Market brief 27/03/2025

VIETNAM STOCK MARKET

1,323.81

1D -0.17%

YTD 4.50%

239.54

1D -0.74%

YTD 5.32%

1,380.26

1D -0.09%

YTD 2.64%

98.96

1D 0.11%

YTD 4.10%

-101.34

1D 0.00%

YTD 0.00%

17,493.27

1D -3.52%

YTD -3.52%

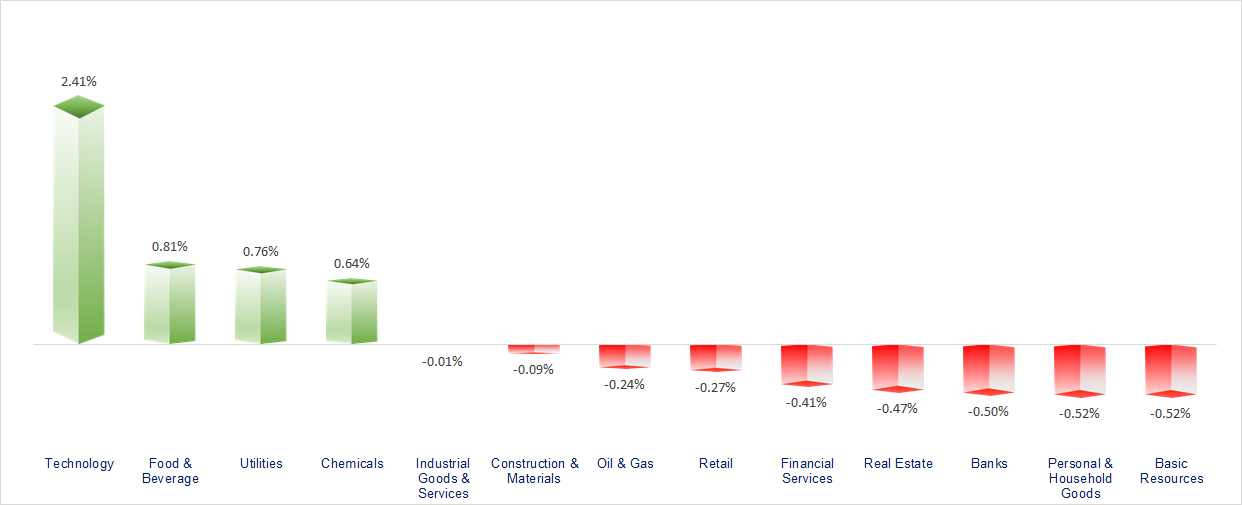

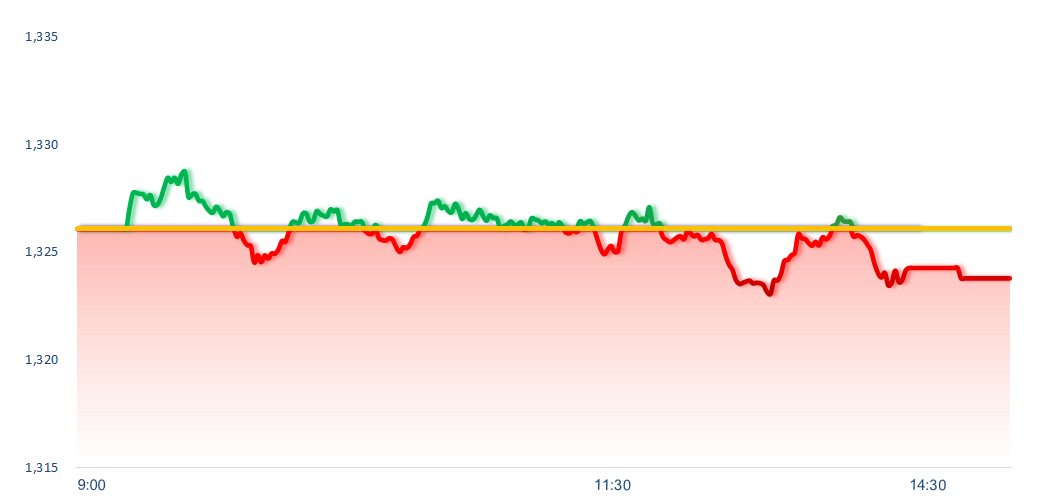

The VN-Index continues to decline with dwindling liquidity, reaching just over VND 16 trillion in today’s session. Information Technology and Food & Beverage were the most positive stock groups today. Meanwhile, Basic Resources, Banking, and Real Estate had a negative impact on the market.

ETF & DERIVATIVES

24,150

1D -0.37%

YTD 2.85%

16,500

1D -0.96%

YTD 1.35%

17,200

1D 0.29%

YTD 2.99%

20,550

1D -1.15%

YTD 2.24%

23,280

1D -0.39%

YTD 5.34%

32,330

1D -0.15%

YTD -3.55%

18,380

1D -0.43%

YTD 2.57%

1,375

1D -0.15%

YTD 0.00%

1,375

1D -0.25%

YTD 0.00%

1,372

1D -0.31%

YTD 0.00%

1,374

1D -0.10%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

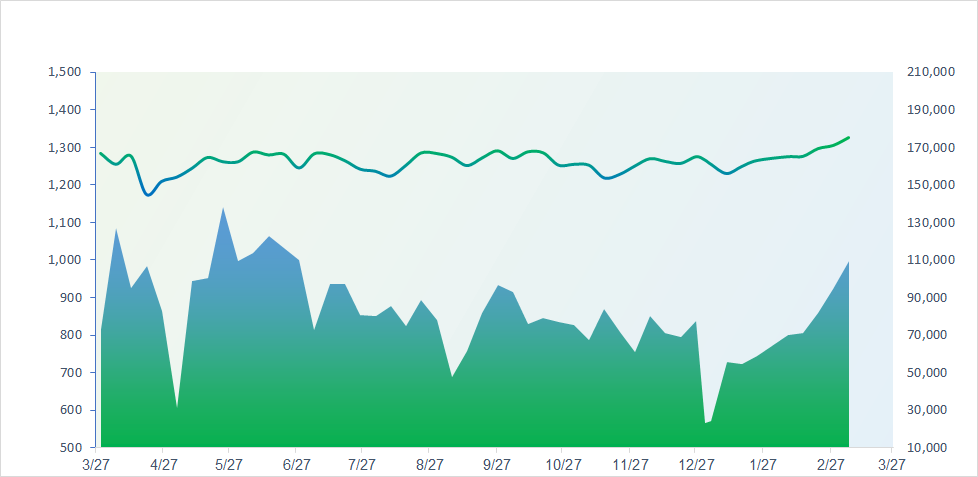

VNINDEX (12M)

GLOBAL MARKET

37,799.97

1D -0.60%

YTD -5.25%

3,373.75

1D 0.15%

YTD 0.66%

23,578.80

1D 0.41%

YTD 17.55%

2,607.15

1D -1.39%

YTD 8.65%

77,612.58

1D 0.39%

YTD -1.22%

3,981.58

1D 0.45%

YTD 5.12%

1,187.90

1D -0.21%

YTD -15.16%

72.92

1D -0.40%

YTD -2.84%

3,045.00

1D 0.84%

YTD 15.56%

Asian stock markets showed mixed movements after the U.S. announced new tariffs. In Japan, the Nikkei index fell 0.6% to 37,799.97 points. In China, the Shanghai Composite rose 0.2% to 3,373.75 points, while the Hang Seng index gained 0.4% to 23,578.80 points.

VIETNAM ECONOMY

3.96%

1D (bps) -38

YTD (bps) -1

4.60%

2.55%

1D (bps) 1

YTD (bps) 7

2.97%

1D (bps) 3

YTD (bps) 12

2575000.00%

1D (%) -0.08%

YTD (%) 0.78%

2830982.00%

1D (%) -0.24%

YTD (%) 3.83%

357719.00%

1D (%) -0.06%

YTD (%) 0.45%

Gasoline prices were adjusted upward for the second consecutive time in today's (March 27) price review. RON 95 gasoline is now close to 20,500 VND/liter.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Dragon Capital proposes tokenizing ETFs in Vietnam;

- Thanh Hoa disburses over VND14.2 trillion in public investment, launching several major projects;

- Ho Chi Minh City to commence construction of Metro Line 2 in December;

- Foreign Minister Lavrov compares Ukraine’s importance to Russia with Greenland’s importance to the U.S;

- Nord Stream restart debate intensifies, suggesting potential U.S. pressure on Europe to accept Russian gas;

- China orders a halt to new cooperation with Li Ka-shing following the Panama port deal.

VN30

BANK

65,500

1D -0.46%

5D -1.95%

Buy Vol. 1,683,441

Sell Vol. 1,751,205

39,100

1D -1.14%

5D -1.76%

Buy Vol. 3,370,522

Sell Vol. 3,658,586

41,600

1D -0.36%

5D 0.00%

Buy Vol. 8,169,284

Sell Vol. 8,785,021

27,750

1D -0.89%

5D 1.09%

Buy Vol. 11,943,360

Sell Vol. 19,958,222

19,250

1D -0.52%

5D -1.79%

Buy Vol. 18,455,182

Sell Vol. 18,338,890

23,900

1D -0.42%

5D -1.44%

Buy Vol. 23,537,213

Sell Vol. 22,776,051

22,650

1D -0.44%

5D -1.95%

Buy Vol. 12,012,163

Sell Vol. 13,327,024

14,300

1D -1.38%

5D -5.92%

Buy Vol. 32,735,132

Sell Vol. 38,062,817

38,250

1D -0.91%

5D -1.67%

Buy Vol. 11,753,073

Sell Vol. 12,074,036

20,000

1D 0.25%

5D -1.96%

Buy Vol. 12,084,766

Sell Vol. 11,745,005

26,000

1D -0.57%

5D -0.95%

Buy Vol. 10,702,003

Sell Vol. 12,267,024

12,700

1D 3.67%

5D 8.09%

Buy Vol. 177,851,695

Sell Vol. 115,943,041

19,600

1D 0.26%

5D -1.26%

Buy Vol. 2,559,619

Sell Vol. 3,459,823

33,000

1D -1.35%

5D -7.17%

Buy Vol. 5,115,786

Sell Vol. 3,248,679

VIB: At today’s Annual General Meeting, VIB set its 2025 targets with total assets reaching VND600.35 trillion, a 22% increase from 2024. Credit balance is expected to grow by 22%, while capital mobilization is projected to rise by 26%. The bank aims for a pre-tax profit of VND11.02 trillion, up 22%. VIB plans to allocate VND2.085 trillion for cash dividends and issue up to 417.07 million bonus shares (equivalent to a 14% ratio) for existing shareholders, along with 7.8 million bonus shares for employees.

OIL & GAS

67,200

1D -0.44%

5D -2.04%

Buy Vol. 1,005,467

Sell Vol. 1,297,645

40,950

1D -0.49%

5D -0.85%

Buy Vol. 1,446,591

Sell Vol. 1,751,448

Oil prices rebound as supply concerns following U.S. threats to impose tariffs on countries purchasing crude oil from Venezuela.

VINGROUP

57,100

1D 0.18%

5D 10.87%

Buy Vol. 8,988,314

Sell Vol. 10,156,667

51,200

1D -0.58%

5D 8.13%

Buy Vol. 12,020,481

Sell Vol. 15,687,793

19,650

1D -1.50%

5D 6.79%

Buy Vol. 18,066,672

Sell Vol. 23,149,105

VHM: The 240-hectare mega urban project, with an investment of over VND23 trillion in Duong Kinh District and Kien Thuy District, Hai Phong, has been confirmed as eligible for capital mobilization for development.

FOOD & BEVERAGE

61,100

1D -0.16%

5D -1.13%

Buy Vol. 4,734,017

Sell Vol. 4,555,876

69,400

1D 1.61%

5D 1.46%

Buy Vol. 12,368,839

Sell Vol. 14,687,765

49,550

1D 0.00%

5D -2.08%

Buy Vol. 1,842,542

Sell Vol. 1,675,580

MSN: Foreign investors returned as net buyers of nearly VND43 billion worth of Masan Group shares.

OTHERS

77,400

1D -0.77%

5D -2.64%

Buy Vol. 1,021,689

Sell Vol. 981,336

53,200

1D 1.92%

5D 0.38%

Buy Vol. 1,445,548

Sell Vol. 1,230,623

96,500

1D -0.21%

5D 0.31%

Buy Vol. 771,388

Sell Vol. 770,560

126,200

1D 2.60%

5D 0.96%

Buy Vol. 16,029,058

Sell Vol. 10,369,962

60,400

1D -0.66%

5D 0.67%

Buy Vol. 5,081,255

Sell Vol. 6,550,601

34,950

1D 1.30%

5D 1.30%

Buy Vol. 6,124,018

Sell Vol. 8,930,994

26,300

1D -0.75%

5D -0.94%

Buy Vol. 26,295,023

Sell Vol. 35,731,664

27,500

1D -0.18%

5D 1.29%

Buy Vol. 21,551,520

Sell Vol. 36,857,140

FPT: FPT officially inaugurated its high-tech and semiconductor R&D center at the Software Park in Da Nang.

Market by numbers

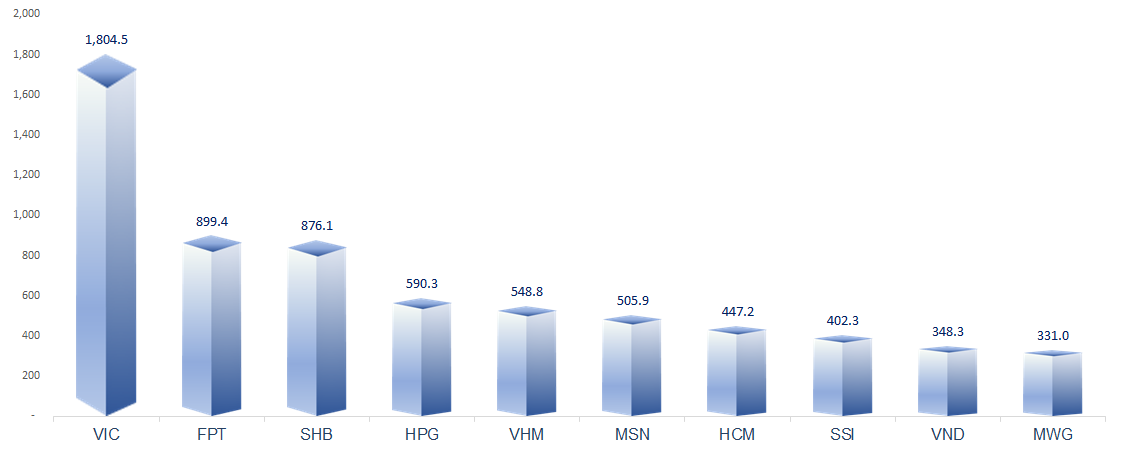

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

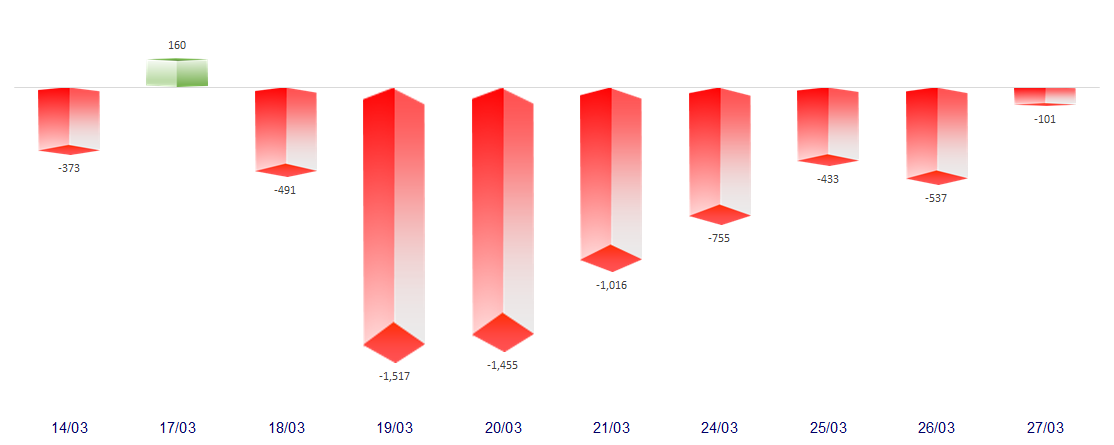

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

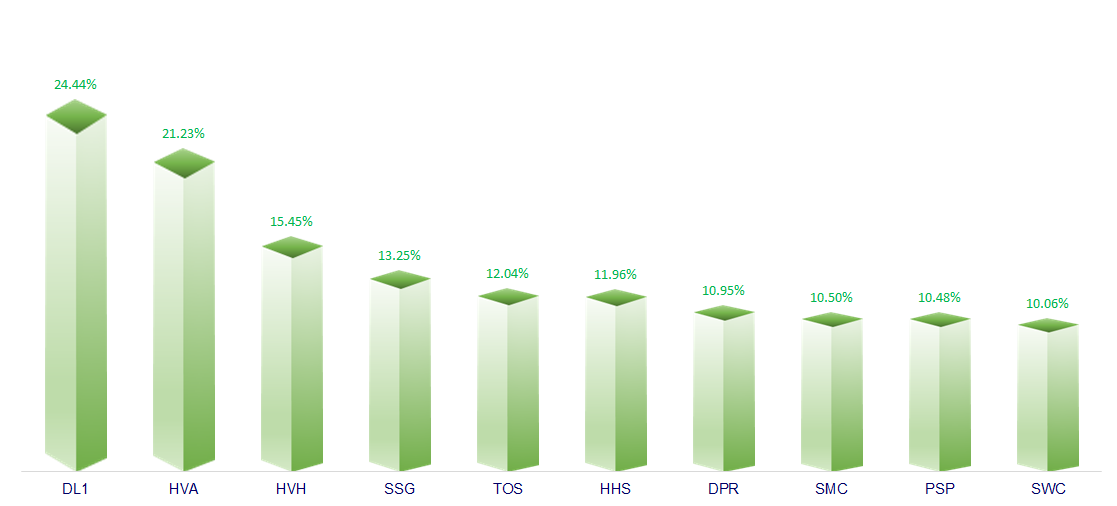

TOP INCREASES 3 CONSECUTIVE SESSIONS

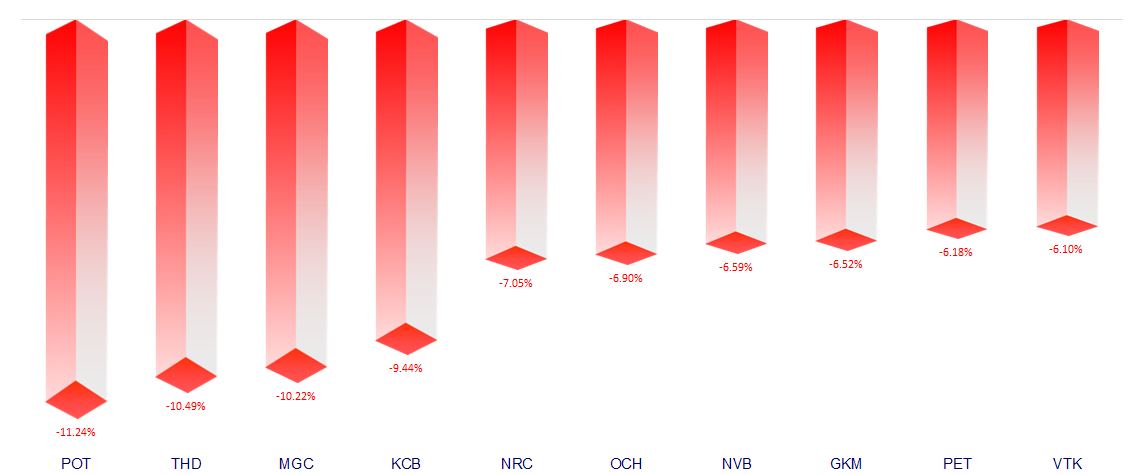

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.