Market brief 19/11/2025

VIETNAM STOCK MARKET

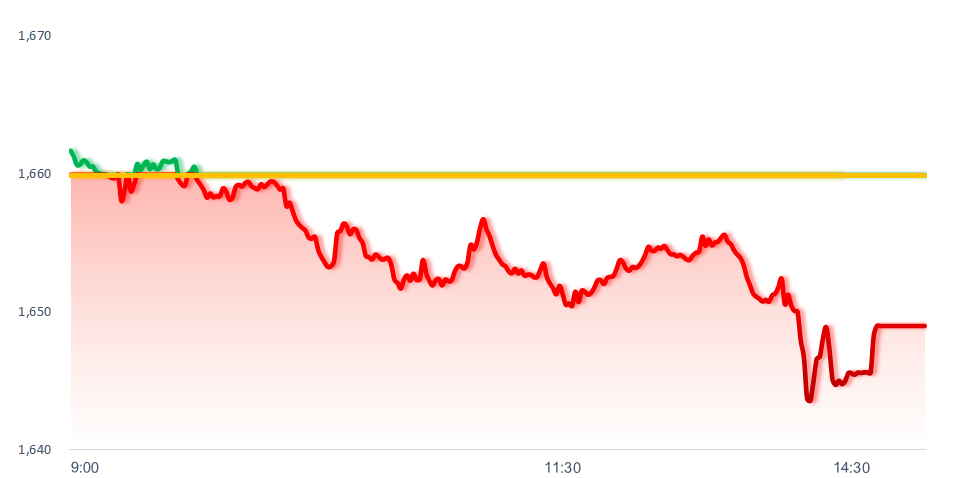

1,649.00

1D -0.66%

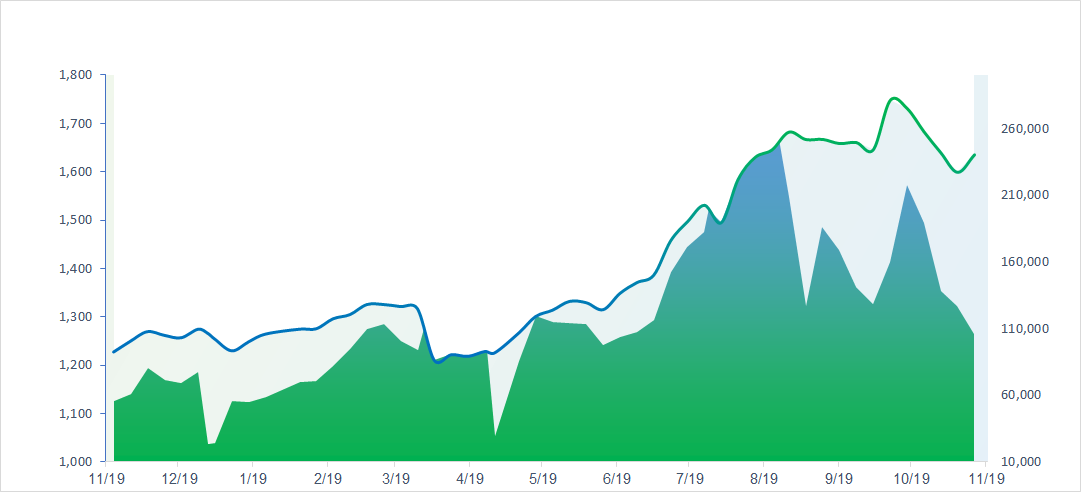

YTD 30.17%

265.03

1D -0.87%

YTD 16.53%

1,886.20

1D -0.63%

YTD 40.26%

119.51

1D -0.41%

YTD 25.72%

-720.08

1D 0.00%

YTD 0.00%

26,699.00

1D 7.15%

YTD 47.26%

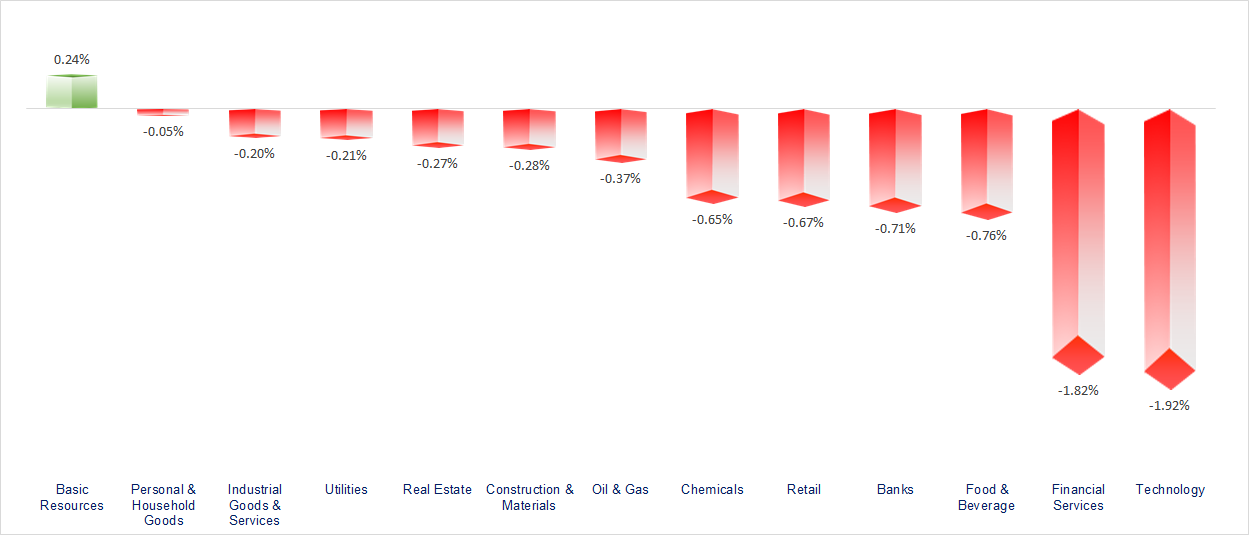

VN-Index lost more than 10 points as the Banking, Real Estate, and Securities sectors corrected. Most industry groups declined in today’s session, with the most negative being Securities, Banking, Retail, and Real Estate.

ETF & DERIVATIVES

33,250

1D -0.89%

YTD 41.61%

22,780

1D -0.78%

YTD 39.93%

23,700

1D 0.17%

YTD 41.92%

28,250

1D -0.49%

YTD 40.55%

29,850

1D -1.81%

YTD 35.07%

38,300

1D -0.10%

YTD 14.26%

25,700

1D -0.77%

YTD 43.42%

1,886

1D -0.64%

YTD 0.00%

1,882

1D -0.05%

YTD 0.00%

1,874

1D -1.16%

YTD 0.00%

1,874

1D -0.40%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

48,537.70

1D -0.34%

YTD 21.67%

3,946.74

1D 0.18%

YTD 17.75%

25,830.65

1D -0.38%

YTD 28.77%

3,929.51

1D -0.61%

YTD 63.76%

85,186.47

1D 0.61%

YTD 8.41%

4,505.22

1D 0.01%

YTD 18.95%

1,272.17

1D 0.17%

YTD -9.14%

64.34

1D -0.85%

YTD -14.27%

4,113.87

1D 1.14%

YTD 56.12%

Asian stock markets mostly fell today, continuing to be weighed down by Technology stocks. Specifically, Japan’s Nikkei 225 dropped more than 0.3% to 48,537.7 points, while Kospi lost over 0.6%, closing at 3,929.51 points.

VIETNAM ECONOMY

4.08%

1D (bps) -13

YTD (bps) 11

4.60%

3.34%

1D (bps) -1

YTD (bps) 87

3.64%

1D (bps) -5

YTD (bps) 79

26,388

1D (%) 0.00%

YTD (%) 3.28%

31,299

1D (%) -0.16%

YTD (%) 14.79%

3,767

1D (%) -0.06%

YTD (%) 5.80%

Domestic gold prices saw a strong rebound today after the previous sharp decline. SJC gold bars, gold rings, and 24K and 18K jewelry all surged sharply, with widespread increases ranging from 1 million to 1.7 million VND/tael at many major retailers.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Prime Minister directs a focus on maintaining macroeconomic stability and boosting exports;

- The Government Inspectorate urges recovery of more than VND 24,000 billion to the state budget after inspections;

- The U.S. exempts reciprocal tariffs on multiple goods, potentially benefiting some of Vietnam’s key sectors;

- A Fed official highlights the decisive factor for adjusting interest rates at the December meeting;

- An important step toward peace for the Gaza Strip;

- South Korea’s steel industry struggles under pressure from cheap Chinese steel and U.S. tariffs.

VN30

BANK

59,400

1D -0.83%

5D -0.17%

Buy Vol. 5,255,933

Sell Vol. 4,691,403

38,100

1D -0.78%

5D -0.39%

Buy Vol. 2,051,235

Sell Vol. 3,772,668

49,350

1D -0.10%

5D 0.30%

Buy Vol. 7,859,862

Sell Vol. 8,839,650

34,800

1D -1.56%

5D -0.57%

Buy Vol. 18,074,112

Sell Vol. 20,462,088

28,100

1D -2.43%

5D 0.36%

Buy Vol. 24,037,517

Sell Vol. 28,713,436

23,500

1D -0.84%

5D -0.84%

Buy Vol. 34,154,926

Sell Vol. 30,952,955

31,300

1D 2.79%

5D 4.33%

Buy Vol. 35,213,173

Sell Vol. 33,735,560

17,150

1D -2.56%

5D -0.87%

Buy Vol. 8,302,264

Sell Vol. 12,528,135

49,500

1D 0.00%

5D -2.17%

Buy Vol. 16,411,182

Sell Vol. 18,263,837

18,700

1D 0.00%

5D 0.27%

Buy Vol. 14,383,774

Sell Vol. 16,181,607

24,900

1D -0.80%

5D -1.19%

Buy Vol. 10,174,678

Sell Vol. 10,322,365

16,450

1D -0.30%

5D 0.92%

Buy Vol. 120,336,673

Sell Vol. 115,107,352

17,200

1D -0.86%

5D 0.29%

Buy Vol. 15,683,718

Sell Vol. 17,090,254

49,500

1D -0.10%

5D 1.75%

Buy Vol. 2,678,249

Sell Vol. 2,063,437

VIB: Vietnam International Commercial Joint Stock Bank (VIB) has just raised deposit interest rates across all tenors from 1 to 36 months. Earlier, at the end of October, VIB had already increased deposit rates by 0.2% per year for tenors of 3–5 months. Accordingly, online savings rates for tenors of 1–2 months and 6–36 months were also raised by 0.2% per year. Particularly, tenors of 3–5 months saw a sharp rise of 0.75% per year — the most notable increase in this adjustment.

OIL & GAS

62,200

1D -0.32%

5D 0.48%

Buy Vol. 860,817

Sell Vol. 1,072,333

34,700

1D 0.43%

5D 1.91%

Buy Vol. 3,791,900

Sell Vol. 3,845,212

Brent crude oil prices fell nearly 1% as reports showed U.S. oil inventories rising, offsetting concerns about the impact of Western sanctions on Russia.

VINGROUP

220,500

1D 0.23%

5D 4.40%

Buy Vol. 7,033,677

Sell Vol. 7,176,665

96,900

1D -0.10%

5D 3.09%

Buy Vol. 6,040,258

Sell Vol. 7,016,078

31,600

1D -2.32%

5D -3.66%

Buy Vol. 9,095,021

Sell Vol. 10,729,875

VIC: VIC has just sought shareholders’ approval for increasing its charter capital to VND77,335 billion. The group also officially added business sectors related to steel production and premium elderly care services.

FOOD & BEVERAGE

60,900

1D 0.33%

5D 1.84%

Buy Vol. 7,190,950

Sell Vol. 8,036,653

78,800

1D -0.25%

5D -0.51%

Buy Vol. 5,977,967

Sell Vol. 7,121,813

47,000

1D -0.42%

5D 0.11%

Buy Vol. 1,309,130

Sell Vol. 1,566,612

VNM: Foreign investors have recorded 10 consecutive sessions of net buying in VNM, with a total value of VND 948 billion.

OTHERS

66,100

1D -2.36%

5D -1.20%

Buy Vol. 611,784

Sell Vol. 815,331

96,600

1D -2.23%

5D 3.32%

Buy Vol. 6,247,580

Sell Vol. 8,620,536

178,000

1D -0.61%

5D 1.08%

Buy Vol. 2,288,247

Sell Vol. 2,600,158

98,000

1D -2.00%

5D -2.58%

Buy Vol. 9,896,945

Sell Vol. 10,978,296

82,400

1D -0.72%

5D 2.36%

Buy Vol. 9,672,463

Sell Vol. 12,030,261

28,000

1D -0.88%

5D -0.17%

Buy Vol. 4,409,760

Sell Vol. 6,474,938

34,650

1D -2.53%

5D -2.39%

Buy Vol. 36,611,012

Sell Vol. 40,461,377

27,600

1D 0.36%

5D 2.22%

Buy Vol. 85,924,107

Sell Vol. 116,765,520

HPG: The Trade Remedies Authority of Vietnam has issued a questionnaire for foreign manufacturers/exporters in the anti-circumvention investigation of trade defense measures on certain hot-rolled steel products originating from the People’s Republic of China. The Authority has sent official investigation questionnaires to known foreign producers/exporters, requesting them to respond. The deadline for submitting responses is before 5:00 p.m. on December 24, 2025.

Market by numbers

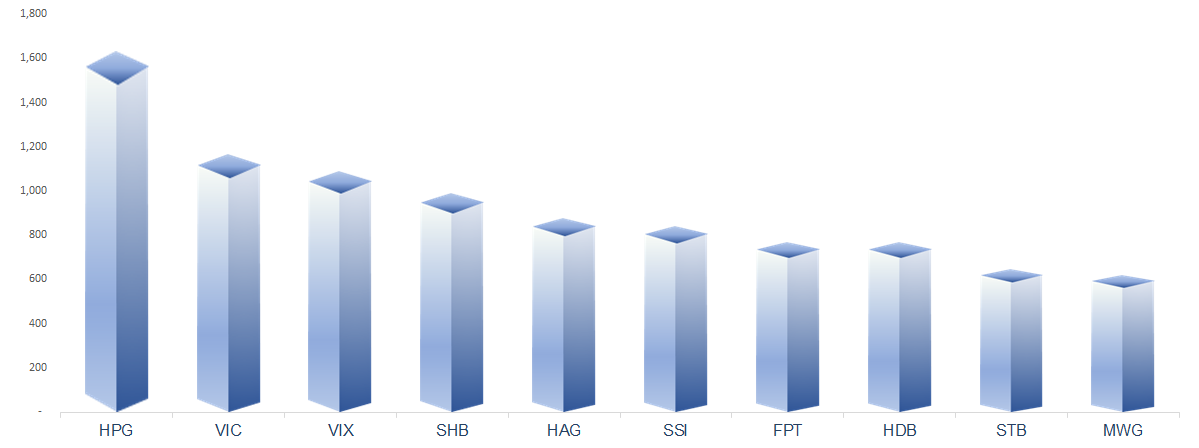

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

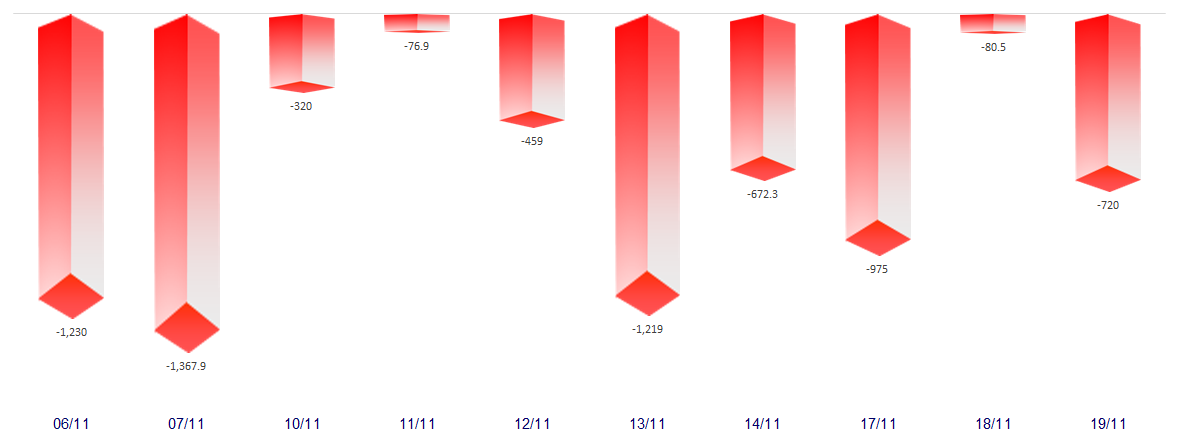

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

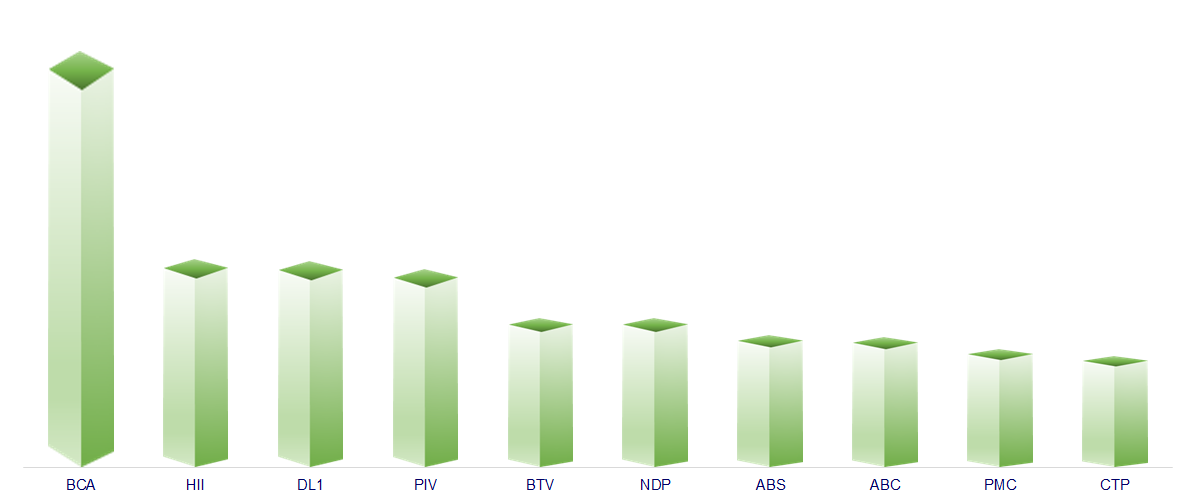

TOP INCREASES 3 CONSECUTIVE SESSIONS

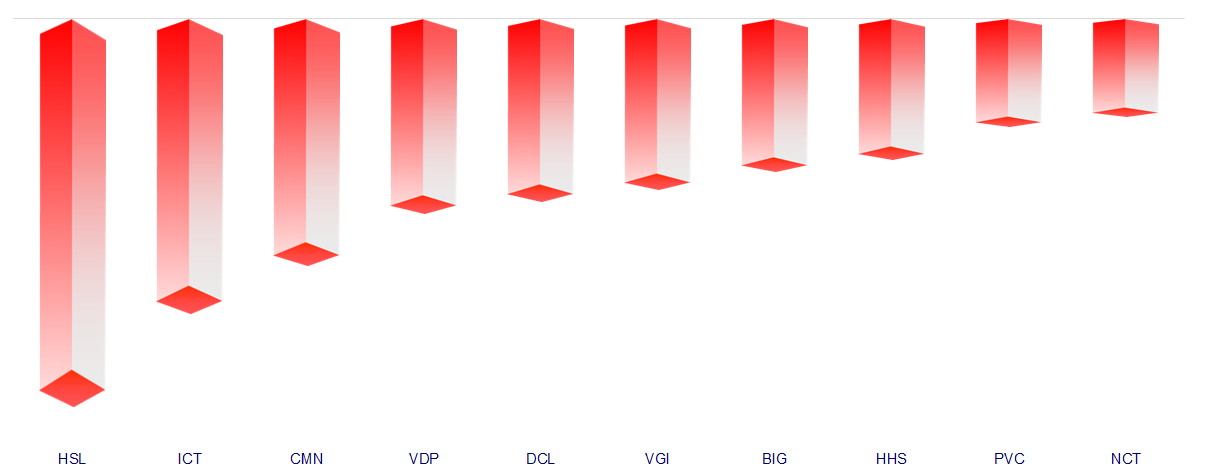

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.