Market Brief 10/03/2021

VIETNAM STOCK MARKET

1,170.08

1D 0.70%

YTD 6.42%

1,172.26

1D 0.80%

YTD 10.76%

267.10

1D 0.86%

YTD 35.51%

80.24

1D 0.88%

YTD 8.68%

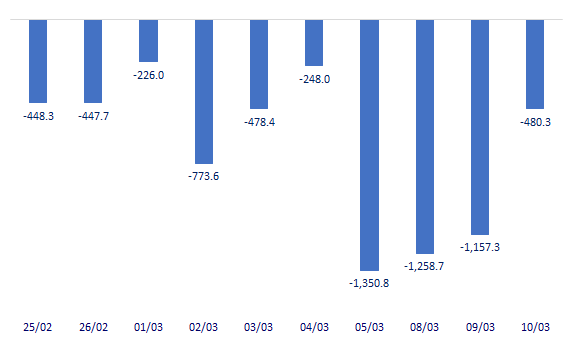

-480.27

1D 0.00%

YTD 0.00%

21,195.60

1D 14.29%

YTD 23.57%

- On HOSE, foreign investors had the 14th net selling session, with the value dropping 58% compared to the previous session and at 474 billion dong, equivalent to the net selling volume of 12.4 million shares. In total in the past 14 sessions, foreign capital flows on this exchange were net sellers of up to 8,700 billion dong

ETF & DERIVATIVES

19,720

1D 0.36%

YTD 4.89%

14,000

1D 2.64%

YTD 11.73%

14,650

1D 0.76%

YTD 9.90%

16,900

1D 0.60%

YTD 6.96%

15,520

1D 0.52%

YTD 13.70%

19,490

1D 0.15%

YTD 13.31%

15,080

1D 0.60%

YTD 8.10%

1,185

1D 1.67%

YTD 0.00%

1,183

1D 1.62%

YTD 0.00%

1,183

1D 1.61%

YTD 0.00%

1,179

1D 1.76%

YTD 0.00%

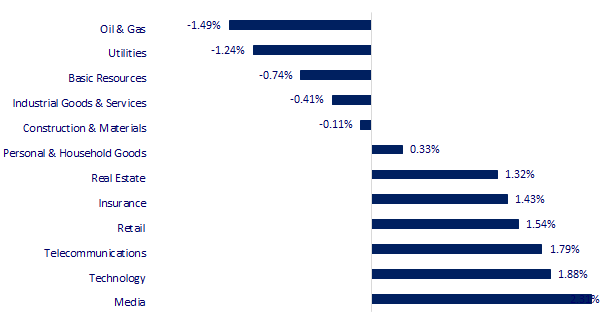

CHANGE IN PRICE BY SECTOR

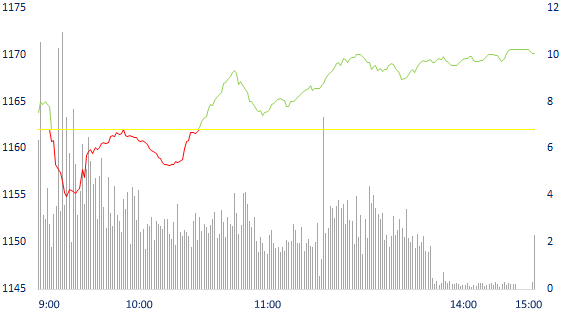

INTRADAY VNINDEX

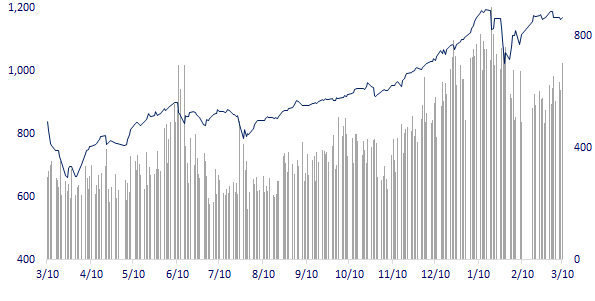

VNINDEX (12M)

GLOBAL MARKET

29,036.56

1D -0.02%

YTD 5.80%

3,357.74

1D -0.05%

YTD -1.66%

2,958.12

1D -0.60%

YTD 2.95%

28,907.52

1D 0.47%

YTD 6.48%

3,079.72

1D -0.93%

YTD 7.34%

1,573.05

1D 1.45%

YTD 8.53%

64.21

1D -0.12%

YTD 32.94%

1,708.35

1D -0.30%

YTD -10.26%

- Investors return with risky assets, mixed Asian stocks. The MSCI Asia-Pacific Index excluding Japan increased by 0.39%. In Japan, Nikkei 225 decreased by 0.02%. China was mixed with Shanghai Composite down 0.05%. Hong Kong's Hang Seng increased by 0.47%. South Korea's Kospi and Kosdaq reversed at the close, losing 0.6% and 0.7%, respectively.

VIETNAM ECONOMY

0.29%

YTD (bps) 16

5.80%

1.20%

1D (bps) -15

YTD (bps) -2

2.28%

1D (bps) 9

YTD (bps) 25

23,153

1D (%) 0.01%

YTD (%) -0.11%

28,145

1D (%) 0.06%

YTD (%) -3.29%

3,612

1D (%) -0.03%

YTD (%) 1.09%

- In the 2021 - 2025 period, Hanoi will spend about 200,000 billion VND on public investment projects, double in the 2016-2020 period, of which transport infrastructure accounts for 60-70%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Hanoi spends 200,000 billion in public investment, doing a series of key transport projects in the next 5 years

- Investment of 260 billion VND to develop organic agriculture

- Expand the industrial park as the past time shows that many provinces and cities have being "hold" and then abandoned

- Financial Times: Considered "gambling-minded" but amateur retail investors are really reshaping the stock market.

- The power of Covid-19 vaccine manufacturers when countries scramble to place orders and raise prices.

- President Joe Biden will attend an online meeting on March 12 with the leaders of Japan, India and Australia from the Quad group.

VN30

BANK

95,500

1D 0.53%

5D -2.95%

Buy Vol. 2,599,400

Sell Vol. 1,690,600

42,000

1D 0.36%

5D -4.11%

Buy Vol. 3,743,400

Sell Vol. 3,176,200

37,550

1D 0.94%

5D -2.72%

Buy Vol. 13,474,800

Sell Vol. 14,356,900

39,300

1D 0.90%

5D -2.60%

Buy Vol. 17,501,000

Sell Vol. 18,570,000

42,000

1D 0.48%

5D 0.96%

Buy Vol. 6,030,900

Sell Vol. 7,648,100

27,950

1D 2.38%

5D -0.18%

Buy Vol. 36,901,800

Sell Vol. 37,532,600

26,100

1D 0.58%

5D -3.15%

Buy Vol. 6,201,500

Sell Vol. 6,350,200

28,450

1D 0.18%

5D -4.37%

Buy Vol. 5,743,100

Sell Vol. 6,228,000

18,700

1D 0.81%

5D -1.58%

Buy Vol. 46,139,600

Sell Vol. 42,660,200

- MBB was net bought by foreign investors for 58 billion dong in today's session. On the other side, CTG and BID were net sold at 85 billion and 47 billion dong, respectively. - TCB: Decision of the Board of Directors to change the name of Phan Dinh Phung Transaction Office to Central Park Transaction Office

REAL ESTATE

82,500

1D 0.61%

5D 1.35%

Buy Vol. 4,920,900

Sell Vol. 4,048,300

22,700

1D 1.57%

5D -0.22%

Buy Vol. 7,627,100

Sell Vol. 10,230,800

31,700

1D 2.92%

5D -3.35%

Buy Vol. 3,634,900

Sell Vol. 2,907,900

64,300

1D 0.94%

5D 0.00%

Buy Vol. 5,018,900

Sell Vol. 4,701,000

- NVL: NVL's profit after tax in 2020 will increase by 15.3% compared to the same period in 2019. Mainly due to capital transfer interest from subsidiaries and investment revaluation

OIL & GAS

92,000

1D -1.81%

5D 1.10%

Buy Vol. 1,571,900

Sell Vol. 1,508,200

13,650

1D 0.37%

5D 6.23%

Buy Vol. 42,143,900

Sell Vol. 44,361,000

55,800

1D -1.41%

5D -4.62%

Buy Vol. 6,008,900

Sell Vol. 6,340,900

- Gas price today (March 10) decreased by 0.22% to $2.64/mmBTU for natural gas contract delivered in April 2021 at 9:30 (GMT).

VINGROUP

106,000

1D 1.63%

5D -0.84%

Buy Vol. 1,721,400

Sell Vol. 875,200

99,900

1D 1.73%

5D -1.58%

Buy Vol. 3,764,800

Sell Vol. 4,720,100

34,150

1D 0.15%

5D -3.80%

Buy Vol. 5,818,200

Sell Vol. 6,947,800

FOOD & BEVERAGE

101,100

1D 0.60%

5D -3.25%

Buy Vol. 7,453,200

Sell Vol. 5,245,000

87,000

1D 0.35%

5D -3.87%

Buy Vol. 2,327,300

Sell Vol. 1,274,200

22,600

1D 0.00%

5D -1.31%

Buy Vol. 5,271,200

Sell Vol. 7,893,100

- MSN: Masan JSC has not sold 1,000,000 registered shares due to not meeting price expectation. Time for transaction registration is from February 4, 2021 to March 5, 2021

OTHERS

135,500

1D 0.44%

5D -1.24%

Buy Vol. 960,600

Sell Vol. 941,200

135,500

1D 0.44%

5D -1.24%

Buy Vol. 960,600

Sell Vol. 941,200

76,300

1D 1.73%

5D -1.80%

Buy Vol. 4,327,700

Sell Vol. 4,521,500

130,500

1D 1.87%

5D -4.19%

Buy Vol. 1,330,000

Sell Vol. 1,198,700

83,600

1D 0.12%

5D -1.18%

Buy Vol. 474,600

Sell Vol. 672,800

54,900

1D -0.18%

5D -3.85%

Buy Vol. 1,538,400

Sell Vol. 1,510,400

33,100

1D 0.15%

5D -5.02%

Buy Vol. 20,211,300

Sell Vol. 22,576,800

45,600

1D -0.55%

5D -2.56%

Buy Vol. 28,444,900

Sell Vol. 31,592,000

- REE: sets revenue target at VND6,933.7b and NI is VND1,769b, up by 24.5% and 8.7% respectively compared to 2020. The BOD proposed not to pay dividend in 2020 and sell 1m treasury shares for employees at the price of VND10,000/share. - VJC: Please extend the time to hold the annual shareholder meeting in 2021.

Market by numbers

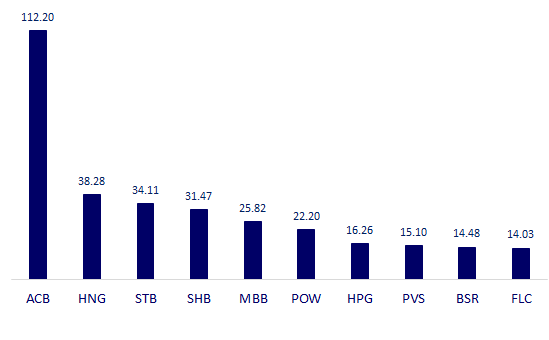

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

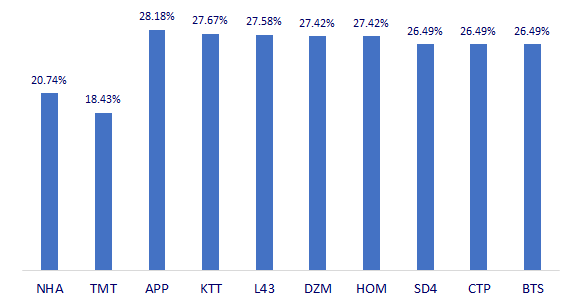

TOP INCREASES 3 CONSECUTIVE SESSIONS

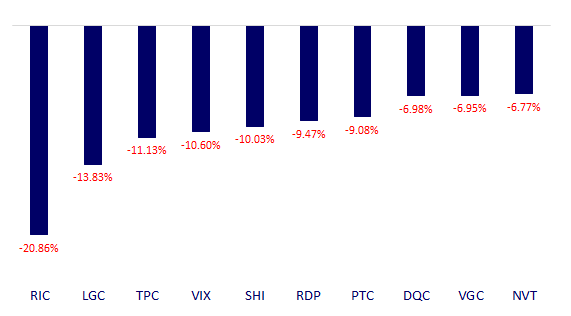

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.