Market Brief 12/04/2021

VIETNAM STOCK MARKET

1,252.45

1D 1.69%

YTD 13.91%

1,278.19

1D 1.99%

YTD 20.77%

295.53

1D 0.59%

YTD 49.94%

84.10

1D 1.31%

YTD 13.91%

-47.01

1D 0.00%

YTD 0.00%

25,677.64

1D 18.01%

YTD 49.70%

- Foreign investors' trade is negativepoint they continue to net sell more than 47 billion dong on the whole market, the selling force focuses on stocks like VPB (-96.8 billion dong), VCB (-90.8 billion dong). , GAS (-85.2 billion), CTG (-77.3 billion) ...

ETF & DERIVATIVES

21,470

1D 2.24%

YTD 14.20%

14,820

1D 0.41%

YTD 18.28%

15,900

1D 1.92%

YTD 19.28%

18,700

1D 2.75%

YTD 18.35%

17,510

1D 2.04%

YTD 28.28%

21,110

1D 1.64%

YTD 22.73%

16,280

1D 0.80%

YTD 16.70%

1,273

1D 2.12%

YTD 0.00%

1,272

1D 1.80%

YTD 0.00%

1,273

1D 1.87%

YTD 0.00%

1,275

1D 1.81%

YTD 0.00%

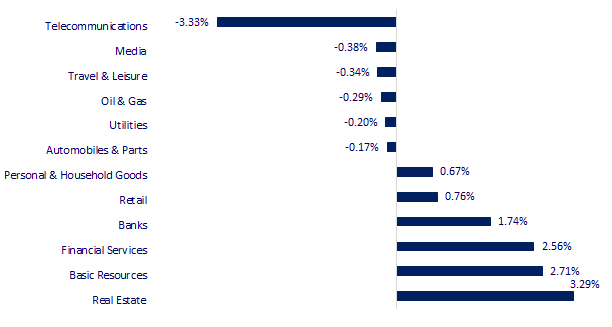

CHANGE IN PRICE BY SECTOR

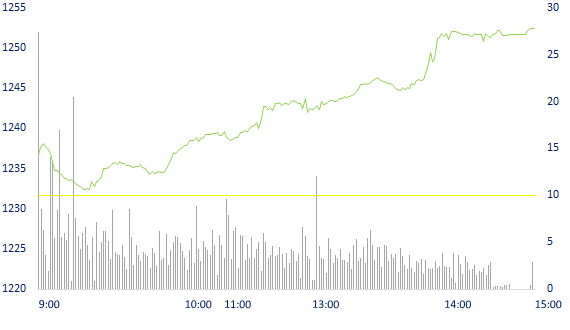

INTRADAY VNINDEX

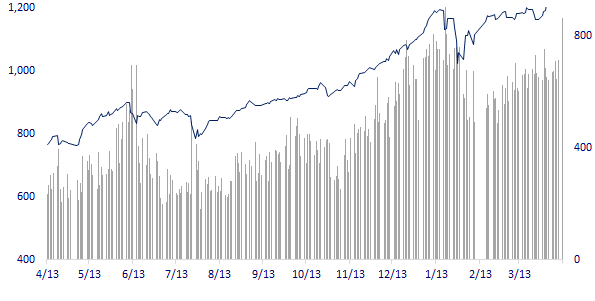

VNINDEX (12M)

GLOBAL MARKET

29,538.73

1D -0.77%

YTD 7.63%

3,412.95

1D -1.09%

YTD -0.04%

3,135.59

1D 0.12%

YTD 9.12%

28,396.00

1D -0.98%

YTD 4.60%

3,173.93

1D -0.33%

YTD 10.62%

1,541.12

1D -1.61%

YTD 6.33%

59.98

1D 0.60%

YTD 24.18%

1,741.80

1D -0.15%

YTD -8.50%

- Asian stocks were mixed, Alibaba shares surged after being fined a record. In Japan, the Nikkei 225 decreased by 0.77%. Chinese market went down with Shanghai Composite down 1.09%. Hong Kong's Hang Seng decreased by 0.98%. The South Korea's Kospi increased by 0.12%.

VIETNAM ECONOMY

0.31%

1D (bps) 1

YTD (bps) 18

5.60%

YTD (bps) -20

1.34%

1D (bps) 14

YTD (bps) 12

2.14%

1D (bps) -14

YTD (bps) 11

23,168

1D (%) 0.01%

YTD (%) -0.04%

28,171

1D (%) 0.11%

YTD (%) -3.20%

3,594

1D (%) 0.17%

YTD (%) 0.59%

- Data from the General Statistics Office showed that as of March 19, money supply growth of the whole market was estimated at 1.5% and capital mobilization growth was only 0.54% compared to the end of last year. Low savings interest rates have caused cash flow to shift to investment channels other than deposits such as real estate, securities ...

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Cash flow into the bank shows signs of slowing down

- The Ministry of Transport agreed to soon build an intersection at An Phu, Thu Duc city

- Quang Tri proposed to start an airport project of 8,014 billion VND in early September

- It is difficult for Fed to raise interest rates this year despite the rapid economic recovery

- The US trade deficit with China may widen because of Mr. Biden's $ 1,900 billion bailout package

- ECB urges Eurozone countries to act to soon implement the Recovery Fund

VN30

BANK

98,900

1D 1.44%

5D -3.04%

Buy Vol. 4,237,800

Sell Vol. 4,020,800

44,750

1D 1.02%

5D -1.76%

Buy Vol. 8,798,600

Sell Vol. 7,679,700

43,200

1D 1.65%

5D 2.86%

Buy Vol. 23,388,700

Sell Vol. 21,767,300

42,150

1D 1.32%

5D 1.57%

Buy Vol. 25,072,500

Sell Vol. 24,762,400

49,000

1D 3.81%

5D 5.49%

Buy Vol. 20,524,800

Sell Vol. 16,395,300

31,650

1D 0.96%

5D 4.11%

Buy Vol. 29,759,600

Sell Vol. 28,799,300

27,900

1D -0.36%

5D 0.90%

Buy Vol. 16,759,200

Sell Vol. 18,421,800

29,150

1D 1.22%

5D 2.64%

Buy Vol. 12,043,200

Sell Vol. 13,591,300

23,450

1D 3.30%

5D 1.30%

Buy Vol. 89,767,100

Sell Vol. 83,814,200

- Since 2010, there has never been a wave of increasing capital of hot banks like now: strongly and simultaneously. According to observations, there are about 20 banks want to increase their charter capital this year. MB is currently the bank with the strongest capital increase plan this year, increasing by more than 10,600b to 38,675b, or up to 38%. Next is BIDV's new plan to increase capital by more than 8,000b to 48,524b. The Bank will increase capital from stock dividends and private/public offerings.

REAL ESTATE

95,300

1D 5.89%

5D 11.46%

Buy Vol. 6,339,400

Sell Vol. 5,519,400

25,900

1D -1.89%

5D 5.50%

Buy Vol. 35,966,300

Sell Vol. 30,940,200

32,100

1D 0.78%

5D 4.56%

Buy Vol. 2,757,900

Sell Vol. 3,346,800

68,300

1D -0.44%

5D 0.44%

Buy Vol. 3,397,000

Sell Vol. 3,378,500

- KDH: In 2021, target profit is 1,200 billion dong, plan to pay 10% dividend by shares and issue 8.4 million ESOP shares.

OIL & GAS

87,900

1D -1.01%

5D -1.68%

Buy Vol. 3,089,100

Sell Vol. 3,567,400

14,250

1D 3.26%

5D 4.40%

Buy Vol. 65,633,200

Sell Vol. 71,084,100

55,900

1D 0.00%

5D 0.00%

Buy Vol. 3,175,200

Sell Vol. 3,080,100

- POW: In the first quarter, PV Power estimated revenue was 7,783 billion dong, down 2% and profit after tax was 720 billion dong, up 43% same period last year.

VINGROUP

132,000

1D 5.68%

5D 6.19%

Buy Vol. 5,579,100

Sell Vol. 4,986,100

101,800

1D 2.93%

5D 0.10%

Buy Vol. 4,773,200

Sell Vol. 5,852,900

35,300

1D 0.86%

5D 2.32%

Buy Vol. 7,735,800

Sell Vol. 10,863,100

- VIC: was the leader among the top stocks that were net bought by foreign investors today, with a value of nearly 111 billion dong.

FOOD & BEVERAGE

100,000

1D 0.20%

5D -2.53%

Buy Vol. 6,846,200

Sell Vol. 6,492,500

91,900

1D -0.22%

5D -1.18%

Buy Vol. 2,294,800

Sell Vol. 3,117,200

22,500

1D -0.88%

5D -0.88%

Buy Vol. 6,825,700

Sell Vol. 7,970,600

- VNM: Vinamilk sets a plan for 2021 to go sideways, pay 29% dividend and will plan pay third dividend of 2020 of 11%, at the end of June 2021.

OTHERS

131,800

1D 0.00%

5D -0.38%

Buy Vol. 778,500

Sell Vol. 1,462,400

131,800

1D 0.00%

5D -0.38%

Buy Vol. 778,500

Sell Vol. 1,462,400

82,100

1D 0.00%

5D 3.14%

Buy Vol. 3,524,100

Sell Vol. 3,804,700

134,900

1D 1.20%

5D 0.60%

Buy Vol. 1,371,400

Sell Vol. 1,583,400

91,800

1D 1.66%

5D 3.38%

Buy Vol. 1,364,400

Sell Vol. 1,246,600

53,600

1D 0.19%

5D 0.00%

Buy Vol. 1,173,200

Sell Vol. 1,347,300

36,500

1D 3.55%

5D 4.29%

Buy Vol. 30,798,600

Sell Vol. 30,359,000

51,200

1D 3.33%

5D 3.85%

Buy Vol. 44,382,700

Sell Vol. 39,973,800

- BVH: Head of the Supervisory Board of BVH, Mr. Ong Tien Hung registered to sell 43,790 shares. Expected trading time is from April 13, 2021 to May 10, 2021

Market by numbers

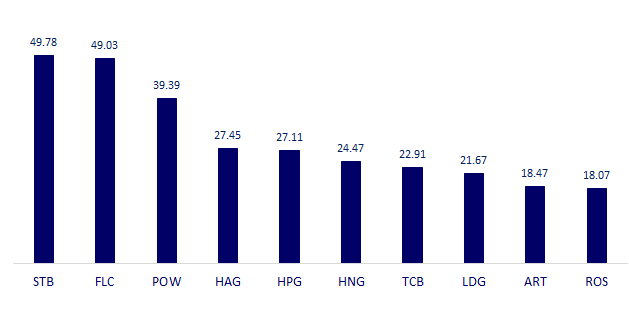

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

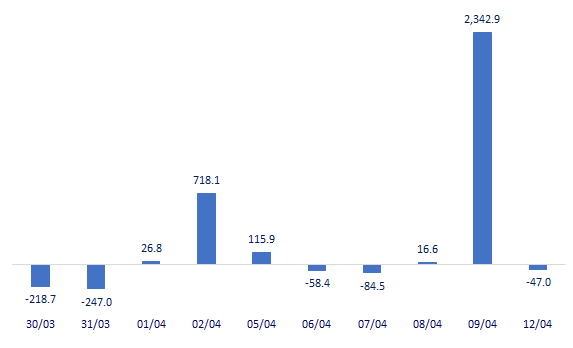

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

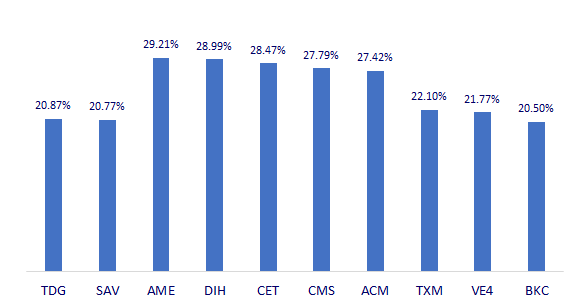

TOP INCREASES 3 CONSECUTIVE SESSIONS

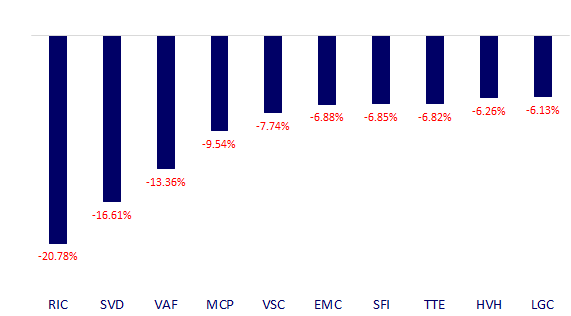

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.