Morning Brief 12/02/2025

GLOBAL MARKET

44,593.65

1D 0.28%

YTD 4.82%

6,068.50

1D 0.03%

YTD 3.18%

19,643.86

1D -0.36%

YTD 1.72%

16.02

1D 1.33%

8,777.39

1D 0.11%

YTD 7.39%

22,037.83

1D 0.58%

YTD 10.69%

8,028.90

1D 0.28%

YTD 8.78%

76.72

1D 1.03%

YTD 2.23%

2,890.34

1D -1.31%

YTD 9.69%

Wall Street's main indexes ended mixed on Tuesday as gains in Coca-Cola and Apple offset losses in Tesla, while investors parsed Federal Reserve Chair Jerome Powell's latest comments. The U.S. central bank is no rush to cut its short-term interest rate again given the economy is "strong overall", with low unemployment and inflation still above the Fed's 2% target, Powell said in opening remarks at a Senate Banking Committee hearing.

VIETNAM ECONOMY

5.42%

1D (bps) -9

YTD (bps) 145

4.60%

2.55%

1D (bps) 13

YTD (bps) 7

2.98%

1D (bps) -4

YTD (bps) 13

2570000.00%

1D (%) 0.55%

YTD (%) 0.58%

2705581.00%

1D (%) 0.68%

YTD (%) -0.77%

354826.00%

1D (%) 0.49%

YTD (%) -0.36%

On February 11, the State Bank increased the USD selling price from 25,450 VND/USD to a record high of 25,689 VND/USD. Compared to the beginning of 2025, the selling price has increased by VND460, equivalent to 1.84%. The last time SBV increased the selling price was at the end of October 2024.

VIETNAM STOCK MARKET

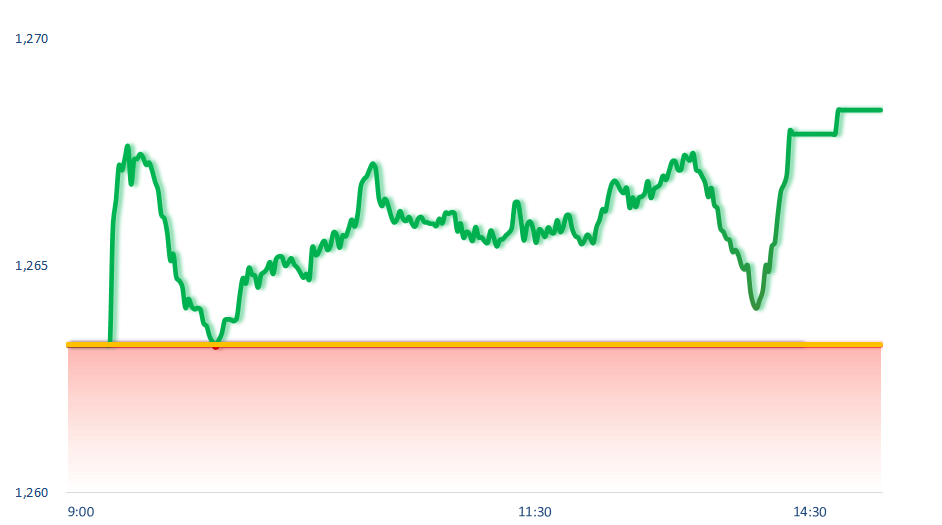

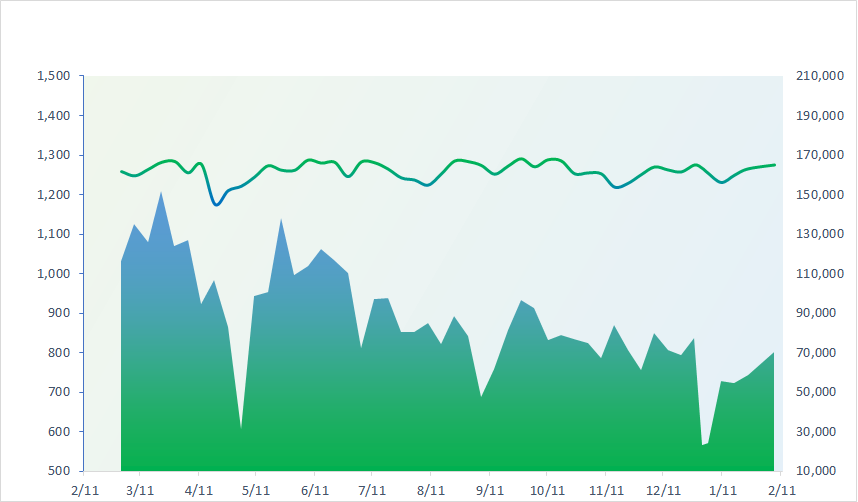

1,263.26

1D -0.94%

YTD -0.28%

227.97

1D -0.66%

YTD 0.24%

1,330.88

1D -0.74%

YTD -1.03%

96.63

1D -0.63%

YTD 1.65%

-624.39

20,727.21

1D 14.32%

YTD 14.32%

VNIndex recovered after the Government proposed adjusting GDP growth in 2025 to 8% or more. The Government spending stocks increased sharply with representatives such as CTI +4%, CTD +2.9%, VCG +2.7%, HHV +1.2%. Proprietary traders net bought VND172 billion, mainly including GEE VND120 billion, E1VFVND30 VND73 billion

INTRADAY

VN30 (12M)

SELECTED NEWS

- Prime Minister: Banks need to sacrifice profits to reduce lending rates;

- Ministry of Industry and Trade develops scenarios when global trade tensions escalate;

- Deputy Governor of the State Bank of Vietnam: moving towards a roadmap to eliminate credit room;

- Trump demands USD500 billion in rare earths from Ukraine for continued support;

- Japan's national debt rises to a record level;

- Gas prices in Europe hit a two-year high.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.