Morning Brief 24/02/2021

VIETNAM STOCK MARKET

1,177.64

1D 0.22%

YTD 7.11%

1,182.47

1D 0.16%

YTD 11.72%

238.78

1D 0.34%

YTD 21.15%

76.47

1D -0.13%

YTD 3.58%

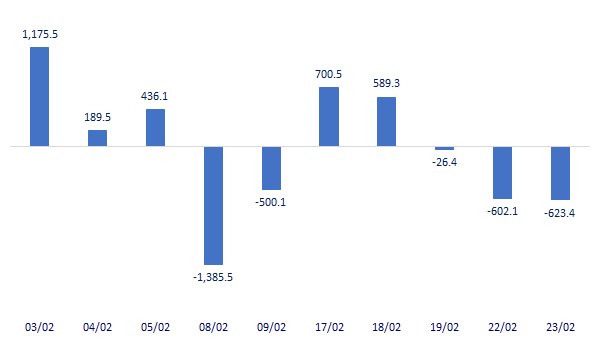

-623.35

18,133.67

1D 3.41%

YTD 5.72%

- Foreign investors' trade was negative they were net sellers on all 3 exchanges with a total value of more than 623 billion dong and this is also the 3rd net selling session in a row. Foreign investors' selling focused on Bluechips such as VNM (-106.4 billion dong), CTG (-77.3 billion dong), and HPG (-69 billion dong) ...

ETF & DERIVATIVES

17,300

1D 0.00%

YTD 14.57%

19,900

1D 0.45%

YTD 15.03%

14,760.0

1D 0.48%

19,600.0

1D -1.01%

1,190.9

1D 0.92%

1,190.0

1D 0.80%

1,190.0

1D 1.24%

1,186.4

1D 1.13%

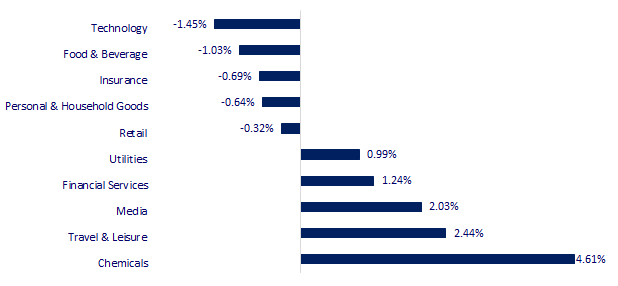

CHANGE IN PRICE BY SECTOR

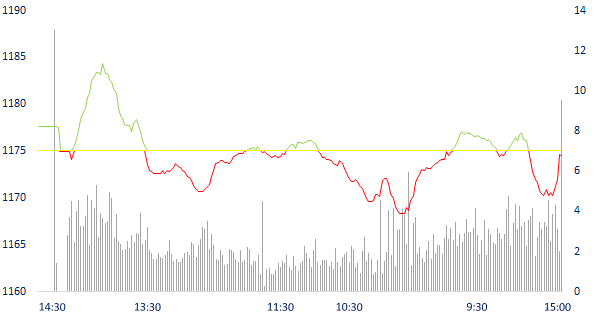

INTRADAY VNINDEX

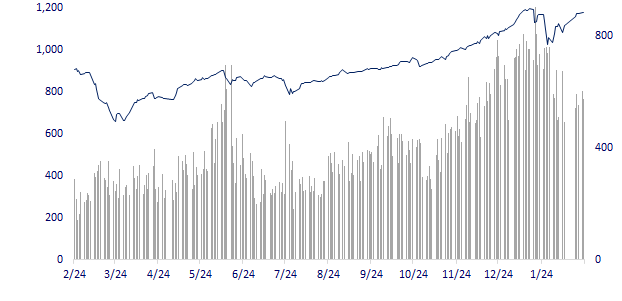

VNINDEX (12M)

GLOBAL MARKET

31,537.35

1D 0.05%

YTD 3.71%

3,881.37

1D 0.13%

YTD 4.00%

13,465.20

1D -0.50%

YTD 4.62%

23.11

6,625.94

1D 0.21%

YTD 1.07%

13,864.81

1D -0.61%

YTD 1.06%

5,779.84

1D 0.22%

YTD 3.22%

30,042.50

1D -0.38%

YTD 9.47%

3,636.36

1D -0.17%

YTD 6.50%

3,070.09

1D -0.31%

YTD 6.84%

30,632.64

1D 1.03%

YTD 12.84%

2,890.70

1D 0.33%

YTD 0.75%

1,500.61

1D 1.52%

YTD 3.54%

61.27

1D -1.30%

YTD 26.85%

1,809.70

1D 0.16%

YTD -4.94%

- At the end of the session 23/2, Dow Jones recovered from a sharp drop when Fed Chairman Jerome Powell made comments to reduce concerns about rising inflation and the possibility of rate hikes. The Dow Jones blue-chip index wiped out a 360-point drop and closed 15.66 points higher, or 0.1%, at 31,537.35 points. The S&P 500 also reversed the 1.8% decline and ended the day with a 0.1% gain with 3,881.37 points. Nasdaq Composite lost 0.5% to 13,465.20 points, after falling 3.9% in the session. At its intraday low, the Nasdaq even dipped below the 50-day moving average for the first time since November 3rd.

VIETNAM ECONOMY

0.42%

1D (bps) -24

YTD (bps) 29

5.80%

1.39%

1D (bps) 13

YTD (bps) 17

2.26%

1D (bps) 22

YTD (bps) 23

23,127

1D (%) 0.01%

YTD (%) -0.22%

28,710

1D (%) -0.02%

YTD (%) -1.35%

3,631

1D (%) 0.00%

YTD (%) 1.62%

- According to the GDC announced on the afternoon of February 22, the first 15 days of this month, the export turnover reached $9.94b, a slight increase of nearly 2.5% compared to the same period of 2020. At the beginning of February, there were 4 groups of export goods with turnover of $1b or more, including: phones; computers; machinery, equipment, tools and spare parts; textile.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Export of plastic materials to Australia increased by more than 900%

- LG's factories in Vietnam achieved revenue of nearly $ 5 billion after 9 months, exceeding 2019

- Vietnam saw a trade surplus of nearly 3 billion USD in the first month of the year

- Among the big economies, only China has positive growth

- EU warns against stopping economic stimulus measures too soon

- Thailand's economic growth prospects are not very positive

VN30

BANK

100,000

1D -0.60%

5D 2.88%

Buy Vol. 2,333,900

Sell Vol. 2,311,500

44,000

1D 0.57%

5D 7.84%

Buy Vol. 2,872,000

Sell Vol. 2,988,500

37,050

1D 0.14%

5D 4.66%

Buy Vol. 14,642,600

Sell Vol. 17,000,100

39,800

1D 3.11%

5D 10.56%

Buy Vol. 44,632,700

Sell Vol. 43,372,200

40,500

1D -1.10%

5D 5.19%

Buy Vol. 12,540,100

Sell Vol. 13,137,500

27,400

1D 2.62%

5D 10.71%

Buy Vol. 57,097,200

Sell Vol. 52,509,400

25,950

1D 0.58%

5D 7.68%

Buy Vol. 8,142,800

Sell Vol. 10,669,000

27,950

1D 0.18%

5D 4.10%

Buy Vol. 5,035,300

Sell Vol. 7,112,900

18,800

1D 1.08%

5D 3.58%

Buy Vol. 52,308,700

Sell Vol. 51,333,300

- VCB: Vietcombank continued to reduce lending interest rates from February 22, applying to both individual and corporate customers. Accordingly, the interest payable as well as the loan interest rate applies to both existing and new loans.

REAL ESTATE

80,800

1D 0.00%

5D 2.28%

Buy Vol. 2,807,300

Sell Vol. 2,795,900

23,000

1D 0.88%

5D 7.98%

Buy Vol. 12,179,200

Sell Vol. 10,587,400

33,500

1D -1.18%

5D 5.02%

Buy Vol. 2,106,100

Sell Vol. 2,236,600

64,000

1D -0.78%

5D 1.91%

Buy Vol. 4,538,600

Sell Vol. 4,100,900

- NVL: Novaland plans to issue at most 46 million shares to convert up to 565,925 bonds. The total convertible bond value is nearly 2,578 billion dong.

OIL & GAS

89,400

1D 1.36%

5D 9.96%

Buy Vol. 2,829,800

Sell Vol. 3,035,900

12,850

1D -0.39%

5D 4.05%

Buy Vol. 17,558,300

Sell Vol. 19,301,700

56,800

1D -0.70%

5D 7.17%

Buy Vol. 1,984,900

Sell Vol. 2,594,600

- PLX: Eneos Corporotion (Japan) announces registration to buy 25 million PLX shares from March 1 to March 30.

VINGROUP

110,000

1D 0.27%

5D 3.58%

Buy Vol. 2,262,800

Sell Vol. 2,382,900

105,300

1D -0.47%

5D 8.78%

Buy Vol. 3,570,700

Sell Vol. 4,197,900

34,400

1D 0.73%

5D 9.03%

Buy Vol. 7,487,000

Sell Vol. 8,541,000

- VIC: From January 2021 up to now, there have been 3 phone models with ID V340U, V341U and V350U officially on the shelves of AT&T carrier.

FOOD & BEVERAGE

107,000

1D -0.47%

5D -0.93%

Buy Vol. 5,317,900

Sell Vol. 5,053,100

60,500

1D -0.98%

5D 1.00%

Buy Vol. 1,514,700

Sell Vol. 1,457,700

92,700

1D -2.01%

5D 4.51%

Buy Vol. 2,605,700

Sell Vol. 2,826,300

22,500

1D 2.27%

5D 2.74%

Buy Vol. 6,832,600

Sell Vol. 6,867,200

- VNM: VNM continued to be net sold by foreigners yesterday with the value of VND 106 billion.

OTHERS

134,000

1D 1.82%

5D 3.88%

Buy Vol. 1,743,100

Sell Vol. 1,380,100

75,500

1D -1.69%

5D 1.21%

Buy Vol. 5,102,000

Sell Vol. 4,878,300

136,200

1D -0.58%

5D 5.17%

Buy Vol. 2,892,200

Sell Vol. 2,687,100

83,500

1D -1.88%

5D -0.12%

Buy Vol. 1,649,300

Sell Vol. 1,707,300

56,400

1D -1.05%

5D -1.05%

Buy Vol. 1,649,100

Sell Vol. 1,593,000

33,600

1D 2.28%

5D 5.83%

Buy Vol. 27,053,400

Sell Vol. 27,940,700

43,300

1D -0.23%

5D 3.59%

Buy Vol. 32,695,400

Sell Vol. 30,915,200

- HPG: Hoa Phat Group said that it is expected to launch Hoa Phat Dung Quat 2 project in early 2022 with a capacity of 5 million tons/year, focusing on HRC production with the most modern technology.

Market by numbers

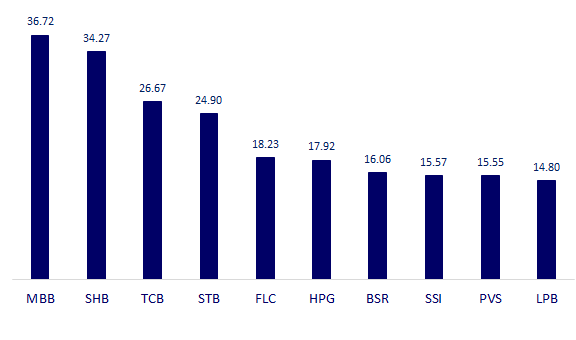

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

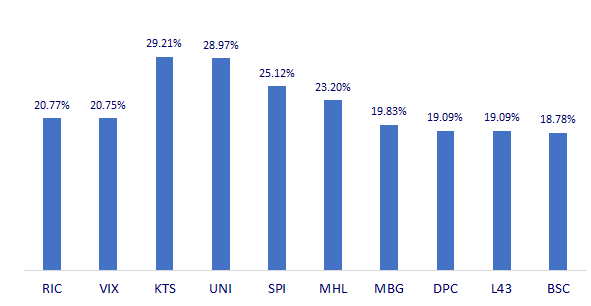

TOP INCREASES 3 CONSECUTIVE SESSIONS

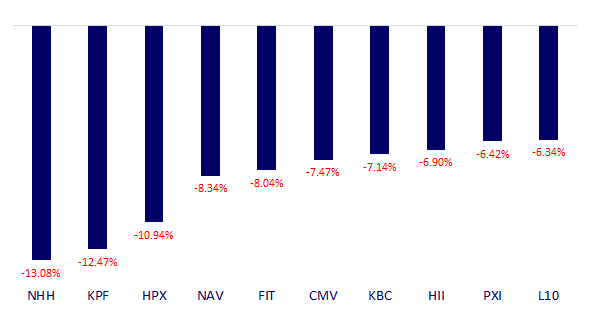

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.