Morning Brief 02/10

GLOBAL MARKET

27,816.90

1D 0.13%

YTD -2.53%

3,380.80

1D 0.53%

YTD 4.64%

11,326.51

1D 1.42%

YTD 26.23%

26.70

5,879.45

1D 0.23%

YTD -22.05%

12,730.77

1D -0.23%

YTD -3.91%

4,824.04

1D 0.43%

YTD -19.30%

23,184.93

1D 0.00%

YTD -1.99%

3,218.05

1D 0.00%

YTD 4.35%

2,327.89

1D 0.00%

YTD 5.93%

23,459.05

1D 0.00%

YTD -17.55%

2,500.74

1D 1.38%

YTD -22.41%

1,243.72

1D 0.54%

YTD -22.16%

38.48

1D -3.80%

YTD -36.66%

1,910.10

1D 0.90%

YTD 25.85%

U.S. stocks advanced, led by gains in the biggest technology companies, as investors weighed the chances Democratic lawmakers and the White House will reach a deal for a fiscal-stimulus package. Oil tumbled on concern the market may be oversupplied. The Nasdaq 100 reached the highest in almost a month as Amazon.com, Microsoft and Tesla rose. The S&P 500 Index’s advance was limited by declines in energy producers. Trading was volatile, with stocks pushed around by the latest developments in efforts to forge a stimulus bill acceptable to Democrats and Republicans. Talks were set to continue Thursday as officials sought a breakthrough. Investors are expecting trading on the Tokyo Stock Exchange to resume after Thursday’s outage, while markets in China and Hong Kong remain shut for a holiday.

VIETNAM ECONOMY

0.13%

1D (bps) 2

YTD (bps) -130

6.00%

YTD (bps) -50

1.63%

1D (bps) 23

YTD (bps) -236

2.61%

1D (bps) -8

YTD (bps) -209

23,283

1D (%) 0.05%

YTD (%) 0.23%

27,941

1D (%) 0.38%

YTD (%) 5.04%

3,450

1D (%) 0.29%

YTD (%) 1.59%

IHS Markit has just released a report showing that Vietnam's September Purchasing Managers' Index (PMI) rose 6.5 points from the previous month and reached 52.2 points, the best level since the beginning of the year. In general, production, number of new orders and employment rate have increased significantly. This is due to the fact that the Covid-19 translation has been basically controlled, helping to improve business prospects.

VIETNAM STOCK MARKET

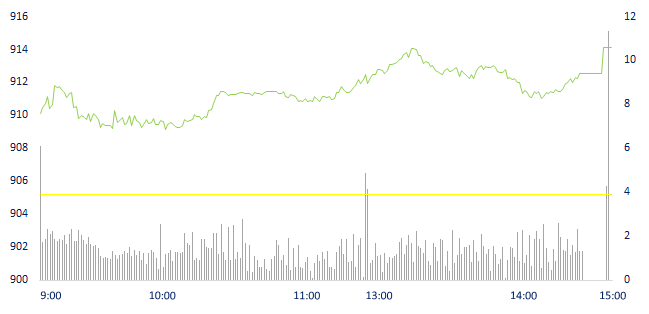

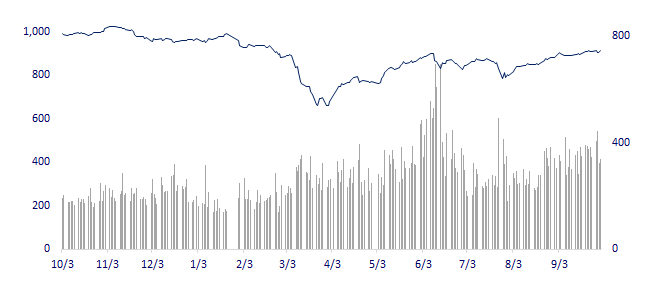

914.09

1D 0.98%

YTD -4.88%

867.58

1D 1.05%

YTD -1.31%

133.50

1D 0.43%

YTD 30.23%

62.42

1D 1.12%

YTD 10.38%

-278.39

8,025.34

1D 7.55%

YTD 129.30%

Foreign investors net sold more than 278 billion dong. The net buying force concentrated on HPG, VNM and VJC shares on HOSE. DXP and VCS were the most net sold stocks on the HNX. The VN-Index ended with an increase of nearly 1%, reaching 914.09 points; The HNX-Index rose 0.43%, reaching 133.50 points.

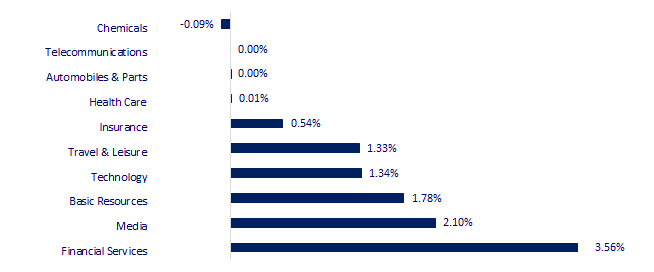

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

SELECTED NEWS

- HSBC: It is expected that Vietnam's GDP growth will reach 2.6% in 2020 and 8.1% in 2021

- Long Thanh Airport: Handing over the ground stage 1 on October 20

- Singapore said that from October 8, 2020, Singapore will continue to remove border restrictions on visitors from Vietnam and Australia (except Victoria).

- The China Manufacturing Purchasing Managers' Index (PMI) rose to 51.5 points in September, the Chinese economy continued to recover strongly.

- The final round of Brexit is set to end on Friday with the two sides making limited progress, setting up a frantic few weeks of last-ditch negotiations.

- The Exchange outage is the last thing local authorities need at a time when Japan is seeking to reinvent the capital as a global financial hub.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.