Market Brief 20/04/2021

VIETNAM STOCK MARKET

1,268.28

1D 0.61%

YTD 15.35%

1,312.37

1D 0.47%

YTD 24.00%

296.48

1D 0.25%

YTD 50.42%

81.73

1D -0.32%

YTD 10.70%

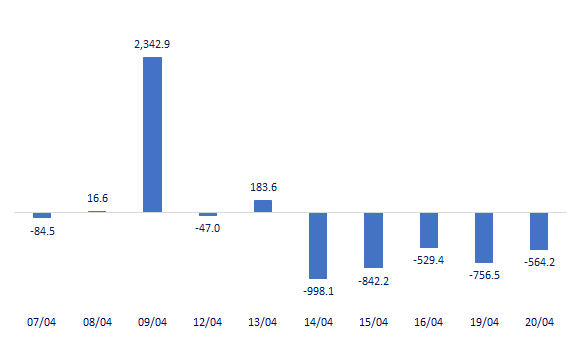

-564.23

1D 0.00%

YTD 0.00%

27,061.32

1D 17.39%

YTD 57.76%

- Foreign investors continued to net sell nearly 564 billion dong on the whole market, the selling focused on Bluechips such as VHM (-340.4 billion), VNM (-129.4 billion dong), CTG (-117.7 billion dong). VND), HPG (-103.2 billion VND) …

ETF & DERIVATIVES

22,380

1D 1.82%

YTD 19.04%

15,160

1D 1.54%

YTD 20.99%

16,360

1D 0.86%

YTD 22.73%

19,500

1D 2.63%

YTD 23.42%

17,150

1D 0.00%

YTD 25.64%

21,000

1D 0.00%

YTD 22.09%

17,000

1D 2.66%

YTD 21.86%

1,298

1D -0.86%

YTD 0.00%

1,297

1D -1.02%

YTD 0.00%

1,299

1D -1.35%

YTD 0.00%

1,300

1D -0.91%

YTD 0.00%

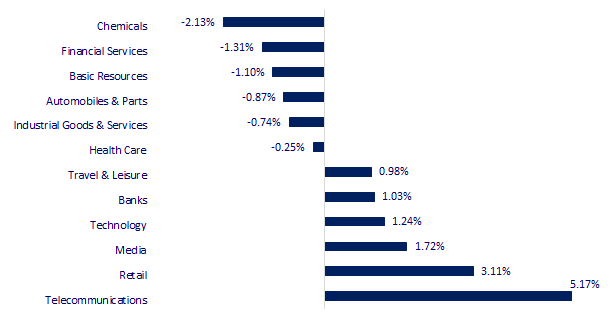

CHANGE IN PRICE BY SECTOR

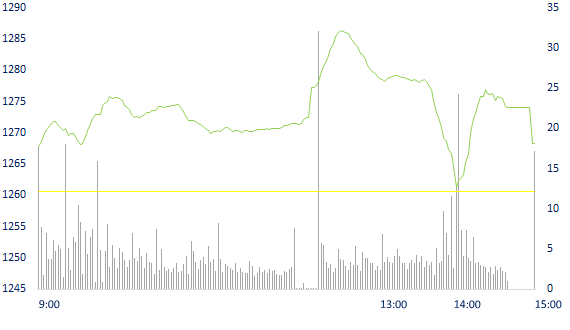

INTRADAY VNINDEX

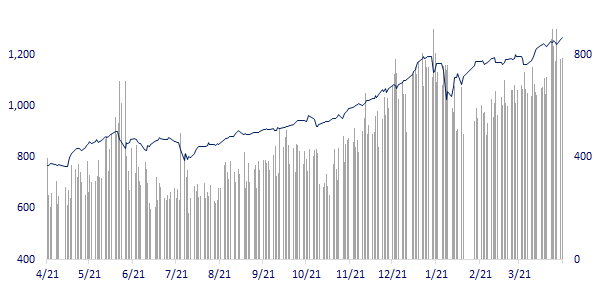

VNINDEX (12M)

GLOBAL MARKET

29,100.38

1D -0.22%

YTD 6.03%

3,472.94

1D -0.13%

YTD 1.71%

3,220.70

1D 0.68%

YTD 12.08%

29,122.12

1D 0.64%

YTD 7.28%

3,192.17

1D -0.55%

YTD 11.26%

1,580.04

1D 0.33%

YTD 9.02%

64.02

1D 0.82%

YTD 32.55%

1,768.65

1D -0.01%

YTD -7.09%

- Asian stocks were mixed as US Stocks fell from record highs. In the Chinese market, the Shanghai Composite decreased 0.13%. Hong Kong's Hang Seng increased 0.64%. In Japan, the Nikkei 225 decreased by 0.22%. The Korean market was in the opposite direction with the Kospi up 0.68%.

VIETNAM ECONOMY

0.43%

YTD (bps) 30

5.60%

YTD (bps) -20

1.24%

1D (bps) -10

YTD (bps) 2

2.34%

1D (bps) 16

YTD (bps) 31

23,178

1D (%) -0.01%

YTD (%) 0.00%

28,539

1D (%) 0.16%

YTD (%) -1.94%

3,622

1D (%) 0.19%

YTD (%) 1.37%

- VEPR raises its GDP growth forecast for Vietnam in 2021 to 6-6.3%. According to this organization, Vietnam needs to stabilize the macro economy and diversify import and export markets.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The return of the trend of FDI enterprises in miniature, "satellite" FDI and risks for Vietnam's economy

- Approving the project of building a logistics center in Vung Ang economic zone

- Hanoi and TP. HCM continuously accounts for over 70% of the country's e-commerce scale

- 3 major hurdles to meet if you want to list in the US through SPAC: Information disclosure, internal control and pricing

- Global consumers save 5.4 trillion USD, the world economy waits for a moment of spending boom

- The world is increasingly 'thirsty' for chips and this is a difficult problem

VN30

BANK

103,000

1D 4.57%

5D 5.64%

Buy Vol. 10,348,300

Sell Vol. 11,644,400

43,200

1D 0.47%

5D -1.03%

Buy Vol. 4,267,300

Sell Vol. 6,989,900

42,000

1D -1.18%

5D -0.12%

Buy Vol. 35,224,700

Sell Vol. 39,883,200

41,150

1D -1.08%

5D -1.08%

Buy Vol. 16,269,900

Sell Vol. 25,149,800

49,500

1D -0.10%

5D -0.40%

Buy Vol. 10,962,800

Sell Vol. 11,652,200

30,500

1D 0.00%

5D -1.93%

Buy Vol. 19,907,500

Sell Vol. 28,586,500

27,200

1D -0.37%

5D -1.63%

Buy Vol. 4,962,300

Sell Vol. 11,481,200

27,800

1D -1.77%

5D -6.08%

Buy Vol. 7,188,300

Sell Vol. 10,072,800

22,500

1D -1.75%

5D -0.88%

Buy Vol. 50,959,700

Sell Vol. 77,854,400

- VPB: By the end of Q1/2021, VPBank's total consolidated assets reached more than VND 436 trillion, an increase of 4.1% compared to the end of 2020. Consolidated bank credit as of March 31, 2021 reached more than VND 332 trillion, an increase of 2.8% compared to the end of 2020; in which individual banks increased by 3.6%.

REAL ESTATE

108,500

1D -0.46%

5D 12.32%

Buy Vol. 4,621,700

Sell Vol. 4,913,900

22,750

1D -2.57%

5D -7.52%

Buy Vol. 8,339,100

Sell Vol. 11,225,300

34,150

1D 3.17%

5D 8.59%

Buy Vol. 9,532,100

Sell Vol. 8,948,200

79,400

1D 4.61%

5D 17.11%

Buy Vol. 8,487,000

Sell Vol. 7,167,300

- PDR: announced that 250 billion dong of bond has been settled 3 years before the deadline. This is the volume of bonds issued by PDR on June 3, 2019 and has a term of 5 years with an interest rate of 10.5%/year.

OIL & GAS

88,000

1D 0.92%

5D 2.33%

Buy Vol. 2,277,600

Sell Vol. 3,015,500

13,000

1D -0.76%

5D -6.14%

Buy Vol. 22,705,000

Sell Vol. 27,086,700

52,900

1D 0.76%

5D -3.64%

Buy Vol. 2,299,500

Sell Vol. 2,314,100

- Brent crude oil price delivery in June increased 0.02% to $66.15/barrel. A weak dollar makes oil prices cheaper for those who buy in other currencies.

VINGROUP

143,100

1D -0.63%

5D 1.71%

Buy Vol. 4,406,500

Sell Vol. 4,952,100

108,600

1D 3.92%

5D 5.95%

Buy Vol. 26,766,600

Sell Vol. 19,250,800

34,600

1D 1.91%

5D -1.98%

Buy Vol. 21,856,000

Sell Vol. 26,746,700

- VIC: Vingroup will issue nearly 423 million shares to pay dividends, with a rate of 12.5%

FOOD & BEVERAGE

99,300

1D 3.33%

5D -0.70%

Buy Vol. 14,318,800

Sell Vol. 12,745,000

105,500

1D -1.49%

5D 12.00%

Buy Vol. 6,469,500

Sell Vol. 7,763,800

21,150

1D -2.08%

5D -4.94%

Buy Vol. 5,029,100

Sell Vol. 6,603,700

- VNM: Vinamilk consecutively ranked in the Top 50 leading dairy companies in the world

OTHERS

131,000

1D 1.39%

5D -0.68%

Buy Vol. 1,083,800

Sell Vol. 1,452,500

131,000

1D 1.39%

5D -0.68%

Buy Vol. 1,083,800

Sell Vol. 1,452,500

82,900

1D 1.72%

5D 2.73%

Buy Vol. 7,778,800

Sell Vol. 8,400,700

142,500

1D 3.71%

5D 5.63%

Buy Vol. 4,239,000

Sell Vol. 3,703,300

94,400

1D 0.43%

5D 4.08%

Buy Vol. 1,085,500

Sell Vol. 1,438,100

52,000

1D -1.33%

5D -2.26%

Buy Vol. 811,300

Sell Vol. 1,205,400

34,100

1D -2.01%

5D -4.21%

Buy Vol. 21,054,900

Sell Vol. 35,707,600

57,200

1D -1.04%

5D 14.17%

Buy Vol. 63,255,100

Sell Vol. 68,641,900

- SSI: reported a private profit of 528 billion dong in the first quarter, 35 times higher than the same period. Outstanding loans in the first quarter reached more than 10,000 billion. Revenue from securities brokerage activities reached 696.1 billion, profit reached 318.6 billion - up 276.2% over the same period.

Market by numbers

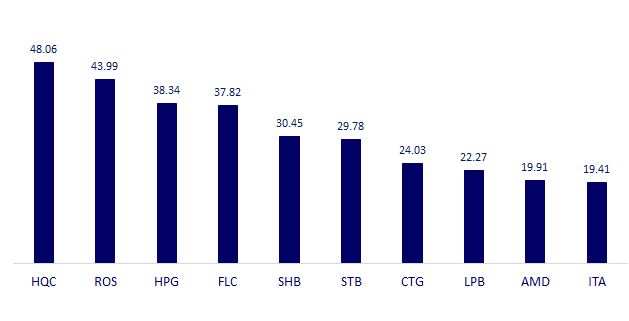

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

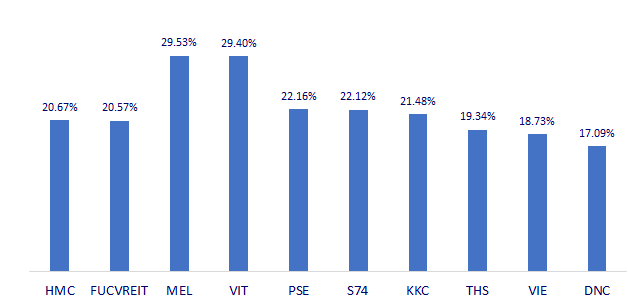

TOP INCREASES 3 CONSECUTIVE SESSIONS

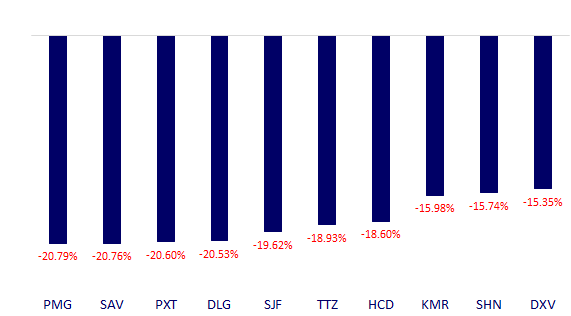

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.