Market Brief 05/05/2021

VIETNAM STOCK MARKET

1,256.43

1D 1.15%

YTD 14.27%

1,346.89

1D 1.42%

YTD 27.26%

280.93

1D 1.16%

YTD 42.53%

80.66

1D 1.00%

YTD 9.25%

-767.28

1D 0.00%

YTD 0.00%

24,635.92

1D 4.82%

YTD 43.62%

- Foreign investors net sold 1,900 billion dong on HoSE after only 3 sessions. In today's session, HPG still led the list of net sellers with the value of 190.5 billion dong. VRE and CTG were net sold at 188 billion and 173 billion dong, respectively. Next was MSB with net selling value of 110 billion dong. On the other side, VPB was bought the most with 114 billion dong.

ETF & DERIVATIVES

22,500

1D 1.35%

YTD 19.68%

15,770

1D 1.28%

YTD 25.86%

16,840

1D 2.18%

YTD 26.33%

19,600

1D 2.62%

YTD 24.05%

18,580

1D 3.22%

YTD 36.12%

22,650

1D 2.26%

YTD 31.69%

17,100

1D 1.18%

YTD 22.58%

1,329

1D 1.22%

YTD 0.00%

1,332

1D 1.07%

YTD 0.00%

1,333

1D 1.07%

YTD 0.00%

1,336

1D 1.20%

YTD 0.00%

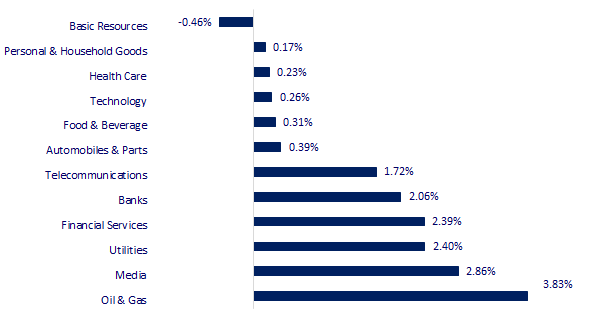

CHANGE IN PRICE BY SECTOR

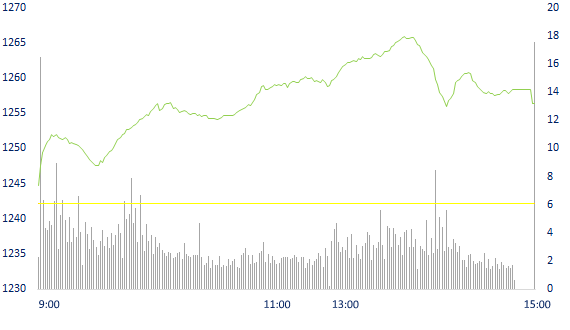

INTRADAY VNINDEX

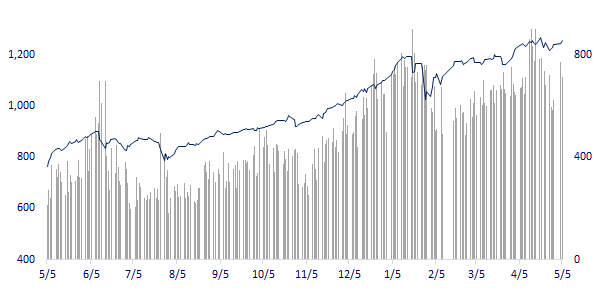

VNINDEX (12M)

GLOBAL MARKET

28,812.63

1D 0.00%

YTD 4.99%

3,446.86

1D 0.00%

YTD 0.95%

3,147.37

1D 0.00%

YTD 9.53%

28,436.50

1D -0.38%

YTD 4.75%

3,153.59

1D -0.80%

YTD 9.91%

1,549.22

1D -2.14%

YTD 6.89%

66.42

1D 1.53%

YTD 37.52%

1,776.45

1D -0.50%

YTD -6.68%

- Asian stocks were almost flat, a series of major markets were on holiday. Japanese, Chinese, Korean markets for a holiday. Hong Kong's Hang Seng decreased by 0.38%.

VIETNAM ECONOMY

0.95%

1D (bps) 5

YTD (bps) 82

5.60%

YTD (bps) -20

1.34%

1D (bps) -2

YTD (bps) 12

2.14%

1D (bps) -6

YTD (bps) 11

23,165

1D (%) 0.00%

YTD (%) -0.06%

28,415

1D (%) -0.06%

YTD (%) -2.36%

3,633

1D (%) 0.00%

YTD (%) 1.68%

- According to the Ministry of Agriculture and Rural Development, in the first 4 months of the year, the total import-export turnover of agricultural, forestry and aquatic products (AFF) was estimated at 32.07 billion USD, of which exports reached about 17.15 billion USD, up 24.2% over the same period last year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Export of agricultural, forestry and aquatic products in 4 months increased by 24.2%.

- The budget revenue of Quang Nam province in the first 4 months of the year is nearly 9,500 billion VND

- Reduce coal and hydroelectric power to make room for solar power

- The United States has a record trade deficit

- Japan considered extending the emergency

- The debt was swollen, China halted two $20b railway projects

VN30

BANK

101,200

1D 2.12%

5D 2.22%

Buy Vol. 2,936,600

Sell Vol. 3,608,200

41,900

1D 1.45%

5D 3.20%

Buy Vol. 5,661,500

Sell Vol. 4,829,600

43,350

1D 0.81%

5D 9.06%

Buy Vol. 34,126,200

Sell Vol. 46,828,400

45,950

1D 5.88%

5D 15.02%

Buy Vol. 48,546,700

Sell Vol. 47,389,200

60,600

1D 1.85%

5D 10.18%

Buy Vol. 35,158,100

Sell Vol. 31,146,400

31,700

1D 1.44%

5D 4.79%

Buy Vol. 41,477,700

Sell Vol. 49,248,300

29,050

1D 6.80%

5D 8.19%

Buy Vol. 29,023,100

Sell Vol. 26,595,900

28,650

1D 2.32%

5D 5.14%

Buy Vol. 9,530,800

Sell Vol. 11,412,500

24,700

1D 2.49%

5D 2.07%

Buy Vol. 106,982,100

Sell Vol. 96,994,400

- MBB: In Q1.2021, non-interest income sources increased sharply such as net income from services (+43%), profits from trading securities, investment securities (+39%), and profits from trading. foreign exchange (+48%). Most notably, profit from other activities was 5 times higher than the same period, reaching nearly 1,217 billion dong, mainly because MB recorded revenue from processed debts of more than 1,107 billion dong.

REAL ESTATE

133,000

1D 1.14%

5D 3.91%

Buy Vol. 2,682,400

Sell Vol. 2,669,200

22,500

1D -0.22%

5D 2.27%

Buy Vol. 6,193,700

Sell Vol. 8,393,100

36,550

1D -1.08%

5D 4.88%

Buy Vol. 9,926,100

Sell Vol. 7,203,200

72,300

1D -0.96%

5D 1.12%

Buy Vol. 3,817,800

Sell Vol. 4,158,600

- PDR: Decision of the Board of Directors approving the plan to issue bonds for the third time in 2021 with a total value of 130 billion dong.

OIL & GAS

85,500

1D 2.64%

5D 4.40%

Buy Vol. 1,704,100

Sell Vol. 1,432,800

12,700

1D 5.39%

5D 4.10%

Buy Vol. 38,005,200

Sell Vol. 27,841,700

50,900

1D 2.52%

5D 1.80%

Buy Vol. 2,447,400

Sell Vol. 2,431,800

- PLX: Q1.2021 consolidated EAT is 736 billion dong (in the same period last year, a loss of 1,813 billion dong) is mainly due to an increase in world oil prices.

VINGROUP

133,700

1D 0.07%

5D 1.67%

Buy Vol. 2,457,900

Sell Vol. 1,916,300

99,600

1D 0.40%

5D -1.29%

Buy Vol. 5,250,600

Sell Vol. 5,372,500

31,600

1D 0.96%

5D 0.32%

Buy Vol. 19,030,000

Sell Vol. 14,798,900

- VIC: Vinfast transferred ownership of nearly 27.5 million VIC shares. After the transaction, Vinfast no longer owns VIC shares

FOOD & BEVERAGE

92,000

1D 0.44%

5D -1.81%

Buy Vol. 6,656,900

Sell Vol. 6,644,600

96,000

1D 0.10%

5D -3.03%

Buy Vol. 3,342,200

Sell Vol. 3,014,000

19,950

1D 1.01%

5D -2.44%

Buy Vol. 4,540,000

Sell Vol. 5,000,200

- SBT: In the 9 months of 2020-2021, SBT consumes 877,000 tons of sugar, up nearly 26% over the same period, net revenue is 10,749 billion dong, up by 18%.

OTHERS

124,500

1D 0.40%

5D -1.19%

Buy Vol. 601,500

Sell Vol. 666,200

124,500

1D 0.40%

5D -1.19%

Buy Vol. 601,500

Sell Vol. 666,200

82,900

1D 0.00%

5D 2.60%

Buy Vol. 4,000,700

Sell Vol. 5,744,100

140,900

1D 1.08%

5D 0.64%

Buy Vol. 3,033,400

Sell Vol. 1,667,800

97,000

1D 1.89%

5D 1.36%

Buy Vol. 931,000

Sell Vol. 1,098,200

52,800

1D 1.34%

5D 3.53%

Buy Vol. 821,700

Sell Vol. 1,003,000

33,600

1D 2.13%

5D 4.67%

Buy Vol. 20,282,500

Sell Vol. 25,008,900

59,300

1D -0.84%

5D 5.89%

Buy Vol. 41,152,100

Sell Vol. 44,898,400

- VJC: Q1.2021, consolidated revenue and profit after tax reached VND 4,048 billion and VND 123 billion respectively. This profit comes from Vietjet investment in projects, financial investment, development of aviation services, compensating for air transport operations.

Market by numbers

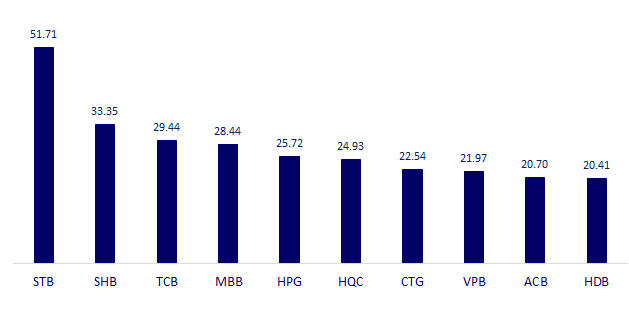

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

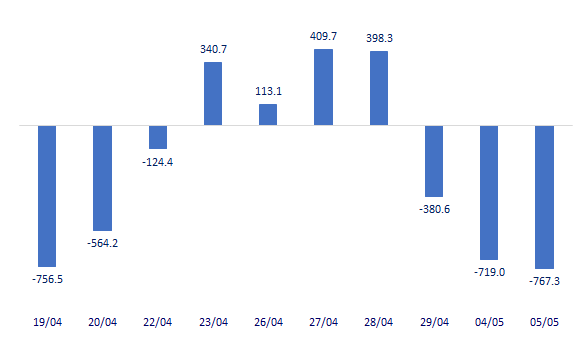

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

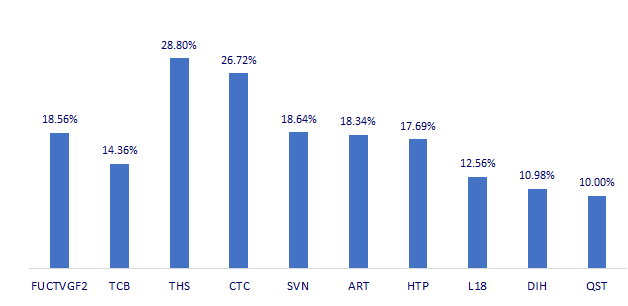

TOP INCREASES 3 CONSECUTIVE SESSIONS

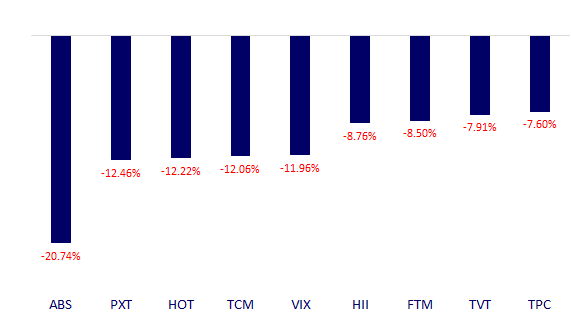

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.