Market Brief 30/03/2021

VIETNAM STOCK MARKET

1,186.36

1D 0.91%

YTD 7.90%

1,190.86

1D 0.91%

YTD 12.52%

281.14

1D 1.80%

YTD 42.64%

80.63

1D 0.14%

YTD 9.21%

-218.74

1D 0.00%

YTD 0.00%

20,549.95

1D 16.97%

YTD 19.80%

- The market increased strongly, foreign investors still net sold nearly 219 billion dong in session 30/3. The selling force focused on VCB, VHM, VRE, CTG …

ETF & DERIVATIVES

20,000

1D 0.55%

YTD 6.38%

13,950

1D 2.72%

YTD 11.33%

14,830

1D 1.71%

YTD 11.25%

17,500

1D 2.34%

YTD 10.76%

16,200

1D 2.53%

YTD 18.68%

19,810

1D -0.45%

YTD 15.17%

15,530

1D 2.31%

YTD 11.33%

1,190

1D -2.20%

YTD 0.00%

1,191

1D 0.59%

YTD 0.00%

1,192

1D 0.82%

YTD 0.00%

1,191

1D 0.69%

YTD 0.00%

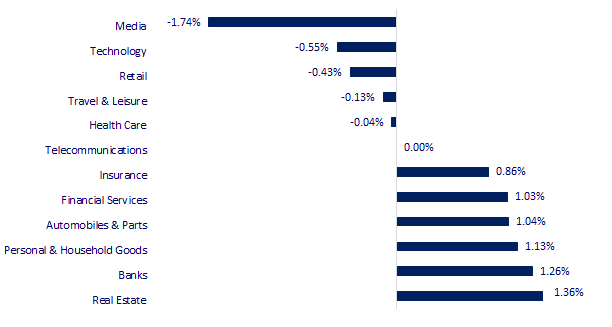

CHANGE IN PRICE BY SECTOR

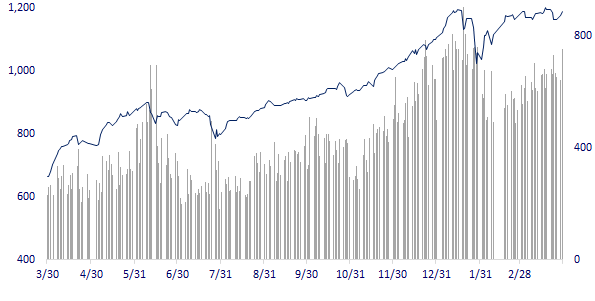

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

29,432.70

1D 0.37%

YTD 7.25%

3,456.68

1D 0.80%

YTD 1.24%

3,070.00

1D 0.67%

YTD 6.84%

28,572.37

1D 0.43%

YTD 5.25%

3,190.89

1D -0.10%

YTD 11.21%

1,589.53

1D 0.36%

YTD 9.67%

61.20

1D -0.46%

YTD 26.71%

1,696.10

1D -0.83%

YTD -10.90%

- Asian stocks mostly increased, the focus of attention is Nomura shares in Japan. In Japan, the Nikkei 225 increased by 0.37%. The Chinese market increased with the Shanghai Composite up 0.80%. Hong Kong's Hang Seng increased by 0.43%. South Korea's Kospi increased by 0.67%.

VIETNAM ECONOMY

0.37%

1D (bps) 11

YTD (bps) 24

5.60%

YTD (bps) -20

1.20%

YTD (bps) -2

2.27%

YTD (bps) 24

23,174

1D (%) 0.02%

YTD (%) -0.02%

27,797

1D (%) -0.23%

YTD (%) -4.49%

3,584

1D (%) 0.06%

YTD (%) 0.31%

- As of March 19, 2021, capital mobilization of credit institutions increased by 0.54% (it was 0.51% in the same period in 2020); credit growth of the economy is 1.47% (at the same time in 2020 it is 0.68%).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- As the VND strengthens, the Vietnamese decreas USD holding

- The FDI enterprises are optimistic about the production and business situation

- Unemployment rate continues to increase, consumption decreases

- The Suez Canal is opened, but the supply chain will remain congested for many more months

- China generates 53% of the world's total thermal power by 2020

- Thailand allows international visitors to have Covid-19 vaccinated into Phuket without quarantine

VN30

BANK

94,800

1D -0.52%

5D -1.04%

Buy Vol. 3,132,700

Sell Vol. 2,748,500

42,850

1D 0.71%

5D -1.95%

Buy Vol. 4,026,200

Sell Vol. 4,340,800

40,400

1D 1.00%

5D -0.25%

Buy Vol. 20,801,000

Sell Vol. 24,851,300

40,050

1D 1.26%

5D -0.99%

Buy Vol. 17,916,000

Sell Vol. 19,227,100

44,950

1D 1.01%

5D 1.01%

Buy Vol. 6,021,900

Sell Vol. 6,396,300

28,300

1D 0.18%

5D -0.18%

Buy Vol. 23,185,800

Sell Vol. 24,624,600

26,200

1D 0.77%

5D -1.13%

Buy Vol. 7,638,400

Sell Vol. 7,444,900

27,800

1D 1.46%

5D -1.77%

Buy Vol. 4,593,100

Sell Vol. 5,054,800

20,500

1D 6.77%

5D 9.04%

Buy Vol. 179,824,100

Sell Vol. 136,296,300

- CTG: VietinBank has just announced the 2021 Annual General Meeting, in which the most notable is the plan to want to pay dividends in both cash and shares. VietinBank continued not to give specific figures for its profit plan. - HDB: Service income increased, HDBank profit was over 5,800 billion dong after auditing

REAL ESTATE

80,700

1D 0.88%

5D 0.88%

Buy Vol. 1,986,300

Sell Vol. 2,200,100

22,800

1D 1.79%

5D 0.66%

Buy Vol. 12,587,200

Sell Vol. 9,767,300

30,400

1D 0.00%

5D -3.18%

Buy Vol. 2,235,600

Sell Vol. 2,246,300

61,800

1D -0.32%

5D -2.22%

Buy Vol. 3,485,400

Sell Vol. 3,301,500

- PDR: From its core business of real estate, Phat Dat moves towards corporation size with the expansion of investment into industrial real estate and renewable energy.

OIL & GAS

89,600

1D 0.11%

5D -2.40%

Buy Vol. 1,123,500

Sell Vol. 1,378,500

13,200

1D 0.76%

5D -0.75%

Buy Vol. 35,097,200

Sell Vol. 29,389,400

55,500

1D -0.18%

5D -2.97%

Buy Vol. 1,733,000

Sell Vol. 1,848,400

- Crude oil prices continued to rise in trading this morning after Reuters reported that Russia will assist in stabilizing production ahead of the meeting of oil producers this week.

VINGROUP

117,000

1D 3.72%

5D 9.86%

Buy Vol. 8,445,500

Sell Vol. 7,394,700

96,300

1D 0.10%

5D -2.43%

Buy Vol. 3,976,800

Sell Vol. 5,388,600

32,600

1D -1.36%

5D -4.54%

Buy Vol. 8,235,500

Sell Vol. 9,017,000

- VHM: NI in 2020 increased by VND3,887b, up 16% compared to 2019, mainly due to an increase of VND9,729b in income from financial activities over the same period.

FOOD & BEVERAGE

99,200

1D 0.20%

5D -1.00%

Buy Vol. 4,325,300

Sell Vol. 5,097,900

88,500

1D 2.79%

5D 2.31%

Buy Vol. 2,574,700

Sell Vol. 2,510,400

22,200

1D 0.68%

5D -4.72%

Buy Vol. 5,262,400

Sell Vol. 4,804,300

- VNM: VNM's management has decided to merge GTNfoods into Vilico at the ratio of 1.6: 1. GTNfoods will cancel the listing.

OTHERS

131,600

1D 0.00%

5D 0.46%

Buy Vol. 665,400

Sell Vol. 1,243,400

131,600

1D 0.00%

5D 0.46%

Buy Vol. 665,400

Sell Vol. 1,243,400

77,100

1D -0.64%

5D -2.16%

Buy Vol. 2,381,500

Sell Vol. 2,650,900

129,400

1D -0.54%

5D -1.22%

Buy Vol. 650,900

Sell Vol. 788,400

84,500

1D -0.59%

5D 0.36%

Buy Vol. 1,774,000

Sell Vol. 1,579,900

53,200

1D -2.03%

5D -4.14%

Buy Vol. 1,318,900

Sell Vol. 1,697,800

31,800

1D 1.27%

5D -3.34%

Buy Vol. 13,414,700

Sell Vol. 14,651,100

46,450

1D 0.32%

5D -0.32%

Buy Vol. 22,874,000

Sell Vol. 24,984,600

- REE: REE's Board of Directors wish that this year as well as in the coming years, the company will not pay dividends to spend money investing in electricity, water and real estate. real. - MWG: The foreign model in Cambodia has been completed and ranked No. 1, MWG is preparing to enter other markets in the ASEAN region.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

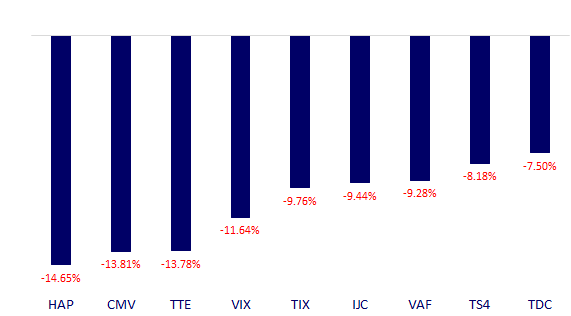

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.