Morning Brief 22/09

GLOBAL MARKET

27,147.70

1D -1.84%

YTD -4.87%

3,281.06

1D -1.16%

YTD 1.56%

10,778.80

1D -0.13%

YTD 20.13%

27.78

5,804.29

1D -3.38%

YTD -23.04%

12,542.44

1D -4.37%

YTD -5.33%

4,792.04

1D -3.74%

YTD -19.84%

23,360.30

1D 0.00%

YTD -1.25%

3,316.94

1D -0.63%

YTD 7.56%

2,389.39

1D -0.95%

YTD 8.72%

23,950.69

1D -2.06%

YTD -15.82%

2,485.71

1D -0.48%

YTD -22.88%

1,275.16

1D -1.03%

YTD -20.19%

39.97

1D -2.63%

YTD -34.21%

1,924.60

1D -1.59%

YTD 26.81%

Stocks pared losses as a rebound in some tech giants tempered concern over cloudy prospects for economic stimulus and a report about suspicious transactions at global banks. Bonds and the dollar rose. After approaching the threshold that many investors consider to be a market correction, the S&P 500 came off session lows as the Nasdaq 100 climbed. Commodity and industrial shares still led the benchmark gauge to its lowest in almost two months. JPMorgan Chase & Co., Bank of America Corp. and Citigroup Inc. slumped more than 2%. Carnival Corp. and American Airlines Group Inc. paced losses in travel companies on worries that an increase in coronavirus cases could prompt further lockdown measures. Asian stocks are set to open weaker on Tuesday.

VIETNAM ECONOMY

0.11%

YTD (bps) -132

6.00%

YTD (bps) -50

1.52%

1D (bps) -4

YTD (bps) -247

2.48%

1D (bps) -9

YTD (bps) -222

23,274

1D (%) 0.02%

YTD (%) 0.19%

27,933

1D (%) -0.76%

YTD (%) 5.01%

3,455

1D (%) -0.26%

YTD (%) 1.74%

Second economic stimulus package: Prioritize pervasive enterprises. The second support package for businesses and employees with a cost of about 18,600 billion.

VIETNAM STOCK MARKET

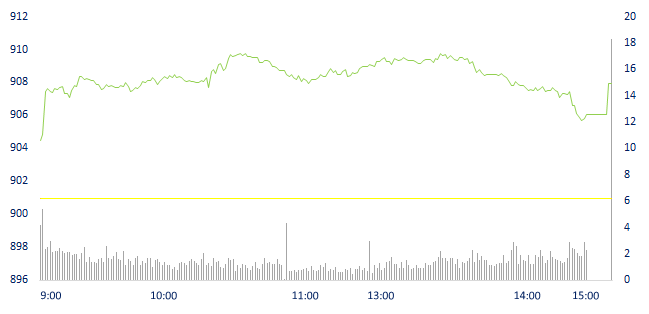

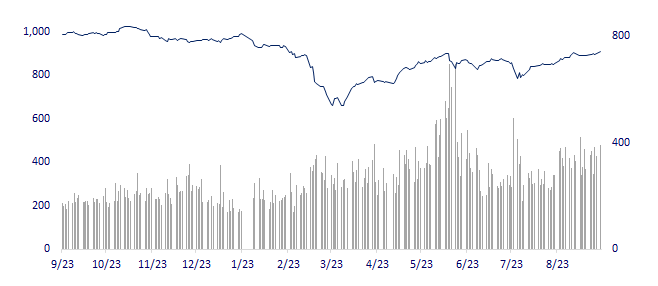

907.94

1D 0.78%

YTD -5.52%

851.54

1D 1.22%

YTD -3.13%

130.58

1D 1.07%

YTD 27.38%

60.74

1D 0.25%

YTD 7.41%

96.86

9,368.97

1D 23.61%

YTD 167.68%

Foreign investors net bought more than 99 billion dong on HOSE and net sold more than 3 billion dong on HNX. The net buying force concentrated on PLX, VNM and VRE stocks on HOSE. NTP and PVS were sold the most on HNX. VN-Index ended up 0.78%, reaching 907.94 points; The HNX-Index increased 1.07%, reaching 130.58 points.

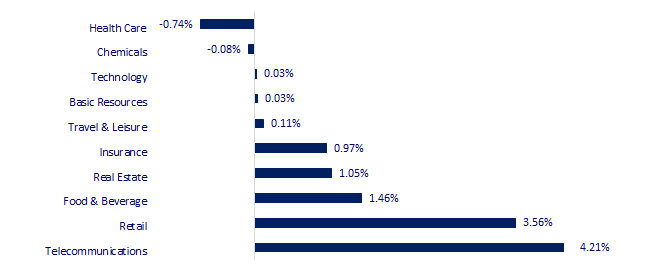

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

SELECTED NEWS

- Negative interest rate difference on interbank rate. USD interest rate remained higher than VND interbank interest rate of the same period on 2 weeks.

- Vietnam surpassed Brazil to become the top supplier of coffee to Japan.

- By the end of September 15, Vietnam's trade balance had a surplus of 14.46 billion USD.

- Federal Reserve Chair Jerome Powell said the U.S. economy is improving but has a long way to go before fully recovering from the coronavirus pandemic.

- Remittance Boom Is Turning Into a Bust for Asia Emerging Markets, defying pandemic expectations and propping up home economies at a critical time.

- Christine Lagarde said the ECB has room to add stimulus and can adapt its already expansive toolkit if the economy needs more help.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.