Market Brief 26/04/2021

VIETNAM STOCK MARKET

1,215.77

1D -2.62%

YTD 10.58%

1,275.04

1D -2.02%

YTD 20.47%

280.68

1D -1.04%

YTD 42.40%

79.42

1D -1.22%

YTD 7.57%

113.13

1D 0.00%

YTD 0.00%

22,365.42

1D -2.95%

YTD 30.39%

- Foreign investors saw the second net buying consensus with a total value of over 113 billion dong. The stocks that were bought the most by foreign investors included FUEVFVND (356.7 billion VND), NVL (97.63 billion VND), PDR (53.75 billion VND), VHM (46.8 billion VND) ...

ETF & DERIVATIVES

21,260

1D -3.36%

YTD 13.09%

14,650

1D -2.27%

YTD 16.92%

16,000

1D -0.50%

YTD 20.03%

18,800

1D -1.57%

YTD 18.99%

16,950

1D -5.36%

YTD 24.18%

21,050

1D -0.61%

YTD 22.38%

16,360

1D 0.00%

YTD 17.28%

1,293

1D 2.37%

YTD 0.00%

1,260

1D -2.70%

YTD 0.00%

1,253

1D -3.24%

YTD 0.00%

1,254

1D -3.29%

YTD 0.00%

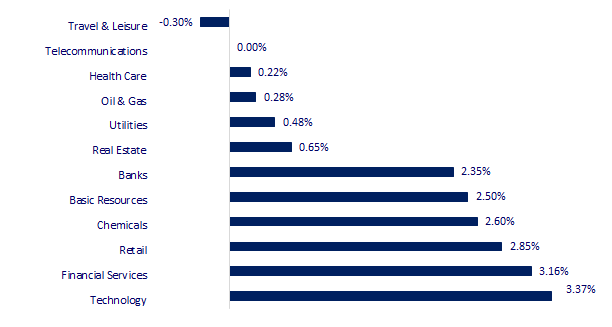

CHANGE IN PRICE BY SECTOR

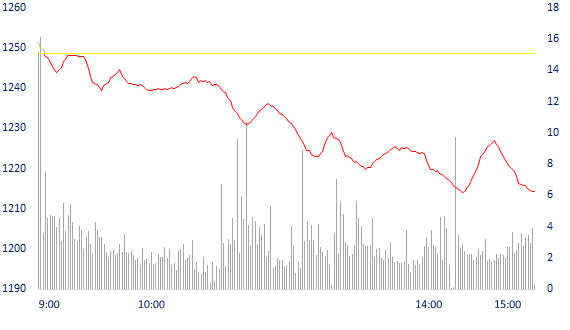

INTRADAY VNINDEX

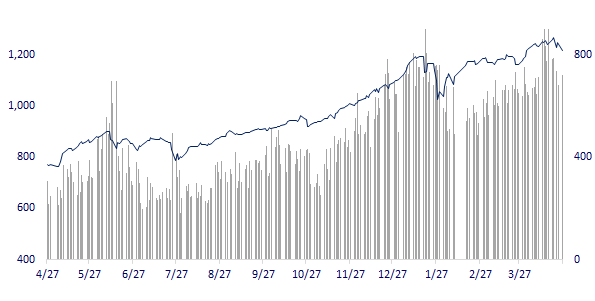

VNINDEX (12M)

GLOBAL MARKET

29,126.23

1D 0.02%

YTD 6.13%

3,441.17

1D -0.95%

YTD 0.78%

3,217.53

1D 0.99%

YTD 11.97%

28,961.12

1D -0.70%

YTD 6.68%

3,204.90

1D 0.34%

YTD 11.70%

1,559.53

1D 0.38%

YTD 7.60%

61.18

1D -1.72%

YTD 26.67%

1,776.75

1D -0.20%

YTD -6.67%

- Asian stocks mixed, investors watched the Indian situation. In Japan, the Nikkei 225 increased by 0.02%. The Chinese market went down with the Shanghai Composite down 0.95%. The Hong Kong Hang Seng Index decreased by 0.7%. South Korea's Kospi index rose 0.99%.

VIETNAM ECONOMY

0.44%

1D (bps) 2

YTD (bps) 31

5.60%

YTD (bps) -20

1.34%

1D (bps) 1

YTD (bps) 12

2.13%

1D (bps) -3

YTD (bps) 10

23,140

1D (%) -0.04%

YTD (%) -0.16%

28,586

1D (%) -0.09%

YTD (%) -1.78%

3,623

1D (%) 0.00%

YTD (%) 1.40%

- Vietnam surpassed France and Germany, ranked 8th in renewable energy investment. According to the figures in 2020, China is the largest investment in renewable energy in the world, with $83.6b. Followed by the United States at $49.3b. The figure in France and Germany is $7.3b and $7.1b, respectively. Thus, Vietnam ranked second in this country, 8th in terms of investment in renewable energy globally.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Ho Chi Minh City proposed the Government to support 3,000 billion VND to build Ho Chi Minh City - Moc Bai expressway

- Korean enterprises expect to invest in the Vietnamese semiconductor market

- Vietnam surpassed France and Germany, ranked 8th in renewable energy investment

- The United States temporarily closes embassy in Turkey following Mr Biden's announcement

- BoE forecasts that the growth rate will recover rapidly in the next quarters

- The Taiwanese manufacturer reported huge profits thanks to the global shortage of chips

VN30

BANK

98,600

1D -5.19%

5D 0.10%

Buy Vol. 5,017,900

Sell Vol. 7,629,600

40,500

1D -3.57%

5D -5.81%

Buy Vol. 5,299,500

Sell Vol. 5,614,800

39,700

1D -3.87%

5D -6.59%

Buy Vol. 21,861,300

Sell Vol. 24,458,900

39,450

1D -2.59%

5D -5.17%

Buy Vol. 18,179,900

Sell Vol. 22,380,500

53,000

1D 3.92%

5D 6.96%

Buy Vol. 28,122,300

Sell Vol. 26,930,100

29,600

1D -2.31%

5D -2.95%

Buy Vol. 22,784,200

Sell Vol. 27,864,600

26,500

1D -1.49%

5D -2.93%

Buy Vol. 5,461,300

Sell Vol. 10,979,600

27,150

1D -3.04%

5D -4.06%

Buy Vol. 4,502,800

Sell Vol. 6,280,300

22,550

1D 0.45%

5D -1.53%

Buy Vol. 65,228,300

Sell Vol. 101,323,400

- TPB: The bank sets a pre-tax profit target of 5,800 billion dong in 2021, up 32% compared to the implementation of 2020. TPBank does not pay dividend in 2020 but leaves 2,979 billion dong of undistributed profit after tax to expand production and business activities 2021

REAL ESTATE

114,400

1D 6.92%

5D 4.95%

Buy Vol. 4,823,300

Sell Vol. 3,358,900

21,500

1D -3.59%

5D -7.92%

Buy Vol. 8,066,100

Sell Vol. 8,737,800

34,500

1D -2.27%

5D 4.23%

Buy Vol. 6,807,500

Sell Vol. 7,862,100

74,200

1D 5.58%

5D 9.19%

Buy Vol. 5,897,500

Sell Vol. 6,121,400

- TCH: Shinhan Bank Co., Ltd transferred ownership of 10,999,930 shares of TCH to Valuesystem Protect Optimus Private Investment Fund.

OIL & GAS

81,500

1D -5.23%

5D -6.54%

Buy Vol. 1,574,500

Sell Vol. 2,027,200

12,100

1D -3.97%

5D -7.63%

Buy Vol. 20,860,100

Sell Vol. 24,816,500

49,950

1D -2.06%

5D -4.86%

Buy Vol. 1,965,900

Sell Vol. 2,466,200

- PLX: Q1.2020, retail volume reached 1.4 million m3, an increase of 6.6% compared to 2020. Estimated profit is expected to reach more than 900 billion.

VINGROUP

131,500

1D -4.92%

5D -8.68%

Buy Vol. 3,786,000

Sell Vol. 4,896,200

99,600

1D -5.14%

5D -4.69%

Buy Vol. 12,683,500

Sell Vol. 15,431,300

31,150

1D -5.03%

5D -8.25%

Buy Vol. 15,834,100

Sell Vol. 19,497,500

- VRE: Sai Dong Investment and Urban Development transferred the ownership of 751m shares (32.25%), with the date of no longer being a major shareholder, April 19.

FOOD & BEVERAGE

96,000

1D -3.52%

5D -0.10%

Buy Vol. 7,858,300

Sell Vol. 11,196,600

95,000

1D -5.00%

5D -11.30%

Buy Vol. 5,824,700

Sell Vol. 7,481,900

20,550

1D 0.74%

5D -4.86%

Buy Vol. 4,286,100

Sell Vol. 5,859,400

- VNM: In 2021, VNM targets to achieve revenue of over 62 trillion dong, up 4.1% compared to 2020. Profit after tax (EAT) is expected to go sideways, approximately 11.2 trillion dong.

OTHERS

127,500

1D -1.54%

5D -1.32%

Buy Vol. 807,400

Sell Vol. 1,174,800

127,500

1D -1.54%

5D -1.32%

Buy Vol. 807,400

Sell Vol. 1,174,800

81,000

1D -2.41%

5D -0.61%

Buy Vol. 4,963,900

Sell Vol. 4,399,200

142,500

1D -3.39%

5D 3.71%

Buy Vol. 3,029,400

Sell Vol. 2,071,600

95,000

1D -1.04%

5D 1.06%

Buy Vol. 982,400

Sell Vol. 1,262,900

51,300

1D -1.91%

5D -2.66%

Buy Vol. 655,100

Sell Vol. 836,700

31,700

1D -3.94%

5D -8.91%

Buy Vol. 19,858,900

Sell Vol. 24,286,800

55,100

1D -2.30%

5D -4.67%

Buy Vol. 38,311,800

Sell Vol. 45,077,000

- HPG: HPG will issue nearly 1.16 billion new shares to pay share dividend at the rate of 35%. Hoa Phat charter capital is expected to increase to 44,726 billion VND. At the same time, the enterprise pays 5% cash dividend. Total expected cash value Hoa Phat will spend is 1,657 billion VND. Implementation time is in May-July and after being approved by the State Securities Commission

Market by numbers

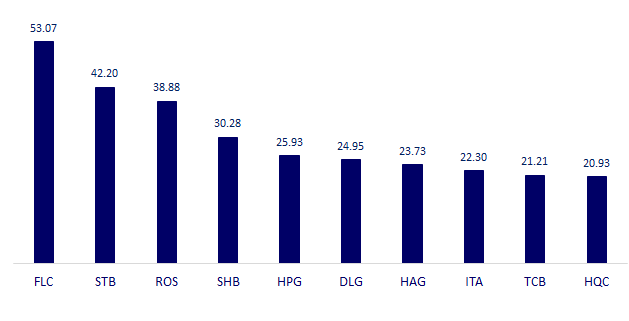

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

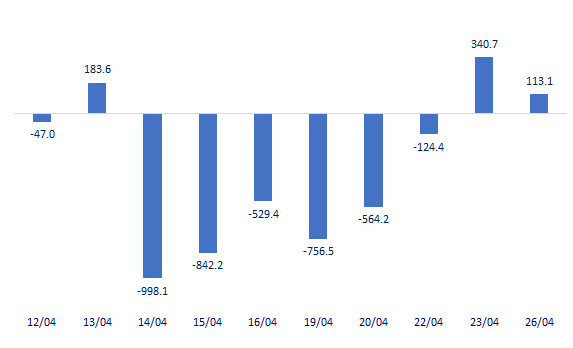

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

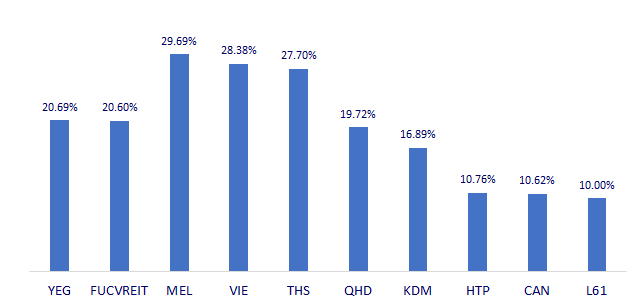

TOP INCREASES 3 CONSECUTIVE SESSIONS

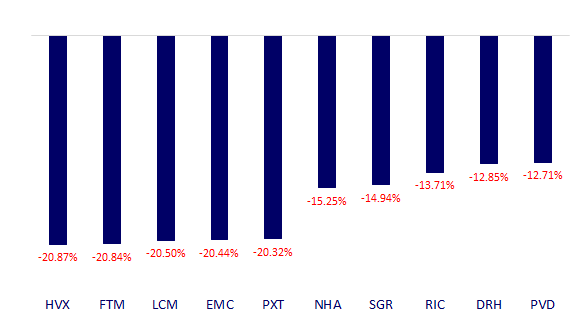

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.