Market Brief 02/03/2021

VIETNAM STOCK MARKET

1,186.61

1D 0.04%

YTD 7.92%

1,194.71

1D 0.24%

YTD 12.88%

247.94

1D -1.76%

YTD 25.79%

77.46

1D 0.40%

YTD 4.92%

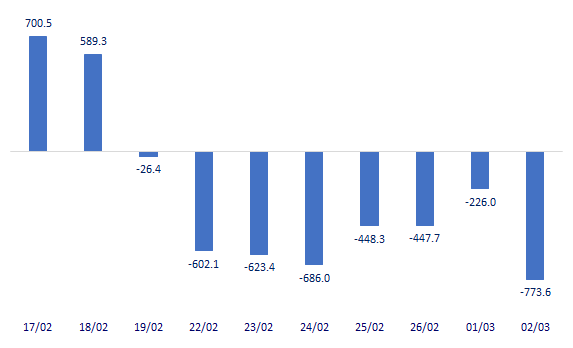

-773.59

1D 0.00%

YTD 0.00%

18,500.19

1D -3.80%

YTD 7.85%

- Foreign investors' trade was not positive as they net sold on all 3 exchanges with a total value of 773 billion dong, the selling focused on Bluechips such as VNM, HPG, VIC, CTG …

ETF & DERIVATIVES

20,030

1D 0.00%

YTD 6.54%

14,010

1D 0.00%

YTD 11.81%

14,920

1D 0.54%

YTD 11.93%

17,500

1D 1.16%

YTD 10.76%

15,800

1D 0.70%

YTD 15.75%

19,990

1D 0.20%

YTD 16.22%

15,400

1D -0.90%

YTD 10.39%

1,199

1D 0.04%

YTD 0.00%

1,197

1D -0.07%

YTD 0.00%

1,197

1D 0.13%

YTD 0.00%

1,194

1D 0.08%

YTD 0.00%

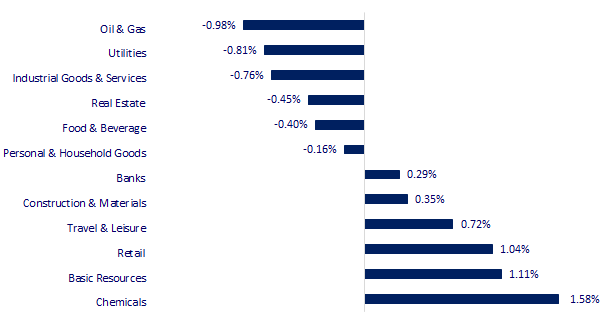

CHANGE IN PRICE BY SECTOR

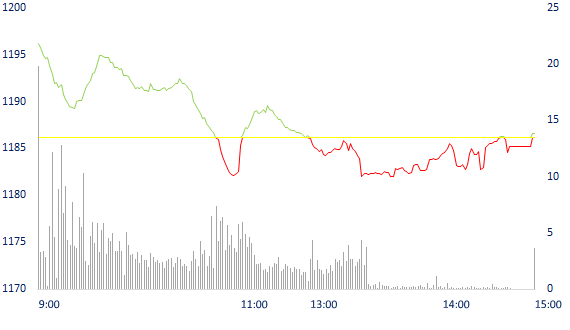

INTRADAY VNINDEX

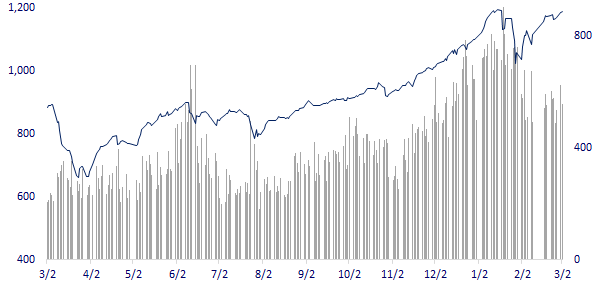

VNINDEX (12M)

GLOBAL MARKET

26,537.31

1D 0.91%

YTD 12.18%

3,369.73

1D 0.22%

YTD 9.27%

2,625.91

1D 0.94%

YTD 19.49%

26,819.45

1D 0.56%

YTD -5.74%

2,857.48

1D -0.42%

YTD -11.34%

1,433.56

1D 1.26%

YTD -10.28%

45.05

1D -1.81%

YTD -25.84%

1,809.60

1D 0.10%

YTD 19.23%

- Asian stocks reversed, almost falling at the end of the session. The MSCI Asia-Pacific Index, excluding Japan, fell 0.24%. The Chinese market fell with the Shanghai Composite down 1.21% and the Shenzhen Component down 0.715%. Hong Kong's Hang Seng lost 1.21%. In Japan, Nikkei 225 decreased by 0.86% while Topix decreased by 0.4%. The South Korean Kospi Index went against the general trend, up 1.03% after the March 1 holiday.

VIETNAM ECONOMY

0.10%

YTD (bps) -133

5.80%

YTD (bps) -70

1.35%

1D (bps) -3

YTD (bps) -264

2.21%

1D (bps) -5

YTD (bps) -249

23,256

1D (%) 0.00%

YTD (%) 0.11%

28,298

1D (%) -0.09%

YTD (%) 6.38%

3,557

1D (%) 0.06%

YTD (%) 4.74%

- The State Treasury has just announced the Government bond bidding plan in 2021 with a total issuance of 350 trillion dong. The volume is expected to include 5-year term of 20 trillion dong, 7-year term of 15 trillion dong, 10-year term of 120 trillion dong, 15-year term of 135 trillion dong, and 20-year term. is 30 trillion dong, 30 year term is 30 trillion dong.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Despite the impact of the COVID-19 epidemic, FDI enterprises are increasingly expanding production in Vietnam

- TP. HCMC budget revenue 2,900 billion/day, nearly double the average receivable

- Prime Minister agrees to invest in 2 industrial zones in Nam Dinh and Vinh Phuc with a total area of more than 300ha

- Bloomberg: VinFast is planning to open a factory in the US

- Multilateralism is "revived" under Mr. Biden

- Nikkei: China massively buys steel, neighbors benefit, including Vietnam

VN30

BANK

99,300

1D 0.10%

5D -0.70%

Buy Vol. 1,895,100

Sell Vol. 2,230,700

44,050

1D -0.11%

5D 0.11%

Buy Vol. 3,260,500

Sell Vol. 3,925,900

38,000

1D -0.26%

5D 2.56%

Buy Vol. 12,567,300

Sell Vol. 16,815,100

40,300

1D 0.25%

5D 1.26%

Buy Vol. 15,093,200

Sell Vol. 20,034,500

40,750

1D -0.12%

5D 0.62%

Buy Vol. 8,082,500

Sell Vol. 9,538,100

28,100

1D -0.88%

5D 2.55%

Buy Vol. 23,709,700

Sell Vol. 31,946,500

26,700

1D 3.49%

5D 2.89%

Buy Vol. 14,960,500

Sell Vol. 16,002,000

29,750

1D 6.25%

5D 6.44%

Buy Vol. 27,330,000

Sell Vol. 23,356,600

19,150

1D 0.26%

5D 1.86%

Buy Vol. 41,000,000

Sell Vol. 52,152,400

- The top 10 banks with net profit from service activities include Vietcombank, BIDV, VietinBank, Techcombank, Sacombank, MB, VPBank, VIB, SCB and ACB. The total net profit from service activities of these banks reached more than 17,060 billion dong, accounting for 85% of the net interest of 28 banks

REAL ESTATE

79,300

1D -0.50%

5D -1.86%

Buy Vol. 2,083,900

Sell Vol. 2,497,800

22,500

1D -0.44%

5D -2.17%

Buy Vol. 6,922,700

Sell Vol. 9,856,700

32,800

1D 0.92%

5D -2.09%

Buy Vol. 2,040,000

Sell Vol. 2,219,500

64,500

1D 0.31%

5D 0.78%

Buy Vol. 4,731,600

Sell Vol. 4,346,400

- NVL: Novaland has been issued red books for two projects in District 2 and will hand over three resort projects including NovaHills Mui Ne, NovaWorld Phan Thiet and NovaWorld Ho Tram this year.

OIL & GAS

91,000

1D -0.98%

5D 1.79%

Buy Vol. 3,030,000

Sell Vol. 2,544,800

12,950

1D -0.77%

5D 0.78%

Buy Vol. 20,007,300

Sell Vol. 24,657,700

58,600

1D -0.68%

5D 3.17%

Buy Vol. 5,181,600

Sell Vol. 6,330,500

- PLX: Re-granted margin since the company has offset losses and starts to book a net profit of 950 billion dong in 2020.

VINGROUP

108,200

1D -0.28%

5D -1.64%

Buy Vol. 1,492,300

Sell Vol. 1,779,100

102,800

1D -0.19%

5D -2.37%

Buy Vol. 3,482,000

Sell Vol. 4,970,400

34,700

1D 1.31%

5D 0.87%

Buy Vol. 9,280,700

Sell Vol. 12,020,900

- VHM: VinFast will receive more than 89.8 million VHM shares, equivalent to 2.68%. The transaction is expected to be deployed from March 4 to April 2

FOOD & BEVERAGE

104,900

1D -0.66%

5D -1.96%

Buy Vol. 4,497,300

Sell Vol. 5,750,700

61,800

1D 0.00%

5D 2.15%

Buy Vol. 1,654,700

Sell Vol. 2,105,600

90,900

1D -0.44%

5D -1.94%

Buy Vol. 1,607,400

Sell Vol. 2,119,600

22,900

1D 0.00%

5D 1.78%

Buy Vol. 5,413,700

Sell Vol. 8,647,900

OTHERS

137,700

1D 1.10%

5D 2.76%

Buy Vol. 1,361,200

Sell Vol. 1,030,600

77,900

1D 0.00%

5D 3.18%

Buy Vol. 3,060,900

Sell Vol. 4,419,500

135,800

1D 0.74%

5D -0.29%

Buy Vol. 925,900

Sell Vol. 1,271,400

84,000

1D -0.83%

5D 0.60%

Buy Vol. 504,600

Sell Vol. 865,900

56,900

1D 0.00%

5D 0.89%

Buy Vol. 860,900

Sell Vol. 1,444,200

35,050

1D 0.14%

5D 4.32%

Buy Vol. 20,031,900

Sell Vol. 26,726,200

46,700

1D 1.08%

5D 7.85%

Buy Vol. 45,428,200

Sell Vol. 45,059,400

- FPT: FPT's net profit after tax increased by 13.1% compared to 2019 to reach VND 4,422 billion; in which, after-tax profit attributable to shareholders of parent company is 3,538 billion dong. The digital transformation segment is the “bright spot” in FPT's revenue structure with its contribution of 3,219 billion dong, up 31% y/y.

Market by numbers

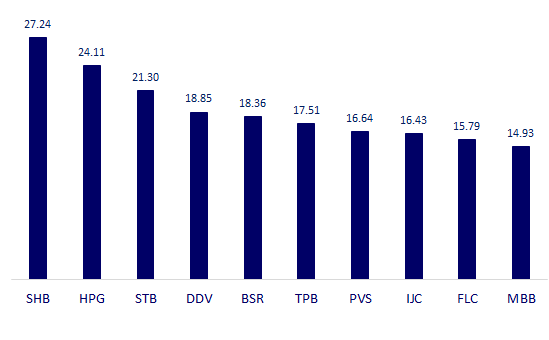

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

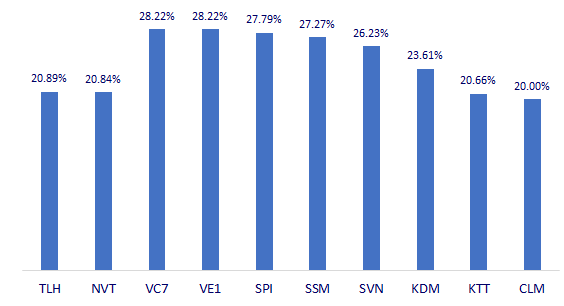

TOP INCREASES 3 CONSECUTIVE SESSIONS

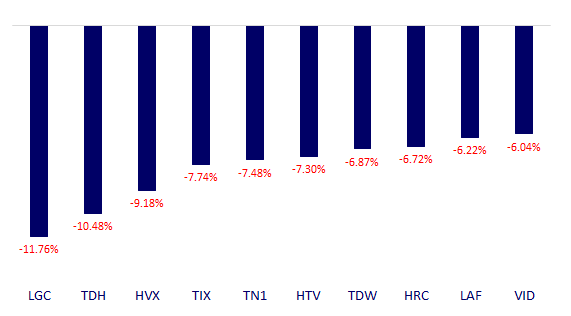

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.