Market brief 19/07/2024

VIETNAM STOCK MARKET

1,264.78

1D -0.76%

YTD 11.76%

240.52

1D -0.81%

YTD 4.58%

1,302.32

1D -0.31%

YTD 15.08%

96.78

1D -0.85%

YTD 10.50%

-316.09

1D 0.00%

YTD 0.00%

20,548.74

1D -4.23%

YTD 8.74%

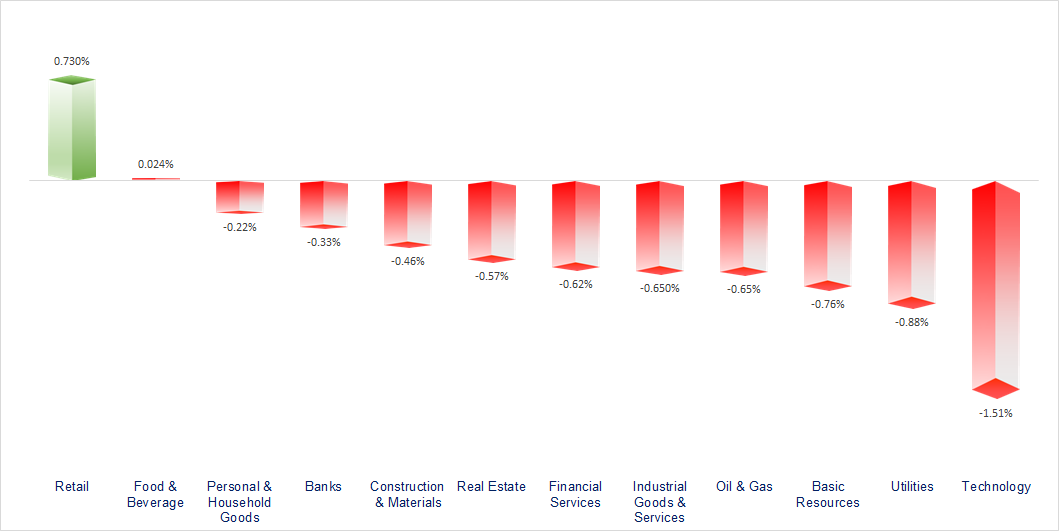

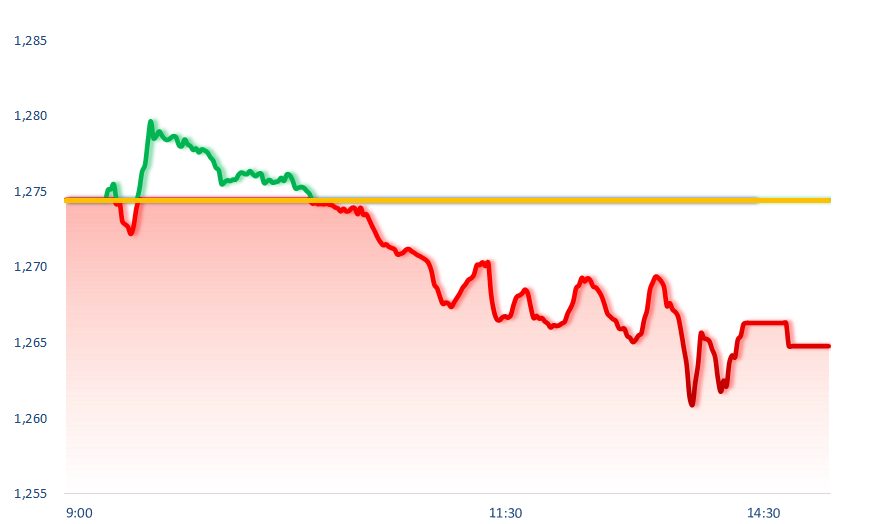

The market had a volatile trading session in red. Almost all sectors decreased, while retail was the rare positive group.

ETF & DERIVATIVES

22,780

1D -0.13%

YTD 16.64%

15,640

1D -0.51%

YTD 16.28%

16,210

1D -0.31%

YTD 16.96%

19,600

1D -0.05%

YTD 15.43%

21,140

1D 0.24%

YTD 14.89%

33,070

1D 0.00%

YTD 27.05%

17,670

1D -1.83%

YTD 15.72%

1,297

1D -0.81%

YTD 0.00%

1,301

1D -0.50%

YTD 0.00%

1,303

1D -0.48%

YTD 0.00%

1,305

1D -0.63%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

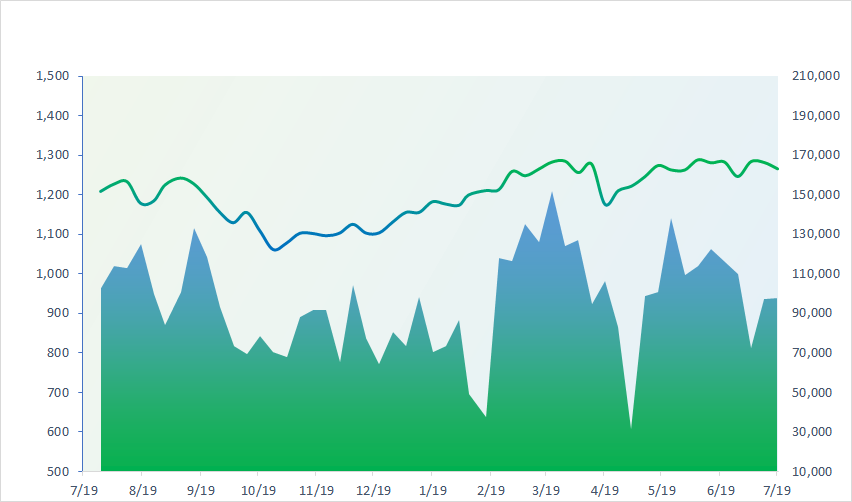

VNINDEX (12M)

GLOBAL MARKET

40,126.35

1D -2.36%

YTD 19.91%

2,977.13

1D 0.48%

YTD 0.50%

17,778.41

1D 0.22%

YTD 5.90%

2,824.35

1D -0.67%

YTD 5.79%

81,343.46

1D 0.78%

YTD 13.15%

3,467.54

1D -0.58%

YTD 7.36%

1,324.76

1D 0.38%

YTD -7.58%

84.96

1D -0.56%

YTD 10.30%

2,414.72

1D -1.86%

YTD 16.27%

Asian markets almost decreased, with Japan's Nikkei 225 index falling the most as the country's core inflation in June was lower than the 2.7% predicted by economists.

VIETNAM ECONOMY

4.52%

1D (bps) -8

YTD (bps) 92

4.60%

YTD (bps) -20

2.28%

1D (bps) -11

YTD (bps) 40

2.75%

1D (bps) 2

YTD (bps) 57

2545800.00%

1D (%) -0.02%

YTD (%) 3.87%

2833200.00%

1D (%) -0.25%

YTD (%) 3.49%

355700.00%

1D (%) -0.08%

YTD (%) 2.33%

The price of SJC gold bars at noon on July 19 temporarily stopped its strong increase when it simultaneously stopped at the 80 million VND/tael mark in the selling direction. Meanwhile, the price of SJC gold jewelry turned to decrease following the world, in some places falling below the 77 million VND/tael mark.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam trade surplus of USD11.88 billion;

- Restarting the Aquarium project in Vung Tau City;

- Da Nang City seizes opportunities for cooperation and investment in semiconductor chips;

- Microsoft's incident causes global turmoil;

- China faces the risk of declining growth if Mr. Trump is re-elected;

- ECB keeps interest rates unchanged and waits for signs of controlled inflation.

VN30

BANK

87,500

1D -0.57%

5D -0.11%

Buy Vol. 2,368,265

Sell Vol. 2,833,654

47,700

1D -1.65%

5D 2.36%

Buy Vol. 5,598,158

Sell Vol. 6,468,570

33,400

1D -0.15%

5D 4.38%

Buy Vol. 17,336,357

Sell Vol. 22,655,339

23,400

1D -1.27%

5D 2.63%

Buy Vol. 24,835,529

Sell Vol. 27,483,379

18,800

1D -1.31%

5D -1.05%

Buy Vol. 32,565,639

Sell Vol. 37,502,559

25,400

1D 2.01%

5D 10.43%

Buy Vol. 101,209,503

Sell Vol. 88,366,458

24,950

1D -0.60%

5D 3.31%

Buy Vol. 10,463,168

Sell Vol. 12,560,587

18,400

1D 2.22%

5D 2.51%

Buy Vol. 74,111,167

Sell Vol. 74,364,209

30,300

1D -0.98%

5D 1.85%

Buy Vol. 16,031,198

Sell Vol. 21,781,703

21,450

1D -0.46%

5D 0.70%

Buy Vol. 9,113,118

Sell Vol. 11,308,998

25,100

1D 1.21%

5D 4.58%

Buy Vol. 29,588,283

Sell Vol. 33,466,188

11,300

1D -1.31%

5D -0.44%

Buy Vol. 47,492,165

Sell Vol. 58,631,181

21,050

1D 0.24%

5D 1.20%

Buy Vol. 3,946,950

Sell Vol. 3,554,273

STB: Sacombank has just increased online deposit interest rates for many terms, with the highest increase reaching 0.7%/year. Notably, Sacombank increased interest rates for 4 and 5-month terms very strongly, by 0.6% and 0.7%/year to 3.4% and 3.5%/year, respectively. However, interest rates for 6-month terms only increased slightly by 0.1%/year to 4.1%/year.

OIL & GAS

77,800

1D -0.38%

5D -12.50%

Buy Vol. 1,757,396

Sell Vol. 1,555,642

13,300

1D -6.34%

5D 1.30%

Buy Vol. 41,414,746

Sell Vol. 39,223,375

46,900

1D -1.26%

5D -2.40%

Buy Vol. 3,779,422

Sell Vol. 5,110,906

GAS: PV GAS plans to spend more than VND13,780 billion to pay dividends in 2023.

VINGROUP

40,750

1D 0.49%

5D -1.69%

Buy Vol. 2,843,447

Sell Vol. 3,238,612

37,850

1D 1.07%

5D -4.10%

Buy Vol. 9,836,722

Sell Vol. 15,104,451

19,900

1D -1.24%

5D -1.51%

Buy Vol. 9,386,747

Sell Vol. 13,851,835

VIC: Vingroup's second quarter revenue reached over VND43,000 billion, total assets exceeded VND700,000 billion for the first time.

FOOD & BEVERAGE

65,300

1D -0.91%

5D -5.08%

Buy Vol. 7,203,765

Sell Vol. 6,023,143

71,000

1D -0.28%

5D -1.43%

Buy Vol. 8,244,006

Sell Vol. 7,748,622

55,200

1D 1.66%

5D 4.31%

Buy Vol. 1,509,169

Sell Vol. 1,428,330

VNM: ThaiBev plans to swap its capital in a real estate to increase its ownership in Singapore Fraser and Neave (a shareholder holding 20.39% of Vinamilk's capital) from 28% to nearly 70%.

OTHERS

67,800

1D -0.29%

5D 0.55%

Buy Vol. 1,912,563

Sell Vol. 2,027,852

45,750

1D -2.66%

5D 3.53%

Buy Vol. 1,771,305

Sell Vol. 1,750,403

105,600

1D -0.09%

5D -5.83%

Buy Vol. 1,037,329

Sell Vol. 1,363,581

126,000

1D -1.49%

5D 1.23%

Buy Vol. 10,858,571

Sell Vol. 12,217,286

65,600

1D 0.92%

5D -8.97%

Buy Vol. 18,695,825

Sell Vol. 22,912,933

34,500

1D -4.30%

5D 1.02%

Buy Vol. 9,955,889

Sell Vol. 9,289,534

34,800

1D 1.31%

5D -1.05%

Buy Vol. 30,203,710

Sell Vol. 35,556,456

28,200

1D -0.70%

5D 0.00%

Buy Vol. 24,462,451

Sell Vol. 27,454,234

SSI: Accumulated in the first 6 months of 2024, SSI is estimated to achieve more than VND2,000 billion in consolidated pre-tax profit, achieving nearly 60% of the annual profit target. The securities service segment recorded the largest revenue proportion in total revenue at 47%.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

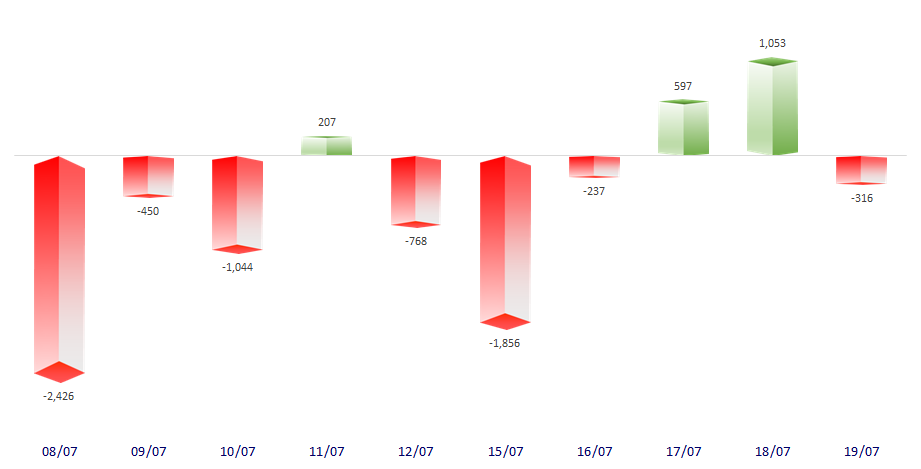

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

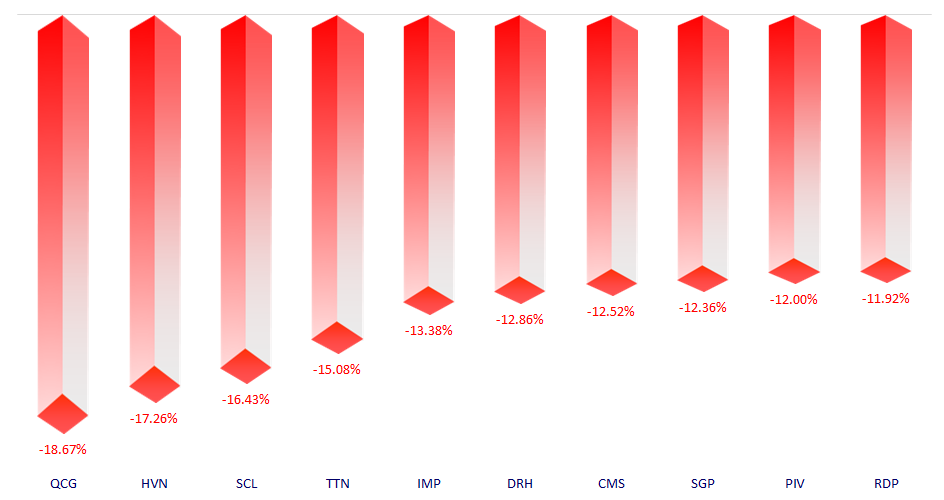

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.