Market Brief 15/12/2023

VIETNAM STOCK MARKET

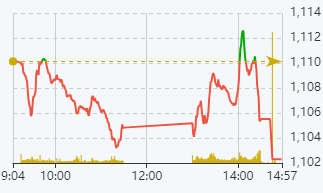

1,102.30

1D -0.71%

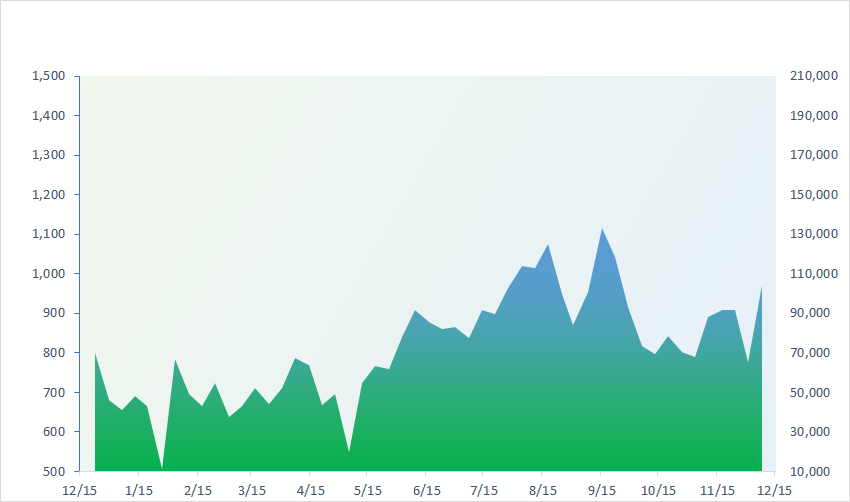

YTD 9.45%

227.02

1D -0.09%

YTD 10.58%

1,097.40

1D -0.64%

YTD 9.17%

85.05

1D -0.20%

YTD 18.70%

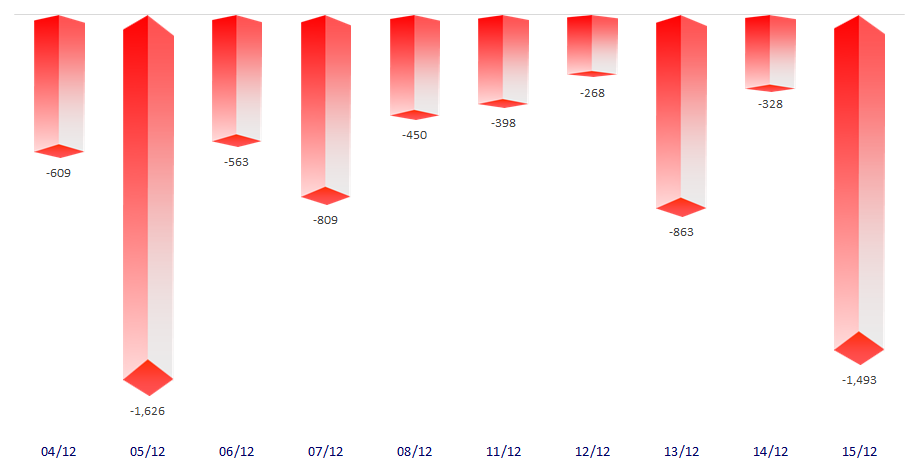

-1,493.34

1D 0.00%

YTD 0.00%

17,910.13

1D 5.86%

YTD 107.87%

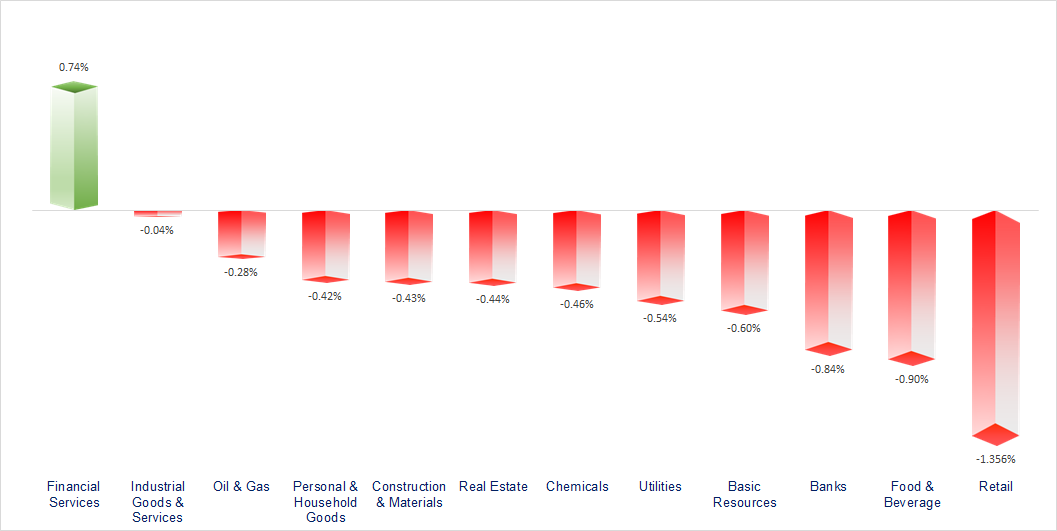

The market dropped for the third consecutive session today. Financial services was the most active sector in today's session. On the contrary, food and beverage, banking, and retail were quite negative.

ETF & DERIVATIVES

19,000

1D -0.42%

YTD 9.64%

13,020

1D -0.61%

YTD 9.23%

13,640

1D -0.22%

YTD 9.29%

17,090

1D 0.00%

YTD 21.64%

17,990

1D 0.00%

YTD 25.37%

25,320

1D 0.12%

YTD 13.04%

14,900

1D -0.67%

YTD 15.06%

1,099

1D -0.42%

YTD 0.00%

1,095

1D -0.86%

YTD 0.00%

1,096

1D -0.57%

YTD 0.00%

1,098

1D -0.52%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

32,970.55

1D 0.87%

YTD 26.35%

2,942.56

1D -0.56%

YTD -4.75%

9,385.33

1D -0.35%

YTD -14.80%

16,792.19

1D 2.38%

YTD -15.11%

2,563.56

1D 0.76%

YTD 14.63%

71,483.75

1D 1.33%

YTD 17.49%

3,116.51

1D -0.21%

YTD -4.15%

1,391.03

1D 0.88%

YTD -16.72%

76.92

1D 0.10%

YTD -10.46%

2,042.95

1D 0.51%

YTD 11.87%

Asian shares jumped to a four-month peak on Friday as sharp declines in the dollar. Hong Kong's Hang Seng index, however, rebounded 2.4%, driven by a more than 3% jump in Chinese real estate firms on news that Beijing and Shanghai have relaxed home purchase restrictions.

VIETNAM ECONOMY

0.20%

1D (bps) 5

YTD (bps) -477

4.80%

YTD (bps) -260

1.92%

1D (bps) 1

YTD (bps) -287

2.24%

1D (bps) -9

YTD (bps) -266

24,447

1D (%) 0.05%

YTD (%) 2.89%

27,334

1D (%) -0.17%

YTD (%) 6.53%

3,486

1D (%) 0.11%

YTD (%) 0.03%

SJC gold price suddenly increased sharply today. Specifically, Saigon Jewelry Company listed SJC gold price at 73.3 - 74.3 million VND/tael, an increase of 500,000 VND/tael compared to yesterday morning. At the same time, world gold prices remained above the 2,000 USD/ounce mark when the US announced that retail sales in November were much higher than market expectations.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Seafood exports to the US prospered in November, the Chinese and Japanese markets have not yet recovered;

- Animal feed prices cool down for the 5th time, the decline may last until early 2024;

- Beef and pork prices dropped sharply at the end of the year;

- PBOC offers record USD112 billion of cash as economy struggles;

- As from the beginning of 2024, the German economy is likely to return to an expansion path and gradually pick up speed;

- The oil market will enter 2024 with concerns about oversupply.

VN30

BANK

82,200

1D -2.61%

5D -3.29%

Buy Vol. 6,733,918

Sell Vol. 4,070,813

41,500

1D -0.24%

5D -0.95%

Buy Vol. 944,858

Sell Vol. 1,077,247

26,700

1D -0.19%

5D -0.74%

Buy Vol. 8,058,423

Sell Vol. 7,182,242

30,600

1D 0.16%

5D -1.13%

Buy Vol. 3,900,359

Sell Vol. 3,701,456

18,700

1D -1.58%

5D -4.59%

Buy Vol. 17,011,875

Sell Vol. 22,277,892

18,050

1D 0.00%

5D -0.82%

Buy Vol. 10,867,526

Sell Vol. 11,978,571

19,000

1D 0.53%

5D 1.33%

Buy Vol. 9,255,948

Sell Vol. 12,936,856

16,950

1D 0.30%

5D -2.87%

Buy Vol. 7,132,935

Sell Vol. 5,431,195

27,100

1D 0.00%

5D -3.90%

Buy Vol. 24,988,068

Sell Vol. 20,850,724

18,800

1D -0.53%

5D -2.84%

Buy Vol. 3,491,879

Sell Vol. 3,657,982

22,750

1D 1.11%

5D 1.56%

Buy Vol. 9,860,926

Sell Vol. 14,294,135

10,800

1D 0.00%

5D -1.82%

Buy Vol. 34,910,081

Sell Vol. 37,923,511

22,600

1D 0.00%

5D -0.44%

Buy Vol. 1,430,737

Sell Vol. 2,021,759

BID: The State Audit Agency has just adjusted to reduce BIDV's profit in 2022. Specifically, with the consolidated financial statements, the State Audit has reduced BIDV's net interest income by nearly VND110 billion.

OIL & GAS

76,000

1D -1.17%

5D -3.86%

Buy Vol. 11,772,018

Sell Vol. 10,775,265

11,200

1D -0.88%

5D -3.79%

Buy Vol. 988,821

Sell Vol. 898,682

34,300

1D -0.15%

5D 1.75%

Buy Vol. 8,259,048

Sell Vol. 10,227,880

POW: Fitch Ratings raised PV Power's international credit rating.

VINGROUP

43,700

1D -0.23%

5D 0.63%

Buy Vol. 11,933,571

Sell Vol. 11,876,673

39,900

1D -0.99%

5D -3.43%

Buy Vol. 9,841,433

Sell Vol. 5,826,386

22,550

1D -1.31%

5D -1.30%

Buy Vol. 5,364,977

Sell Vol. 7,151,196

VHM: VinaCapital experts said "the most difficult period of the real estate market is now over".

FOOD & BEVERAGE

68,100

1D -0.44%

5D -4.83%

Buy Vol. 8,222,005

Sell Vol. 6,118,930

63,000

1D -3.08%

5D -4.27%

Buy Vol. 1,757,320

Sell Vol. 1,221,206

62,800

1D -0.32%

5D -4.62%

Buy Vol. 772,222

Sell Vol. 758,683

MSN: On December 15 session, MSN was the second stock (only behind VCB) in the top falling stocks that had the most impact on VNIndex.

OTHERS

62,000

1D -2.67%

5D -0.13%

Buy Vol. 1,289,092

Sell Vol. 1,011,671

39,500

1D -1.62%

5D -0.13%

Buy Vol. 1,289,092

Sell Vol. 1,011,671

103,000

1D -2.18%

5D -1.15%

Buy Vol. 1,311,797

Sell Vol. 1,317,081

96,200

1D 0.00%

5D 2.12%

Buy Vol. 2,482,073

Sell Vol. 3,327,104

40,750

1D -2.04%

5D -4.34%

Buy Vol. 15,630,058

Sell Vol. 15,214,581

19,900

1D 0.25%

5D -0.75%

Buy Vol. 2,471,950

Sell Vol. 2,234,311

31,800

1D -0.63%

5D -2.45%

Buy Vol. 46,943,771

Sell Vol. 34,606,855

26,800

1D -0.92%

5D -3.25%

Buy Vol. 67,336,463

Sell Vol. 54,864,803

FPT: FPT has announced business results for the first 11 months of 2023, in which revenue and pre-tax profit reached VND47,201 billion and VND8,545 billion, an increase of 20.3% and 19.2% over the same period last year, respectively. Profit after tax for parent company shareholders and EPS reached VND6,027 billion and 4,757 VND/share, respectively, an increase of about 19%.

Market by numbers

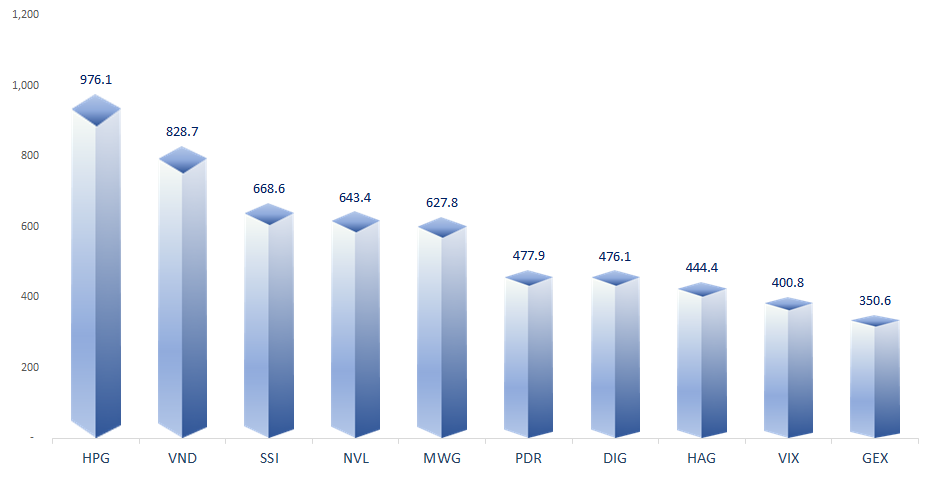

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

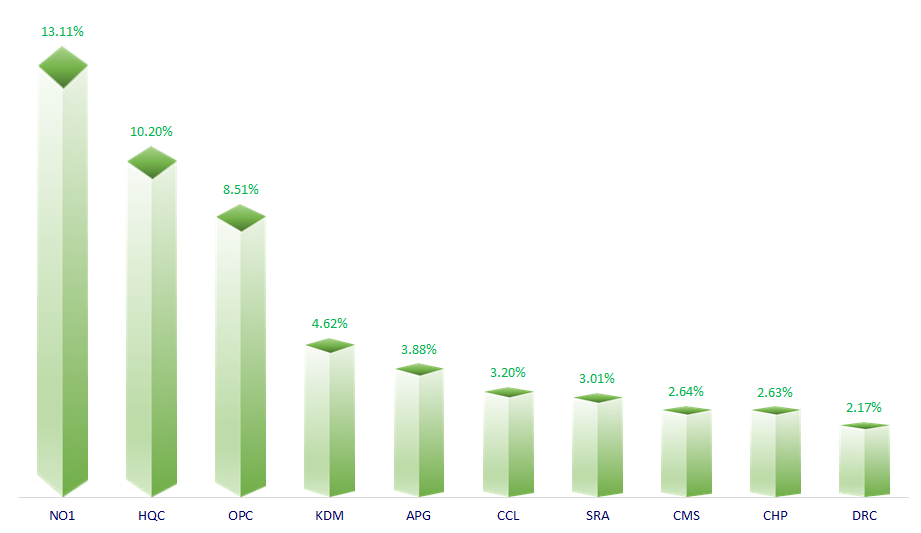

TOP INCREASES 3 CONSECUTIVE SESSIONS

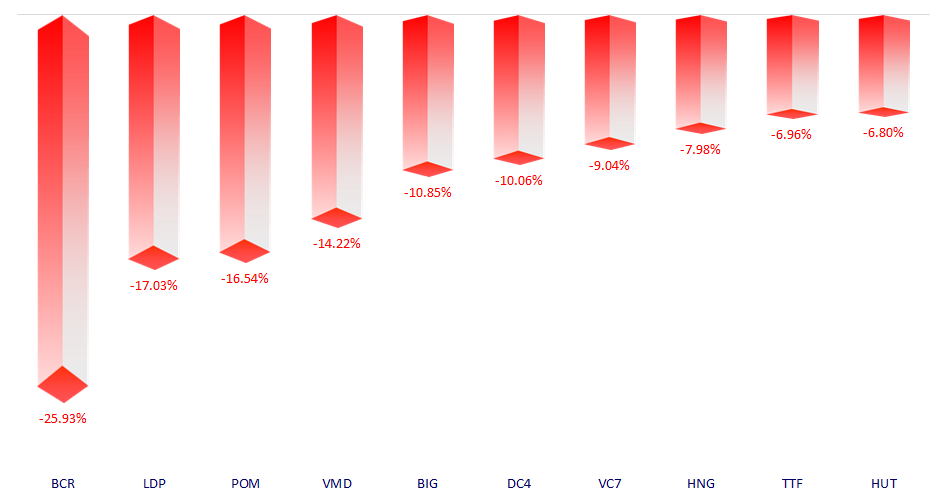

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.