Morning Brief 03/09

GLOBAL MARKET

29,100.50

1D 1.59%

YTD 1.97%

3,580.84

1D 1.54%

YTD 10.84%

12,056.44

1D 0.98%

YTD 34.37%

26.57

5,940.95

1D 0.88%

YTD -21.23%

13,243.43

1D 1.64%

YTD -0.04%

5,031.74

1D 1.56%

YTD -15.83%

23,247.15

1D 0.47%

YTD -1.73%

3,404.80

1D -0.17%

YTD 10.41%

2,364.37

1D 0.63%

YTD 7.59%

25,120.09

1D -0.26%

YTD -11.71%

2,539.94

1D 0.05%

YTD -21.19%

1,315.88

1D 0.75%

YTD -17.65%

41.67

1D -3.34%

YTD -31.41%

1,949.50

1D -2.38%

YTD 28.45%

U.S. equities rose alongside European stocks as the nearly relentless rally in risk assets continued, but with a twist as tech shares underperformed. The S&P 500 jumped the most in almost two months to an all-time high, with some of this year’s least-loved shares helping fuel the rally. The Russell 1000 Value Index rose 1.7%, beating its growth counterpart. Utilities and financial stocks -- two of the three worst performing sectors in 2020 -- each rose more than 1.4%. The Stoxx Europe 600 Index added the most in three weeks. Stocks in Asia followed their U.S. peers higher amid signs a rally that took global equities to a record high is broadening into other sectors and away from technology.

VIETNAM ECONOMY

0.16%

1D (bps) -2

YTD (bps) -127

6.00%

YTD (bps) -50

1.77%

YTD (bps) -222

2.79%

1D (bps) -2

YTD (bps) -191

23,262

1D (%) -0.01%

YTD (%) 0.14%

28,478

1D (%) 0.17%

YTD (%) 7.05%

3,427

1D (%) 0.03%

YTD (%) 0.91%

PMI in August continued to decline to 45.7 points from 47.6 points in July. The report showed that production output fell rapidly again as new orders decreased, accompanied by decreasing strongest employment ever recorded and output prices fell for the 7th consecutive month.

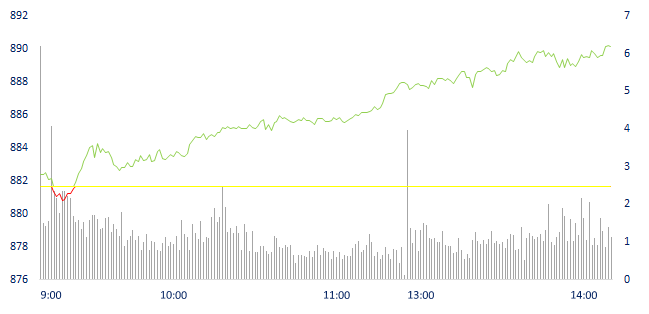

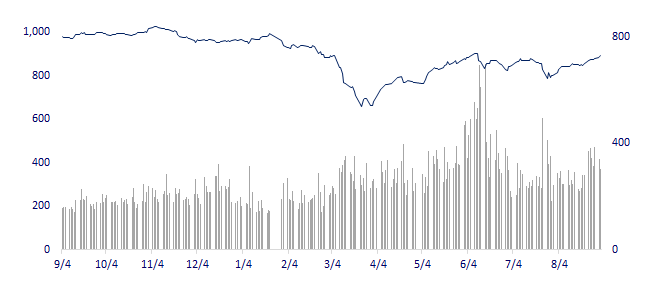

VIETNAM STOCK MARKET

891.73

1D 1.14%

YTD -7.21%

832.03

1D 0.98%

YTD -5.35%

125.41

1D 0.45%

YTD 22.34%

58.80

1D -0.03%

YTD 3.98%

-194.75

6,827.11

1D -10.71%

YTD 95.06%

Although the index increased quite well, the market liquidity declined, reaching more than 6800 billion dong of transaction value. Foreign investors remained net sellers during the session with the value of nearly 195 billion dong. In which, the net selling force focused on HPG, VCB, VHM on HOSE. SHS, BVS were the stocks that were sold the most on the HNX.

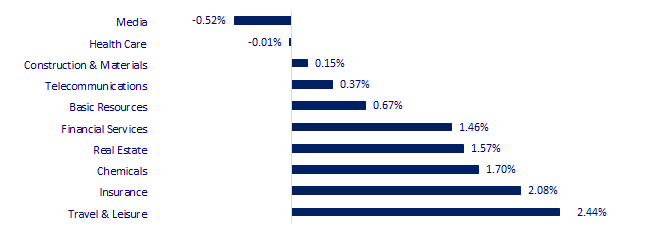

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

SELECTED NEWS

- VN-Index was the strongest stock index in the world in August with an increase of 10.43%

- Bank profits may drop 22% in the second half of the year, when credit growth is estimated to be less than 9% in 2020.

- 620 real estate companies go bankrupt in the first 8 months of 2020

- Beijing Pushes Its Big Banks to Weakest Health in a Decade

- Ant’s Mega IPO Sets Up Jack Ma to Escalate War With Tencent

- White House Poised to Set Boundaries of WeChat, TikTok Crackdown

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.