Morning Brief 14/12

GLOBAL MARKET

30,046.37

1D 0.16%

YTD 5.28%

3,663.46

1D -0.13%

YTD 13.39%

12,377.87

1D -0.23%

YTD 37.95%

23.31

6,546.75

1D -0.80%

YTD -13.20%

13,114.30

1D -1.36%

YTD -1.02%

5,507.55

1D -0.76%

YTD -7.87%

26,652.52

1D -0.39%

YTD 12.66%

3,347.19

1D -0.77%

YTD 8.54%

2,770.06

1D 0.86%

YTD 26.05%

26,505.87

1D 0.36%

YTD -6.84%

2,821.70

1D -0.12%

YTD -12.45%

1,482.67

1D 0.00%

YTD -7.21%

46.62

1D -1.19%

YTD -23.26%

1,839.65

1D -0.12%

YTD 21.21%

In a volatile session, the S&P 500 quickly trimmed a slide that reached about 1% earlier Friday, and at ending session only 0,13%. The equity benchmark still notched its worst weekly drop since October amid an impasse over a relief package and concern about tougher restrictions as coronavirus cases swept across the nation. Giants Facebook Inc. and Tesla Inc. paced declines in the Nasdaq 100, while the Dow Jones Industrial Average rose as Walt Disney Co. soared to an all-time high after a bold forecast for its new streaming services. Stocks pared losses as lawmakers passed a stopgap spending bill to avert a federal-government shutdown, but gave no signals of an imminent stimulus deal.

VIETNAM ECONOMY

0.11%

YTD (bps) -132

5.80%

YTD (bps) -70

1.28%

YTD (bps) -271

2.07%

YTD (bps) -263

23,223

1D (%) -0.01%

YTD (%) -0.03%

28,765

1D (%) -0.12%

YTD (%) 8.13%

3,573

1D (%) 0.11%

YTD (%) 5.21%

ADB recorded a rapid growth of Vietnam from 0.4% in 2Q2020 to 2.6% in 3Q2020, bringing the average growth rate for the January-September period to 2.1%. Overall, for the whole 2020, Vietnam's GDP is forecast to reach 2.3% from 1.8% in September thanks to increased public investment, domestic consumption recovers, and trade increases. Currently, the Government of Vietnam sets the annual growth target of 2.5-3%.

VIETNAM STOCK MARKET

1,045.96

1D 1.46%

YTD 8.84%

1,008.65

1D 1.45%

YTD 14.74%

162.32

1D 1.90%

YTD 58.35%

68.72

1D 0.01%

YTD 21.52%

695.22

12,128.63

1D -22.06%

YTD 246.53%

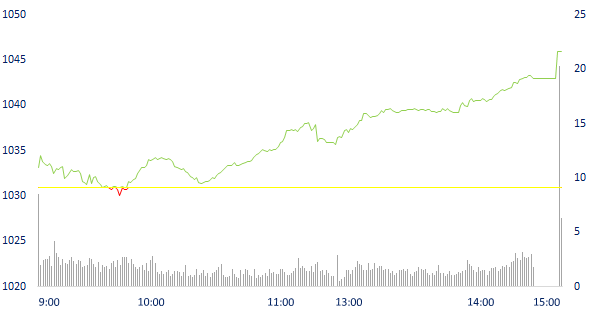

Foreign investors net bought nearly 700 billion. The net buying force focused on PME stocks, VFMVN Diamond ETF certificates and VCB on HOSE; PVS and SHB were the stocks to be bought the most on the HNX. The VN-Index ended up 1.46%, reaching 1,045.96 points; The HNX-Index increased by 1.90%, reaching 162.32 points.

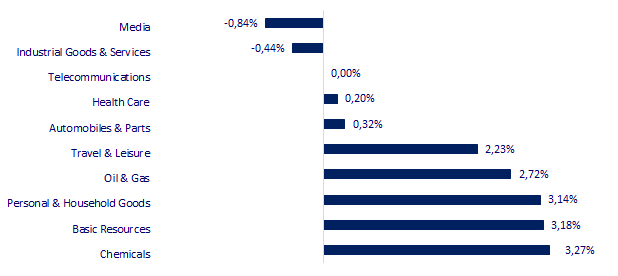

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

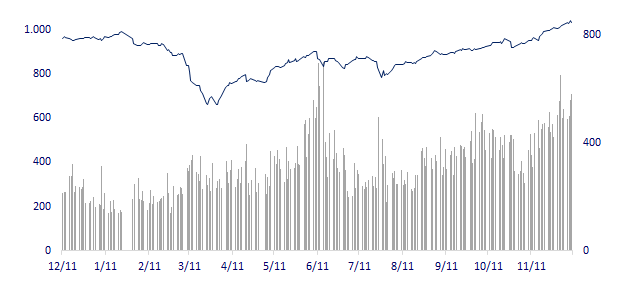

VNINDEX (12M)

SELECTED NEWS

- In 10-11/2020, the credit growth rate of the banking system averaged nearly 1.2% / month, nearly double the average rate of the first 9 months.

- Textile and garment affirms its position and aims to export 55 billion USD by 2025.

- HCM City will have a credit package of more than 4,000 billion VND, 0% interest rate to support businesses facing difficulties because of COVID-19.

- The Fed may soon send a positive signal about the US economy.

- The risk of defaults on local governments in China increases, a sign of new loans to repay old debts.

- On December 13, the Germany Government agreed to impose a full blockade from December 16.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.