Market brief 22/11/2024

VIETNAM STOCK MARKET

1,228.10

1D -0.02%

YTD 8.52%

221.29

1D -0.21%

YTD -3.78%

1,286.07

1D -0.05%

YTD 13.65%

91.70

1D 0.22%

YTD 4.70%

28.17

1D 0.00%

YTD 0.00%

14,089.78

1D 5.63%

YTD -25.44%

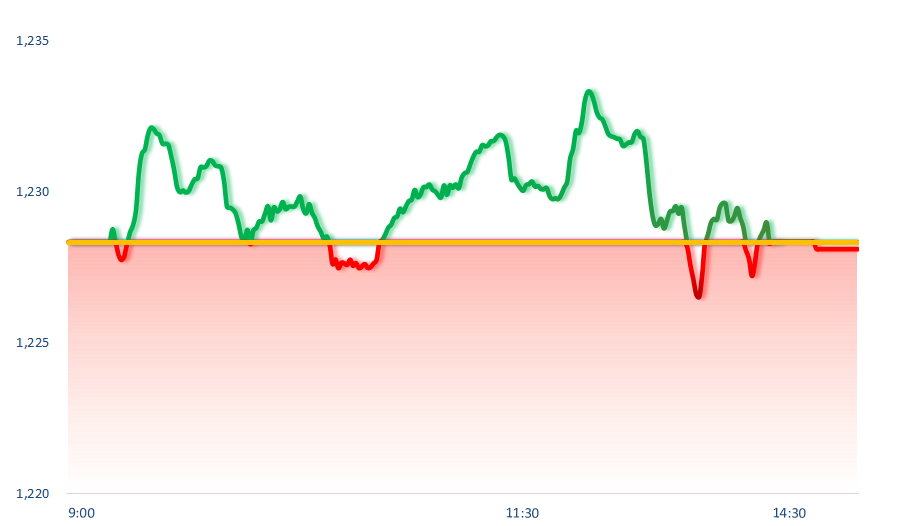

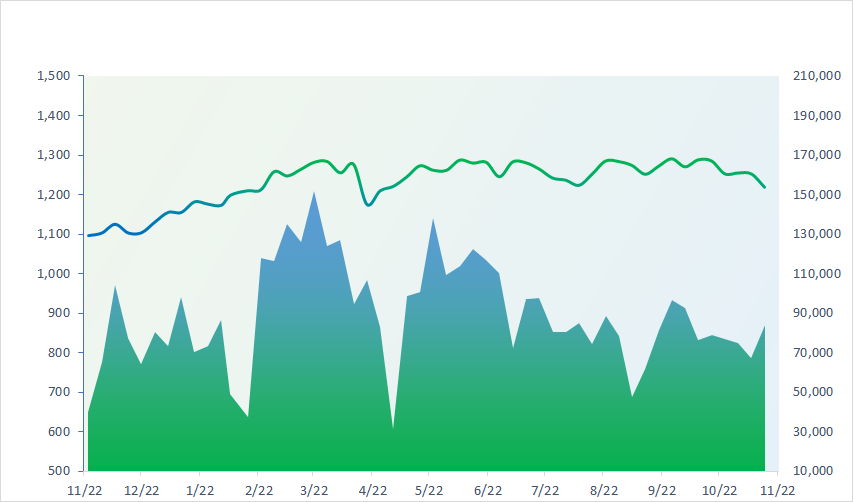

The market traded within a narrow range after two consecutive strong rallies. The positive takeaway is that foreign investors returned to net buying after more than a month of consecutive net selling. VHM shares dropped 3.9% after completing the buyback of 370 million treasury shares, making it the largest negative contributor to the VNIndex.

ETF & DERIVATIVES

22,500

1D 0.00%

YTD 15.21%

15,520

1D 0.26%

YTD 15.39%

16,080

1D 0.94%

YTD 16.02%

19,150

1D 0.00%

YTD 12.78%

20,730

1D -0.05%

YTD 12.66%

31,740

1D 0.03%

YTD 21.94%

17,190

1D 0.47%

YTD 12.57%

1,298

1D 0.39%

YTD 0.00%

1,301

1D 1.03%

YTD 0.00%

1,303

1D 0.48%

YTD 0.00%

1,303

1D 1.13%

YTD 0.00%

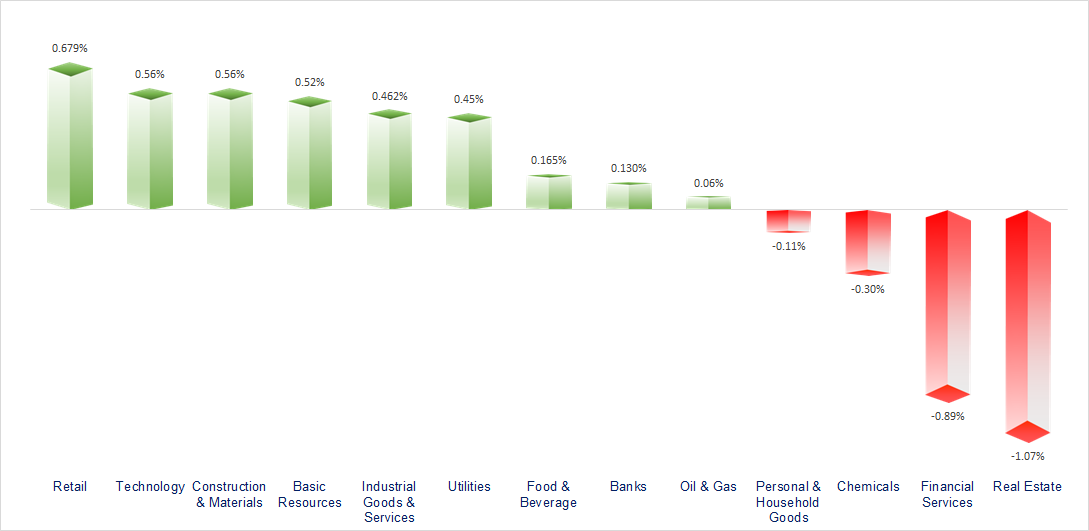

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

38,283.85

1D 0.68%

YTD 14.40%

3,267.19

1D -3.06%

YTD 10.29%

19,229.97

1D -1.89%

YTD 14.54%

2,501.24

1D 0.83%

YTD -6.31%

79,117.11

1D 2.54%

YTD 10.05%

3,746.02

1D 0.18%

YTD 15.98%

1,446.30

1D 0.41%

YTD 0.90%

74.54

1D 0.23%

YTD -3.23%

2,706.10

1D 1.13%

YTD 30.30%

Markets in the Asia-Pacific region mostly rose on Friday, except for the stock exchanges in Hong Kong and China. According to some analysts, investors might be cautious, awaiting clear developments regarding the U.S.-China tariffs. Japan's core inflation index rose 2.3% compared to a year ago, slightly higher than the 2.2% estimate from economists polled by Reuters. This figure is lower than the previous month's 2.4%. As a result, Japan's CPI stood at 2.3%, down from 2.5% in September.

VIETNAM ECONOMY

4.60%

1D (bps) 42

YTD (bps) 100

4.60%

YTD (bps) -20

2.24%

1D (bps) -4

YTD (bps) 36

2.63%

1D (bps) -1

YTD (bps) 45

2550900.00%

1D (%) 0.04%

YTD (%) 4.08%

2714343.00%

1D (%) -1.94%

YTD (%) -0.85%

356518.00%

1D (%) 0.02%

YTD (%) 2.57%

On November 22, gold prices in the domestic market continued to rise sharply at major brands. At the DOJI system, SJC gold increased by over 1 million VND/tael on the bid side and more than 500,000 VND/tael on the ask side. Specifically, the bid price is now at 85 million VND/tael, while the ask price stands at 87 million VND/tael. Gold rings also surged, reaching 85.2 million VND/tael for bid price and 86.2 million VND/tael for ask price.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Proposal to impose taxes on sugary drinks based on sugar content;

- Proposal for e-commerce platforms and digital platforms to pay corporate income tax;

- Vietnam-U.S. trade surpasses USD100 billion;

- Warning of excess solar battery capacity in China;

- Europe's "super battery factory" files for bankruptcy;

- Former Congressman Matt Gaetz withdraws from U.S. Attorney General nomination.

VN30

BANK

90,600

1D 0.11%

5D -1.20%

Buy Vol. 2,589,006

Sell Vol. 2,531,192

45,700

1D 0.77%

5D 2.24%

Buy Vol. 3,557,628

Sell Vol. 4,925,997

35,000

1D 0.00%

5D 5.74%

Buy Vol. 9,543,781

Sell Vol. 12,860,685

23,500

1D 1.29%

5D 4.68%

Buy Vol. 24,223,783

Sell Vol. 28,465,499

19,050

1D -0.78%

5D 1.87%

Buy Vol. 38,272,507

Sell Vol. 40,088,470

24,000

1D 0.00%

5D 2.13%

Buy Vol. 22,096,990

Sell Vol. 18,006,628

24,700

1D -0.40%

5D 0.00%

Buy Vol. 12,135,063

Sell Vol. 11,937,044

16,100

1D -0.92%

5D 3.21%

Buy Vol. 17,882,117

Sell Vol. 19,462,653

32,650

1D -1.21%

5D 0.77%

Buy Vol. 12,513,601

Sell Vol. 15,385,153

18,200

1D -0.55%

5D 0.28%

Buy Vol. 10,348,618

Sell Vol. 11,171,669

24,950

1D 0.40%

5D 2.25%

Buy Vol. 11,763,612

Sell Vol. 12,042,964

10,250

1D 0.00%

5D 0.49%

Buy Vol. 17,539,979

Sell Vol. 22,912,060

16,900

1D 0.00%

5D 0.60%

Buy Vol. 4,296,411

Sell Vol. 3,347,465

On November 18, 2024, the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) and the Vietnam Rubber Group (VRG) held a ceremony to sign a comprehensive cooperation agreement for the period 2024 - 2029.

OIL & GAS

69,200

1D 1.47%

5D 0.87%

Buy Vol. 2,166,828

Sell Vol. 2,190,675

11,400

1D -0.44%

5D 1.33%

Buy Vol. 9,231,869

Sell Vol. 8,352,800

39,150

1D 0.26%

5D 1.95%

Buy Vol. 803,679

Sell Vol. 959,642

Foreign investors have been actively buying GAS shares for two consecutive sessions, with a total net purchase value exceeding VND26 billion.

VINGROUP

40,450

1D 0.25%

5D -0.25%

Buy Vol. 3,142,303

Sell Vol. 3,271,340

41,600

1D -3.93%

5D 3.35%

Buy Vol. 18,126,014

Sell Vol. 18,937,510

18,100

1D -0.55%

5D -0.55%

Buy Vol. 11,302,124

Sell Vol. 12,143,248

VIC: The China-based Thai Binh Duong Construction Group will collaborate with Vingroup to implement the Tu Lien Bridge project in Hanoi.

FOOD & BEVERAGE

64,300

1D 0.63%

5D 0.94%

Buy Vol. 4,015,383

Sell Vol. 5,271,420

71,000

1D -0.42%

5D 0.57%

Buy Vol. 6,417,426

Sell Vol. 7,503,423

55,400

1D 0.18%

5D -0.18%

Buy Vol. 703,247

Sell Vol. 805,552

SAB: Member of Parliament has proposed delaying the increase in special consumption tax on beer and alcohol for an additional year.

OTHERS

65,800

1D 0.46%

5D -3.24%

Buy Vol. 292,530

Sell Vol. 383,939

44,200

1D 0.00%

5D 1.88%

Buy Vol. 591,626

Sell Vol. 700,069

101,700

1D 0.00%

5D -1.55%

Buy Vol. 977,899

Sell Vol. 874,059

133,900

1D 0.68%

5D 0.00%

Buy Vol. 4,869,867

Sell Vol. 6,311,013

59,000

1D 0.51%

5D -1.50%

Buy Vol. 9,259,037

Sell Vol. 8,814,963

30,900

1D -0.96%

5D -0.32%

Buy Vol. 3,391,333

Sell Vol. 4,403,470

24,350

1D -1.02%

5D 1.67%

Buy Vol. 22,031,670

Sell Vol. 25,056,467

26,100

1D 0.97%

5D 0.77%

Buy Vol. 45,120,519

Sell Vol. 38,190,852

HPG: In the webinar "Steel Industry and the Health of Hoa Phat Group," Hoa Phat Group's Chief Financial Officer, Mrs. Pham Thi Kim Oanh, revealed that the key project, the Dung Quat 2 Steel Complex, will begin producing a small portion of commercial products by the end of 2024 and will start making significant contributions from 2025.

Market by numbers

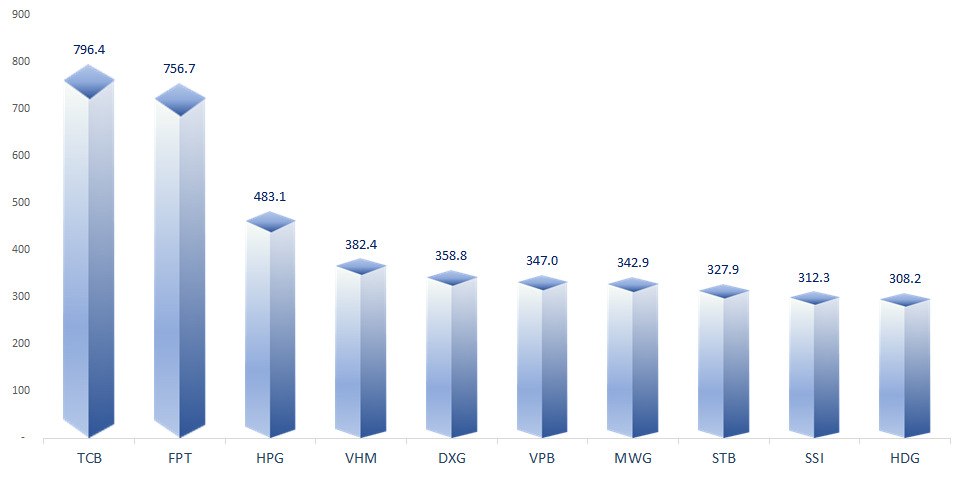

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

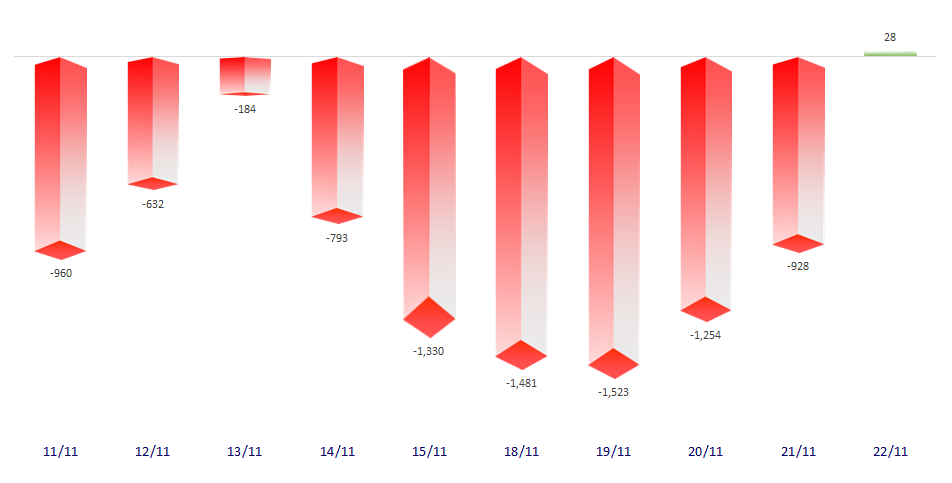

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

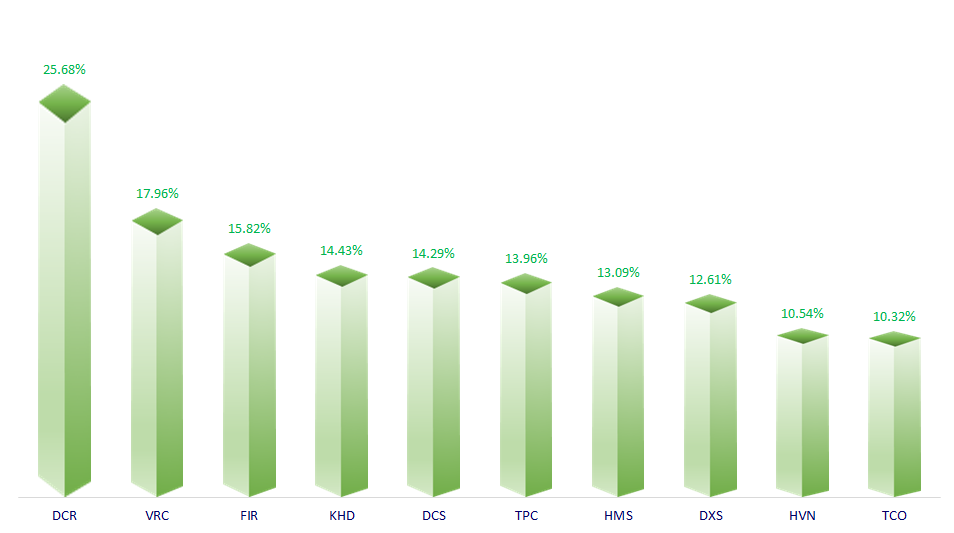

TOP INCREASES 3 CONSECUTIVE SESSIONS

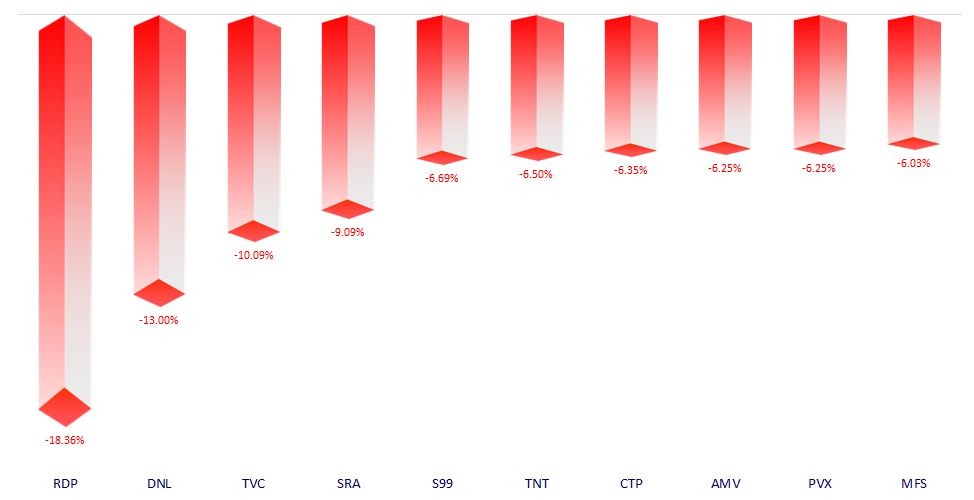

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.