Market Brief 25/03/2021

VIETNAM STOCK MARKET

1,163.10

1D 0.11%

YTD 5.79%

1,164.64

1D -0.24%

YTD 10.04%

267.19

1D -0.56%

YTD 35.56%

80.38

1D -0.15%

YTD 8.87%

271.77

1D 0.00%

YTD 0.00%

19,505.05

1D -9.45%

YTD 13.71%

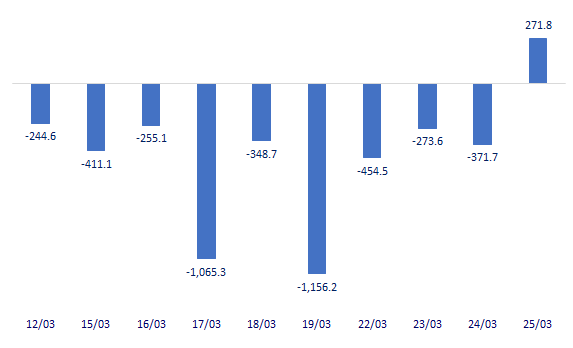

- Foreign investors returned to be net buyers on all 3 exchanges with a total value of nearly 272 billion dong, ending the chain of 24 previous consecutive net selling sessions. The buying power focused on VIC with the value of 756 billion dong and was mostly done through put-through method in the last few minutes of the session.

ETF & DERIVATIVES

19,600

1D -0.51%

YTD 4.26%

13,710

1D 0.07%

YTD 9.42%

14,580

1D 0.55%

YTD 9.38%

17,000

1D -3.95%

YTD 7.59%

15,700

1D 0.64%

YTD 15.02%

19,620

1D -0.91%

YTD 14.07%

15,130

1D 0.20%

YTD 8.46%

1,176

1D 0.08%

YTD 0.00%

1,161

1D -0.95%

YTD 0.00%

1,160

1D -0.95%

YTD 0.00%

1,162

1D -0.76%

YTD 0.00%

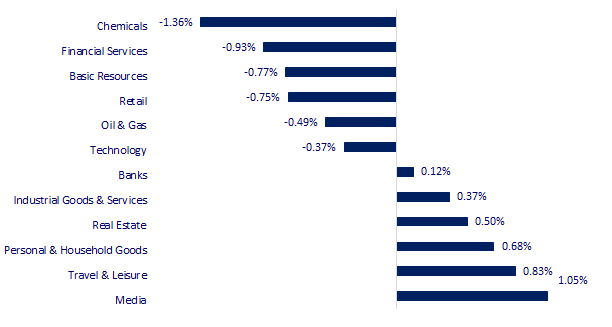

CHANGE IN PRICE BY SECTOR

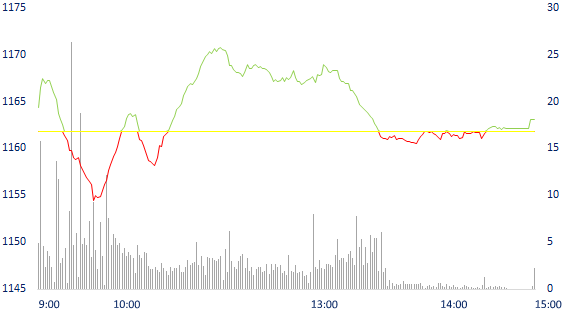

INTRADAY VNINDEX

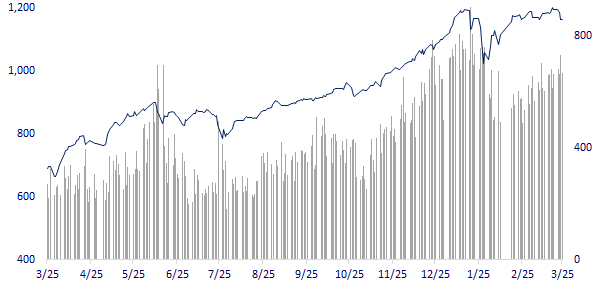

VNINDEX (12M)

GLOBAL MARKET

28,729.88

1D 0.90%

YTD 4.68%

3,363.59

1D -0.10%

YTD -1.49%

3,008.33

1D 0.40%

YTD 4.69%

27,899.61

1D -0.07%

YTD 2.77%

3,141.71

1D 0.27%

YTD 9.50%

1,571.04

1D 0.01%

YTD 8.40%

59.85

1D -0.28%

YTD 23.91%

1,729.55

1D -0.22%

YTD -9.15%

- Asian stocks are mixed after technology shares were sold off on Wall Street. In Japan, the Nikkei 225 increased by 0.9%. The Chinese market was mixed with the Shanghai Composite down 0.1% and the Shenzhen Composite up 0.13%. Hong Kong's Hang Seng decreased 0.07%. South Korea's Kospi Index rose 0.4%.

VIETNAM ECONOMY

0.26%

YTD (bps) 13

6.00%

YTD (bps) 20

1.34%

1D (bps) -1

YTD (bps) 12

2.17%

1D (bps) -1

YTD (bps) 14

23,195

1D (%) 0.06%

YTD (%) 0.07%

27,998

1D (%) 0.09%

YTD (%) -3.80%

3,603

1D (%) -0.11%

YTD (%) 0.84%

- In 2020, 10 ministries, agencies and 45 localities have proactively proposed to return foreign investment plans to the central budget. The Ministry of Planning and Investment more than 365 billion VND, the Central Party Office 52 billion VND, the Committee for Ethnic Minorities 50.25 billion VND, the Government Office 10 billion VND. and the State Capital Management Committee in enterprises 1.6 billion VND.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam becomes an Intel manufacturing base

- Hai Duong proposed to change to a new normal from 1/4

- The tourism industry welcomes international visitors from July

- Bloomberg: $60 billion in the new US stimulus package will 'flow' to China

- Chinese Foreign Minister visits the Middle East, can build anti-sanctions coalition of the West

- The plunge of Chinese stocks is a warning for the US market

VN30

BANK

95,100

1D 0.42%

5D -2.46%

Buy Vol. 1,860,900

Sell Vol. 2,066,500

42,250

1D 0.24%

5D -6.11%

Buy Vol. 4,093,300

Sell Vol. 4,522,000

39,400

1D 1.03%

5D -2.72%

Buy Vol. 30,940,400

Sell Vol. 26,363,300

39,350

1D 0.13%

5D -6.20%

Buy Vol. 20,677,000

Sell Vol. 18,528,500

43,250

1D -1.93%

5D -5.67%

Buy Vol. 3,771,400

Sell Vol. 5,211,200

27,550

1D -0.18%

5D -5.65%

Buy Vol. 25,663,600

Sell Vol. 25,201,600

25,600

1D 0.39%

5D -6.91%

Buy Vol. 7,285,900

Sell Vol. 7,638,100

26,900

1D -0.19%

5D -7.24%

Buy Vol. 9,971,000

Sell Vol. 10,952,100

18,750

1D 1.90%

5D -4.82%

Buy Vol. 49,302,000

Sell Vol. 50,243,400

- State banks this year were able to share dividends to expand their business scale after the amendment of Decree 121/2020/ND-CP. Accordingly, CTG consulted shareholders to increase its charter capital to VND48,000b through the issuance of more than 1b shares to pay dividends, equivalent to the rate of nearly 28.8%, VCB also has the ability to share stock dividends. However, banks with more than 50% state capital want to pay dividends in shares with the consent of the Government and relevant agencies.

REAL ESTATE

80,000

1D 0.25%

5D -1.48%

Buy Vol. 3,387,100

Sell Vol. 4,184,900

21,800

1D -0.46%

5D -8.40%

Buy Vol. 8,580,000

Sell Vol. 8,808,700

30,900

1D 0.00%

5D -4.04%

Buy Vol. 3,876,200

Sell Vol. 3,018,900

62,200

1D -0.80%

5D 0.62%

Buy Vol. 3,471,400

Sell Vol. 3,783,800

- TCH: HHS will submit a plan to its parent company, TCH, to increase its ownership from over 45.67% to 52.95% through buying 20 million shares of HHS by matching orders on HOSE.

OIL & GAS

90,300

1D 0.22%

5D -1.63%

Buy Vol. 1,159,900

Sell Vol. 2,487,700

12,600

1D -1.18%

5D -9.03%

Buy Vol. 23,980,700

Sell Vol. 30,089,200

56,200

1D -0.18%

5D -2.60%

Buy Vol. 1,708,600

Sell Vol. 2,132,400

- PLX: On March 22, ENEOS Corporation completed the acquisition of 25 million PLX shares, increasing its ownership of PLX from 1% to 2.94%.

VINGROUP

110,400

1D 2.32%

5D 3.56%

Buy Vol. 6,539,400

Sell Vol. 6,457,700

96,700

1D -0.51%

5D -3.01%

Buy Vol. 3,667,900

Sell Vol. 4,363,600

32,850

1D -1.65%

5D -6.14%

Buy Vol. 8,821,600

Sell Vol. 9,393,900

- VIC: On March 24, 2021, VinFast officially announced to accept the order of the first electric car model VF e34 with the price of VND 690 million.

FOOD & BEVERAGE

98,500

1D -0.20%

5D -3.90%

Buy Vol. 5,435,700

Sell Vol. 5,734,500

86,000

1D 1.06%

5D -4.12%

Buy Vol. 2,221,100

Sell Vol. 1,850,800

22,150

1D -2.42%

5D -5.74%

Buy Vol. 6,601,400

Sell Vol. 9,110,400

- VNM: Platinum Victory Pte Ltd and F&N Dairy Investments Pte Ltd continuously registered to buy nearly 21m units from the beginning of 2021 up to now. But no stock was traded.

OTHERS

128,100

1D 0.08%

5D -5.04%

Buy Vol. 758,000

Sell Vol. 771,000

128,100

1D 0.08%

5D -5.04%

Buy Vol. 758,000

Sell Vol. 771,000

76,600

1D -0.52%

5D -5.43%

Buy Vol. 3,828,000

Sell Vol. 4,303,200

128,800

1D -0.85%

5D -3.59%

Buy Vol. 895,000

Sell Vol. 1,017,700

85,000

1D 1.07%

5D 0.12%

Buy Vol. 674,000

Sell Vol. 1,251,300

53,400

1D -1.11%

5D -1.29%

Buy Vol. 901,000

Sell Vol. 944,700

30,800

1D -1.60%

5D -7.51%

Buy Vol. 23,642,100

Sell Vol. 27,347,200

45,000

1D -0.99%

5D -3.43%

Buy Vol. 33,519,200

Sell Vol. 37,947,600

- FPT: In 2020, IT service revenue for foreign markets will reach 12,000 billion VND, an increase of 10.6% compared to 2019 and accounting for 40% of the total revenue structure of FPT.

Market by numbers

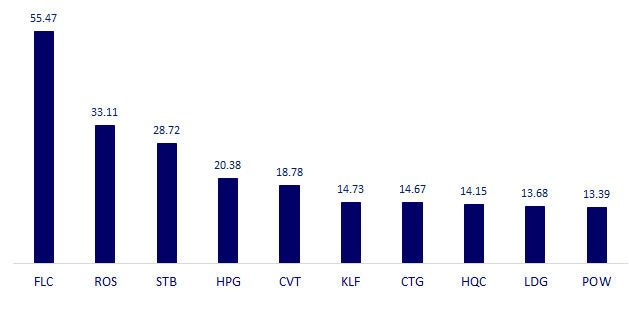

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

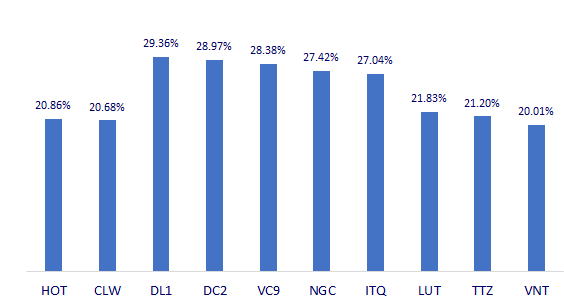

TOP INCREASES 3 CONSECUTIVE SESSIONS

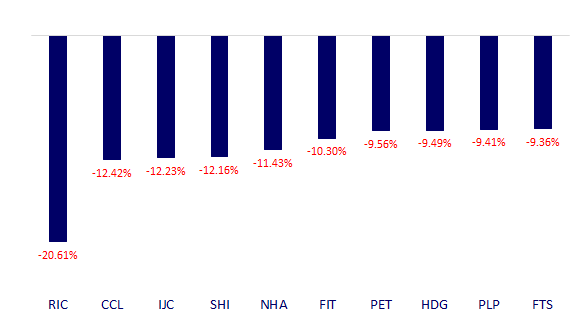

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.