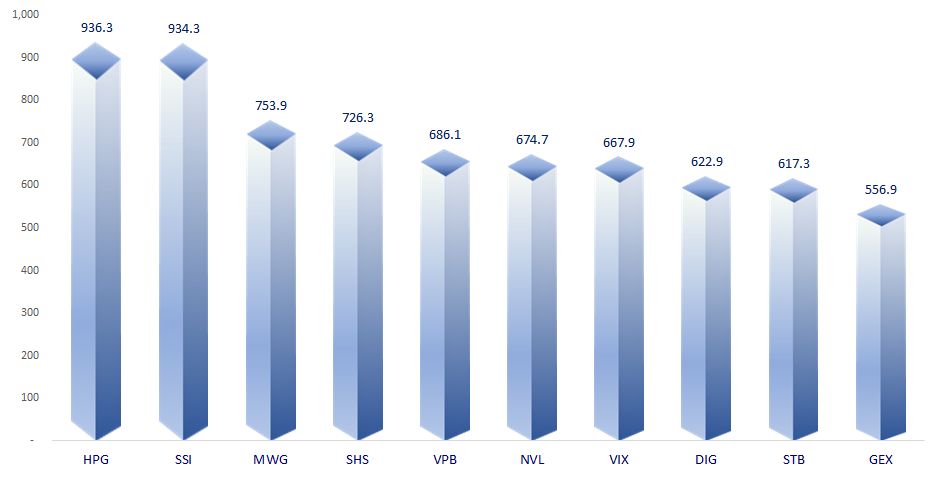

HPG: After 3 consecutive months of net selling, foreign investors are making a strong comeback on HPG shares. Foreign investors have net bought this stock for 7 consecutive sessions with a total value of nearly VND450 billion.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

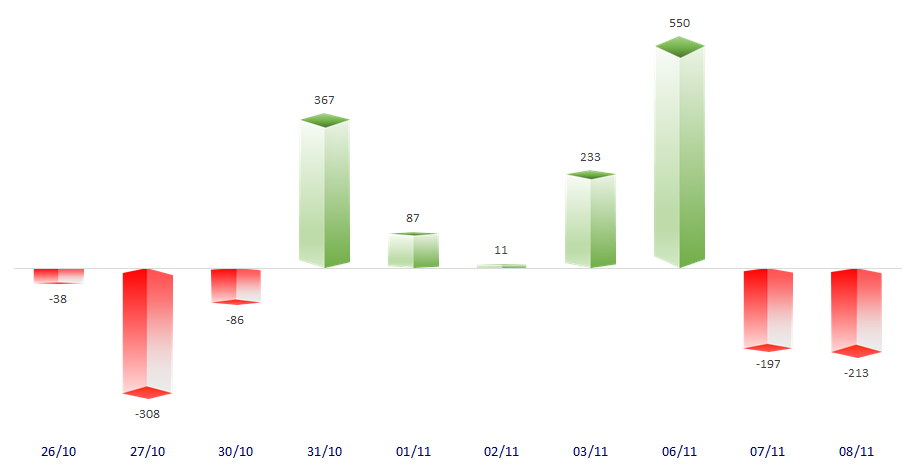

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

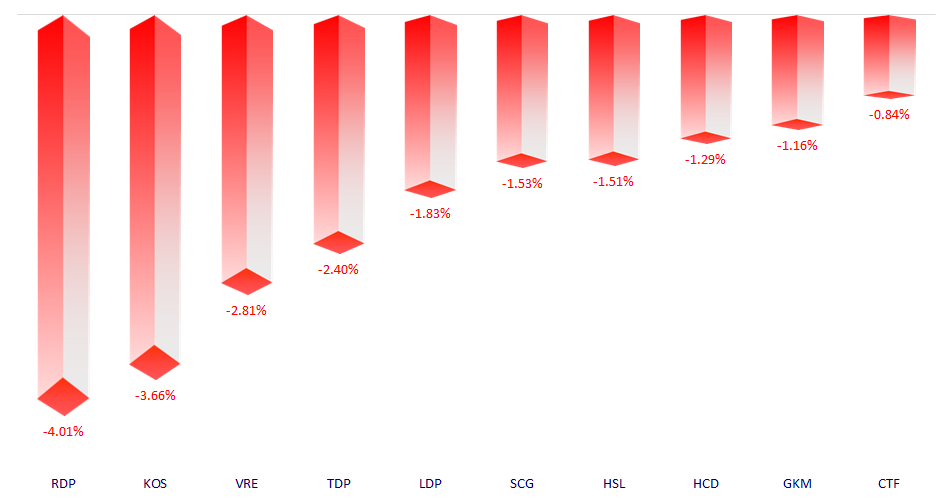

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.