Morning brief 15/09/2025

GLOBAL MARKET

45,834.22

1D -0.59%

YTD 7.73%

6,584.29

1D -0.05%

YTD 11.95%

22,141.10

1D 0.44%

YTD 14.66%

14.76

1D 0.34%

9,283.29

1D -0.15%

YTD 13.58%

23,698.15

1D -0.02%

YTD 19.03%

7,825.24

1D 0.02%

YTD 6.02%

67.21

1D -0.49%

YTD -10.45%

3,627.00

1D -0.57%

YTD 37.64%

The U.S. stock market ended Friday’s session (September 12) mixed across major indexes but wrapped up a strong week overall, as investors viewed signs of labor market weakness and subdued inflation as a foundation for the Federal Reserve to cut interest rates next week. At the close, the Nasdaq gained 0.44% to a record high of 22,141.1 points, with Tesla surging nearly 7.4%, making it the biggest contributor to the index’s performance. In contrast, the Dow Jones fell 273.59 points, or 0.59%.

VIETNAM ECONOMY

4.16%

1D (bps) 9

YTD (bps) 19

4.60%

3.10%

1D (bps) -2

YTD (bps) 62

3.56%

1D (bps) 9

YTD (bps) 71

26,476

1D (%) -0.02%

YTD (%) 3.62%

31,765

1D (%) 0.32%

YTD (%) 16.50%

3,768

1D (%) 0.06%

YTD (%) 5.81%

Deputy Prime Minister Ho Duc Phoc signed Decision No. 2014/QĐ-TTg on September 12, 2025, approving the Plan to Upgrade Vietnam’s Stock Market. The plan’s main objective is to fully meet the criteria for an upgrade from frontier to secondary emerging market status by FTSE Russell in 2025. It also targets fulfilling the requirements for emerging market status under MSCI and higher-tier emerging market status by FTSE Russell by 2030.

VIETNAM STOCK MARKET

1,667.26

1D 0.57%

YTD 31.61%

276.51

1D 0.85%

YTD 21.58%

1,865.45

1D 0.56%

YTD 38.72%

110.09

1D -0.01%

YTD 15.81%

-1,210.16

37,240.00

1D -7.56%

YTD 105.40%

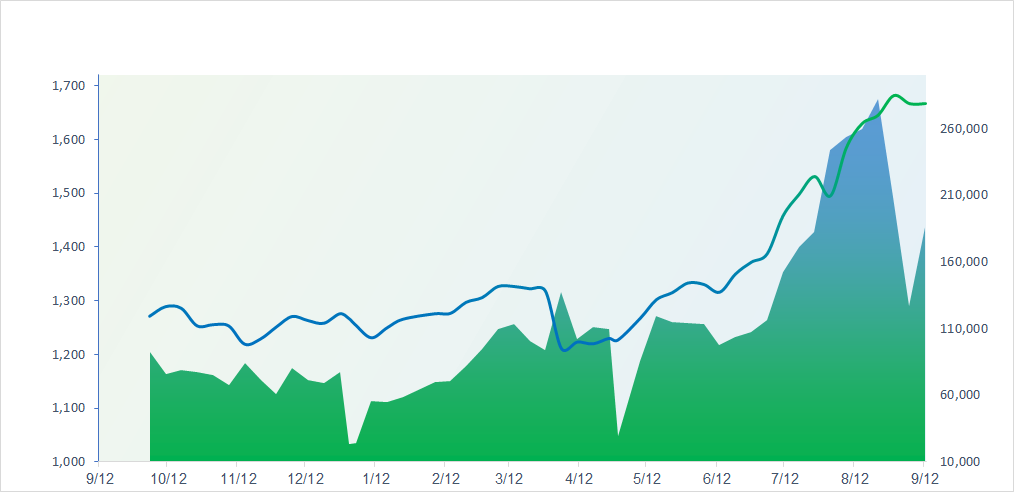

On September 12, VN-Index continued its recovery, supported by strong capital inflows into mid-cap stocks. Meanwhile, Proprietary recorded a net sell of 197 billion VND on September 11, with the heaviest outflows in MSN (87 billion VND), MWG (38 billion VND), VIX (25 billion VND), and VCB (24 billion VND). On the other hand, they net bought HPG (44 billion VND) and GEX (28 billion VND).

INTRADAY

VN30 (12M)

SELECTED NEWS

- Decision No. 2014/QĐ-TTg approving the Plan to Upgrade Vietnam’s Stock Market;

- The Government requires that income from gold trading be subject to taxation to curb speculation;

- Banks must maintain a minimum capital adequacy ratio (CAR) of 8% starting from September 15;

- Morgan Stanley and Deutsche Bank forecast that the Fed will cut rates three times this year;

- Legal challenges threaten President Donald Trump’s tariff policy;

- Reasons why the U.S. has yet to respond to President Trump’s invitation to visit China.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.