Morning Brief 08/09

GLOBAL MARKET

28,133.31

1D 0.00%

YTD -1.42%

3,426.96

1D 0.00%

YTD 6.07%

11,313.13

1D 0.00%

YTD 26.09%

30.75

5,937.40

1D 2.39%

YTD -21.28%

13,100.28

1D 2.01%

YTD -1.12%

5,053.72

1D 1.79%

YTD -15.46%

23,089.95

1D -0.50%

YTD -2.40%

3,292.59

1D -1.87%

YTD 6.77%

2,384.22

1D 0.67%

YTD 8.49%

24,589.65

1D -0.43%

YTD -13.57%

2,511.21

1D 0.06%

YTD -22.08%

1,311.95

1D 0.00%

YTD -17.89%

39.22

1D 1.27%

YTD -35.44%

1,937.10

1D -0.22%

YTD 27.63%

The Europe Stoxx 600 rose Monday with broad gains led by automakers. Oil extended its retreat below $40 a barrel as a price cut by Saudi Arabia signaled fuel consumption is wavering in key markets. Futures on the S&P 500 Index turned higher. The dollar gained while Treasury yields were little changed. Asian stocks looked set for modest gains Tuesday after European shares climbed despite the tech-led downdraft in the U.S. The pound steadied after sinking on concern the U.K. is inching closer to a no-deal Brexit. Investors returning Tuesday from the U.S. Labor Day holiday will need to take stock of a rally that’s fizzling as doubts grow over positioning and valuations that look extreme.

VIETNAM ECONOMY

0.16%

YTD (bps) -127

6.00%

YTD (bps) -50

1.73%

1D (bps) -5

YTD (bps) -226

2.76%

1D (bps) -14

YTD (bps) -194

23,263

1D (%) 0.00%

YTD (%) 0.14%

28,074

1D (%) -0.29%

YTD (%) 5.54%

3,421

1D (%) 0.03%

YTD (%) 0.74%

The Ministry of Industry and Trade strives that by 2025, the added value of domestic trade will contribute about 13.5% of GDP. The Ministry of Industry and Trade predicts that the average annual growth rate of the 2021 - 2025 period of the total retail sales of consumer goods and services, without excluding the price factor, will reach between 9 - 9.5%/year.

VIETNAM STOCK MARKET

888.25

1D -1.47%

YTD -7.57%

824.36

1D -1.92%

YTD -6.22%

125.43

1D -0.57%

YTD 22.36%

58.64

1D -0.42%

YTD 3.70%

55.65

8,535.97

1D 12.32%

YTD 143.88%

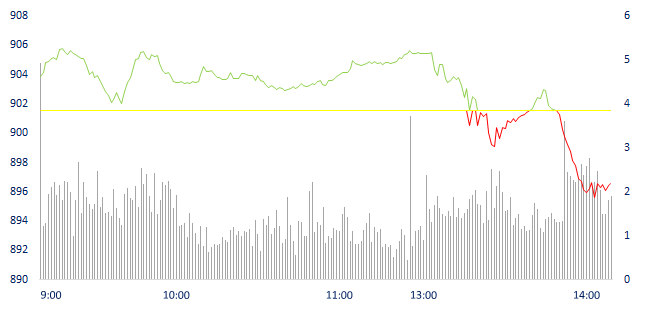

The market plunged at the end of the session, down 1.47%, down to 888.25 points. Foreign investors net bought more than 55 billion dong. Net buying focused on VFMVN Diamond ETF certificates and VNM, HPG and VRE stocks on HOSE. NTP and BVS were the top net buyers on the HNX.

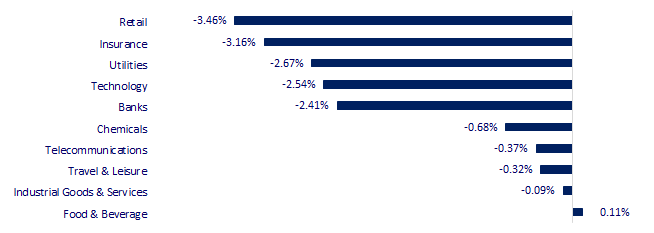

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

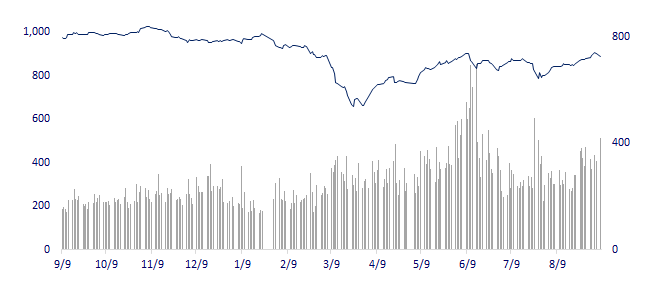

VNINDEX (12M)

SELECTED NEWS

- Short-term deposit rates plummeted to below 3%/year.

- Southeast Asia's GDP is expected to decrease by 4.2% in 2020, Vietnam continues to be the only bright spot in the region

- More than 7.2 million billion of real estate is pledged at the bank

- Trump said he intends to curb the U.S. economic relationship with China by threatening to punish any American companies that create jobs overseas.

- Taiwan Exports Surge to Record Amid Huawei Scramble for Chips

- Korea agreed to launch a fourth additional budget package worth nearly 6 billion USD to finance those severely affected by the COVID-19 epidemic.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.