Market Brief 29/04/2021

VIETNAM STOCK MARKET

1,239.39

1D 0.80%

YTD 12.72%

1,312.28

1D 1.41%

YTD 23.99%

281.75

1D -0.11%

YTD 42.95%

80.68

1D 0.70%

YTD 9.28%

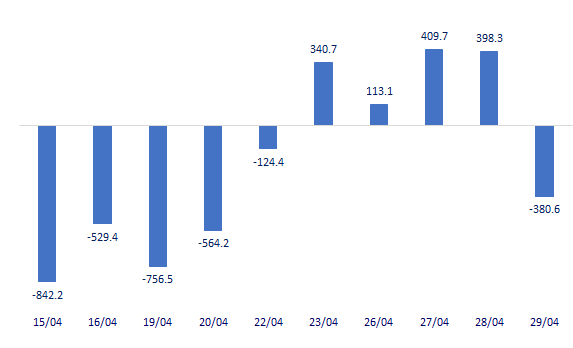

-380.61

1D 0.00%

YTD 0.00%

21,977.16

1D 25.76%

YTD 28.12%

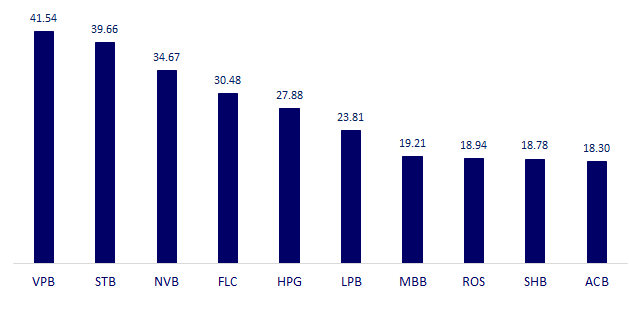

- Foreign investors ended the chain of net buying for 4 consecutive sessions with a net selling of 381 billion dong. VPB was strongly net sold by foreign investors with the value of nearly 580 billion dong. Foreigners were net buyers with the strongest net buying value of HPG with 113 billion dong.

ETF & DERIVATIVES

22,000

1D 1.71%

YTD 17.02%

15,690

1D 5.59%

YTD 25.22%

16,240

1D 1.75%

YTD 21.83%

19,050

1D 0.26%

YTD 20.57%

17,550

1D 1.98%

YTD 28.57%

21,900

1D 2.10%

YTD 27.33%

16,510

1D 0.00%

YTD 18.35%

1,280

1D 1.15%

YTD 0.00%

1,296

1D 1.65%

YTD 0.00%

1,299

1D 2.28%

YTD 0.00%

1,301

1D 2.04%

YTD 0.00%

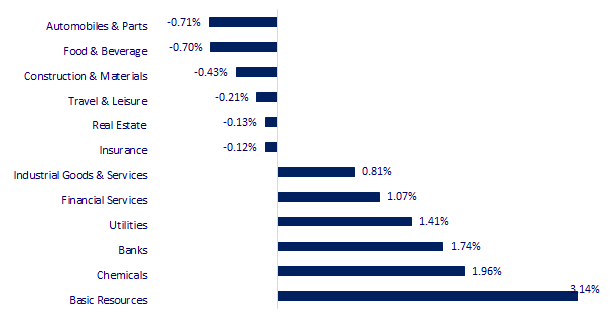

CHANGE IN PRICE BY SECTOR

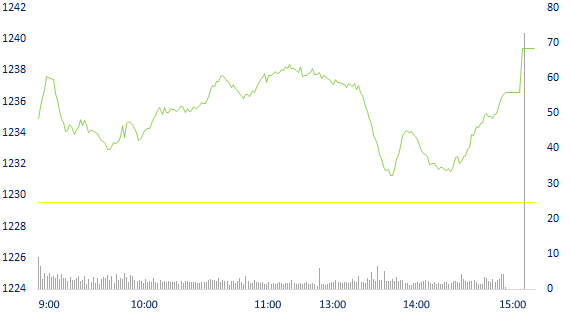

INTRADAY VNINDEX

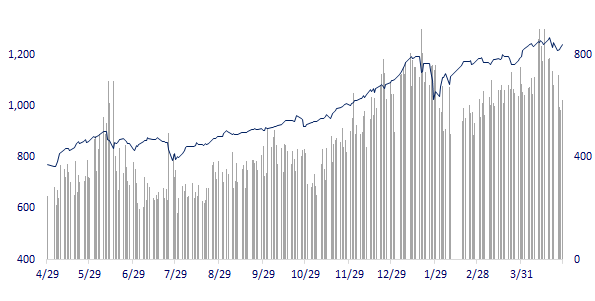

VNINDEX (12M)

GLOBAL MARKET

29,053.97

1D 0.00%

YTD 5.87%

3,474.90

1D 0.52%

YTD 1.77%

3,174.07

1D -0.23%

YTD 10.46%

29,303.00

1D -0.23%

YTD 7.94%

3,221.58

1D 0.06%

YTD 12.28%

1,590.46

1D 0.87%

YTD 9.74%

64.68

1D 0.84%

YTD 33.91%

1,776.15

1D -0.68%

YTD -6.70%

- Asian stocks mostly rose, Japanese markets were on a holiday. China market went up with Shanghai Composite up 0.52% and Shenzhen Component up 0.45%. Hong Kong's Hang Seng decreased by 0.23%. South Korea's Kospi index fell 0.23%.

VIETNAM ECONOMY

1.20%

1D (bps) 15

YTD (bps) 107

5.60%

YTD (bps) -20

1.29%

1D (bps) 2

YTD (bps) 7

2.36%

1D (bps) 2

YTD (bps) 33

23,160

1D (%) 0.03%

YTD (%) -0.08%

28,655

1D (%) -0.22%

YTD (%) -1.54%

3,635

1D (%) 0.06%

YTD (%) 1.74%

- Out of a total of more than 12 billion USD of foreign investment in Vietnam in the first four months of the year, 451 new projects were granted investment registration certificates, a decrease of 54.2% over the same period, the total registered capital reached. nearly 8.5 billion USD, up 24.7% over the same period in 2020.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Foreign investment in Vietnam started to slow down, FDI in the first four months of the year reached more than 12 billion USD

- Australia concludes that the dumping margin of Vietnam coated steel is negligible

- Newly established businesses have the highest growth rate in 5 years, especially in real estate industry

- China cancels export tax refund for HRC steel and other products

- President Biden challenges China's ambitions

- India, Japan, Australia founded supply chain initiatives to deal with China

VN30

BANK

100,000

1D 1.01%

5D -2.91%

Buy Vol. 2,677,200

Sell Vol. 2,706,600

41,000

1D 0.99%

5D 0.00%

Buy Vol. 4,073,600

Sell Vol. 4,100,900

40,800

1D 2.64%

5D 4.21%

Buy Vol. 35,331,400

Sell Vol. 24,163,400

41,000

1D 2.63%

5D 3.27%

Buy Vol. 33,879,500

Sell Vol. 34,148,300

58,500

1D 6.36%

5D 19.39%

Buy Vol. 52,034,100

Sell Vol. 62,896,000

30,350

1D 0.33%

5D 3.94%

Buy Vol. 35,702,500

Sell Vol. 37,757,200

27,250

1D 1.49%

5D 3.61%

Buy Vol. 9,086,600

Sell Vol. 12,158,500

27,400

1D 0.55%

5D 1.48%

Buy Vol. 12,559,800

Sell Vol. 9,336,700

23,900

1D -1.24%

5D 13.81%

Buy Vol. 56,112,400

Sell Vol. 88,851,000

- BID: BIDV tightens the debt of nearly 500 billion, which is guaranteed by NEM fashion shares, in which the total outstanding loans as of April 15, 2021 are 498 billion dong, of which principal debt is 257 billion dong, interest debt is 173. 8 billion VND, penalty fee 67 billion overdue.

REAL ESTATE

131,400

1D 2.66%

5D 22.46%

Buy Vol. 4,525,100

Sell Vol. 5,525,100

21,700

1D -1.36%

5D 0.93%

Buy Vol. 6,065,000

Sell Vol. 8,890,600

35,150

1D 0.86%

5D 6.52%

Buy Vol. 33,540,700

Sell Vol. 13,951,400

70,200

1D -1.82%

5D 2.63%

Buy Vol. 4,013,000

Sell Vol. 4,235,200

- KDH: In Q1.2021, KDH achieved a profit of more than 200b dong, up 30% over the same period and fulfilling 17% of the year plan. In 2021, KDH targets revenue of VND4,800b, profit after tax of VND1,200b, up 6% and 4% respectively last year.

OIL & GAS

83,500

1D 1.95%

5D -2.68%

Buy Vol. 1,793,100

Sell Vol. 1,466,300

12,300

1D 0.82%

5D -0.40%

Buy Vol. 12,633,200

Sell Vol. 16,421,800

50,300

1D 0.60%

5D -1.37%

Buy Vol. 1,782,300

Sell Vol. 1,949,300

- The US WTI crude oil rose 0.02% to $63.86/barrel at 7:15 (GMT) on April 29. While the price of Brent crude oil delivered in June increased 0.27% to $66.71/barrel.

VINGROUP

131,000

1D -0.38%

5D -5.62%

Buy Vol. 4,399,600

Sell Vol. 3,845,300

99,300

1D -1.59%

5D -3.69%

Buy Vol. 9,865,300

Sell Vol. 10,205,400

32,000

1D 1.59%

5D -0.62%

Buy Vol. 10,748,700

Sell Vol. 11,508,400

- VHM: In Q1, VHM recorded net revenue of nearly 12.99 trillion dong, nearly 2 times higher than same period last year and net profit of nearly 5.4 trillion dong.

FOOD & BEVERAGE

93,500

1D -0.21%

5D -4.59%

Buy Vol. 12,376,000

Sell Vol. 10,646,000

98,000

1D -1.01%

5D -0.20%

Buy Vol. 3,423,300

Sell Vol. 4,474,000

20,000

1D -2.20%

5D 1.52%

Buy Vol. 4,767,400

Sell Vol. 5,222,700

- VNM: SCIC and Platium Victory PTE. Ltd registered to trade but these two organizations still could not buy any shares due to unfavorable market conditions.

OTHERS

124,900

1D -0.87%

5D -4.22%

Buy Vol. 616,200

Sell Vol. 825,900

124,900

1D -0.87%

5D -4.22%

Buy Vol. 616,200

Sell Vol. 825,900

80,900

1D 0.12%

5D 1.13%

Buy Vol. 3,880,100

Sell Vol. 3,729,800

140,900

1D 0.64%

5D -1.12%

Buy Vol. 3,490,400

Sell Vol. 1,058,100

98,000

1D 2.40%

5D 4.37%

Buy Vol. 1,641,500

Sell Vol. 1,926,000

53,600

1D 5.10%

5D 4.69%

Buy Vol. 1,396,800

Sell Vol. 1,546,400

32,600

1D 1.56%

5D 2.68%

Buy Vol. 16,351,600

Sell Vol. 19,929,300

58,100

1D 3.75%

5D 5.64%

Buy Vol. 56,104,500

Sell Vol. 52,639,200

- SSI: sets targets for 2021 with the goal of reaching 5,263 billion dong in revenue. Expected pre-tax profit is 1,870 billion VND, up 312 billion VND compared to the implementation level in 2020 and is the highest among securities companies that have submitted a business plan to 2021. SSI rewards shares 6: 2, issue 6: 1

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

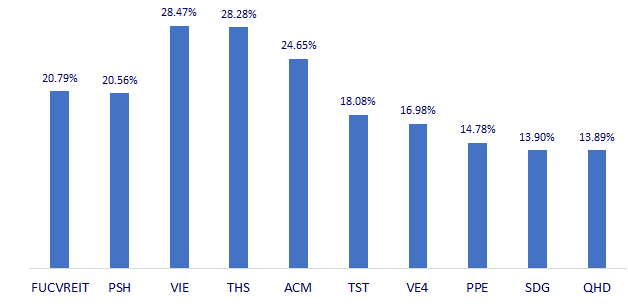

TOP INCREASES 3 CONSECUTIVE SESSIONS

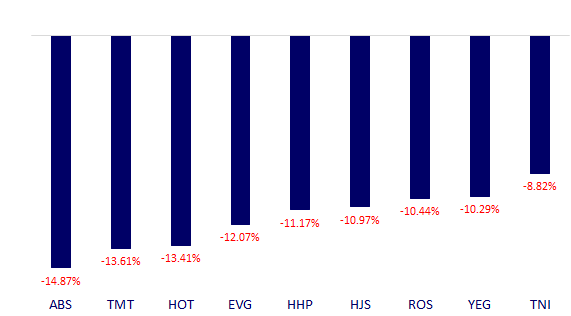

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.