Market Brief 25/02/2021

VIETNAM STOCK MARKET

1,165.43

1D 0.29%

YTD 6.00%

1,169.82

1D 0.23%

YTD 10.53%

246.20

1D 3.49%

YTD 24.91%

76.48

1D 0.34%

YTD 3.59%

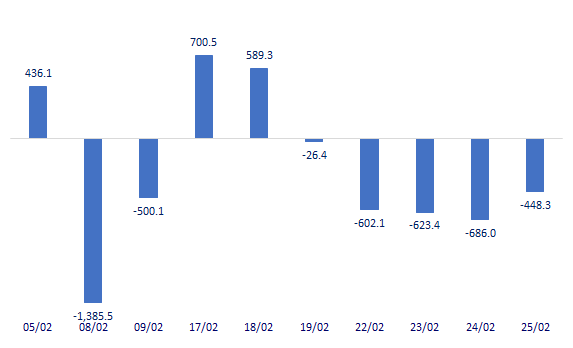

-448.33

1D 0.00%

YTD 0.00%

15,838.32

1D -14.12%

YTD -7.67%

- Foreign investors continued to net sell 448 billion dong on all 3 exchanges, their selling focused on VNM, PLX, KDH ... Generally in the last 4 sessions, foreign investors net sold about 2,500 billion dong on the whole market.

ETF & DERIVATIVES

19,720

1D 0.87%

YTD 4.89%

13,500

1D -1.60%

YTD 7.74%

14,500

1D 0.00%

YTD 8.78%

16,900

1D 0.00%

YTD 6.96%

15,310

1D -1.23%

YTD 12.16%

19,510

1D 0.05%

YTD 13.43%

15,100

1D -1.31%

YTD 8.24%

1,185

1D 1.10%

YTD 0.00%

1,184

1D 0.77%

YTD 0.00%

1,190

1D 1.67%

YTD 0.00%

1,182

1D 1.72%

YTD 0.00%

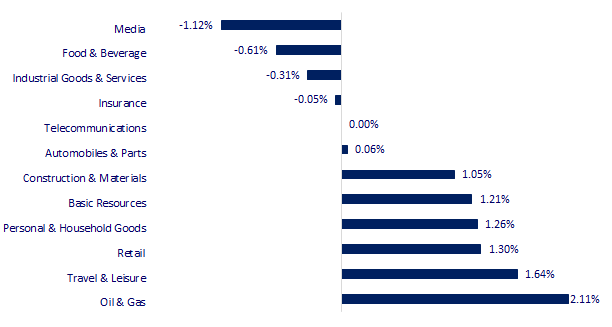

CHANGE IN PRICE BY SECTOR

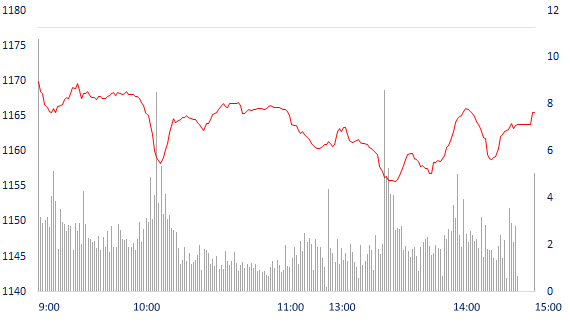

INTRADAY VNINDEX

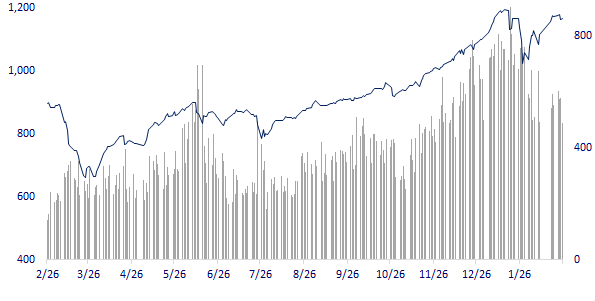

VNINDEX (12M)

GLOBAL MARKET

26,537.31

1D 0.91%

YTD 12.18%

3,369.73

1D 0.22%

YTD 9.27%

2,625.91

1D 0.94%

YTD 19.49%

26,819.45

1D 0.56%

YTD -5.74%

2,857.48

1D -0.42%

YTD -11.34%

1,433.56

1D 1.26%

YTD -10.28%

45.05

1D -1.81%

YTD -25.84%

1,809.60

1D 0.10%

YTD 19.23%

- Asian stocks rose after the peak session of Wall Street. The MSCI Asia-Pacific Index, excluding Japan, rose 0.94%. In Japan, the Nikkei 225 increased by 1.61% with Softbank Group shares up more than 4%. Topix increased 1.41%. China market went up with Shanghai Composite up 0.6%, Shenzhen Component up 0.486%. Hong Kong's Hang Seng rose 0.62%, while South Korea's Kospi Index rose 2.06%.

VIETNAM ECONOMY

0.10%

YTD (bps) -133

5.80%

YTD (bps) -70

1.35%

1D (bps) -3

YTD (bps) -264

2.21%

1D (bps) -5

YTD (bps) -249

23,256

1D (%) 0.00%

YTD (%) 0.11%

28,298

1D (%) -0.09%

YTD (%) 6.38%

3,557

1D (%) 0.06%

YTD (%) 4.74%

- With the deposit interest rate continuing to decrease, the expected interest rate will also decrease to support businesses to revive production and business activities in 2021 …

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- USD 5.46 billion of FDI into Vietnam in the first 2 months of the year, Japan surpassed Singapore to lead

- 2021 - Consumer credit is difficult to accelerate

- Nikkei Asia: 'Vietnam's growth will continue to lead Southeast Asia'

- Europe is increasingly cold with China

- Yields skyrocketed to the highest level in many years, global bond investors wobbled over unprecedented stimulus packages.

- Mr. Biden signed a decree to save the US semiconductor industry "

VN30

BANK

98,200

1D 0.10%

5D -3.73%

Buy Vol. 1,642,300

Sell Vol. 1,652,300

42,950

1D -0.23%

5D -1.04%

Buy Vol. 3,946,000

Sell Vol. 3,118,400

37,300

1D -0.53%

5D 1.36%

Buy Vol. 16,525,500

Sell Vol. 19,939,500

39,100

1D 0.00%

5D 0.51%

Buy Vol. 32,698,300

Sell Vol. 29,730,000

39,600

1D -0.25%

5D -4.12%

Buy Vol. 14,346,800

Sell Vol. 12,969,000

27,300

1D 1.11%

5D 4.20%

Buy Vol. 37,172,600

Sell Vol. 33,691,600

25,500

1D 0.20%

5D 0.00%

Buy Vol. 9,991,300

Sell Vol. 10,215,000

27,350

1D -0.18%

5D -1.80%

Buy Vol. 3,425,600

Sell Vol. 3,927,900

18,500

1D 0.82%

5D -0.54%

Buy Vol. 41,755,900

Sell Vol. 42,593,700

- VCB: At the next shareholder meeting, Vietcombank's shareholders will consider and approve the report, the plan to set up the fund in 2020 and the plan to increase charter capital in the period of 2021 - 2022.

REAL ESTATE

80,000

1D -0.50%

5D -1.84%

Buy Vol. 2,488,100

Sell Vol. 3,391,100

22,050

1D -0.90%

5D -6.17%

Buy Vol. 13,181,300

Sell Vol. 13,034,300

32,400

1D -1.52%

5D -5.54%

Buy Vol. 3,287,900

Sell Vol. 3,295,100

62,200

1D -1.43%

5D -4.45%

Buy Vol. 3,995,900

Sell Vol. 3,890,200

-

OIL & GAS

89,200

1D 1.25%

5D -1.00%

Buy Vol. 2,241,500

Sell Vol. 2,040,400

12,700

1D 0.40%

5D -2.68%

Buy Vol. 15,524,300

Sell Vol. 18,781,600

58,400

1D 1.92%

5D 4.10%

Buy Vol. 4,892,700

Sell Vol. 4,313,800

- POW: announced 2 months of 2021 business index with total power output of plants reaching 2,809.8 million kWh, total revenue is estimated at 4,676.7 billion dong

VINGROUP

108,900

1D 0.65%

5D -1.00%

Buy Vol. 1,772,800

Sell Vol. 2,096,600

102,800

1D 0.00%

5D -0.39%

Buy Vol. 4,886,700

Sell Vol. 4,071,600

33,750

1D 0.15%

5D -3.16%

Buy Vol. 7,550,000

Sell Vol. 8,090,700

- VHM and VIC were both bought in by foreign investors for the 5th consecutive net selling session of foreign investors with a value of 31 billion and 15 billion dong respectively.

FOOD & BEVERAGE

104,600

1D -1.13%

5D -4.04%

Buy Vol. 7,838,400

Sell Vol. 7,354,600

59,600

1D -0.17%

5D -3.72%

Buy Vol. 1,379,400

Sell Vol. 1,380,300

89,600

1D -1.54%

5D -5.78%

Buy Vol. 3,220,800

Sell Vol. 2,520,100

21,950

1D -1.79%

5D -6.00%

Buy Vol. 4,847,300

Sell Vol. 4,907,100

OTHERS

135,000

1D 2.35%

5D 2.43%

Buy Vol. 1,193,100

Sell Vol. 1,091,900

76,200

1D 1.06%

5D -2.56%

Buy Vol. 3,826,300

Sell Vol. 3,524,000

135,700

1D 1.42%

5D -2.72%

Buy Vol. 1,455,200

Sell Vol. 1,066,700

84,000

1D 1.45%

5D -4.00%

Buy Vol. 839,600

Sell Vol. 803,000

56,400

1D -1.05%

5D -5.37%

Buy Vol. 1,485,900

Sell Vol. 1,334,900

33,450

1D 0.00%

5D 0.45%

Buy Vol. 21,745,700

Sell Vol. 24,313,500

44,150

1D 1.26%

5D 0.68%

Buy Vol. 41,810,000

Sell Vol. 45,075,500

- PNJ: PNJ's gold bar sales increased by nearly 79% in the month near the Lunar New Year. In January, PNJ recorded net revenue of VND 2,170 billion, an increase of 30.2% and profit after tax of VND 168 billion, an increase of 2.5% compared to the same period last year, mainly thanks to the growth of sales. odd and gold bars.

Market by numbers

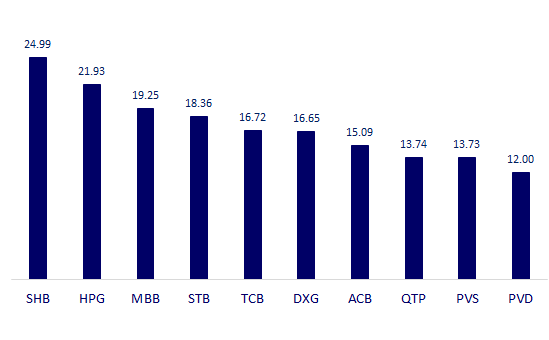

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

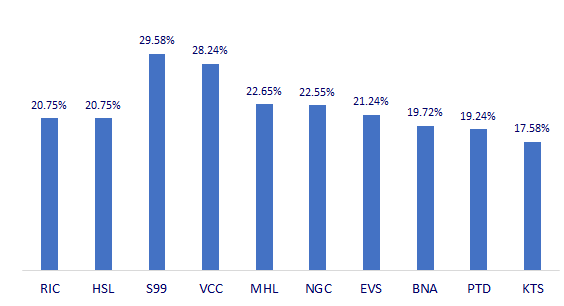

TOP INCREASES 3 CONSECUTIVE SESSIONS

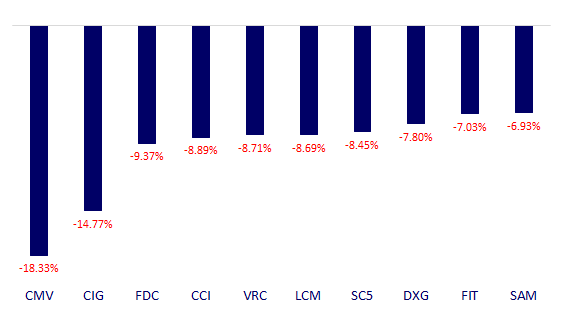

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.