Market Brief 26/03/2021

VIETNAM STOCK MARKET

1,162.21

1D -0.08%

YTD 5.70%

1,167.19

1D 0.22%

YTD 10.28%

270.96

1D 1.41%

YTD 37.47%

79.85

1D -0.66%

YTD 8.15%

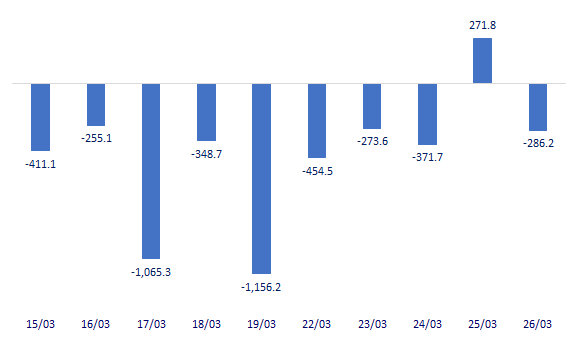

-286.20

1D 0.00%

YTD 0.00%

20,061.87

1D 2.85%

YTD 16.96%

- After net buying yesterday, foreign investors returned to their familiar net selling trend of VND 286 billion on the whole market. The selling focused on a few stocks like CTG (-176.6 billion dong), MBB (-81.6 billion dong), VIC (-62 billion dong) …

ETF & DERIVATIVES

19,650

1D 0.26%

YTD 4.52%

13,580

1D -0.95%

YTD 8.38%

14,300

1D -1.92%

YTD 7.28%

16,800

1D -1.18%

YTD 6.33%

15,450

1D -1.59%

YTD 13.19%

19,590

1D -0.15%

YTD 13.90%

15,040

1D -0.59%

YTD 7.81%

1,174

1D -0.15%

YTD 0.00%

1,175

1D 1.20%

YTD 0.00%

1,173

1D 1.07%

YTD 0.00%

1,173

1D 0.95%

YTD 0.00%

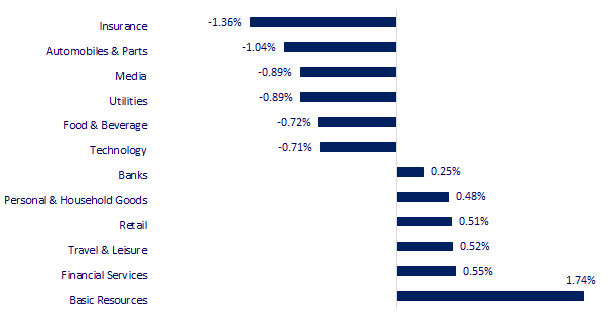

CHANGE IN PRICE BY SECTOR

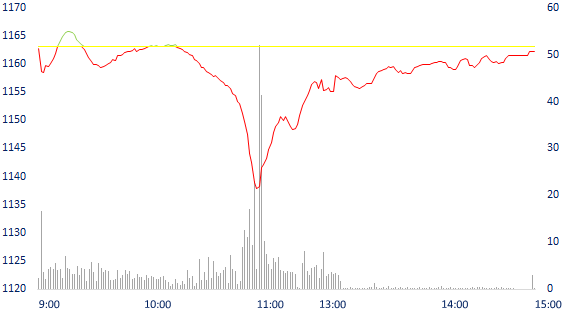

INTRADAY VNINDEX

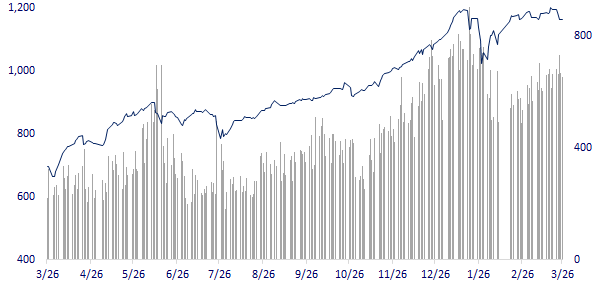

VNINDEX (12M)

GLOBAL MARKET

29,176.70

1D 0.51%

YTD 6.31%

3,418.33

1D 1.63%

YTD 0.11%

3,041.01

1D 1.09%

YTD 5.83%

28,336.43

1D 1.25%

YTD 4.38%

3,157.95

1D 0.52%

YTD 10.06%

1,574.86

1D 0.24%

YTD 8.66%

59.85

1D 1.22%

YTD 23.91%

1,726.75

1D 0.04%

YTD -9.29%

- Asian stocks rose after a Wall Street rally. In Japan, the Nikkei 225 increased by 0.51%. The Chinese market went up from the beginning with the Shanghai Composite up 1.63%, the Shenzhen Component up 2.597%. Hong Kong's Hang Seng increased by 1.25%. South Korea's Kospi Index increased by 1.09%

VIETNAM ECONOMY

0.25%

1D (bps) -1

YTD (bps) 12

6.00%

YTD (bps) 20

1.34%

YTD (bps) 12

2.16%

1D (bps) -1

YTD (bps) 13

23,182

1D (%) -0.08%

YTD (%) 0.02%

27,931

1D (%) 0.01%

YTD (%) -4.03%

3,600

1D (%) -0.03%

YTD (%) 0.76%

- The SBV will harmonize the support policy for businesses by continuing to restructure the remaining due debts and allow credit institutions to assess a realistic credit quality so that they can make provision. Risk provisions are aimed at ensuring the financial capacity as well as the safety of the national financial system in the medium and long term.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Expanding industrial park to catch FDI waves

- The domestic currency bond market of Vietnam reaches USD 71 billion

- Allowing postponement, rescheduling, debt restructuring: Amending Circular 01 is necessary

- Suez Canal crisis: up to 238 ships waiting at both ends of the canal, at least 10 days to be able to 'rescue' Ever Given

- EU warns against exporting Covid-19 vaccines in certain quantities

- Strong demand, fear of supply shortage, iron ore prices in China rose for 3 consecutive days

VN30

BANK

94,900

1D -0.21%

5D 0.74%

Buy Vol. 1,639,700

Sell Vol. 2,085,700

42,100

1D -0.36%

5D -6.44%

Buy Vol. 4,641,400

Sell Vol. 4,862,200

39,050

1D -0.89%

5D -3.46%

Buy Vol. 29,618,300

Sell Vol. 27,577,700

39,400

1D 0.13%

5D -6.19%

Buy Vol. 19,957,600

Sell Vol. 18,094,400

43,400

1D 0.35%

5D -3.98%

Buy Vol. 6,247,700

Sell Vol. 5,411,300

27,500

1D -0.18%

5D -5.82%

Buy Vol. 24,960,500

Sell Vol. 24,668,800

25,750

1D 0.59%

5D -5.16%

Buy Vol. 6,627,000

Sell Vol. 8,029,100

26,700

1D -0.74%

5D -7.61%

Buy Vol. 8,367,900

Sell Vol. 8,925,100

18,950

1D 1.07%

5D -3.32%

Buy Vol. 41,253,700

Sell Vol. 51,084,600

- CTG: In 2020, CTG's consolidated business results showed a strong growth compared to the previous years. Consolidated profit in 2020 will reach more than 13,737 billion VND, an increase of 45% compared to the previous year, mainly thanks to the increase in net interest income.

REAL ESTATE

79,500

1D -0.63%

5D 0.63%

Buy Vol. 2,785,200

Sell Vol. 3,383,400

21,600

1D -0.92%

5D -6.09%

Buy Vol. 10,806,700

Sell Vol. 9,110,300

30,000

1D -2.91%

5D -7.55%

Buy Vol. 2,162,100

Sell Vol. 2,248,600

61,500

1D -1.13%

5D -1.24%

Buy Vol. 3,321,200

Sell Vol. 3,932,300

- PDR: This year, Phat Dat started the project of the first logistics warehouse with an area of 24 hectares near Cai Mep port, Ba Ria - Vung Tau province, expected profit 2021 nearly 1,870 billion.

OIL & GAS

89,200

1D -1.22%

5D -1.87%

Buy Vol. 745,800

Sell Vol. 1,286,000

12,700

1D 0.79%

5D -5.22%

Buy Vol. 29,437,000

Sell Vol. 29,315,900

55,900

1D -0.53%

5D -0.71%

Buy Vol. 2,442,800

Sell Vol. 2,520,600

- POW: PV Power finished selling nearly 20 million PVM shares, divested from PV Machino

VINGROUP

112,400

1D 1.81%

5D 3.69%

Buy Vol. 4,222,200

Sell Vol. 4,863,100

95,700

1D -1.03%

5D -2.15%

Buy Vol. 3,274,500

Sell Vol. 3,924,900

32,200

1D -1.98%

5D -5.29%

Buy Vol. 12,151,400

Sell Vol. 11,374,000

- VHM: Vinhomes suddenly withdrew from the 1,445ha urban area project in Hai Phong.

FOOD & BEVERAGE

97,400

1D -1.12%

5D -4.23%

Buy Vol. 6,389,100

Sell Vol. 6,550,100

85,900

1D -0.12%

5D -3.16%

Buy Vol. 1,917,000

Sell Vol. 1,602,600

22,000

1D -0.68%

5D -4.35%

Buy Vol. 7,830,700

Sell Vol. 9,000,400

- VNM: VNM's management has decided to merge GTNfoods into Vilico at the ratio of 1.6: 1. GTNfoods will cancel the listing.

OTHERS

130,500

1D 1.87%

5D 0.00%

Buy Vol. 886,400

Sell Vol. 539,600

130,500

1D 1.87%

5D 0.00%

Buy Vol. 886,400

Sell Vol. 539,600

76,100

1D -0.65%

5D -4.64%

Buy Vol. 4,448,900

Sell Vol. 4,477,200

130,000

1D 0.93%

5D -2.26%

Buy Vol. 1,091,500

Sell Vol. 870,500

84,900

1D -0.12%

5D 0.35%

Buy Vol. 603,400

Sell Vol. 810,100

54,000

1D 1.12%

5D -3.91%

Buy Vol. 1,574,100

Sell Vol. 1,497,200

30,900

1D 0.32%

5D -7.21%

Buy Vol. 20,492,400

Sell Vol. 19,827,500

46,200

1D 2.67%

5D -2.01%

Buy Vol. 50,888,900

Sell Vol. 50,314,700

- HPG: HPG's Board of Directors has approved the 2021 production and business plan with a target of 120 trillion dong in revenue and 18 trillion dong in profit after tax, up 33 percent and 34 percent, respectively, compared to 2020 results. The company plans to pay a dividend of 35% for 2020 (5% in cash) and 30% for 2021

Market by numbers

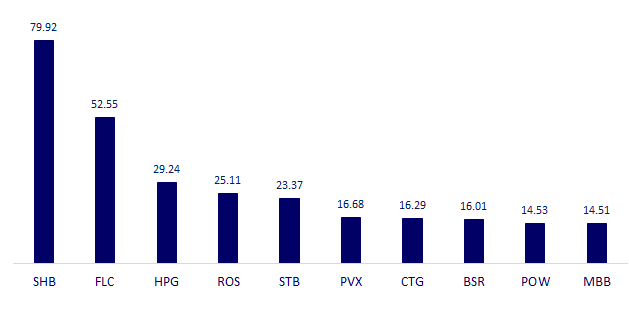

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

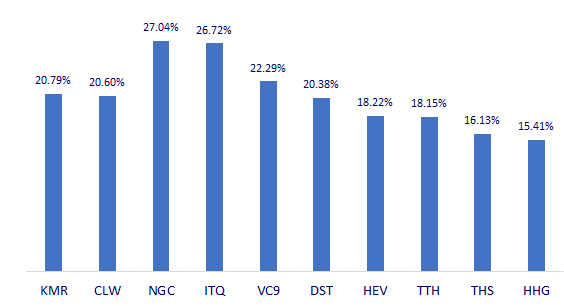

TOP INCREASES 3 CONSECUTIVE SESSIONS

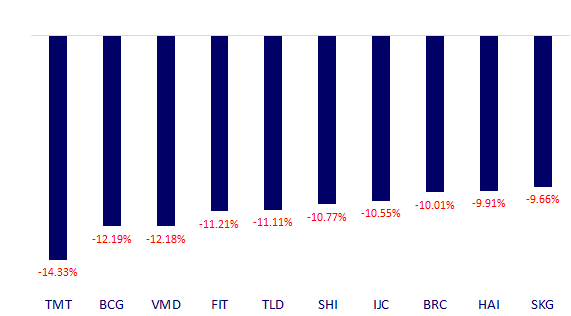

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.