Market Brief 04/08/2025

VIETNAM STOCK MARKET

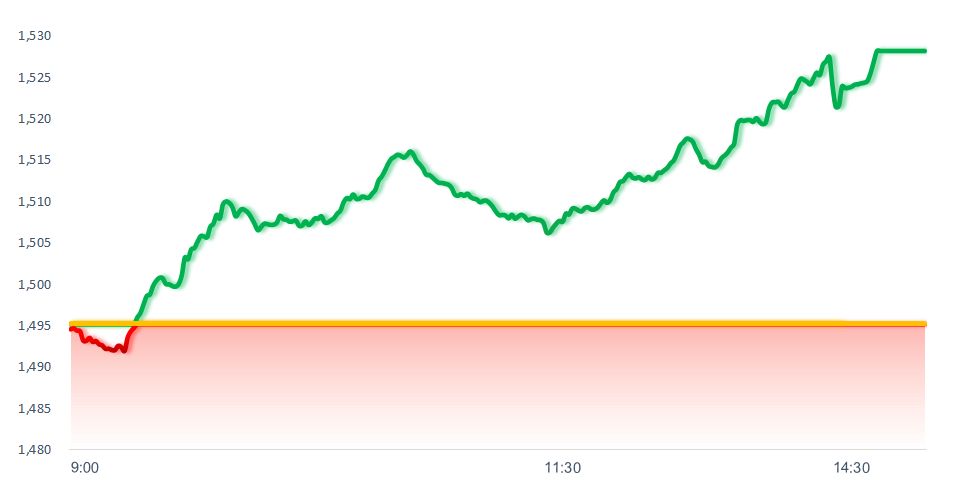

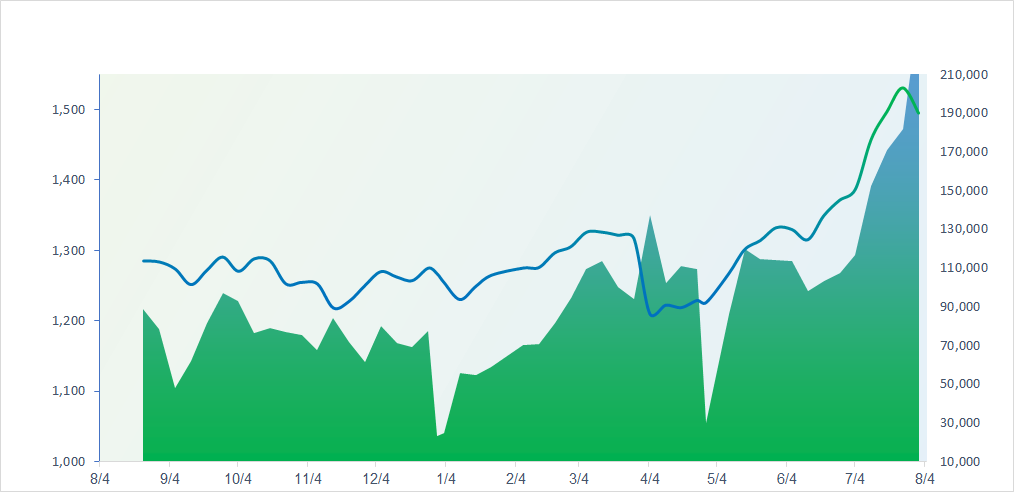

1,528.19

1D 2.21%

YTD 20.64%

268.34

1D 1.29%

YTD 17.99%

1,653.22

1D 2.42%

YTD 22.94%

107.16

1D 0.66%

YTD 12.73%

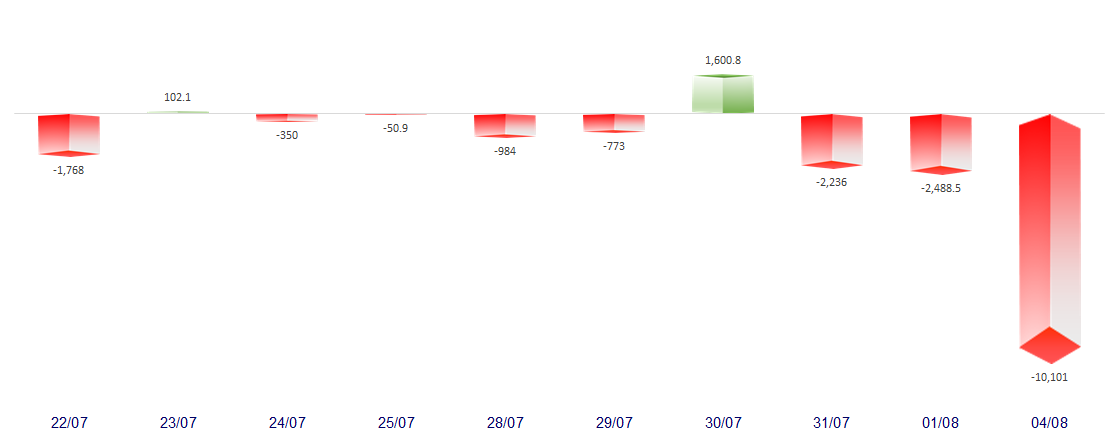

-10,100.66

1D 0.00%

YTD 0.00%

46,966.00

1D 0.91%

YTD 159.04%

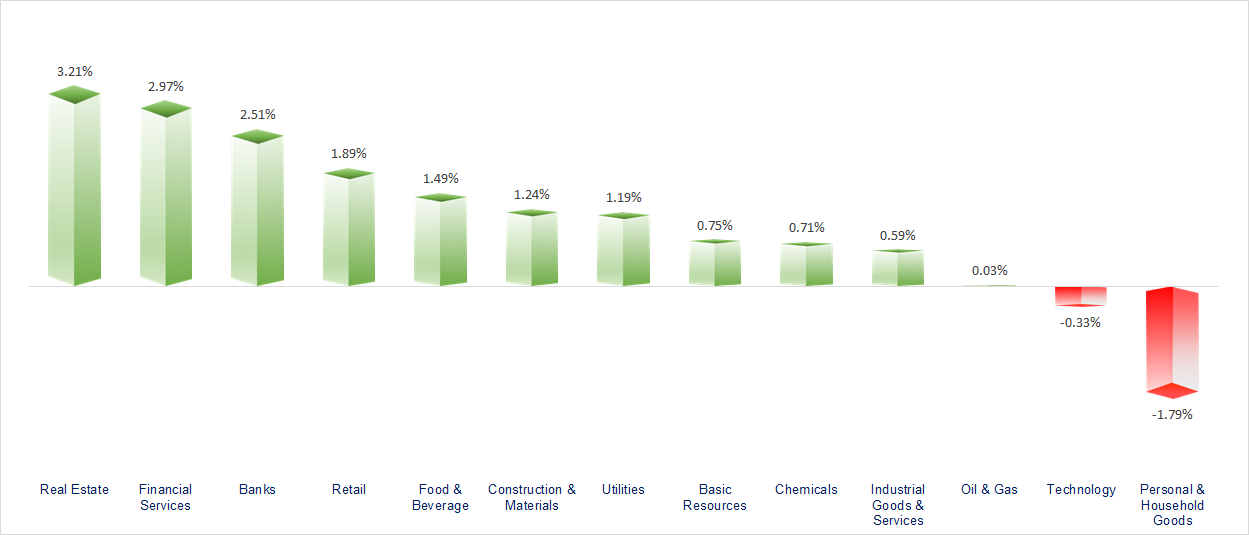

VN-Index rebounded by more than 30 points despite strong net selling of over VND10,000 billion from foreign investors. Most sectors posted positive gains, with Real Estate and Securities standing out the most. In contrast, Personal & Household Goods and Technology saw rather lackluster performance.

ETF & DERIVATIVES

29,300

1D 3.53%

YTD 24.79%

20,080

1D 2.97%

YTD 23.34%

20,850

1D 0.34%

YTD 24.85%

25,080

1D 3.72%

YTD 24.78%

28,940

1D 2.77%

YTD 30.95%

35,700

1D 2.29%

YTD 6.50%

22,370

1D 3.56%

YTD 24.83%

1,654

1D 2.38%

YTD 0.00%

1,638

1D 2.37%

YTD 0.00%

1,648

1D 2.61%

YTD 0.00%

1,646

1D 2.69%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

40,290.70

1D -1.25%

YTD 0.99%

3,583.31

1D 0.66%

YTD 6.91%

24,733.45

1D 0.92%

YTD 23.30%

3,147.75

1D 0.91%

YTD 31.18%

81,015.44

1D 0.52%

YTD 3.11%

4,197.23

1D 1.04%

YTD 10.82%

1,229.40

1D 0.91%

YTD -12.20%

68.85

1D -1.18%

YTD -8.26%

3,358.00

1D -0.15%

YTD 27.44%

Most stock markets across the Asia-Pacific region ended higher today, except for Japan’s Nikkei 225, which closed in the red amid declines in government bond yields — the 10-year yield dropped 4.7 basis points to 1.506%, and the 5-year yield fell 5.8 basis points to 1.026%.

VIETNAM ECONOMY

5.30%

1D (bps) -10

YTD (bps) 133

4.60%

2.91%

1D (bps) -1

YTD (bps) 44

3.33%

1D (bps) 25

YTD (bps) 48

26,370

1D (%) -0.11%

YTD (%) 3.21%

31,056

1D (%) 1.06%

YTD (%) 13.90%

3,702

1D (%) 0.46%

YTD (%) 3.95%

The DXY Index has rebounded by more than 1.9% over the past month, reaching 98.96 points.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Prime Minister: By no later than 2027, essential semiconductor chips must be designed, manufactured, and tested;

- On the afternoon of August 4, the State Bank of Vietnam will meet with commercial banks to discuss interest rate issues;

- Details of the corporate income tax rates to be applied from October 1 have been released;

- Tariffs have begun to impact the U.S. economy;

- The Prime Minister of Hungary has urged Ukraine to abandon its bid to join NATO;

- Bangladeshi garment workers are “struggling” amid the chaos of Trump’s tariffs.

VN30

BANK

61,100

1D 1.50%

5D -2.71%

Buy Vol. 7,909,335

Sell Vol. 7,218,364

38,050

1D 2.28%

5D -3.43%

Buy Vol. 7,532,412

Sell Vol. 8,861,028

45,650

1D 3.05%

5D 0.11%

Buy Vol. 15,458,920

Sell Vol. 14,740,305

35,350

1D 3.67%

5D -0.70%

Buy Vol. 39,500,084

Sell Vol. 34,984,799

26,400

1D 2.33%

5D 5.18%

Buy Vol. 62,856,256

Sell Vol. 57,197,053

27,800

1D 2.39%

5D -3.30%

Buy Vol. 46,387,470

Sell Vol. 29,516,007

28,000

1D 3.70%

5D -1.58%

Buy Vol. 29,719,288

Sell Vol. 28,122,570

16,750

1D 6.69%

5D 1.82%

Buy Vol. 130,328,955

Sell Vol. 64,717,385

50,000

1D 1.21%

5D 1.83%

Buy Vol. 15,302,054

Sell Vol. 16,513,581

19,350

1D 1.84%

5D 2.65%

Buy Vol. 17,762,203

Sell Vol. 19,264,168

23,300

1D 1.30%

5D -2.31%

Buy Vol. 21,885,127

Sell Vol. 18,002,126

18,600

1D 6.90%

5D 15.53%

Buy Vol. 180,529,341

Sell Vol. 111,666,713

20,250

1D 3.32%

5D -4.03%

Buy Vol. 4,428,207

Sell Vol. 3,922,545

34,700

1D 0.58%

5D -5.06%

Buy Vol. 6,169,028

Sell Vol. 5,966,125

SHB: SHB will pay a 2024 dividend at a rate of 13% through the issuance of 528.5 million shares, raising its charter capital to more than VND45,942 billion, thereby maintaining its position among the Top 5 largest private joint-stock commercial banks in the system. Previously, SHB had completed the first 2024 cash dividend payment at a rate of 5%. The total dividend rate for 2024, approved by SHB’s AGM, is 18% and is expected to be maintained in 2025.

OIL & GAS

68,000

1D 0.59%

5D -1.31%

Buy Vol. 2,758,732

Sell Vol. 2,776,240

36,600

1D 2.23%

5D -3.30%

Buy Vol. 4,392,488

Sell Vol. 4,308,472

PLX: In 2nd quarter PLX's pre-tax profit of nearly VND2,000 billion. However, net cash flow during the period was negative by more than VND4,186 billion.

VINGROUP

111,200

1D 6.92%

5D -3.81%

Buy Vol. 98,319,672

Sell Vol. 94,436,718

92,200

1D 2.56%

5D -3.56%

Buy Vol. 8,808,930

Sell Vol. 9,677,278

29,100

1D 2.28%

5D -0.85%

Buy Vol. 6,848,732

Sell Vol. 8,223,578

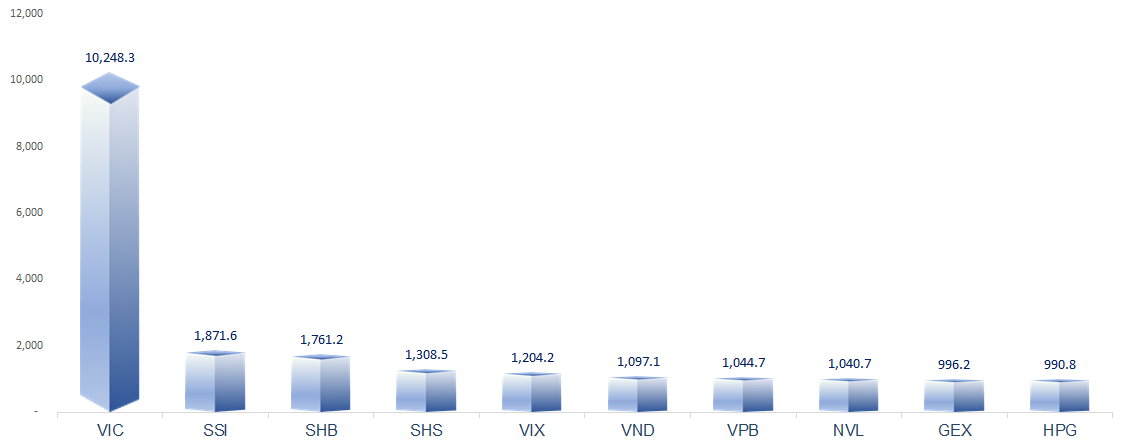

VIC: Vingroup will invest in the Nam Do Son port and logistics center project in Hai Phong, with a capital of over USD14 billion. In addition, VIC saw nearly VND10,000 billion in negotiated sales by foreign investors in today’s session.

FOOD & BEVERAGE

60,400

1D 0.67%

5D -4.58%

Buy Vol. 7,569,875

Sell Vol. 6,617,444

73,900

1D 1.93%

5D -4.77%

Buy Vol. 9,365,687

Sell Vol. 9,513,978

48,100

1D 0.31%

5D -2.43%

Buy Vol. 1,336,170

Sell Vol. 2,089,836

VNM: Two Singaporean foreign funds — F&N Dairy Investments Pte. Ltd and Platinum Victory Pte Ltd — each registered to purchase 20,899,554 shares from August 5 to September 3, 2025.

OTHERS

71,000

1D 1.57%

5D 1.87%

Buy Vol. 1,052,428

Sell Vol. 1,545,664

50,000

1D 0.00%

5D -4.21%

Buy Vol. 986,993

Sell Vol. 1,230,526

127,300

1D 6.97%

5D 0.24%

Buy Vol. 4,868,302

Sell Vol. 4,233,585

106,600

1D -0.37%

5D -4.22%

Buy Vol. 9,079,850

Sell Vol. 8,537,177

67,000

1D 2.76%

5D -4.56%

Buy Vol. 16,195,655

Sell Vol. 12,066,277

29,900

1D 0.67%

5D -4.78%

Buy Vol. 4,152,336

Sell Vol. 5,041,038

34,000

1D 2.41%

5D -5.03%

Buy Vol. 85,114,586

Sell Vol. 82,036,549

25,300

1D 0.60%

5D -3.98%

Buy Vol. 66,773,904

Sell Vol. 67,439,988

BCM: Becamex IDC Corporation recorded net revenue of over VND2,500 billion, more than doubling from the same period last year. Of this, the real estate business alone contributed over VND2,300 billion, up 3.2 times compared to Q2/2024.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

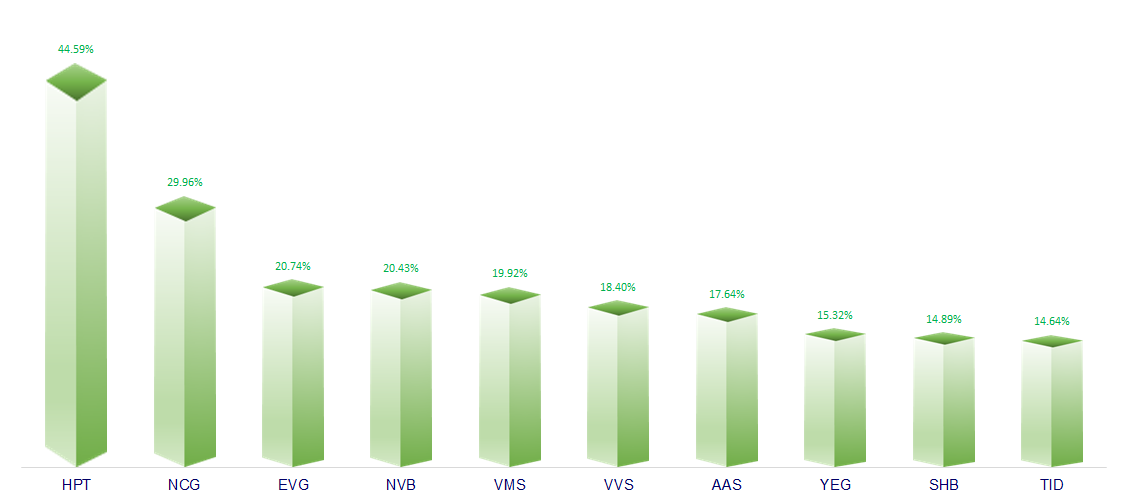

TOP INCREASES 3 CONSECUTIVE SESSIONS

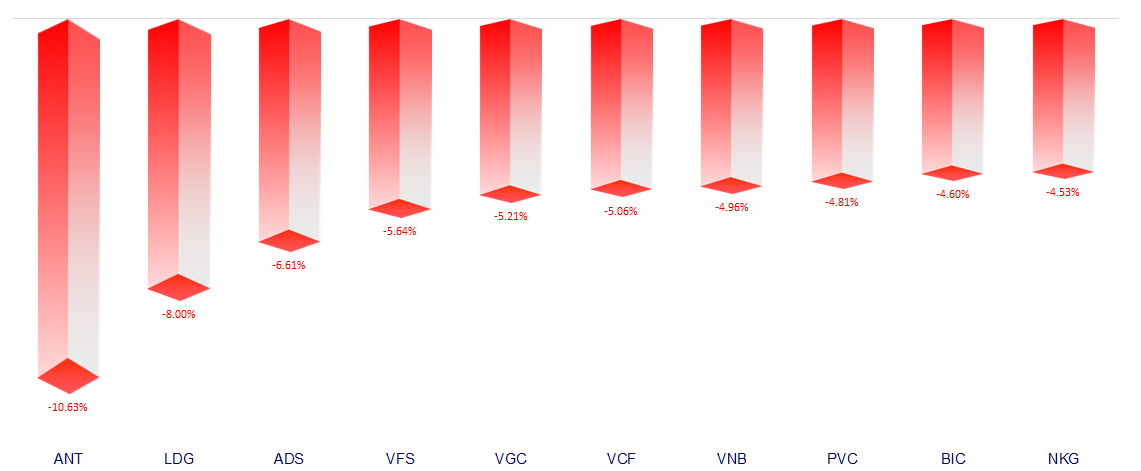

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.