Market Brief 17/04/2024

VIETNAM STOCK MARKET

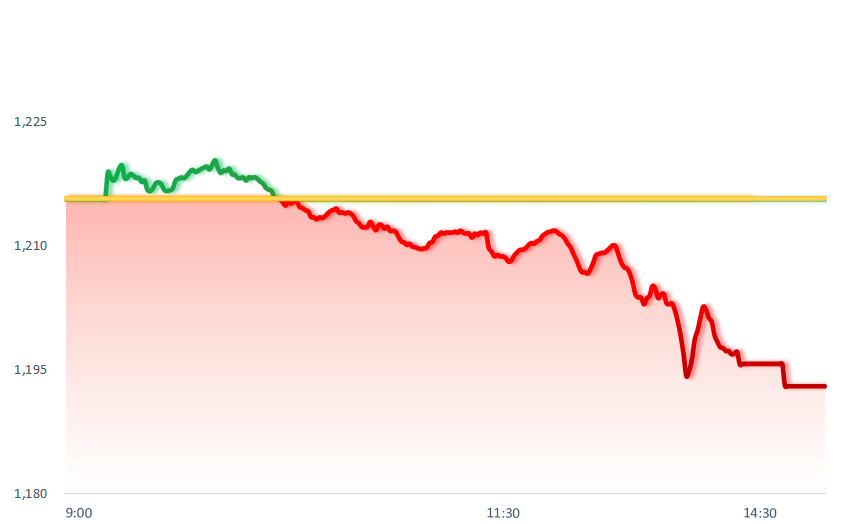

1,193.01

1D -1.86%

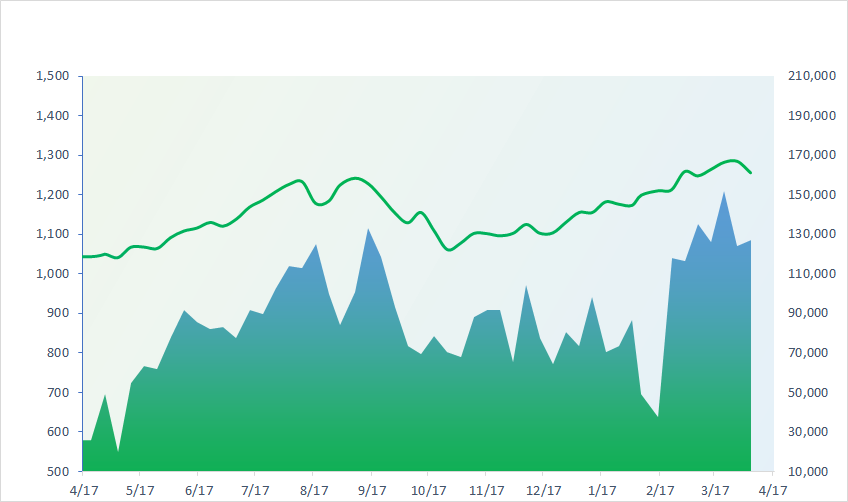

YTD 5.42%

226.20

1D -1.15%

YTD -1.65%

1,210.74

1D -1.78%

YTD 6.99%

88.15

1D -0.54%

YTD 0.65%

-996.58

1D 0.00%

YTD 0.00%

21,309.84

1D -36.59%

YTD 12.77%

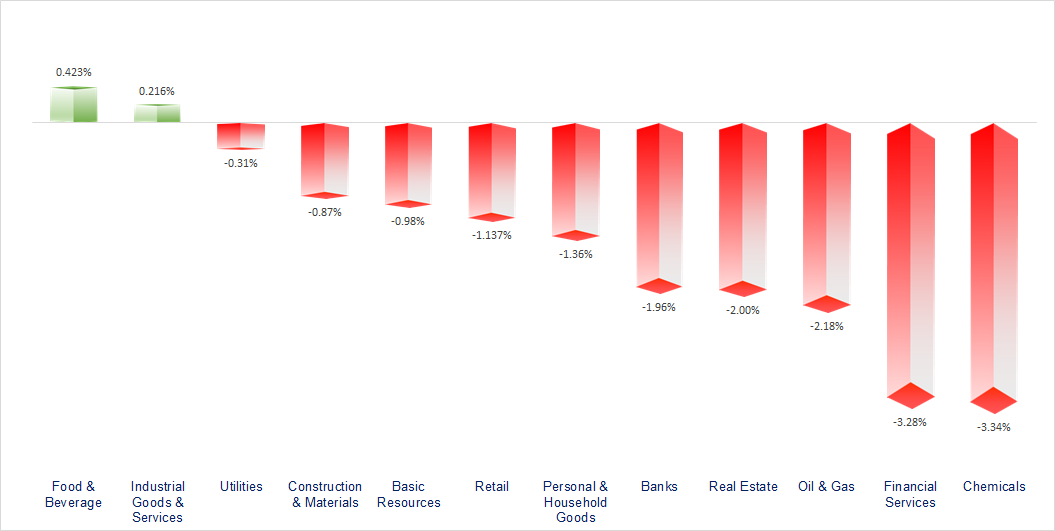

The market continued to fall as exchange rates heated up. Oil and gas stocks continued to fall sharply, despite positive world oil prices (PVC -6.6%, PVD -4.7%, PVS -3.3%, PLX -1.8%).

ETF & DERIVATIVES

21,060

1D -3.04%

YTD 7.83%

14,440

1D -1.50%

YTD 7.36%

14,950

1D -2.22%

YTD 7.86%

18,560

1D -2.67%

YTD 9.31%

19,600

1D -1.06%

YTD 6.52%

29,180

1D -1.32%

YTD 12.10%

16,260

1D -0.97%

YTD 6.48%

1,215

1D -1.25%

YTD 0.00%

1,211

1D -1.94%

YTD 0.00%

1,213

1D -1.75%

YTD 0.00%

1,224

1D -1.10%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

37,961.80

1D -1.32%

YTD 13.44%

3,071.38

1D 2.14%

YTD 3.68%

16,251.84

1D 0.02%

YTD -3.20%

2,584.18

1D -0.98%

YTD -3.21%

72,943.68

1D 0.00%

YTD 1.46%

3,154.69

1D 0.32%

YTD -2.33%

1,366.94

1D -2.11%

YTD -4.64%

89.19

1D -0.50%

YTD 15.79%

2,392.55

1D 0.40%

YTD 15.21%

Asia-Pacific markets were mixed after Tuesday’s broad sell-off. Japan’s Nikkei 225 slipped 1.32% to end at 37,961.8, below the 38,000 mark for the first time since February. Chinese stocks climbed, in contrast to the wider decline in Asian markets. The China Securities Regulatory Commission, in a session with journalists, explained that tighter rules would not spark a wave of delistings. The Bombay Stock Exchange (BSE) was closed today, in observance of Ram Navami celebrations.

VIETNAM ECONOMY

4.92%

1D (bps) -6

YTD (bps) 132

4.70%

YTD (bps) -10

2.31%

1D (bps) 3

YTD (bps) 43

2.83%

1D (bps) 5

YTD (bps) 65

25,425

1D (%) -0.07%

YTD (%) 3.73%

27,896

1D (%) 0.76%

YTD (%) 1.90%

3,583

1D (%) 0.56%

YTD (%) 3.08%

On April 17 session, the State Bank net injected nearly VND172 billion. Of which, SBV has provided a total of nearly VND5,672 billion to 5 commercial banks through the OMO channel with an interest rate of 4%/year, and at the same time issued VND5,500 billion of 28-day T-bills, with an interest rate of 3.59%/year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- USD on the "black market" soared to nearly VND25,700;

- Interbank interest rates increased to the highest level in 11 months;

- The Ministry of Finance and World Bank and FTSE Russell discussed solutions to upgrade Vietnam's stock market;

- New York can replace London as a financial technology center;

- Factors that can push oil prices to 100 USD/barrel;

- The world may have a shortage of 800 thousand tons of rubber per year in 2024 - 2025.

VN30

BANK

90,500

1D -0.55%

5D -4.23%

Buy Vol. 2,499,853

Sell Vol. 2,641,132

48,100

1D -4.37%

5D -7.50%

Buy Vol. 3,739,547

Sell Vol. 5,014,256

32,700

1D -3.96%

5D -2.82%

Buy Vol. 31,060,287

Sell Vol. 33,360,204

44,850

1D -1.43%

5D -1.75%

Buy Vol. 14,223,309

Sell Vol. 13,451,015

18,150

1D -3.20%

5D -6.20%

Buy Vol. 24,550,069

Sell Vol. 27,904,823

23,100

1D -3.35%

5D -2.94%

Buy Vol. 39,784,365

Sell Vol. 44,904,708

23,000

1D -2.13%

5D -3.97%

Buy Vol. 13,858,131

Sell Vol. 13,177,206

17,000

1D -3.41%

5D -7.36%

Buy Vol. 11,820,101

Sell Vol. 13,862,970

26,800

1D -1.83%

5D -7.90%

Buy Vol. 23,968,869

Sell Vol. 22,356,144

21,500

1D -1.83%

5D -3.33%

Buy Vol. 11,485,105

Sell Vol. 12,657,543

26,750

1D -1.47%

5D -1.29%

Buy Vol. 16,878,474

Sell Vol. 17,126,846

11,100

1D -3.48%

5D -0.89%

Buy Vol. 56,337,704

Sell Vol. 78,770,560

22,200

1D 0.23%

5D 0.91%

Buy Vol. 2,890,963

Sell Vol. 4,295,530

TPB: Since April, TPBank has launched a loan package worth VND3,000 billion, exclusively for first-time customers at TPBank, with interest rates from only 4.5%.

OIL & GAS

75,100

1D -1.18%

5D -3.10%

Buy Vol. 1,302,957

Sell Vol. 12,601,798

10,950

1D 0.46%

5D -3.55%

Buy Vol. 14,667,300

Sell Vol. 1,137,939

35,300

1D -1.81%

5D -7.22%

Buy Vol. 1,258,424

Sell Vol. 7,238,260

Gasoline prices increased by about 400 VND/liter from this afternoon.

VINGROUP

45,000

1D -3.02%

5D -5.43%

Buy Vol. 5,004,960

Sell Vol. 20,496,843

41,800

1D -2.11%

5D -9.28%

Buy Vol. 15,403,243

Sell Vol. 11,249,452

22,000

1D -0.90%

5D -3.89%

Buy Vol. 13,290,290

Sell Vol. 7,888,386

VIC: Vingroup has successfully issued VND2,000 billion of bonds with an interest rate of 12.5%/year.

FOOD & BEVERAGE

64,200

1D 0.31%

5D -7.86%

Buy Vol. 7,148,688

Sell Vol. 11,764,301

66,800

1D 1.06%

5D -2.35%

Buy Vol. 13,633,405

Sell Vol. 1,009,259

54,000

1D -1.46%

5D -11.42%

Buy Vol. 833,535

Sell Vol. 1,751,827

MSN: Bloomberg quoted a source saying that Masan Group is considering listing its consumer unit.

OTHERS

54,300

1D -2.34%

5D -7.10%

Buy Vol. 1,018,500

Sell Vol. 1,138,121

38,600

1D -1.91%

5D -7.10%

Buy Vol. 1,158,112

Sell Vol. 1,138,121

103,400

1D -2.45%

5D 1.37%

Buy Vol. 1,339,545

Sell Vol. 1,616,237

111,800

1D -1.06%

5D -1.76%

Buy Vol. 3,787,836

Sell Vol. 3,353,830

49,400

1D -1.00%

5D -5.00%

Buy Vol. 11,406,835

Sell Vol. 11,399,311

28,650

1D -5.60%

5D -9.48%

Buy Vol. 8,072,520

Sell Vol. 8,351,713

34,400

1D -2.27%

5D -6.90%

Buy Vol. 26,401,241

Sell Vol. 29,555,208

28,000

1D -1.23%

5D -5.56%

Buy Vol. 28,131,685

Sell Vol. 29,492,029

MWG: MWG's board of directors expects that the Bach Hoa Xanh chain will be MWG's "trump card" in the next 5 years. In 2024, the chain's goal will be to contribute about 30% of MWG's revenue, expecting double-digit revenue growth, increasing market share and starting to make a profit.

Market by numbers

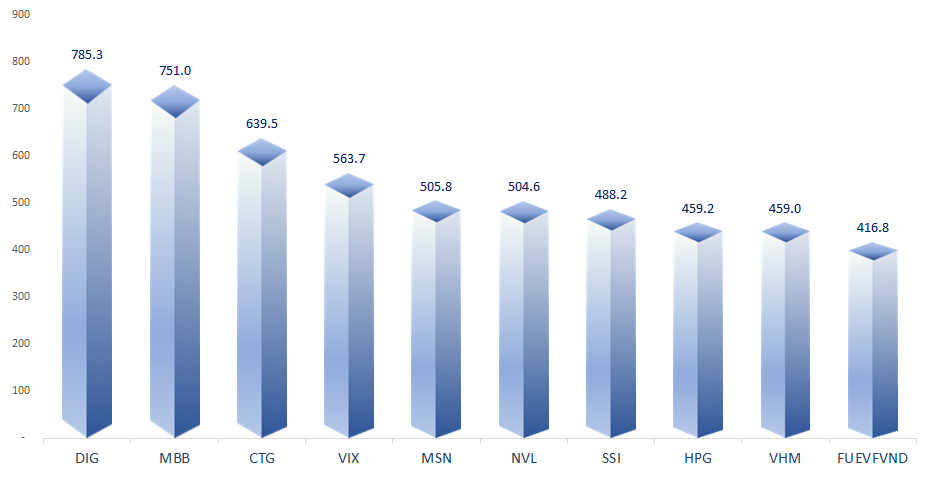

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

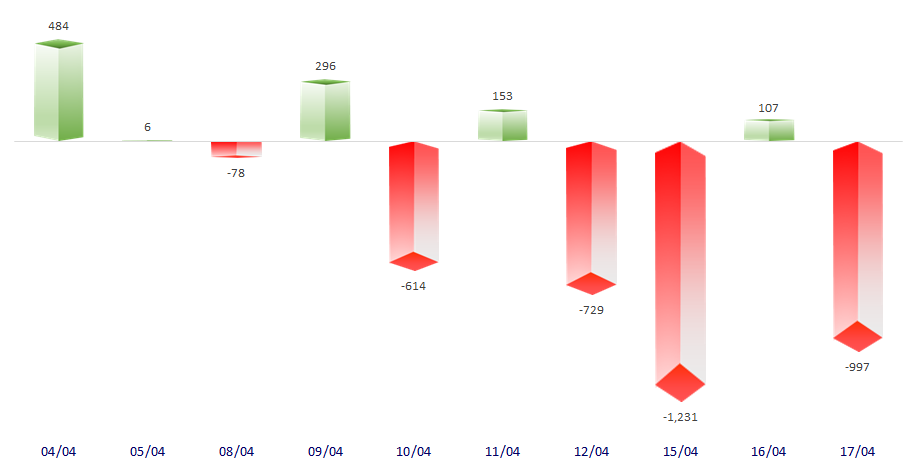

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

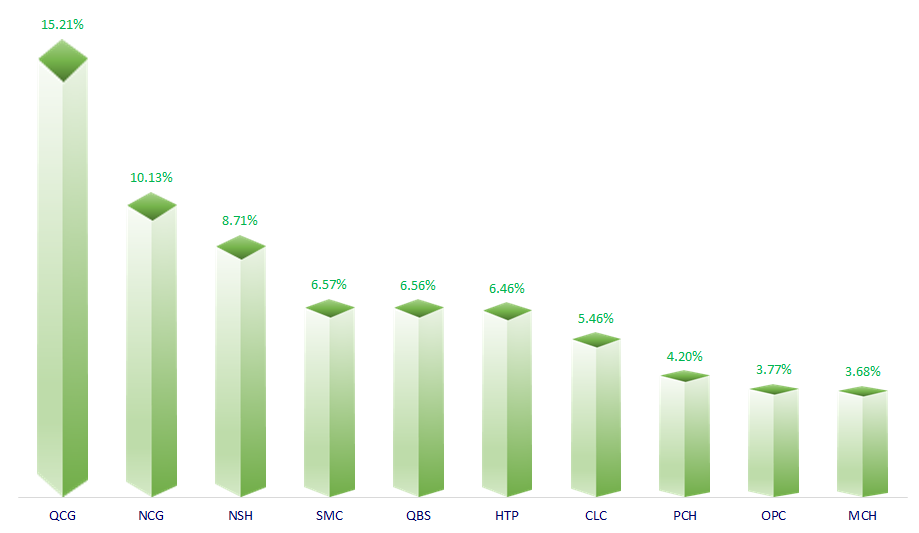

TOP INCREASES 3 CONSECUTIVE SESSIONS

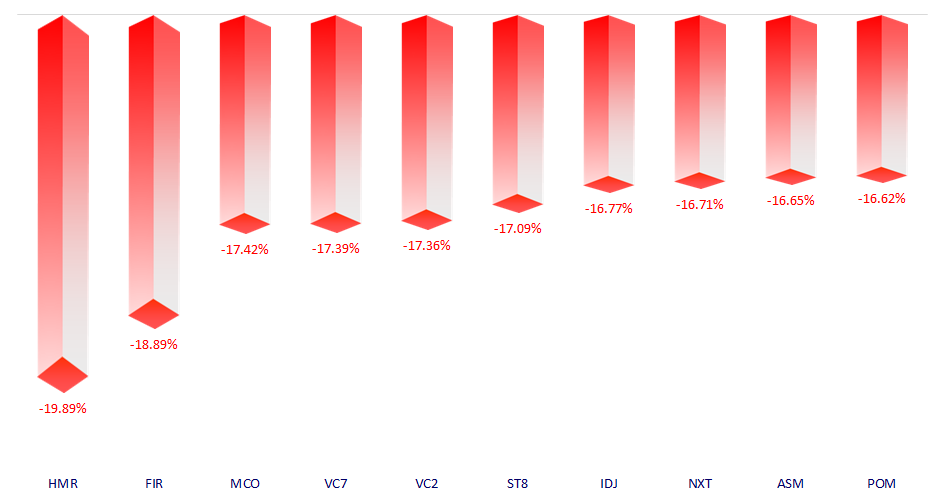

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.