Market Brief 11/12/2023

VIETNAM STOCK MARKET

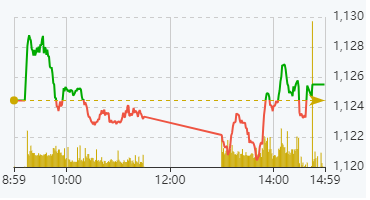

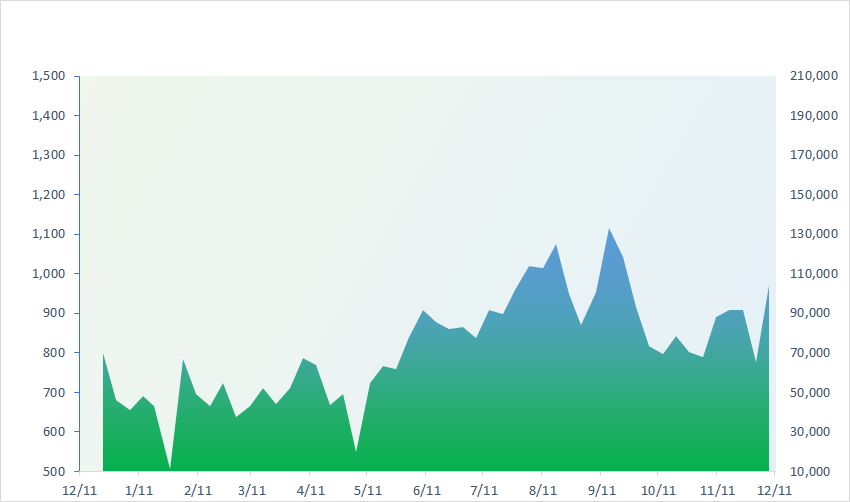

1,125.50

1D 0.09%

YTD 11.76%

231.37

1D 0.07%

YTD 12.70%

1,117.34

1D 0.22%

YTD 11.16%

85.48

1D -0.27%

YTD 19.30%

-393.60

1D 0.00%

YTD 0.00%

16,687.26

1D -18.15%

YTD 93.68%

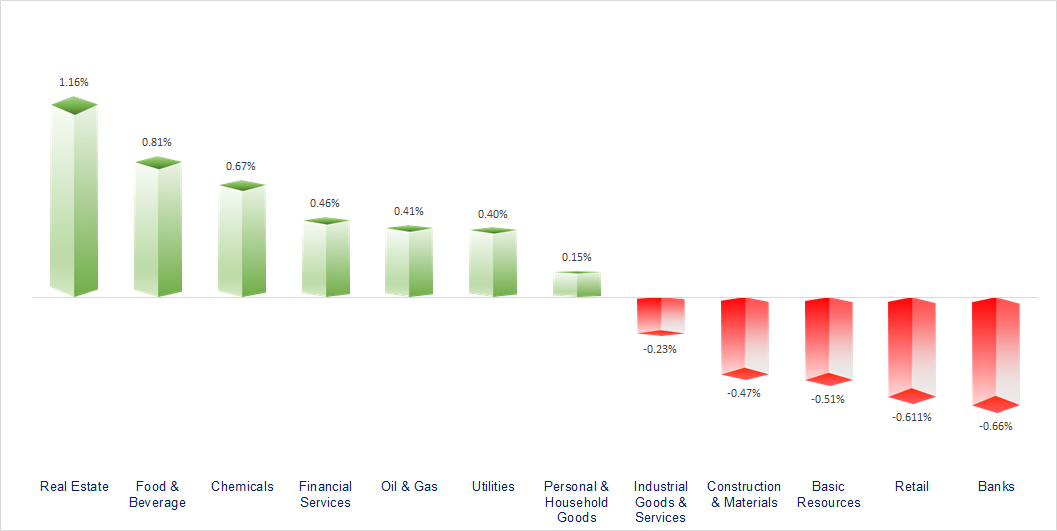

Today's session, the market continued to fluctuate within a narrow range, showing the cautious trend of investors at the present time. Real estate, food and beverage were the two most positive groups while the banking industry was quite negative.

ETF & DERIVATIVES

19,290

1D 0.31%

YTD 11.31%

13,100

1D -1.06%

YTD 9.90%

13,790

1D 0.22%

YTD 10.50%

17,000

1D 0.00%

YTD 21.00%

18,290

1D -0.49%

YTD 27.46%

25,500

1D 0.12%

YTD 13.84%

15,120

1D 0.07%

YTD 16.76%

1,117

1D 0.45%

YTD 0.00%

1,114

1D 0.38%

YTD 0.00%

1,113

1D 0.36%

YTD 0.00%

1,111

1D 0.38%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

32,791.80

1D 1.50%

YTD 25.67%

2,991.44

1D 0.74%

YTD -3.17%

9,632.61

1D 0.82%

YTD -12.56%

16,201.49

1D -0.88%

YTD -18.10%

2,525.36

1D 0.30%

YTD 12.92%

69,914.45

1D 0.13%

YTD 14.91%

3,090.20

1D -0.66%

YTD -4.96%

1,380.99

1D 0.16%

YTD -17.32%

75.74

1D 1.62%

YTD -11.84%

1,992.85

1D -1.84%

YTD 9.13%

Most major stock markets in Asia increased today as investors waited for the Fed meeting to take place this week. Hong Kong was a rare market that decreased today, after the data weakness from the Chinese economy. Data released over the weekend showed that China's CPI fell at the fastest rate in the past 3 years in November while PPI fell for the 14th consecutive month.

VIETNAM ECONOMY

0.15%

YTD (bps) -482

4.80%

YTD (bps) -260

1.93%

1D (bps) -13

YTD (bps) -286

2.46%

1D (bps) -4

YTD (bps) -244

24,425

1D (%) -0.10%

YTD (%) 2.80%

26,836

1D (%) -0.40%

YTD (%) 4.59%

3,448

1D (%) -0.49%

YTD (%) -1.06%

The U.S dollar started Monday on the front foot, with a reading on U.S. inflation and the Federal Reserve's last policy meeting for the year likely to set the tone for the week, while rising deflationary pressure in China leant on the yuan. China's yuan fell to a three-week low after data showed deflation in the country worsened in November.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Nvidia - US chip giant aims to set up centre in Vietnam;

- UOB forecasts that the USD/VND exchange rate will be at 24,000 in the first quarter of 2024;

- Submit to the Government the price mechanism for electricity imported from Laos in the first quarter of 2024;

- Korea aims to attract more than 20 million foreign tourists in 2024;

- US stocks arrive the final decisive moments of 2023;

- Factory activity in Asia remains gloomy.

VN30

BANK

84,200

1D -0.94%

5D -2.09%

Buy Vol. 2,531,829

Sell Vol. 2,314,424

41,400

1D -1.19%

5D 4.02%

Buy Vol. 2,488,696

Sell Vol. 2,893,422

26,850

1D -0.19%

5D 1.13%

Buy Vol. 4,186,366

Sell Vol. 6,301,483

30,850

1D -0.32%

5D 2.15%

Buy Vol. 3,574,052

Sell Vol. 3,368,235

19,400

1D -1.02%

5D -0.51%

Buy Vol. 16,059,350

Sell Vol. 15,933,288

18,150

1D -0.27%

5D 0.55%

Buy Vol. 10,479,233

Sell Vol. 12,574,087

18,750

1D 0.00%

5D 1.35%

Buy Vol. 9,282,253

Sell Vol. 10,262,736

17,350

1D -0.57%

5D 0.87%

Buy Vol. 6,072,090

Sell Vol. 9,629,606

27,850

1D -1.24%

5D -1.24%

Buy Vol. 25,703,955

Sell Vol. 25,283,606

19,200

1D -0.78%

5D 0.26%

Buy Vol. 4,391,583

Sell Vol. 6,086,867

22,400

1D 0.00%

5D 0.45%

Buy Vol. 4,269,721

Sell Vol. 6,775,671

11,150

1D 1.36%

5D 0.45%

Buy Vol. 41,984,657

Sell Vol. 39,600,695

22,650

1D -0.22%

5D -0.44%

Buy Vol. 1,402,982

Sell Vol. 1,979,223

At the end of the December 11 session, foreign investors mainly net sold banking stocks in the VN30 group. Among them, VCB was sold the most with VND140 billion, followed by STB - VND65 billion and VPB - VND47 billion.

OIL & GAS

78,300

1D 0.90%

5D 0.43%

Buy Vol. 5,457,470

Sell Vol. 8,424,664

11,600

1D -0.43%

5D 0.42%

Buy Vol. 982,635

Sell Vol. 988,708

35,650

1D 0.00%

5D 2.56%

Buy Vol. 8,908,018

Sell Vol. 10,687,247

POW: Accumulated for 11 months, PV Power's estimated revenue is about VND27,431 billion (+3.3% yoy), equivalent to 90% of the year's plan.

VINGROUP

44,050

1D 2.56%

5D -0.73%

Buy Vol. 15,773,232

Sell Vol. 17,045,371

41,000

1D 3.40%

5D 2.83%

Buy Vol. 7,190,895

Sell Vol. 9,382,072

23,650

1D 1.28%

5D 1.74%

Buy Vol. 7,345,475

Sell Vol. 8,147,924

VIC: Reuters said Nvidia is expected to reach a technology transfer agreement with at least one Vietnamese company during meetings with Vingroup, FPT, and Viettel

FOOD & BEVERAGE

70,000

1D 1.45%

5D 8.52%

Buy Vol. 5,088,019

Sell Vol. 5,477,048

67,500

1D 1.96%

5D 1.24%

Buy Vol. 820,531

Sell Vol. 898,429

65,500

1D -0.15%

5D 9.97%

Buy Vol. 918,336

Sell Vol. 992,713

VNM: VNM will make its second dividend payment this year, with December 23 set as the record date. Each shareholder will receive VND1,400 for each VNM share held.

OTHERS

65,100

1D 0.15%

5D 0.13%

Buy Vol. 961,048

Sell Vol. 763,259

40,050

1D 1.26%

5D 0.13%

Buy Vol. 961,048

Sell Vol. 763,259

104,200

1D 0.00%

5D -1.51%

Buy Vol. 1,085,415

Sell Vol. 913,779

95,000

1D 0.85%

5D 1.50%

Buy Vol. 2,700,041

Sell Vol. 4,295,937

42,500

1D -0.23%

5D 6.38%

Buy Vol. 9,939,903

Sell Vol. 12,015,705

20,350

1D 1.50%

5D -1.21%

Buy Vol. 2,807,227

Sell Vol. 2,932,254

32,700

1D 0.31%

5D -2.68%

Buy Vol. 44,990,767

Sell Vol. 36,223,107

27,500

1D -0.72%

5D 0.00%

Buy Vol. 35,159,425

Sell Vol. 39,114,414

MWG: Chairman of MWG - Mr. Nguyen Duc Tai said the reason for not buying all the registered shares was because it was not consistent with the market situation. Although he could not complete the previous transaction, Mr. Nguyen Duc Tai continued to register to buy another 500,000 MWG shares. Implementation period is from December 12, 2023 to January 10, 2024.

Market by numbers

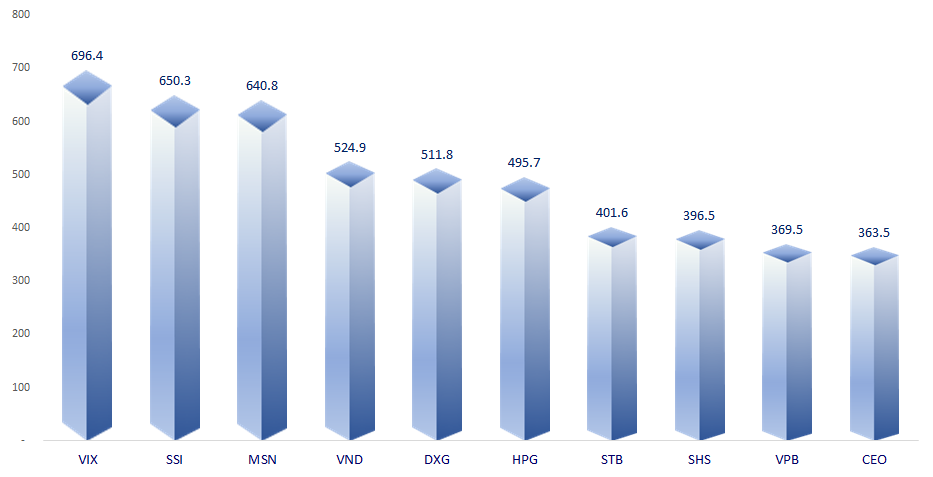

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

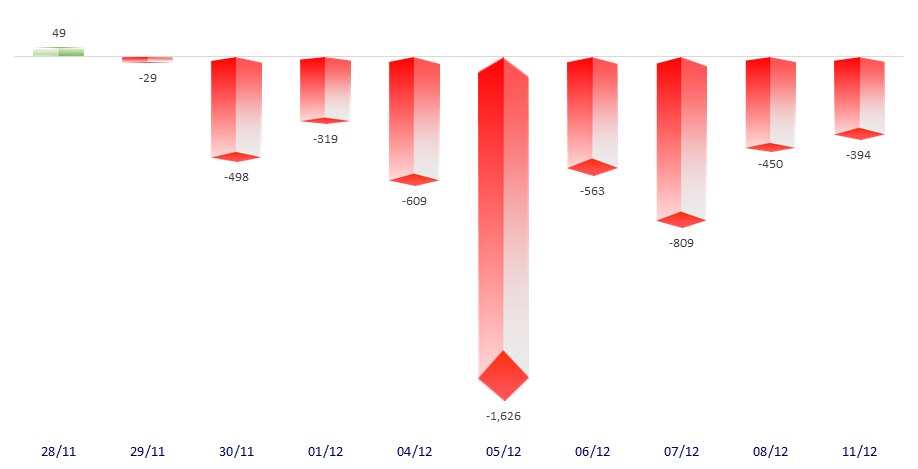

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

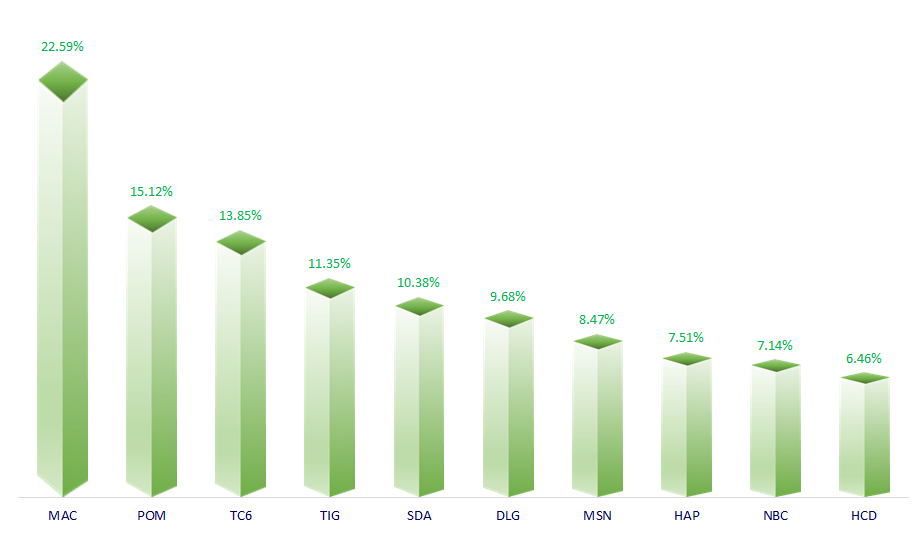

TOP INCREASES 3 CONSECUTIVE SESSIONS

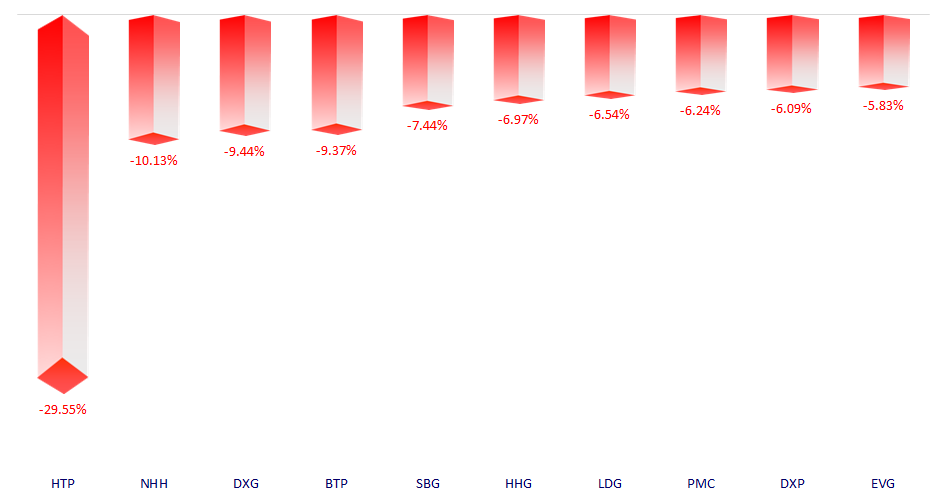

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.