Market Brief 27/04/2021

VIETNAM STOCK MARKET

1,219.75

1D 0.33%

YTD 10.94%

1,283.81

1D 0.69%

YTD 21.30%

280.56

1D -0.04%

YTD 42.34%

79.41

1D -0.01%

YTD 7.56%

409.65

1D 0.00%

YTD 0.00%

16,538.31

1D -26.05%

YTD -3.58%

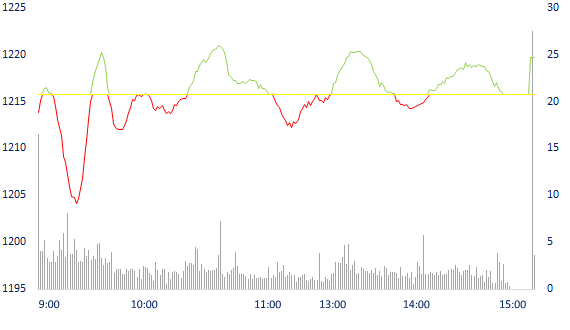

- Session 27/4: The market shook strongly, foreign investors continued to “gather” more than 409 billion dong of shares and it is likely that Fubon FTSE Vietnam ETF will continue to buy. The stocks that were bought the most by foreign investors included HPG (174 billion dong), NVL (97 billion dong), and MSN (87 billion dong) ...

ETF & DERIVATIVES

21,460

1D 0.94%

YTD 14.15%

14,830

1D 1.23%

YTD 18.36%

15,980

1D -0.13%

YTD 19.88%

18,800

1D 0.00%

YTD 18.99%

17,100

1D 0.88%

YTD 25.27%

21,500

1D 2.14%

YTD 25.00%

16,380

1D 0.12%

YTD 17.42%

1,248

1D -3.47%

YTD 0.00%

1,265

1D 0.40%

YTD 0.00%

1,267

1D 1.12%

YTD 0.00%

1,265

1D 0.88%

YTD 0.00%

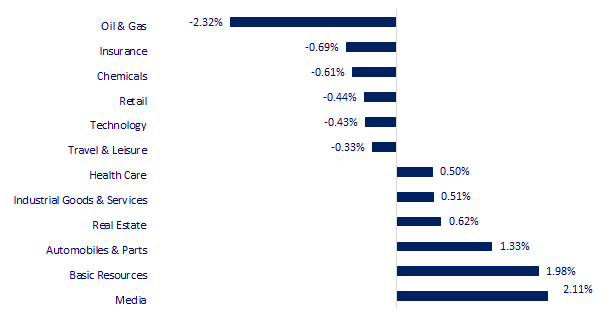

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

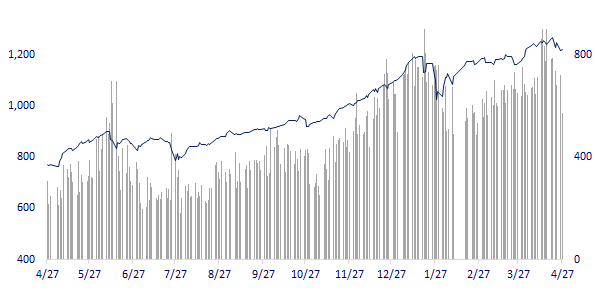

VNINDEX (12M)

GLOBAL MARKET

28,991.89

1D -0.33%

YTD 5.64%

3,442.61

1D 0.04%

YTD 0.82%

3,215.42

1D -0.07%

YTD 11.90%

28,902.37

1D 0.11%

YTD 6.47%

3,214.43

1D 0.30%

YTD 12.03%

1,559.23

1D -0.02%

YTD 7.58%

62.34

1D 0.31%

YTD 29.07%

1,779.65

1D 0.21%

YTD -6.51%

- Japan kept the policy of interest rates and Asian stocks mixed. In Japan, the Nikkei 225 decreased by 0.33%. China market went up with Shanghai Composite up 0.04% and Shenzhen Component up 0.279%. Hong Kong's Hang Seng increased by 0.11%. The South Korea's Kospi decreased by 0.07%.

VIETNAM ECONOMY

0.77%

1D (bps) 33

YTD (bps) 64

5.60%

YTD (bps) -20

1.21%

1D (bps) -13

YTD (bps) -1

2.28%

1D (bps) 15

YTD (bps) 25

23,140

1D (%) 0.00%

YTD (%) -0.16%

28,524

1D (%) 0.00%

YTD (%) -1.99%

3,623

1D (%) 0.03%

YTD (%) 1.40%

- Interbank interest rates started to rise sharply. Specifically, the overnight interbank rate was 0.69%; 1 week 0.86%; 2 weeks 0.93% and 1 month 1.11%. While last week, the market was still stable, the interbank interest rate went sideways at 0.43%/year for the overnight term and 0.6%/year for the 1 week term.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Interbank interest rates started to increase sharply

- More than 1.3 billion USD poured into 17 industrial zone projects in Bac Ninh

- Nearly 40% of tourism workers still cannot return to work

- Oil prices rose amid OPEC + optimism about oil demand

- The value of the Chinese and ASEAN digital economies may reach $9,500 billion

- Foreign investors are about to withdraw their strongest capital in 13 months from the Indian stock market

VN30

BANK

99,000

1D 0.41%

5D -3.88%

Buy Vol. 2,277,700

Sell Vol. 2,523,900

40,350

1D -0.37%

5D -6.60%

Buy Vol. 3,941,000

Sell Vol. 3,640,900

39,650

1D -0.13%

5D -5.60%

Buy Vol. 16,011,300

Sell Vol. 14,540,000

39,500

1D 0.13%

5D -4.01%

Buy Vol. 14,823,800

Sell Vol. 14,497,200

53,200

1D 0.38%

5D 7.47%

Buy Vol. 22,920,300

Sell Vol. 25,224,000

29,600

1D 0.00%

5D -2.95%

Buy Vol. 17,378,100

Sell Vol. 19,759,200

26,800

1D 1.13%

5D -1.47%

Buy Vol. 6,103,000

Sell Vol. 8,244,500

27,100

1D -0.18%

5D -2.52%

Buy Vol. 3,691,100

Sell Vol. 4,790,400

23,100

1D 2.44%

5D 2.67%

Buy Vol. 85,642,700

Sell Vol. 97,232,100

- TCB: In the first quarter of 2021, Techcombank's pre-tax profit was 5,518 billion dong, up 76.8% year-on-year. NPL ratio after the first 3 months of the year decreased from 0.47% to 0.38%. - MBB: 2021 profit growth plan is at least 20%, there are 3-5 million new customers and shareholders are proposing to sell their shares to Viettel at the price of at least 20,000 VND/share.

REAL ESTATE

121,500

1D 6.21%

5D 11.98%

Buy Vol. 3,368,100

Sell Vol. 3,559,100

21,750

1D 1.16%

5D -4.40%

Buy Vol. 7,871,600

Sell Vol. 7,349,400

34,550

1D 0.14%

5D 1.17%

Buy Vol. 7,426,600

Sell Vol. 7,444,500

72,200

1D -2.70%

5D 1.57%

Buy Vol. 3,930,500

Sell Vol. 5,091,200

- PDR: Approved the transfer of a part of urban development investment project in Division 9 of Nhon Hoi eco-tourism urban area (High-class apartment building) to BIDICO Real Estate JSC

OIL & GAS

81,500

1D 0.00%

5D -7.39%

Buy Vol. 1,720,300

Sell Vol. 2,253,100

12,100

1D 0.00%

5D -6.92%

Buy Vol. 19,841,700

Sell Vol. 16,491,100

48,600

1D -2.70%

5D -8.13%

Buy Vol. 2,682,800

Sell Vol. 3,231,600

- PLX: Plans that petroleum output for sale in 2021 is over 12.2 million m3, only equivalent to the output in 2020, but pre-tax profit will increase by 238% to 3,360 billion VND.

VINGROUP

132,100

1D 0.46%

5D -7.69%

Buy Vol. 2,951,800

Sell Vol. 2,791,200

100,000

1D 0.40%

5D -7.92%

Buy Vol. 7,461,100

Sell Vol. 7,370,800

30,600

1D -1.77%

5D -11.56%

Buy Vol. 12,204,000

Sell Vol. 10,780,100

- VIC: VIC is the stock with the largest proportion in the portfolio with 11.11% in the Fubon FTSE Vietnam ETF portfolio.

FOOD & BEVERAGE

95,700

1D -0.31%

5D -3.63%

Buy Vol. 5,354,300

Sell Vol. 6,154,700

98,000

1D 3.16%

5D -7.11%

Buy Vol. 4,486,800

Sell Vol. 4,154,700

20,250

1D -1.46%

5D -4.26%

Buy Vol. 2,754,500

Sell Vol. 4,297,800

- VNM: Q1.2020, total revenue reached 13,241b, down 7% QoQ and reached 21.3% of the plan. Profit after tax was 2,597b, down 6% QoQ last year and reached 23% of the year plan.

OTHERS

127,200

1D -0.24%

5D -2.90%

Buy Vol. 568,200

Sell Vol. 640,800

127,200

1D -0.24%

5D -2.90%

Buy Vol. 568,200

Sell Vol. 640,800

80,700

1D -0.37%

5D -2.65%

Buy Vol. 3,064,900

Sell Vol. 2,681,800

141,900

1D -0.42%

5D -0.42%

Buy Vol. 2,885,900

Sell Vol. 1,495,200

96,000

1D 1.05%

5D 1.69%

Buy Vol. 775,200

Sell Vol. 903,300

51,000

1D -0.58%

5D -1.92%

Buy Vol. 871,300

Sell Vol. 874,600

31,800

1D 0.32%

5D -6.74%

Buy Vol. 17,124,000

Sell Vol. 12,865,100

56,300

1D 2.18%

5D -1.57%

Buy Vol. 41,206,100

Sell Vol. 40,242,000

- MWG: just announced Q1/2021 business with net revenue of over 30.8 trillion dong and after tax profit of over 1.3 trillion dong, up by 5% and 18% QoQ, respectively. However, in the electronics and mobile phone business in Cambodia, Bluetronics (a brand of MWG) currently has 52 stores in this country and has stopped opening because of the complicated epidemic situation here.

Market by numbers

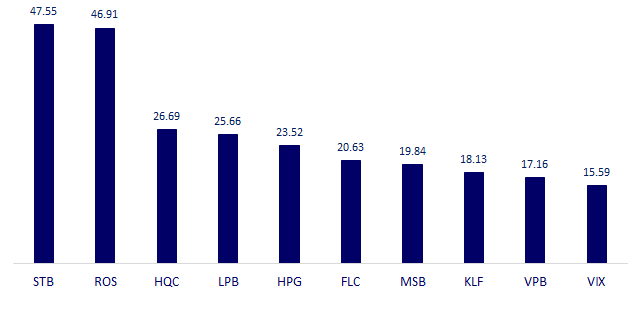

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

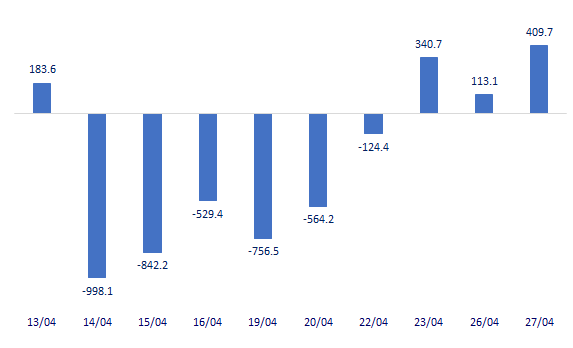

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

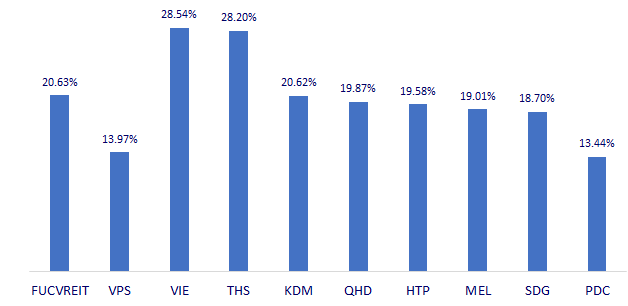

TOP INCREASES 3 CONSECUTIVE SESSIONS

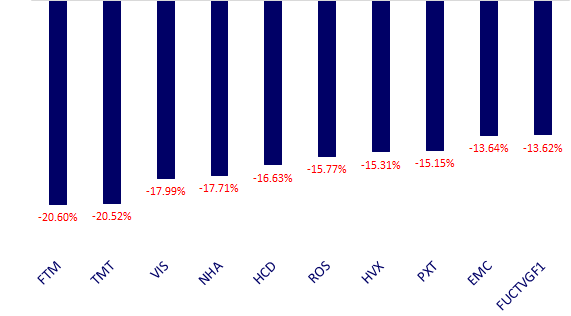

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.