Market Brief 23/03/2021

VIETNAM STOCK MARKET

1,183.45

1D -0.92%

YTD 7.64%

1,186.98

1D -0.96%

YTD 12.15%

272.34

1D -0.91%

YTD 38.17%

81.14

1D -0.17%

YTD 9.90%

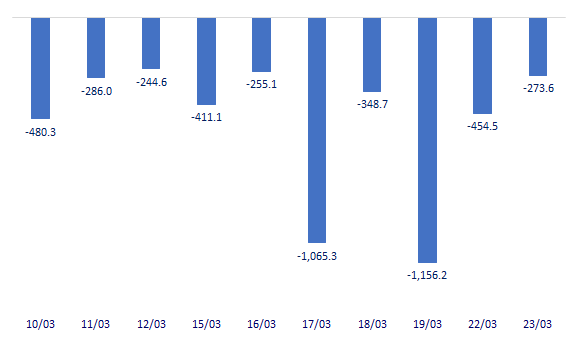

-273.64

1D 0.00%

YTD 0.00%

19,051.02

1D -1.84%

YTD 11.06%

- Foreign investors continued to be net sellers but the pressure has decreased significantly, only remaining at nearly VND 273 billion on the whole market. Selling force focused on a few "familiar" names such as VNM (-187.5 billion), CTG (-76.6 billion), VCB (-31.8 billion) ...

ETF & DERIVATIVES

19,950

1D -1.34%

YTD 6.12%

13,940

1D -1.34%

YTD 11.25%

14,850

1D -1.00%

YTD 11.40%

17,600

1D 0.00%

YTD 11.39%

15,990

1D -1.66%

YTD 17.14%

20,120

1D -0.98%

YTD 16.98%

15,430

1D -0.90%

YTD 10.61%

0

1D -100.00%

YTD 0.00%

1,186

1D -0.61%

YTD 0.00%

1,186

1D -0.55%

YTD 0.00%

1,185

1D -0.66%

YTD 0.00%

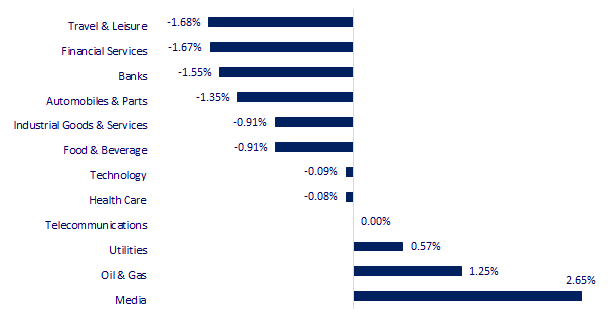

CHANGE IN PRICE BY SECTOR

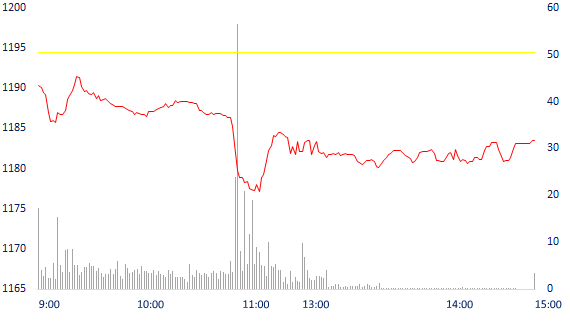

INTRADAY VNINDEX

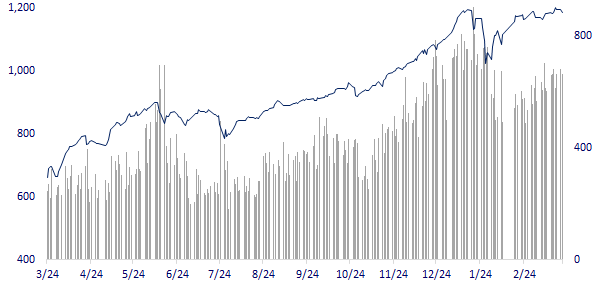

VNINDEX (12M)

GLOBAL MARKET

28,995.92

1D -1.31%

YTD 5.65%

3,411.51

1D -0.93%

YTD -0.09%

3,004.74

1D -1.01%

YTD 4.57%

28,497.38

1D -1.34%

YTD 4.97%

3,131.74

1D 0.12%

YTD 9.15%

1,564.25

1D -0.13%

YTD 7.93%

59.34

1D -3.90%

YTD 22.86%

1,738.50

1D 0.35%

YTD -8.68%

- Asian stocks fell by technology sector. In Japan, the Nikkei 225 decreased by 1.31%. The Chinese market fell from the beginning with the Shanghai Composite down 0.93% and the Shenzhen Component down 1,117%. Hong Kong's Hang Seng decreased by 1.34%.

VIETNAM ECONOMY

0.27%

1D (bps) 1

YTD (bps) 14

6.00%

1D (bps) 20

YTD (bps) 20

1.39%

1D (bps) 5

YTD (bps) 17

2.23%

1D (bps) 6

YTD (bps) 20

23,175

1D (%) 0.00%

YTD (%) -0.01%

28,152

1D (%) -0.34%

YTD (%) -3.27%

3,613

1D (%) -0.08%

YTD (%) 1.12%

- Hanoi will start the construction of technical infrastructure for 43 industrial clusters that have had a decision to establish in the period of 2018-2020, Hanoi will also focus on reviewing the planning for development of industrial clusters in the city.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Hanoi will start a series of industrial clusters

- The Prime Minister directed 55 public services to be provided soon on the National Public Service Portal

- Assign Thu Duc City to collect more than 8,300 billion VND

- Chairman Powell: The economy is far from fully recovering, the Fed will continue to support

- The US is able to launch a stimulus package worth 3,000 billion USD

- Australia may open its borders to people who have received the Covid-19 vaccine by 2022

VN30

BANK

95,800

1D -1.24%

5D 0.10%

Buy Vol. 1,767,700

Sell Vol. 1,907,000

43,700

1D -2.13%

5D 3.07%

Buy Vol. 7,296,400

Sell Vol. 7,866,700

40,500

1D -1.46%

5D 7.43%

Buy Vol. 23,262,100

Sell Vol. 27,532,500

40,450

1D -2.06%

5D 1.51%

Buy Vol. 20,609,100

Sell Vol. 21,660,400

44,500

1D -0.89%

5D 0.34%

Buy Vol. 5,940,500

Sell Vol. 5,935,300

28,350

1D -1.05%

5D -1.05%

Buy Vol. 27,052,500

Sell Vol. 26,913,600

26,500

1D -1.67%

5D -1.12%

Buy Vol. 6,241,700

Sell Vol. 7,478,500

28,300

1D -1.74%

5D -0.70%

Buy Vol. 6,775,300

Sell Vol. 8,579,000

18,800

1D -2.08%

5D -0.53%

Buy Vol. 40,208,400

Sell Vol. 46,143,400

- BID: BIDV plans to issue 207.3 million shares to pay dividends in 2019 (equivalent to 5.2%), issue 281.5 million shares to pay dividends in 2020 (equivalent to 7 %). Expected time to pay stock dividend is in the third and fourth quarters. In early 2021, BIDV also spent more than 3,200 billion dong to pay dividend in cash, at the rate of 8%.

REAL ESTATE

80,000

1D -0.99%

5D -1.11%

Buy Vol. 3,959,300

Sell Vol. 4,681,300

22,650

1D -2.37%

5D -4.03%

Buy Vol. 7,211,900

Sell Vol. 8,953,700

31,400

1D -1.88%

5D 0.48%

Buy Vol. 2,325,700

Sell Vol. 2,581,000

63,200

1D 2.99%

5D 3.61%

Buy Vol. 4,313,000

Sell Vol. 4,294,000

- NVL: Trade union of No Va registered to buy 800,000 NVL shares from March 25, 2021-23 April 2021 - KDH: Used more than 1,400 billion VND to increase the land fund in Phu Huu and An Phu Ward, Thu Duc City

OIL & GAS

91,800

1D 1.44%

5D 1.66%

Buy Vol. 1,048,500

Sell Vol. 1,087,500

13,300

1D -1.85%

5D -2.21%

Buy Vol. 22,049,900

Sell Vol. 35,305,700

57,200

1D 2.14%

5D -1.04%

Buy Vol. 3,225,600

Sell Vol. 2,909,100

- Natural gas in this morning session continued to decline due to low demand and supply concerns in the market.

VINGROUP

106,500

1D -0.75%

5D 1.04%

Buy Vol. 1,776,200

Sell Vol. 1,773,300

98,700

1D -0.60%

5D -0.80%

Buy Vol. 2,160,800

Sell Vol. 2,282,100

34,150

1D -1.30%

5D -1.87%

Buy Vol. 6,557,800

Sell Vol. 7,295,000

- VIC: Transfers the entire 5G telecommunications equipment manufacturing project to Viettel for free.

FOOD & BEVERAGE

100,200

1D -0.60%

5D -0.79%

Buy Vol. 8,102,700

Sell Vol. 6,865,300

86,500

1D -1.82%

5D -1.70%

Buy Vol. 1,965,500

Sell Vol. 1,932,300

23,300

1D -0.85%

5D -1.69%

Buy Vol. 4,571,100

Sell Vol. 8,029,000

- VNM: VNM ETF bought over 1.1 million VNM shares last week, helping to increase the proportion of VNM in the fund to 7.9%

OTHERS

131,000

1D -1.28%

5D -2.67%

Buy Vol. 566,800

Sell Vol. 555,400

131,000

1D -1.28%

5D -2.67%

Buy Vol. 566,800

Sell Vol. 555,400

78,800

1D 0.13%

5D -2.72%

Buy Vol. 3,868,900

Sell Vol. 4,594,700

131,000

1D -0.68%

5D -1.65%

Buy Vol. 1,232,400

Sell Vol. 1,014,900

84,200

1D 0.00%

5D 0.84%

Buy Vol. 380,700

Sell Vol. 593,000

55,500

1D -1.77%

5D 2.97%

Buy Vol. 753,100

Sell Vol. 1,444,200

32,900

1D -1.50%

5D 0.61%

Buy Vol. 16,556,900

Sell Vol. 17,229,100

46,600

1D -0.32%

5D 1.08%

Buy Vol. 23,327,800

Sell Vol. 26,104,600

- PNJ: According to the explanation of the consolidated financial statements in 2020, PNJ's net revenue increased by 3%, the net profit decreased by 10.44% compared to the same period in 2019. However, the net profit after tax exceeded 128.5% of the plan set at the beginning of the year.

Market by numbers

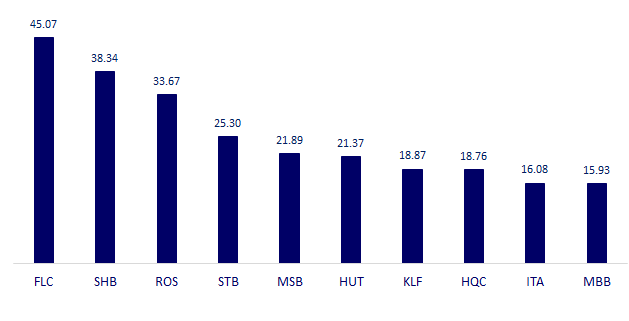

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

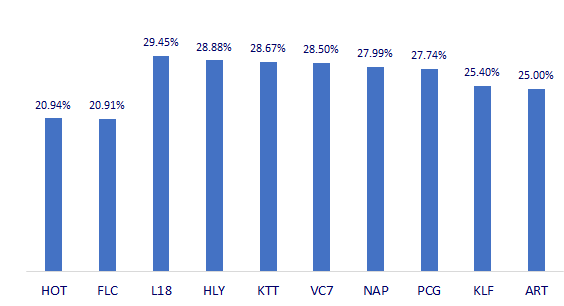

TOP INCREASES 3 CONSECUTIVE SESSIONS

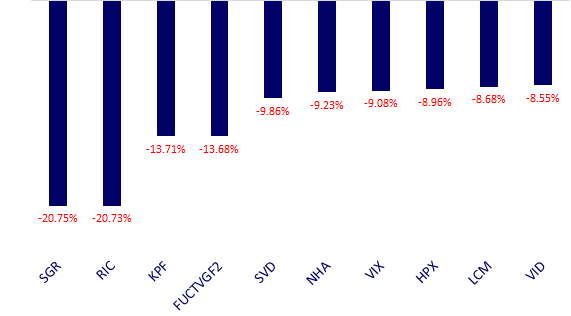

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.