Market Brief 23/04/2021

VIETNAM STOCK MARKET

1,248.53

1D 1.69%

YTD 13.56%

1,301.39

1D 2.35%

YTD 22.96%

283.63

1D -1.19%

YTD 43.90%

80.40

1D 0.82%

YTD 8.90%

340.65

1D 0.00%

YTD 0.00%

23,045.69

1D -8.14%

YTD 34.35%

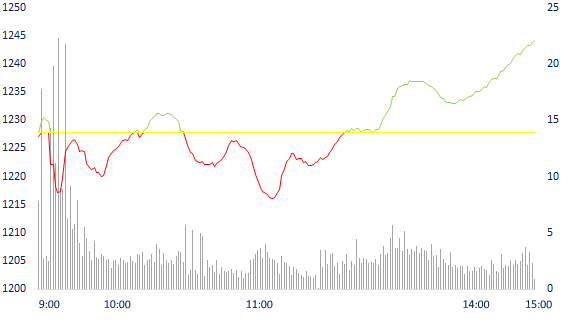

- At the end of the session, VnIndex surged 21 points to 1248 points. Investors were excited when the stock market still had strong momentum. As many as 26/30 stocks in the VN30 rose today while only 3 stocks slightly decreased. STB and KDH closed the day in purple. Bank stocks broke out strongly.

ETF & DERIVATIVES

22,000

1D 1.43%

YTD 17.02%

14,990

1D 0.00%

YTD 19.63%

16,080

1D 0.75%

YTD 20.63%

19,100

1D -1.04%

YTD 20.89%

17,910

1D 6.93%

YTD 31.21%

21,180

1D 2.17%

YTD 23.14%

16,360

1D -2.97%

YTD 17.28%

1,263

1D 0.01%

YTD 0.00%

1,295

1D 2.70%

YTD 0.00%

1,295

1D 2.69%

YTD 0.00%

1,297

1D 2.81%

YTD 0.00%

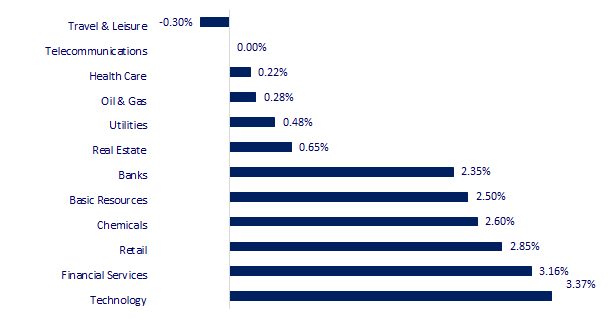

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

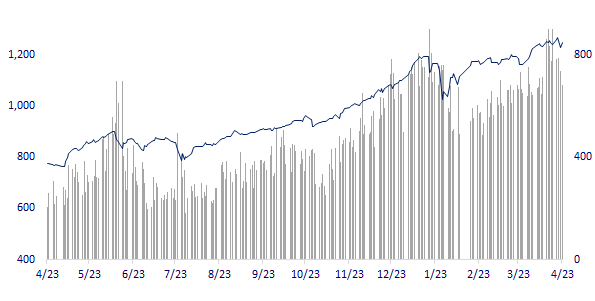

VNINDEX (12M)

GLOBAL MARKET

29,020.63

1D -0.04%

YTD 5.74%

3,474.17

1D 0.26%

YTD 1.75%

3,186.10

1D 0.27%

YTD 10.88%

29,076.00

1D 0.25%

YTD 7.11%

3,194.04

1D 0.20%

YTD 11.32%

1,553.59

1D -0.93%

YTD 7.19%

61.50

1D -0.52%

YTD 27.33%

1,785.90

1D -0.19%

YTD -6.19%

- Asian stocks were mixed, cryptocurrencies were sold off. In Japan, Nikkei 225 lost 0.04%, sometimes lost more than 1%. China market went up with Shanghai Composite up 0.26% and Shenzhen Component up 1,002%. Hong Kong's Hang Seng increased by 0.25%. South Korea's Kospi index rose 0.27%.

VIETNAM ECONOMY

0.42%

1D (bps) -1

YTD (bps) 29

5.60%

YTD (bps) -20

1.33%

1D (bps) 11

YTD (bps) 11

2.16%

1D (bps) -18

YTD (bps) 13

23,145

1D (%) -0.08%

YTD (%) -0.14%

28,492

1D (%) 0.17%

YTD (%) -2.10%

3,619

1D (%) -0.11%

YTD (%) 1.29%

- Credit for real estate has not increased sharply in 2020 and the first quarter of 2021. Real estate credit currently accounts for about 19% of the total outstanding loans of the whole economy, the State Bank is still tightly controlling. Tighten credit on this area

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- FDI enterprises in industrial zones in Dong Nai invested more than 2.5 billion USD in the first quarter

- Nikkei: Japan wants Vietnam to join the first oil sharing agreement in ASEAN

- As of April 16, 2021, the credit of the economy increases by 3.34% compared to the end of 2020

- European Central Bank maintains record low interest rates

- Singapore, Canada, UK simultaneously banned people entering from India

- Thailand recorded an unprecedented increase in new infections

VN30

BANK

104,000

1D 0.97%

5D 8.00%

Buy Vol. 3,960,000

Sell Vol. 4,485,900

42,000

1D 2.44%

5D 0.00%

Buy Vol. 7,026,600

Sell Vol. 5,458,800

41,300

1D 5.49%

5D -1.67%

Buy Vol. 40,204,400

Sell Vol. 28,868,200

40,500

1D 2.02%

5D 0.12%

Buy Vol. 19,406,200

Sell Vol. 20,632,200

51,000

1D 4.08%

5D 4.19%

Buy Vol. 27,336,800

Sell Vol. 24,231,200

30,300

1D 3.77%

5D 0.33%

Buy Vol. 33,925,100

Sell Vol. 27,933,500

26,900

1D 2.28%

5D 0.94%

Buy Vol. 7,109,700

Sell Vol. 8,127,000

28,000

1D 3.70%

5D 1.08%

Buy Vol. 7,645,800

Sell Vol. 7,482,200

22,450

1D 6.90%

5D 1.58%

Buy Vol. 104,540,600

Sell Vol. 68,226,800

- TPB: Profit before tax in the first quarter of 2021 of TPBank reached VND 1,422 billion, an increase of 40.9% over the same period last year and equal to 26% of the year plan. In which, net interest income and service income still contributed mainly with the results of nearly 2,264 billion dong (up 31%) and over 282 billion dong (up 79.7%).

REAL ESTATE

107,000

1D -0.28%

5D -0.93%

Buy Vol. 1,997,800

Sell Vol. 2,300,200

22,300

1D 3.72%

5D -2.83%

Buy Vol. 16,492,700

Sell Vol. 11,701,100

35,300

1D 6.97%

5D 12.42%

Buy Vol. 18,339,900

Sell Vol. 9,875,900

78,500

1D 2.75%

5D 10.56%

Buy Vol. 5,206,200

Sell Vol. 4,510,800

- KDH: Dragon Capital has sold nearly 1.9 million shares, reducing its holding to 55.2 million units, equivalent to 9.9% of capital. The transaction date for ownership rate change is April 19.

OIL & GAS

86,000

1D 0.23%

5D 0.00%

Buy Vol. 1,726,300

Sell Vol. 2,010,200

12,600

1D 2.02%

5D -4.55%

Buy Vol. 32,185,800

Sell Vol. 25,041,800

51,000

1D 0.00%

5D -3.41%

Buy Vol. 3,818,600

Sell Vol. 3,333,300

- WTI crude oil of the US increased 0.52% to $61.75/barrel at 7:40 am (GMT) on 23/4. The price of Brent crude oil delivered in June also increased by 0.06% to $65.65/barrel.

VINGROUP

138,300

1D -0.36%

5D -3.29%

Buy Vol. 6,531,100

Sell Vol. 5,794,300

105,000

1D 1.84%

5D 3.96%

Buy Vol. 15,140,800

Sell Vol. 14,603,700

32,800

1D 1.86%

5D -3.39%

Buy Vol. 16,563,700

Sell Vol. 13,164,700

- VIC: $500m of Vingroup bond with options to be listed on the Singapore exchange from 21/04. Bonds have the option to receive shares of VHM at the price of VND123,000/share.

FOOD & BEVERAGE

99,500

1D 1.53%

5D 2.68%

Buy Vol. 7,413,200

Sell Vol. 8,282,900

100,000

1D 1.83%

5D -0.10%

Buy Vol. 9,668,600

Sell Vol. 8,174,200

20,400

1D 3.55%

5D -7.27%

Buy Vol. 7,360,800

Sell Vol. 6,082,400

- VNM: Vinamilk continuously leads the liquid milk industry for many years. Vinamilk currently has nearly 250 products of all kinds, meeting nearly all nutritional needs of consumers

OTHERS

129,500

1D -0.69%

5D 0.39%

Buy Vol. 1,017,800

Sell Vol. 1,099,700

129,500

1D -0.69%

5D 0.39%

Buy Vol. 1,017,800

Sell Vol. 1,099,700

83,000

1D 3.75%

5D 4.14%

Buy Vol. 5,875,000

Sell Vol. 4,841,200

147,500

1D 3.51%

5D 10.07%

Buy Vol. 4,164,000

Sell Vol. 3,132,900

96,000

1D 2.24%

5D 5.61%

Buy Vol. 2,085,700

Sell Vol. 2,211,000

52,300

1D 2.15%

5D 2.55%

Buy Vol. 865,200

Sell Vol. 1,019,700

33,000

1D 3.94%

5D -2.94%

Buy Vol. 32,456,100

Sell Vol. 26,330,700

56,400

1D 2.55%

5D 3.30%

Buy Vol. 51,188,600

Sell Vol. 45,862,500

- MWG: submitted the dividend plan at the ratio of 2: 1, profit is expected to grow 12% to 4,750 billion dong. The retail of mobile devices and electronics is still the main driver of cash flow. Bach Hoa Xanh chain is expected to contribute 25% of revenue, setting EBITDA profit target at Company level.

Market by numbers

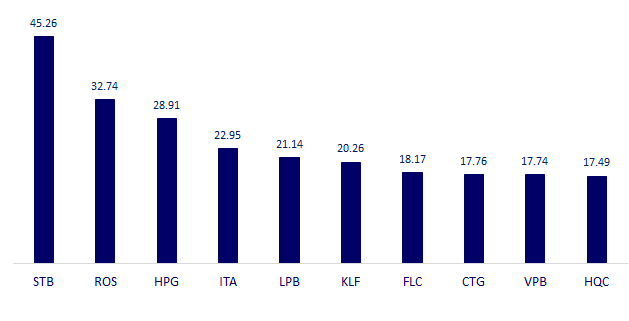

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

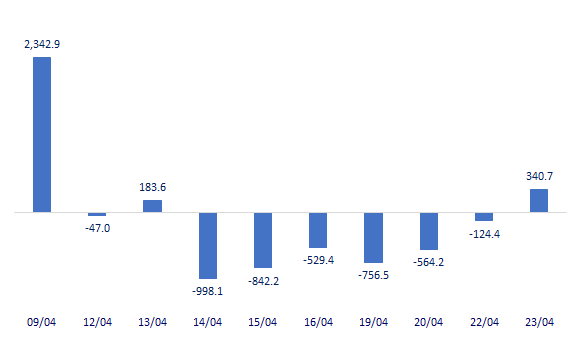

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

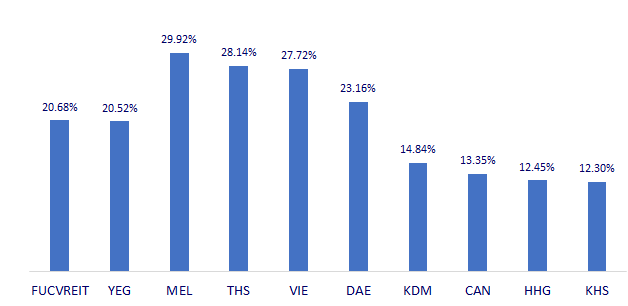

TOP INCREASES 3 CONSECUTIVE SESSIONS

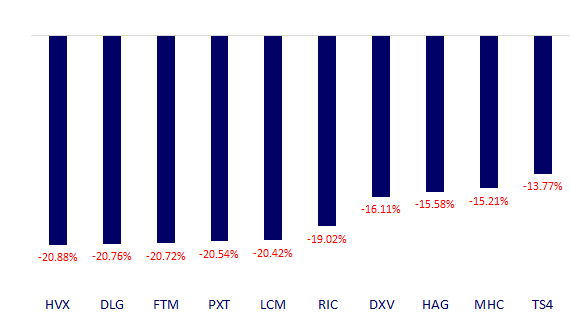

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.