Market brief 12/08/2024

VIETNAM STOCK MARKET

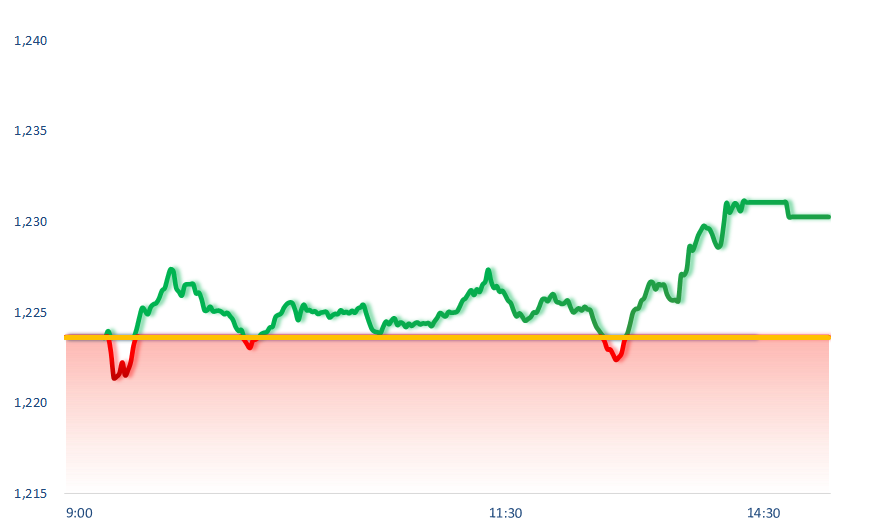

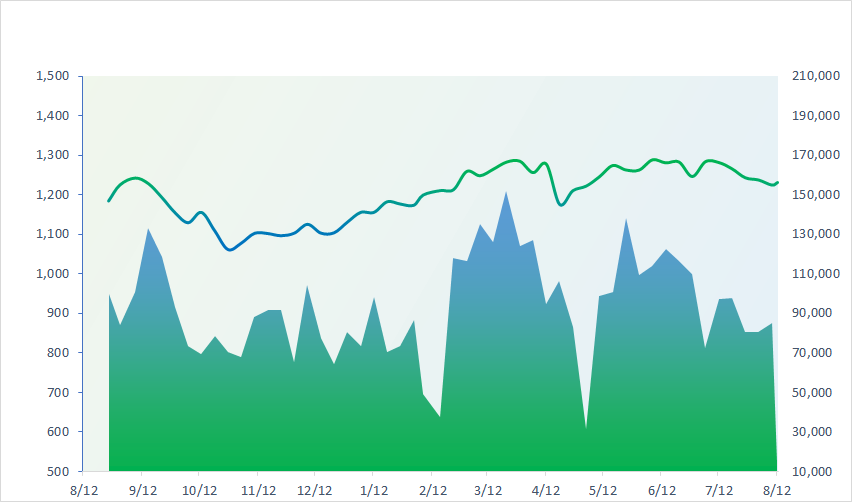

1,230.28

1D 0.54%

YTD 8.71%

230.77

1D 0.61%

YTD 0.34%

1,271.44

1D 0.52%

YTD 12.35%

93.00

1D 0.22%

YTD 6.19%

56.90

1D 0.00%

YTD 0.00%

15,580.56

1D -2.72%

YTD -17.55%

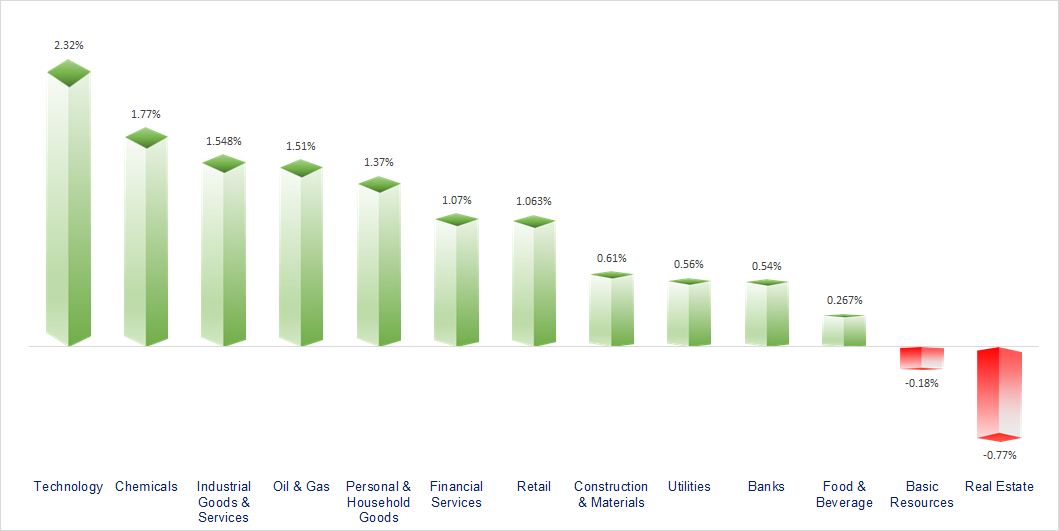

The market continued to have a recovery session with low liquidity. The aviation, technology and chemical groups were the most active today, while real estate and basic resources remained quite gloomy.

ETF & DERIVATIVES

22,250

1D 0.23%

YTD 13.93%

15,300

1D 0.66%

YTD 13.75%

15,750

1D 0.19%

YTD 13.64%

18,980

1D -2.57%

YTD 11.78%

19,960

1D 0.45%

YTD 8.48%

32,100

1D 1.26%

YTD 23.32%

17,200

1D -1.43%

YTD 12.64%

1,270

1D 0.40%

YTD 0.00%

1,271

1D 0.38%

YTD 0.00%

1,271

1D 0.32%

YTD 0.00%

1,273

1D 0.27%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

35,025.00

1D 0.00%

YTD 4.66%

2,858.20

1D -0.14%

YTD -3.51%

17,111.65

1D 0.13%

YTD 1.92%

2,618.30

1D 1.15%

YTD -1.93%

79,674.83

1D -0.01%

YTD 10.82%

3,235.59

1D -0.80%

YTD 0.17%

1,297.07

1D 0.00%

YTD -9.51%

80.36

1D 0.90%

YTD 4.33%

18.55

1D -99.25%

YTD -99.11%

Asian markets were mostly higher, recovering from a volatile week. The biggest gainer was South Korea's Kospi, which rose more than 1% on strong results from semiconductor companies.

VIETNAM ECONOMY

4.40%

YTD (bps) 80

4.60%

YTD (bps) -20

2.37%

1D (bps) 3

YTD (bps) 49

2.68%

1D (bps) 3

YTD (bps) 51

2530100.00%

1D (%) 0.10%

YTD (%) 3.23%

2821400.00%

1D (%) 0.16%

YTD (%) 3.06%

357100.00%

1D (%) 0.03%

YTD (%) 2.73%

At noon on the first day of the week, August 12, gold trading businesses continued to report that the price of SJC gold bars had stagnated while 24K jewelry gold prices had slightly decreased by no more than VND50,000/tael compared to the noon session last weekend.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Textile and garment exports surpass USD4 billion for first time in a year;

- There will be an additional 1,200 km of highways by 2025;

- Vietnam welcomes 10 million international visitors thanks to open entry policies;

- A slight rise in US inflation will not derail the Fed's interest rate policy;

- US refineries cut capacity, raising concerns about a global crude glut;

- Foreign investors withdraw capital from China at a record pace.

VN30

BANK

87,800

1D 0.11%

5D 1.04%

Buy Vol. 1,941,469

Sell Vol. 1,758,037

46,800

1D 0.21%

5D 1.52%

Buy Vol. 2,669,698

Sell Vol. 3,195,634

31,700

1D 0.63%

5D 5.14%

Buy Vol. 5,594,343

Sell Vol. 6,256,159

21,250

1D 0.71%

5D -4.71%

Buy Vol. 21,159,007

Sell Vol. 20,469,524

18,150

1D 0.83%

5D 0.00%

Buy Vol. 22,489,168

Sell Vol. 19,854,130

23,700

1D 1.07%

5D 3.27%

Buy Vol. 30,111,608

Sell Vol. 16,988,279

25,550

1D 0.20%

5D 4.29%

Buy Vol. 14,709,808

Sell Vol. 13,542,063

17,250

1D 0.88%

5D 2.68%

Buy Vol. 10,558,749

Sell Vol. 9,701,726

29,200

1D 1.21%

5D 7.35%

Buy Vol. 15,327,720

Sell Vol. 15,671,870

20,800

1D -0.48%

5D 2.72%

Buy Vol. 6,451,842

Sell Vol. 5,146,913

23,800

1D 0.85%

5D 2.59%

Buy Vol. 8,902,804

Sell Vol. 7,108,859

10,500

1D 0.00%

5D 1.94%

Buy Vol. 19,717,131

Sell Vol. 21,757,579

21,750

1D 0.23%

5D -0.68%

Buy Vol. 3,821,318

Sell Vol. 3,403,295

SSB: SeABank will issue 329 million shares to pay dividends to shareholders, equivalent to an issuance ratio of 13.18%. In addition, the bank will also issue an additional 10.3 million shares to increase capital from equity, equivalent to a ratio of 0.4127%. Accordingly, the total issuance ratio of the two above options is 13.6%. After completion, SeABank's charter capital will increase by VND3,393 billion to VND28,350 billion.

OIL & GAS

82,500

1D 1.10%

5D 2.26%

Buy Vol. 4,498,756

Sell Vol. 4,563,278

13,600

1D -1.81%

5D 7.36%

Buy Vol. 13,839,326

Sell Vol. 15,979,041

48,850

1D 1.77%

5D -1.69%

Buy Vol. 6,831,790

Sell Vol. 9,726,158

POW: PV Power (POW) and 4 other contractors bid to implement the USD2.3 billion super thermal power project in Thanh Hoa.

VINGROUP

40,600

1D -1.46%

5D 5.80%

Buy Vol. 4,002,463

Sell Vol. 3,384,298

36,500

1D -1.88%

5D 3.57%

Buy Vol. 13,186,760

Sell Vol. 16,326,148

17,400

1D -0.57%

5D 5.19%

Buy Vol. 11,681,997

Sell Vol. 10,691,603

VHM: The Vinhomes Vung Ang Industrial Park is being proposed by Ha Tinh to strive to start construction in the second half of 2024.

FOOD & BEVERAGE

73,000

1D -0.41%

5D 6.67%

Buy Vol. 10,705,013

Sell Vol. 11,879,170

75,200

1D 0.00%

5D 3.85%

Buy Vol. 8,677,863

Sell Vol. 9,068,895

54,000

1D 0.75%

5D 5.48%

Buy Vol. 1,314,427

Sell Vol. 1,059,389

VNM: Vinamilk will operate phase 1 of the Vinabeef Tam Dao Complex with a capacity of 10,000 tons of beef/year from the fourth quarter of 2024.

OTHERS

71,200

1D -0.42%

5D 3.34%

Buy Vol. 1,006,983

Sell Vol. 1,707,258

43,300

1D 0.00%

5D 1.20%

Buy Vol. 764,844

Sell Vol. 703,167

101,100

1D 0.20%

5D 9.61%

Buy Vol. 1,099,773

Sell Vol. 1,053,455

130,000

1D 2.44%

5D 8.12%

Buy Vol. 14,137,171

Sell Vol. 10,730,234

66,600

1D 1.52%

5D 10.30%

Buy Vol. 16,319,961

Sell Vol. 20,072,219

33,200

1D 2.15%

5D 8.11%

Buy Vol. 5,813,941

Sell Vol. 6,741,665

32,000

1D 2.24%

5D -0.39%

Buy Vol. 21,665,177

Sell Vol. 21,824,516

25,850

1D -0.77%

5D 0.00%

Buy Vol. 23,663,487

Sell Vol. 21,382,522

HPG: According to S&P Global, on August 8, the European Commission (EC) announced an anti-dumping investigation into a number of non-ferrous metal products originating from countries such as Egypt, India, Japan and Vietnam.

Market by numbers

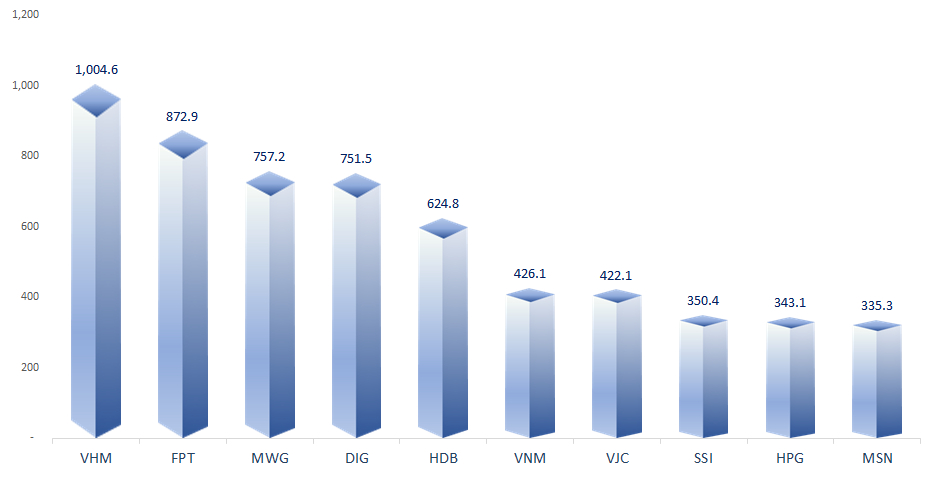

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

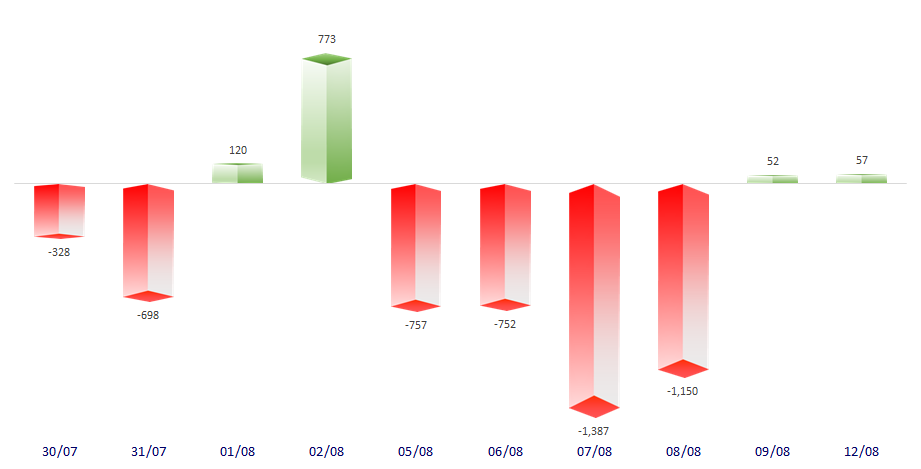

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

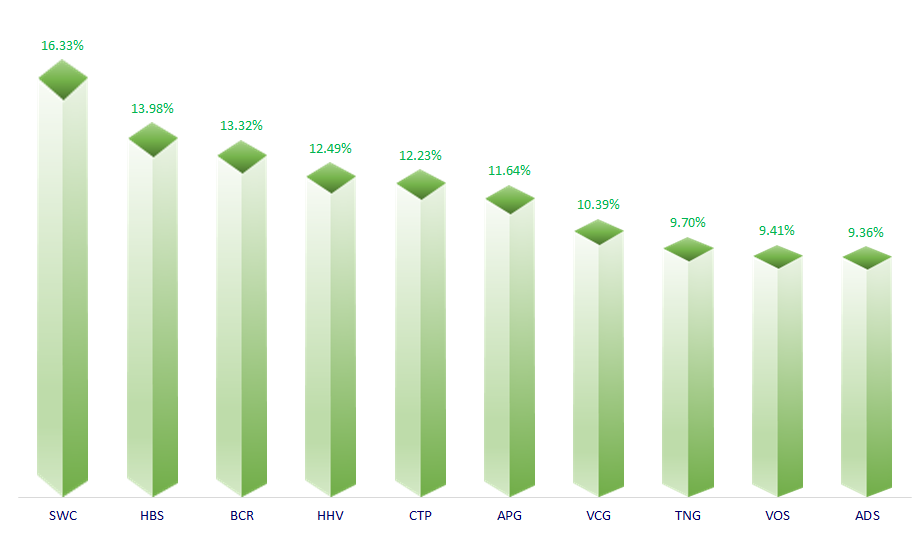

TOP INCREASES 3 CONSECUTIVE SESSIONS

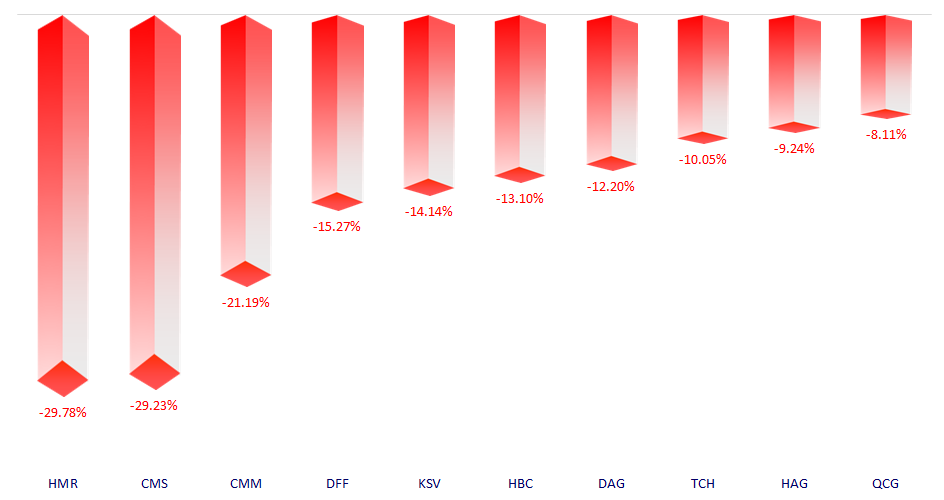

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.