Market brief 18/09/2025

VIETNAM STOCK MARKET

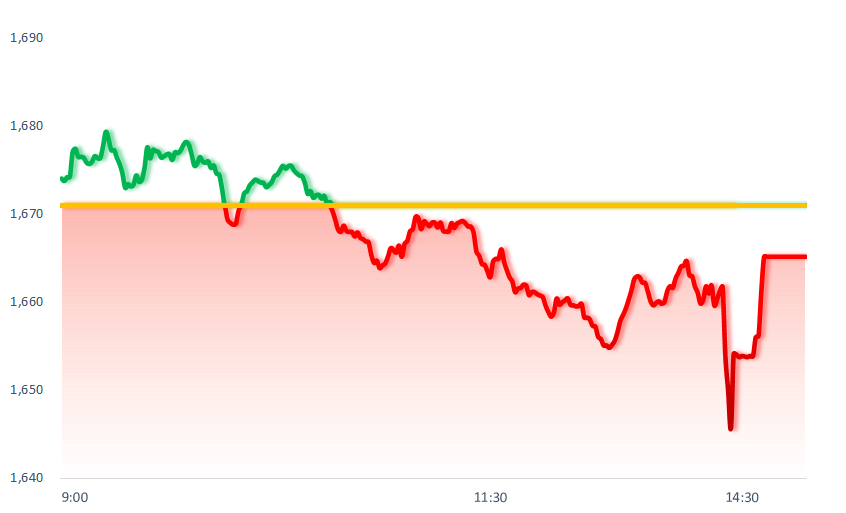

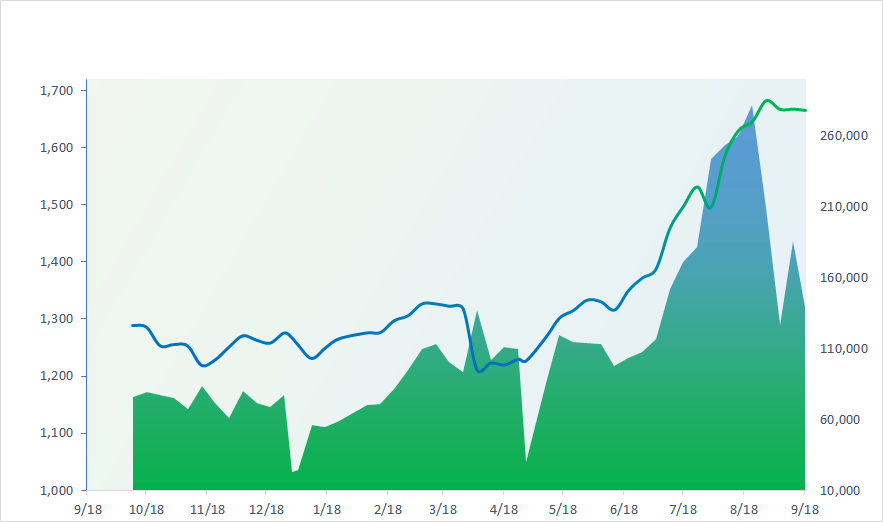

1,665.18

1D -0.35%

YTD 31.45%

276.92

1D -0.26%

YTD 21.76%

1,861.74

1D -0.38%

YTD 38.45%

111.10

1D -0.61%

YTD 16.87%

-1,699.54

1D 0.00%

YTD 0.00%

30,653.59

1D -17.47%

YTD 69.07%

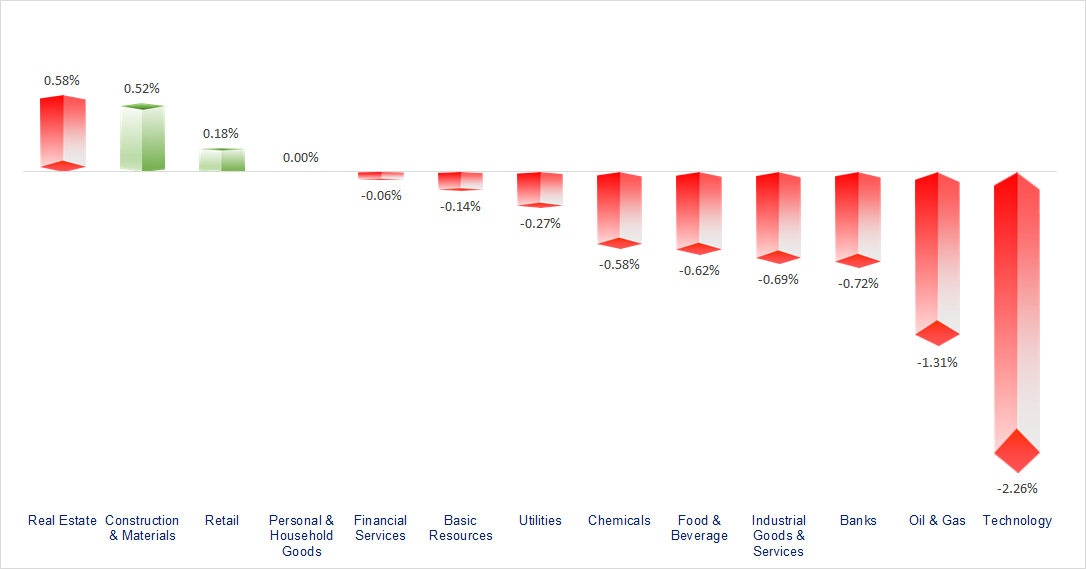

VN-Index held firm above its 20-day moving average despite closing the session down more than 15 points. Real estate and retail were the best-performing sectors today, while technology, oil & gas, and banking saw rather subdued movements.

ETF & DERIVATIVES

32,900

1D -0.99%

YTD 40.12%

22,630

1D -0.75%

YTD 39.00%

23,580

1D 0.00%

YTD 41.20%

28,400

1D -0.25%

YTD 41.29%

33,200

1D -0.03%

YTD 50.23%

40,400

1D -1.17%

YTD 20.53%

24,950

1D 0.00%

YTD 39.23%

1,850

1D -1.02%

YTD 0.00%

1,857

1D -0.91%

YTD 0.00%

1,840

1D -1.04%

YTD 0.00%

1,827

1D -0.98%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

45,303.43

1D 1.15%

YTD 13.56%

3,831.66

1D -1.15%

YTD 14.32%

26,544.85

1D -1.35%

YTD 32.33%

3,422.44

1D 0.00%

YTD 42.63%

83,013.94

1D 0.39%

YTD 5.65%

4,312.62

1D -0.26%

YTD 13.86%

1,297.01

1D -0.74%

YTD -7.37%

67.83

1D -0.18%

YTD -9.62%

3,667.42

1D 0.23%

YTD 39.18%

Across Asia, markets saw mixed action. Japan’s Nikkei 225, led by gains in tech and real estate, rose 1.15% to 45,303 points, hitting a fresh all‑time high.

VIETNAM ECONOMY

4.20%

1D (bps) -39

YTD (bps) 23

4.60%

3.16%

1D (bps) 5

YTD (bps) 69

3.50%

1D (bps) 3

YTD (bps) 65

26,445

1D (%) -0.05%

YTD (%) 3.50%

31,954

1D (%) -0.37%

YTD (%) 17.19%

3,768

1D (%) 0.06%

YTD (%) 5.82%

After the Fed’s rate cut, USD interbank rates dropped across all tenors: the overnight rate fell to 4.11% per year, the one‑week rate to 4.14%, and the one‑month rate to 4.26%. The decline ranged from 0.17 to 0.22 percentage points.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- UOB upgraded Vietnam’s GDP growth forecast for 2025 from 6.9% to 7.5%;

- Vietnam and Singapore signed a strategic deal targeting a USD250 billion market, expected to “boom” by 2050;

- VCCI recommends keeping the interest withholding tax rate for FDI loans at 5% rather than raising it to 10%;

- The EU could see widespread business closures due to China tightening rare earth exports;

- Despite large investments, the US and Europe remain behind China and Japan in key industries;

- The Fed remains unclear about the US economic outlook.

VN30

BANK

63,900

1D -1.39%

5D -2.74%

Buy Vol. 12,848,024

Sell Vol. 13,211,347

40,800

1D -0.49%

5D 0.37%

Buy Vol. 8,429,748

Sell Vol. 7,937,053

51,200

1D -0.39%

5D 1.19%

Buy Vol. 13,636,649

Sell Vol. 12,631,263

38,800

1D 0.26%

5D 0.26%

Buy Vol. 21,548,146

Sell Vol. 25,743,031

30,800

1D -0.65%

5D -4.50%

Buy Vol. 50,348,275

Sell Vol. 41,145,360

26,800

1D -0.74%

5D 0.37%

Buy Vol. 44,179,837

Sell Vol. 31,135,854

30,700

1D -0.65%

5D -2.54%

Buy Vol. 18,891,530

Sell Vol. 20,409,237

18,850

1D -2.33%

5D -4.07%

Buy Vol. 30,806,469

Sell Vol. 27,664,098

57,000

1D 1.42%

5D 2.89%

Buy Vol. 15,189,355

Sell Vol. 17,449,405

20,550

1D -0.48%

5D -2.14%

Buy Vol. 15,487,026

Sell Vol. 13,570,755

25,550

1D -2.29%

5D -2.48%

Buy Vol. 31,391,811

Sell Vol. 33,463,578

17,850

1D -1.11%

5D 0.28%

Buy Vol. 105,772,379

Sell Vol. 109,028,243

20,000

1D -0.50%

5D -0.50%

Buy Vol. 14,625,885

Sell Vol. 14,935,573

45,400

1D 0.22%

5D 3.18%

Buy Vol. 5,080,534

Sell Vol. 4,297,524

VCB: Vietcombank is the first to register to use both the Standardized Approach (SA) and Internal Ratings‑Based Approach (IRB) as per Circular 14/2025/TT‑NHNN, effective from September 15, 2025.

OIL & GAS

63,000

1D -1.56%

5D 1.61%

Buy Vol. 1,231,060

Sell Vol. 1,807,336

35,600

1D -1.39%

5D 0.71%

Buy Vol. 3,151,301

Sell Vol. 3,356,479

Today’s petrol price adjustment: RON 95‑III increased by VND200 to 20,600 VND/litre; E5 RON 92 rose to 19,980 VND/litre.

VINGROUP

145,000

1D 1.33%

5D 6.62%

Buy Vol. 11,276,855

Sell Vol. 9,942,679

103,500

1D 0.58%

5D -2.27%

Buy Vol. 9,547,543

Sell Vol. 8,142,333

30,200

1D 0.00%

5D -2.89%

Buy Vol. 11,120,996

Sell Vol. 10,390,143

VIC: Vingroup now has a market cap over VND551 trillion, surpassing Vietcombank to become the largest listed company.

FOOD & BEVERAGE

63,600

1D -2.30%

5D 3.92%

Buy Vol. 8,172,018

Sell Vol. 9,477,826

84,000

1D -0.24%

5D 2.44%

Buy Vol. 11,598,832

Sell Vol. 10,455,657

46,800

1D -1.06%

5D 0.86%

Buy Vol. 1,867,611

Sell Vol. 2,436,967

MSN: Foreign investors sold about VND89 billion of MSN shares today.

OTHERS

69,200

1D -0.72%

5D 2.37%

Buy Vol. 534,049

Sell Vol. 964,417

98,800

1D -1.00%

5D 1.86%

Buy Vol. 2,615,273

Sell Vol. 2,940,966

139,800

1D -1.55%

5D -3.85%

Buy Vol. 2,461,948

Sell Vol. 3,060,720

103,000

1D -2.37%

5D 0.98%

Buy Vol. 14,615,473

Sell Vol. 20,187,994

78,500

1D 0.64%

5D -0.38%

Buy Vol. 16,142,679

Sell Vol. 11,448,516

28,800

1D -0.35%

5D 0.17%

Buy Vol. 3,321,995

Sell Vol. 2,941,434

40,800

1D 0.49%

5D -3.89%

Buy Vol. 52,235,451

Sell Vol. 43,497,946

29,150

1D -0.17%

5D 0.00%

Buy Vol. 127,407,634

Sell Vol. 109,858,806

MWG: Dragon Capital’s funds sold over 3.26 million shares in Mobile World (MWG), lowering their stake from 5.21% to 4.99%, making them no longer major shareholders.

Market by numbers

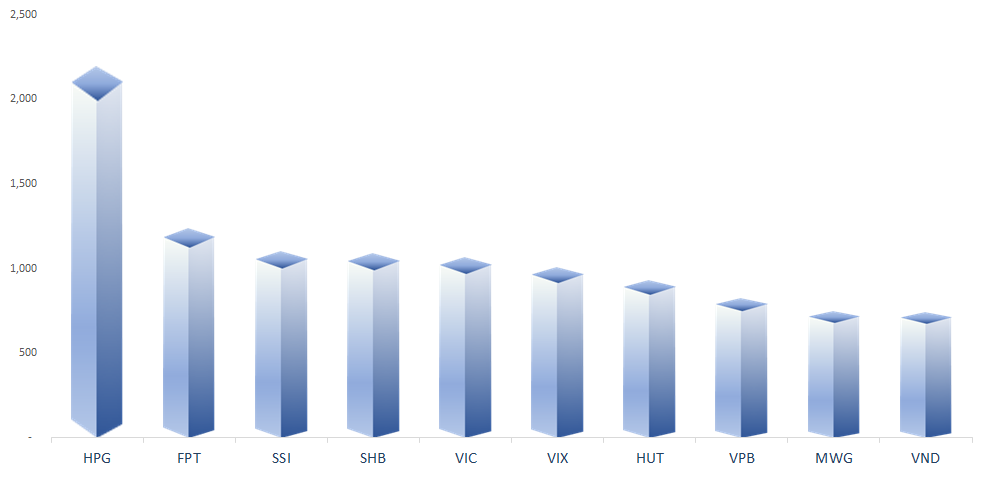

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

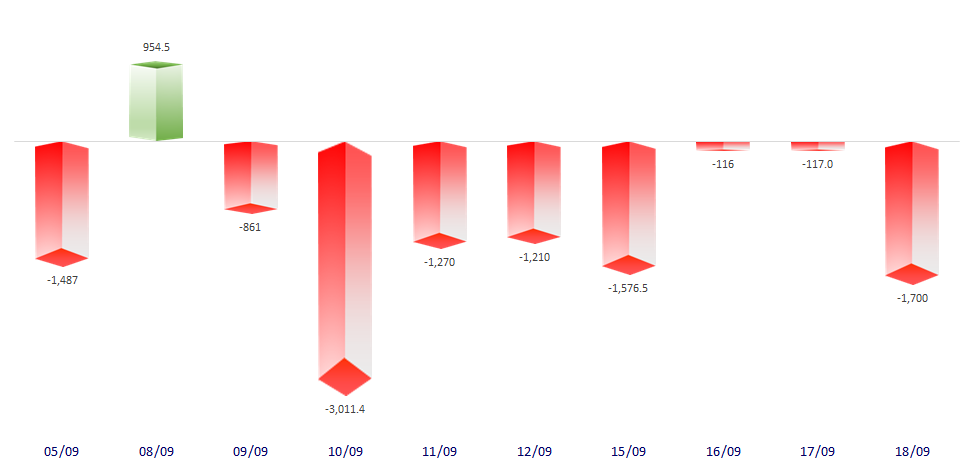

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

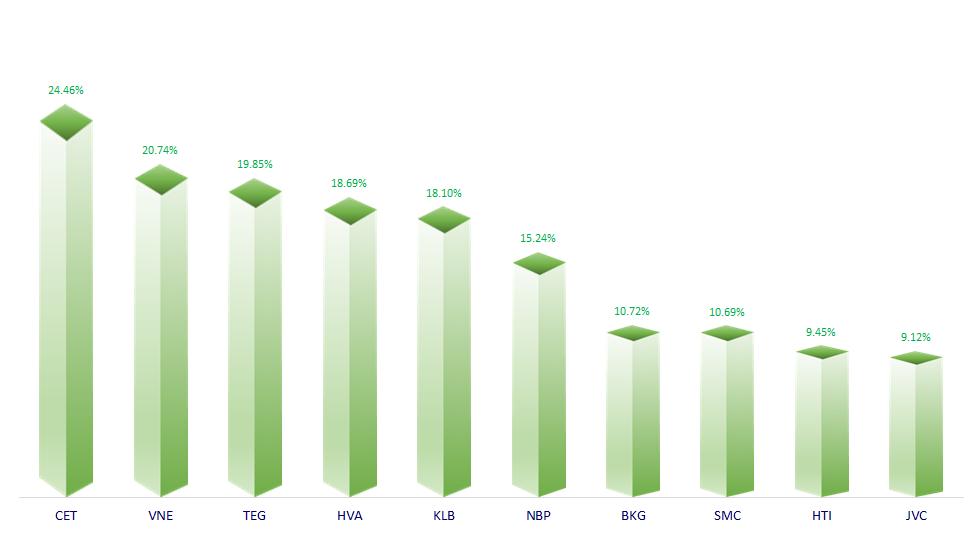

TOP INCREASES 3 CONSECUTIVE SESSIONS

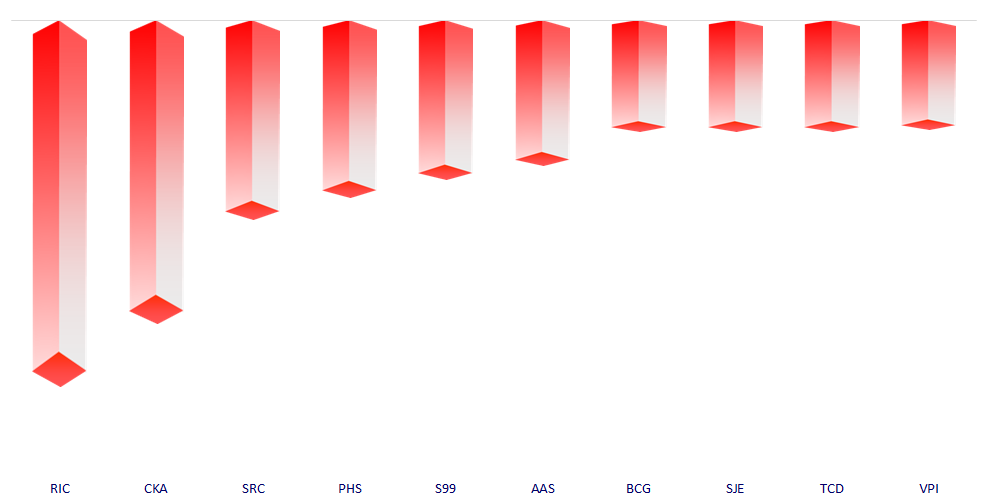

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.