Market Brief 13/11/2023

VIETNAM STOCK MARKET

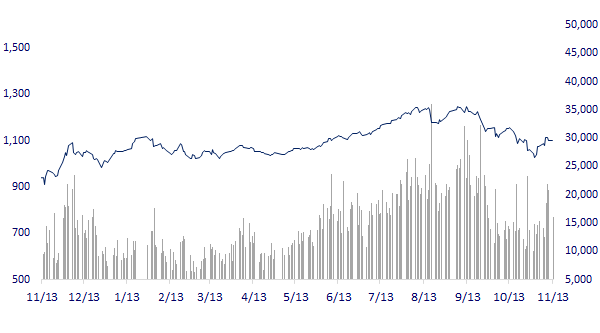

1,100.07

1D -0.15%

YTD 9.23%

1,106.72

1D -0.21%

YTD 10.10%

226.11

1D -0.24%

YTD 10.13%

85.98

1D -0.06%

YTD 20.00%

-358.78

1D 0.00%

YTD 0.00%

18,281.01

1D -23.02%

YTD 112.18%

The market fluctuated in the first session of the week. The market traded above the reference level most of the time, but since about 2pm, VNIndex suddenly dropped deeply with high trading volume. The basic resources sector (represented by steel stocks) had the best gain today.

ETF & DERIVATIVES

19,050

1D 0.00%

YTD 9.92%

13,100

1D -1.06%

YTD 9.90%

13,600

1D -0.80%

YTD 8.97%

16,800

1D 0.00%

YTD 19.57%

17,950

1D -0.44%

YTD 25.09%

24,870

1D -0.24%

YTD 11.03%

14,940

1D -0.33%

YTD 15.37%

1,107

1D -0.14%

YTD 0.00%

1,105

1D 0.00%

YTD 0.00%

1,102

1D 0.13%

YTD 0.00%

1,096

1D -0.65%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

32,585.11

1D 0.05%

YTD 24.87%

3,046.53

1D 0.25%

YTD -1.38%

9,988.83

1D 0.10%

YTD -9.32%

17,426.21

1D 1.30%

YTD -11.91%

2,403.76

1D -0.24%

YTD 7.48%

64,971.59

1D 0.29%

YTD 6.79%

3,106.68

1D -0.91%

YTD -4.45%

1,387.13

1D -0.46%

YTD -16.96%

81.35

1D 0.28%

YTD -5.31%

1,937.80

1D -0.06%

YTD 6.11%

Asian stocks were mixed in the first session of the week, Chinese and Japanese markets increased while Korean markets decreased. South Korea's consumer price index stood 3.8% higher in October from a year ago, the fastest inflation rate since March 2023 and above the 3.6% forecast by a Reuters poll. South Korean inflation is likely to ease in November to about 3.6% as prices of agricultural products have started to fall, the finance minister said on Sunday.

VIETNAM ECONOMY

0.56%

1D (bps) -8

YTD (bps) -441

5.00%

YTD (bps) -240

2.15%

1D (bps) -17

YTD (bps) -264

2.27%

1D (bps) -37

YTD (bps) -263

24,551

1D (%) 0.23%

YTD (%) 3.33%

26,792

1D (%) 0.25%

YTD (%) 4.42%

3,415

1D (%) 0.23%

YTD (%) -2.01%

The central exchange rate today (November 13) was announced by the State Bank at 24,015 VND/USD, an increase of VND1 compared to the rate listed last weekend. Applying a margin of 5%, the current exchange rate that commercial banks are allowed to trade is from 22,814 - 25,216 VND/USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Construction steel consumption in October increased sharply compared to the same period last year;

- Gold price on November 13: SJC gold kept above the threshold of 70 million VND/tael;

- Exports have not recovered, seafood businesses encountered difficulties in the third quarter;

- Moody's downgraded the US public debt outlook to negative;

- Many EU countries continue to buy Russian gas;

- China accounts for over 90% of the world's electric buses and trucks.

VN30

BANK

85,500

1D -0.58%

5D -4.47%

Buy Vol. 1,554,556

Sell Vol. 1,481,393

42,100

1D -0.24%

5D 0.72%

Buy Vol. 744,792

Sell Vol. 1,207,486

29,400

1D 0.00%

5D 2.98%

Buy Vol. 5,859,609

Sell Vol. 5,769,484

30,900

1D -0.48%

5D -0.32%

Buy Vol. 5,823,470

Sell Vol. 4,418,240

19,200

1D -1.79%

5D -3.16%

Buy Vol. 16,530,988

Sell Vol. 18,040,054

18,100

1D 0.56%

5D 0.84%

Buy Vol. 12,927,502

Sell Vol. 12,774,400

18,800

1D -0.27%

5D 3.01%

Buy Vol. 15,059,216

Sell Vol. 17,850,563

17,250

1D 1.47%

5D 3.92%

Buy Vol. 8,124,527

Sell Vol. 8,055,264

29,250

1D -0.85%

5D -0.68%

Buy Vol. 27,231,354

Sell Vol. 36,745,596

19,200

1D 1.05%

5D 1.59%

Buy Vol. 5,507,182

Sell Vol. 5,966,134

22,450

1D 0.22%

5D 1.13%

Buy Vol. 6,110,278

Sell Vol. 9,222,421

11,050

1D -0.90%

5D 0.45%

Buy Vol. 26,768,428

Sell Vol. 27,634,585

23,000

1D -3.36%

5D -9.09%

Buy Vol. 2,633,755

Sell Vol. 3,172,019

ACB: Credit rating agencies Fitch and Moody's continue to maintain a "stable outlook" rating for ACB.

OIL & GAS

11,900

1D 0.38%

5D 5.78%

Buy Vol. 28,677,680

Sell Vol. 23,569,190

33,350

1D 1.71%

5D 0.30%

Buy Vol. 1,195,915

Sell Vol. 1,265,650

44,800

1D 0.00%

5D 6.41%

Buy Vol. 5,841,603

Sell Vol. 8,883,986

PVN said that petroleum production (excluding Nghi Son Refinery and Petrochemical products) in October reached 6.08 million tons (+5.9% yoy), exceeding 10% of the yearly plan.

VINGROUP

41,350

1D -0.33%

5D 0.85%

Buy Vol. 11,054,409

Sell Vol. 12,979,127

23,500

1D -2.25%

5D -2.08%

Buy Vol. 7,340,008

Sell Vol. 7,958,897

68,700

1D -1.88%

5D -3.24%

Buy Vol. 3,029,687

Sell Vol. 3,108,758

VHM: Foreign investors continued to net sell VHM with a value of VND67 billion today.

FOOD & BEVERAGE

62,000

1D -1.29%

5D -3.13%

Buy Vol. 2,239,063

Sell Vol. 2,134,396

61,300

1D 0.49%

5D -7.40%

Buy Vol. 1,104,186

Sell Vol. 1,003,812

59,800

1D -1.76%

5D 0.67%

Buy Vol. 479,654

Sell Vol. 508,233

VNM: Vinamilk expects net revenue from exports to maintain an increase of 5% in the fourth quarter.

OTHERS

40,550

1D -0.99%

5D -0.37%

Buy Vol. 329,191

Sell Vol. 455,550

40,550

1D -0.12%

5D -0.37%

Buy Vol. 329,191

Sell Vol. 455,550

108,000

1D -0.92%

5D 0.65%

Buy Vol. 1,380,541

Sell Vol. 1,350,233

91,400

1D -0.11%

5D 3.28%

Buy Vol. 2,899,777

Sell Vol. 2,844,567

40,000

1D 1.52%

5D 5.12%

Buy Vol. 17,211,119

Sell Vol. 17,230,965

19,450

1D 0.52%

5D 5.14%

Buy Vol. 3,278,034

Sell Vol. 2,823,262

31,450

1D 2.11%

5D 8.45%

Buy Vol. 40,775,245

Sell Vol. 37,453,891

27,200

1D 2.64%

5D 5.63%

Buy Vol. 75,303,149

Sell Vol. 82,243,048

GVR: GVR said that in the third quarter, the selling price of rubber latex decreased over the same period, while the prices of many input items increased sharply, causing gross profit margin to decrease from 27% in the same period to 19.9% this quarter. In the third quarter, the rubber latex production and trading segment contributed 78%, equivalent to VND4,822 billion, an increase of 25% over the same period.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

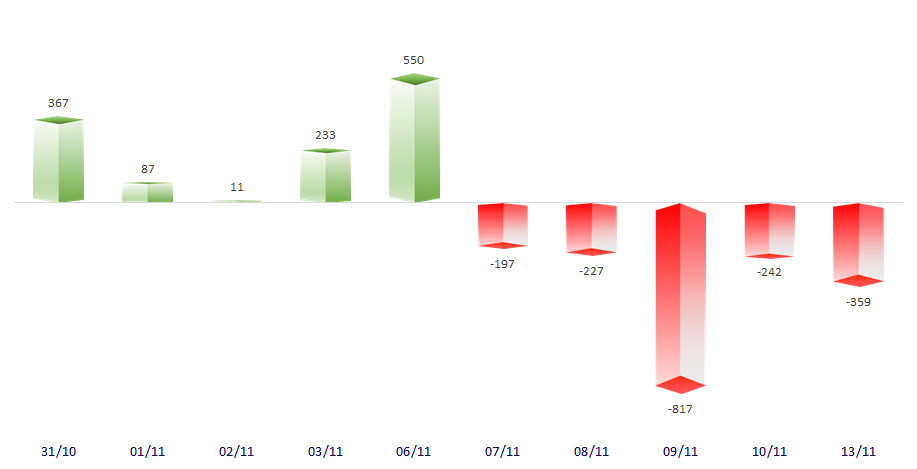

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

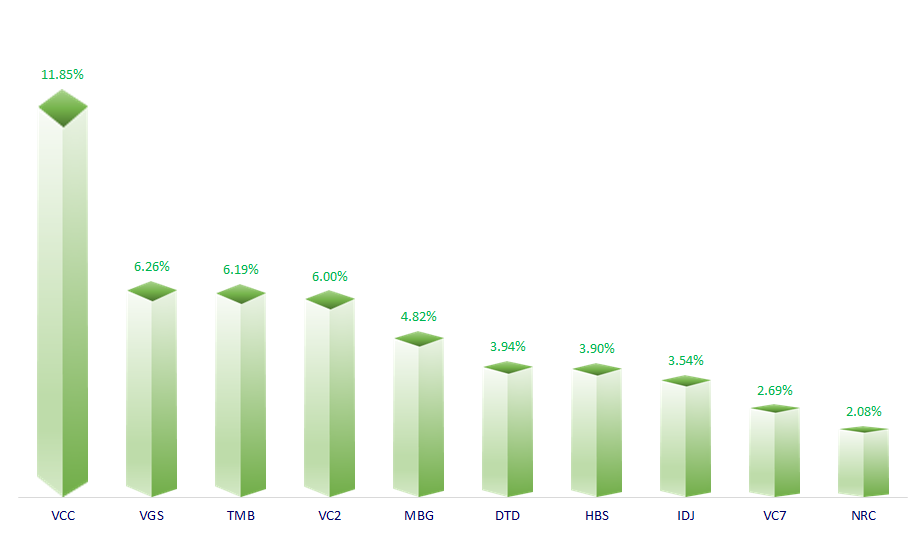

TOP INCREASES 3 CONSECUTIVE SESSIONS

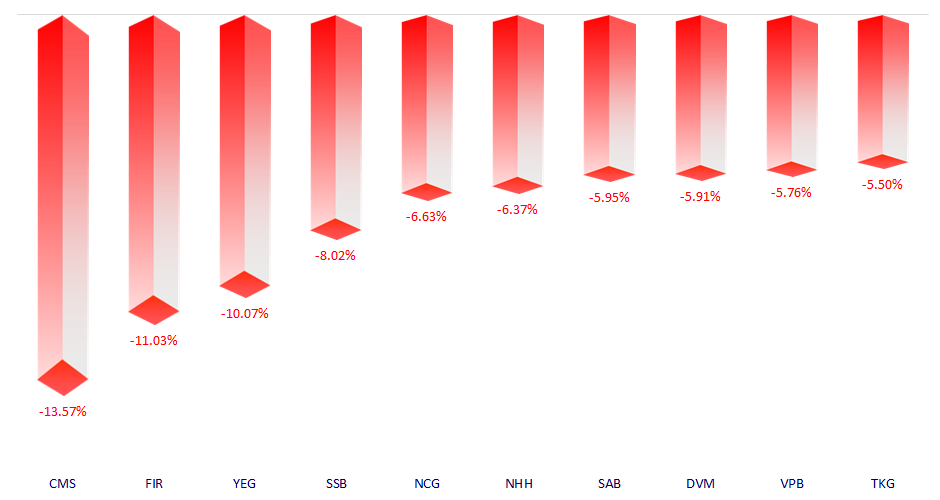

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.