Market brief 14/03/2025

VIETNAM STOCK MARKET

1,326.15

1D -0.01%

YTD 4.69%

242.73

1D 0.59%

YTD 6.73%

1,387.03

1D -0.02%

YTD 3.14%

99.38

1D 0.36%

YTD 4.54%

-377.29

1D 0.00%

YTD 0.00%

24,988.16

1D 37.82%

YTD 37.82%

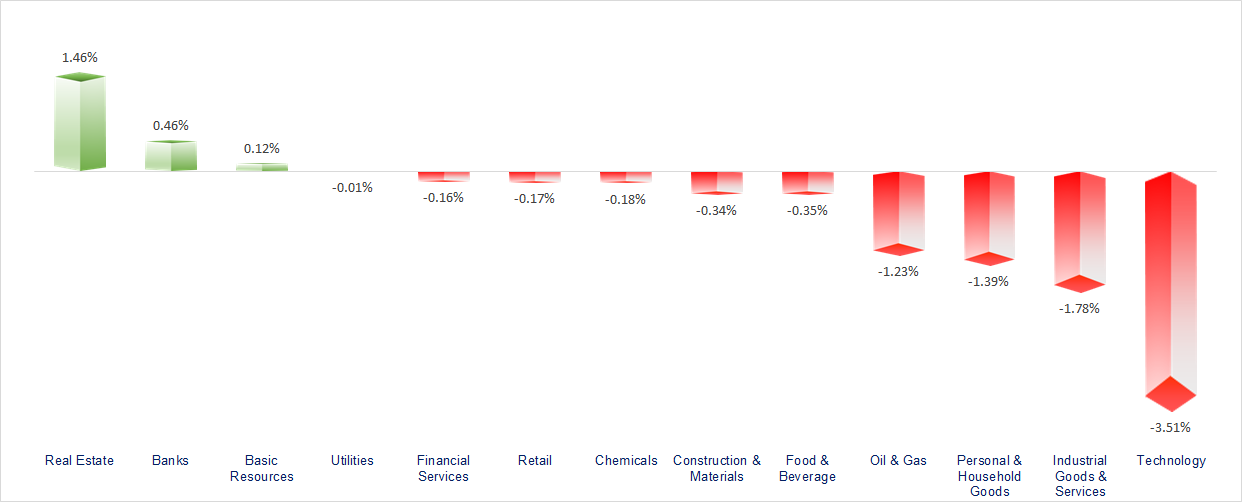

VN-Index saw a slight adjustment with high divergence among stock groups. Banking and real estate were the most positive sectors today, while technology, telecommunications, and oil & gas suffered the biggest losses, ending in the red.

ETF & DERIVATIVES

24,240

1D 0.00%

YTD 3.24%

16,750

1D -0.18%

YTD 2.89%

17,220

1D 0.12%

YTD 3.11%

20,740

1D 0.05%

YTD 3.18%

23,300

1D 0.26%

YTD 5.43%

32,880

1D -0.12%

YTD -1.91%

18,500

1D -0.48%

YTD 3.24%

1,385

1D -0.32%

YTD 0.00%

1,385

1D -0.32%

YTD 0.00%

1,380

1D -0.56%

YTD 0.00%

1,382

1D -0.35%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

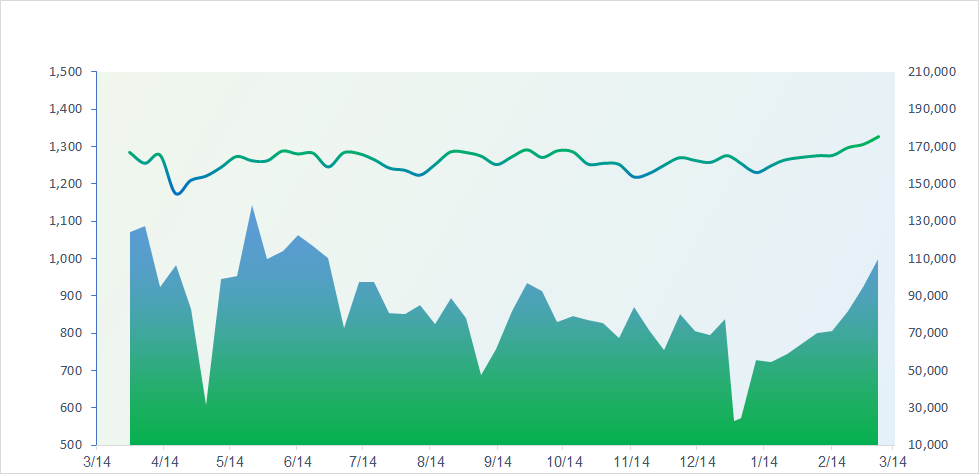

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

37,211.50

1D 1.05%

YTD -6.73%

3,419.56

1D 1.81%

YTD 2.02%

23,959.99

1D 2.12%

YTD 19.45%

2,566.36

1D -0.28%

YTD 6.95%

73,828.91

1D -0.27%

YTD -6.04%

3,836.03

1D -0.01%

YTD 1.28%

1,175.14

1D 1.13%

YTD -16.07%

70.21

1D 0.20%

YTD -6.45%

2,995.00

1D 0.17%

YTD 13.66%

Asian stock markets performed well, in contrast to Wall Street’s downturn last night. Hong Kong and China led the rally after the People's Bank of China (PBOC) pledged to cut interest rates in the near future.

VIETNAM ECONOMY

4.30%

1D (bps) -26

YTD (bps) 33

4.60%

2.54%

1D (bps) 4

YTD (bps) 6

2.95%

1D (bps) 4

YTD (bps) 10

2571000.00%

1D (%) 0.12%

YTD (%) 0.62%

2843875.00%

1D (%) -0.24%

YTD (%) 4.30%

357899.00%

1D (%) 0.01%

YTD (%) 0.51%

Domestic gold prices continued to surge, setting new record highs. SJC gold bars reached 95.8 million VND/tael, while plain gold rings broke all previous price peaks, hitting 96.2 million VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Treasury plans to purchase an additional USD300 million from banks, which could impact liquidity and exchange rates;

- The State Bank of Vietnam (SBV) may lower the OMO interest rate in March to reduce interbank interest rates and support banking system liquidity;

- Novaland has won a lawsuit related to a VND10 trillion project, opening positive prospects for the real estate group;

- The U.S. Federal Reserve (Fed) may start cutting interest rates in June, aligning with market expectations for a more accommodative monetary policy;

- The U.S. is "preparing military options" to access the Panama Canal, raising concerns about geopolitical tensions;

- Gold futures have surpassed 3,000 USD/ounce.

VN30

BANK

66,000

1D 0.76%

5D 3.75%

Buy Vol. 6,896,164

Sell Vol. 9,085,101

40,400

1D 0.50%

5D -1.82%

Buy Vol. 4,988,410

Sell Vol. 4,884,441

42,300

1D 0.00%

5D -0.24%

Buy Vol. 13,521,034

Sell Vol. 11,872,850

27,300

1D 0.00%

5D -1.62%

Buy Vol. 23,231,107

Sell Vol. 17,753,444

19,600

1D 1.82%

5D 1.82%

Buy Vol. 34,286,711

Sell Vol. 31,977,460

24,300

1D 0.00%

5D -0.82%

Buy Vol. 50,894,957

Sell Vol. 33,262,603

23,200

1D 0.22%

5D -0.85%

Buy Vol. 14,260,914

Sell Vol. 12,566,752

16,100

1D 0.31%

5D -1.53%

Buy Vol. 22,298,809

Sell Vol. 22,210,333

38,850

1D -0.38%

5D -2.26%

Buy Vol. 21,499,732

Sell Vol. 18,043,918

20,350

1D 0.25%

5D -2.86%

Buy Vol. 14,235,749

Sell Vol. 11,698,854

26,000

1D -0.38%

5D -2.44%

Buy Vol. 17,778,379

Sell Vol. 16,744,875

10,700

1D 7.00%

5D 7.00%

Buy Vol. 274,171,533

Sell Vol. 162,423,050

19,800

1D 0.00%

5D 0.76%

Buy Vol. 2,346,255

Sell Vol. 3,052,142

34,950

1D -0.99%

5D -1.27%

Buy Vol. 4,429,386

Sell Vol. 3,787,375

BID: The Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) has just released documents for its 2025 Annual General Meeting of Shareholders (AGM), outlining a credit growth target of approximately 15-16%. The bank aims for total outstanding loans of nearly VND2.4 quadrillion while keeping the non-performing loan (NPL) ratio below 1.4%.

OIL & GAS

67,700

1D -0.88%

5D -0.15%

Buy Vol. 1,689,034

Sell Vol. 2,091,799

41,400

1D -0.72%

5D -3.38%

Buy Vol. 3,040,621

Sell Vol. 2,759,507

Vietnamese companies are in talks with U.S. firms to buy American crude oil and LNG.

VINGROUP

52,200

1D 1.56%

5D 15.23%

Buy Vol. 13,226,603

Sell Vol. 16,049,782

47,900

1D 0.21%

5D 6.56%

Buy Vol. 24,894,938

Sell Vol. 33,781,230

18,750

1D -0.27%

5D 3.02%

Buy Vol. 16,451,285

Sell Vol. 26,046,384

VIC: Vingroup's market capitalization has reached approximately VND200 trillion, reclaiming its position as the top private enterprise on the Vietnamese stock exchange.

FOOD & BEVERAGE

62,100

1D 0.16%

5D -0.96%

Buy Vol. 5,401,429

Sell Vol. 6,719,103

71,100

1D 0.99%

5D 3.04%

Buy Vol. 10,858,483

Sell Vol. 17,699,835

51,600

1D 0.98%

5D 0.78%

Buy Vol. 3,940,225

Sell Vol. 3,116,295

VNM: Vinamilk will break ground on the Hung Yen dairy factory in Q2 2025, with a total investment of VND4.6 trillion, covering nearly 25 hectares, and a designed capacity of approximately 400 million liters/year.

OTHERS

79,000

1D 0.25%

5D 5.33%

Buy Vol. 1,355,237

Sell Vol. 1,048,899

53,600

1D -0.92%

5D -5.47%

Buy Vol. 1,386,493

Sell Vol. 1,450,477

98,600

1D 1.34%

5D 1.65%

Buy Vol. 1,555,913

Sell Vol. 1,427,539

131,400

1D -3.74%

5D -7.07%

Buy Vol. 25,499,037

Sell Vol. 22,204,655

61,500

1D 0.00%

5D -0.65%

Buy Vol. 16,200,356

Sell Vol. 14,825,810

33,300

1D 0.91%

5D -0.60%

Buy Vol. 6,813,113

Sell Vol. 9,608,946

26,950

1D 0.00%

5D 0.19%

Buy Vol. 63,200,655

Sell Vol. 60,073,796

27,550

1D -0.54%

5D -1.78%

Buy Vol. 30,906,339

Sell Vol. 43,875,507

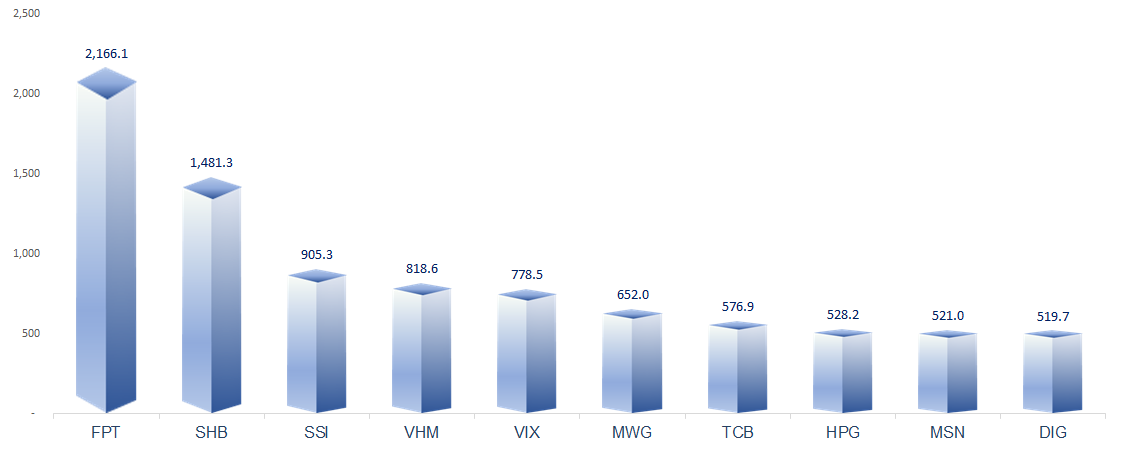

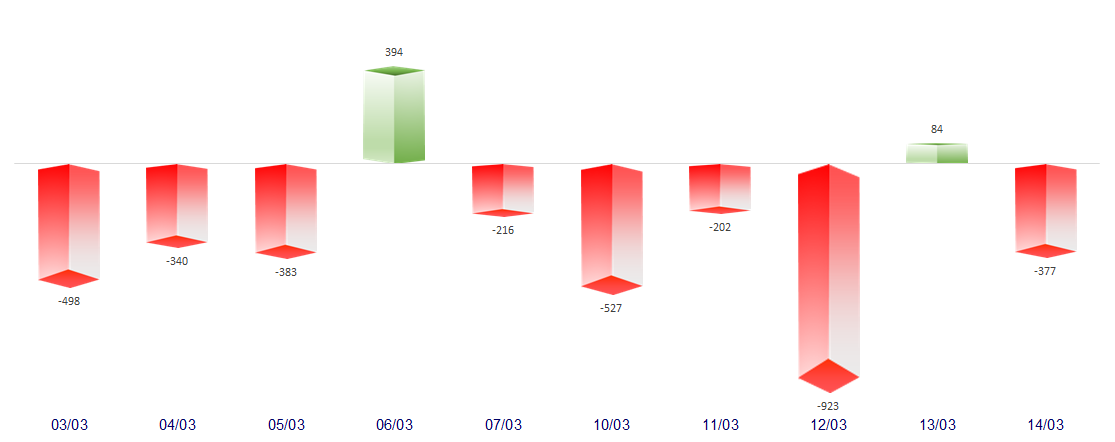

FPT: Foreign investors net sold FPT shares aggressively, with a total value of over VND640 billion in the trading session on March 14, 2025.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

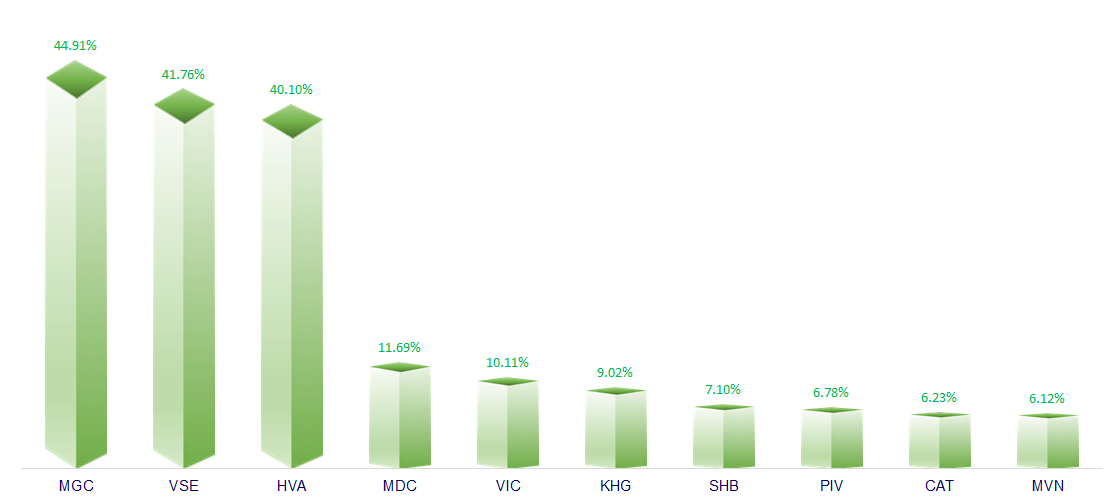

TOP INCREASES 3 CONSECUTIVE SESSIONS

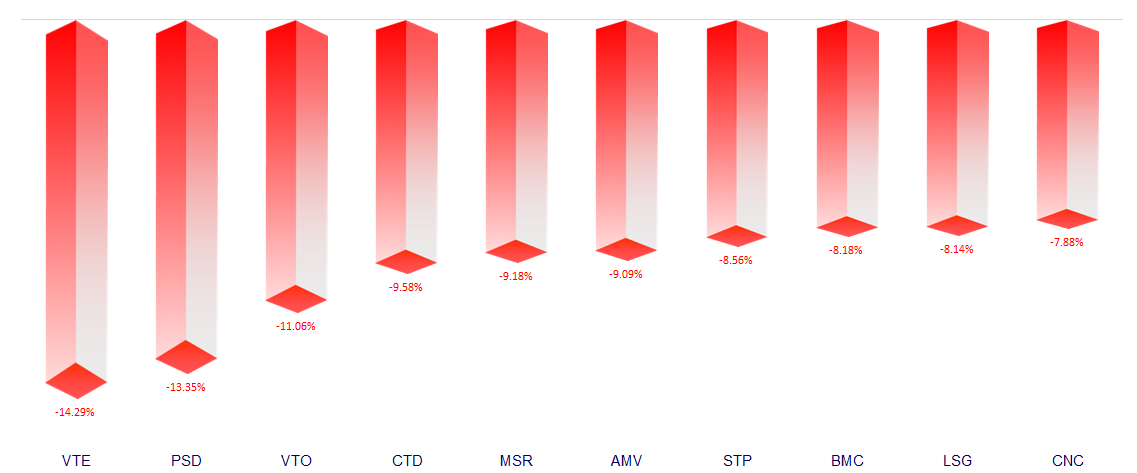

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.