Market Brief 07/05/2021

VIETNAM STOCK MARKET

1,241.81

1D -0.70%

YTD 12.94%

1,340.73

1D -0.29%

YTD 26.68%

279.86

1D -0.44%

YTD 41.99%

80.85

1D -0.41%

YTD 9.51%

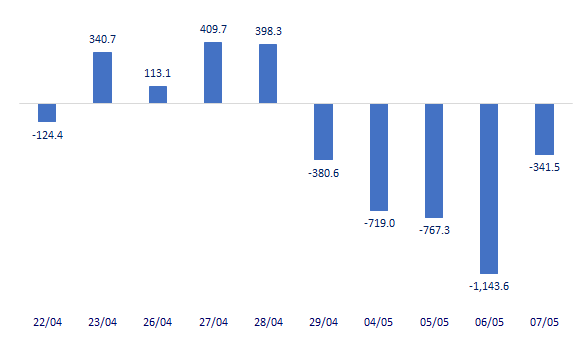

-341.47

1D 0.00%

YTD 0.00%

26,101.38

1D 14.72%

YTD 52.17%

- Session 7/5: Foreign investors continued to net sell nearly 341 billion dong, the selling focused on Bluechips like VPB (-369 billion dong), HPG (-124 billion dong), VNM (-95 billion dong) …

ETF & DERIVATIVES

22,400

1D 0.00%

YTD 19.15%

15,750

1D 1.22%

YTD 25.70%

16,680

1D -0.71%

YTD 25.13%

19,400

1D -1.02%

YTD 22.78%

18,500

1D -0.48%

YTD 35.53%

23,000

1D -2.95%

YTD 33.72%

17,140

1D 0.41%

YTD 22.87%

1,307

1D -0.98%

YTD 0.00%

1,310

1D -1.87%

YTD 0.00%

1,320

1D -0.68%

YTD 0.00%

1,324

1D -0.95%

YTD 0.00%

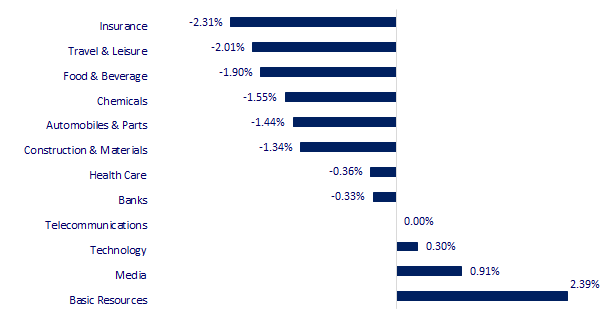

CHANGE IN PRICE BY SECTOR

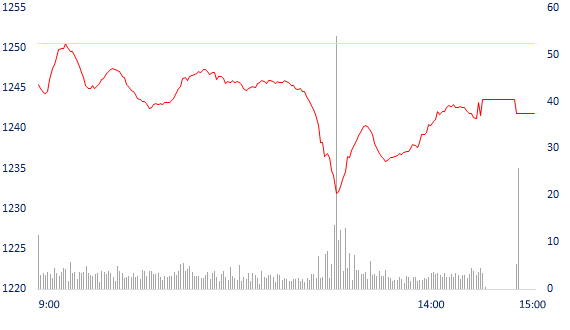

INTRADAY VNINDEX

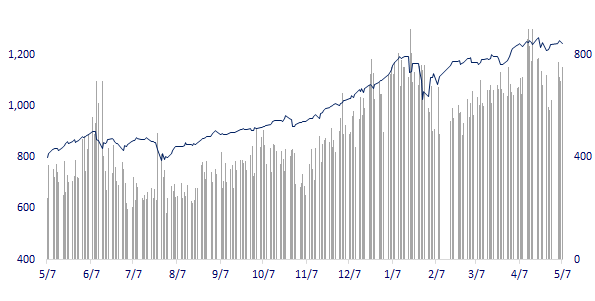

VNINDEX (12M)

GLOBAL MARKET

29,357.82

1D -0.22%

YTD 6.97%

3,418.87

1D -0.65%

YTD 0.13%

3,197.20

1D 0.58%

YTD 11.27%

28,628.00

1D -0.44%

YTD 5.46%

3,200.26

1D 0.86%

YTD 11.54%

1,583.66

1D 0.75%

YTD 9.27%

64.55

1D -0.23%

YTD 33.64%

1,820.50

1D 0.34%

YTD -4.37%

- Asian stocks mostly declined despite Wall Street's positive session. In Japan, the Nikkei 225 decreased by 0.22%. The Chinese market could not hold its momentum, closing in the red with the Shanghai Composite down 0.65% and the Shenzhen Component down 1.95%. Hong Kong's Hang Seng decreased by 0.44%. In South Korea, the Kospi increased by 0.58%.

VIETNAM ECONOMY

1.14%

YTD (bps) 101

5.60%

YTD (bps) -20

1.37%

YTD (bps) 15

2.24%

1D (bps) 2

YTD (bps) 21

23,160

1D (%) -0.02%

YTD (%) -0.08%

28,541

1D (%) 0.03%

YTD (%) -1.93%

3,640

1D (%) 0.05%

YTD (%) 1.88%

- According to the report of the Ministry of Industry and Trade, the export turnover of goods in April 2021 was estimated at 25.5 billion USD, down 14% from the previous month, of which the domestic economic sector reached 6.69 billion USD, down 11.4%; foreign investment sector (including crude oil) reached 18.8 billion USD, down 14.9%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Bac Ninh: Que Vo II Industrial Park - Phase 2 is over 277 hectares

- Made-in-Vietnam phones and computers export growth has grown by two digits

- More than 100,000 billion VND to invest in Roadway 4 going through Hanoi, Hung Yen, Bac Ninh

- US President Joe Biden will maintain pressure on China by continuing investment bans under Donald Trump

- Fed warns the stock market to face the risk of 'red fire' when asset prices rise too high

- The US President can accept a lower corporate tax rate than the proposal

VN30

BANK

97,000

1D -2.32%

5D -3.00%

Buy Vol. 3,701,100

Sell Vol. 3,821,200

40,650

1D -1.45%

5D -0.85%

Buy Vol. 6,654,200

Sell Vol. 6,487,100

43,800

1D 2.10%

5D 7.35%

Buy Vol. 48,765,900

Sell Vol. 43,293,000

47,050

1D -0.11%

5D 14.76%

Buy Vol. 42,183,900

Sell Vol. 40,810,100

61,500

1D -0.49%

5D 5.13%

Buy Vol. 54,865,600

Sell Vol. 49,966,000

31,600

1D 0.00%

5D 4.12%

Buy Vol. 45,775,000

Sell Vol. 41,518,400

30,000

1D 4.17%

5D 10.09%

Buy Vol. 28,963,600

Sell Vol. 29,053,800

29,100

1D 3.37%

5D 6.20%

Buy Vol. 20,765,800

Sell Vol. 24,037,400

24,000

1D -1.64%

5D 0.42%

Buy Vol. 97,402,600

Sell Vol. 93,489,300

- BID: 76% of bad debt BIDV is likely to lose capital, coverage rate exceeds 100%. The bank raised its NPL coverage from 89% to 107% in Q1. Group 5 debt accounts for 76% of total NPLs. BIDV's pre-tax profit was 7,173 billion dong, up 88% in the first quarter, fulfilling 55% of the year plan. Profit from other activities increased by 210%, reaching VND 1,805 billion.

REAL ESTATE

135,800

1D 0.07%

5D 3.35%

Buy Vol. 3,327,300

Sell Vol. 3,092,500

21,900

1D -3.52%

5D 0.92%

Buy Vol. 10,405,100

Sell Vol. 12,026,400

36,300

1D -0.41%

5D 3.27%

Buy Vol. 9,819,800

Sell Vol. 10,620,900

70,900

1D -1.25%

5D 1.00%

Buy Vol. 3,378,000

Sell Vol. 3,563,600

- PDR: Phat Dat has just completed the payment of all foreign loans worth 22.5 million USD to Vietnam New Urban Center LP Fund on time as committed by the parties.

OIL & GAS

84,000

1D -1.06%

5D 0.60%

Buy Vol. 1,363,800

Sell Vol. 1,399,800

12,100

1D -1.63%

5D -1.63%

Buy Vol. 22,754,500

Sell Vol. 22,299,700

50,700

1D -0.20%

5D 0.80%

Buy Vol. 3,075,200

Sell Vol. 2,993,200

- PLX: Q1.2021 net profit is 661 billion dong, flying fuel segment is affected by Covid-19

VINGROUP

132,000

1D -0.38%

5D 0.76%

Buy Vol. 2,844,700

Sell Vol. 2,594,000

97,100

1D -1.62%

5D -2.22%

Buy Vol. 9,076,500

Sell Vol. 8,858,200

31,000

1D -0.64%

5D -3.13%

Buy Vol. 9,736,700

Sell Vol. 11,329,500

- Vingroup recently reported selling more than 12.28m VGT shares - half of the previous 25m shares registered to be sold. The transaction is carried out from 01-29/04/2021.

FOOD & BEVERAGE

87,000

1D -2.90%

5D -6.95%

Buy Vol. 14,241,300

Sell Vol. 10,803,300

95,000

1D -0.63%

5D -3.06%

Buy Vol. 4,525,600

Sell Vol. 4,158,400

19,350

1D -2.52%

5D -3.25%

Buy Vol. 3,824,900

Sell Vol. 4,992,600

- VNM: In 2020, VNM recorded a 6% growth in revenue, mainly thanks to the consolidation of Moc Chau Milk's business results, while the purchasing power of the market was weak.

OTHERS

119,500

1D -2.05%

5D -4.32%

Buy Vol. 568,500

Sell Vol. 970,400

119,500

1D -2.05%

5D -4.32%

Buy Vol. 568,500

Sell Vol. 970,400

83,000

1D 0.36%

5D 2.60%

Buy Vol. 4,648,200

Sell Vol. 5,930,300

140,200

1D -1.27%

5D -0.50%

Buy Vol. 2,336,600

Sell Vol. 1,681,900

95,500

1D -0.52%

5D -2.55%

Buy Vol. 1,052,600

Sell Vol. 1,349,300

56,100

1D 1.81%

5D 4.66%

Buy Vol. 1,834,600

Sell Vol. 1,862,100

32,700

1D -0.46%

5D 0.31%

Buy Vol. 20,492,400

Sell Vol. 24,761,100

60,800

1D 2.36%

5D 4.65%

Buy Vol. 59,909,500

Sell Vol. 47,585,100

- HPG: Chairman of the Board of Directors Tran Dinh Long and his family are holding approximately 35% capital of Hoa Phat Group, so they will receive nearly 580 billion dong of cash dividend in the next few months. Mr. Long intends to use dividends to buy more HPG shares.

Market by numbers

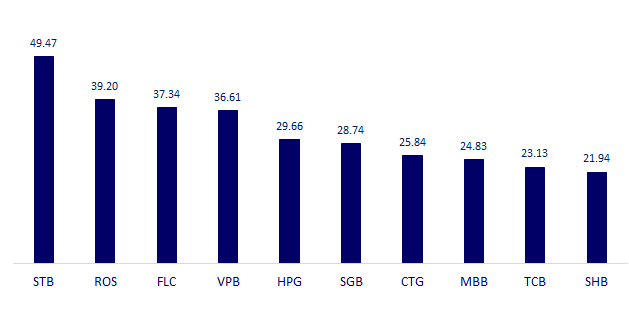

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

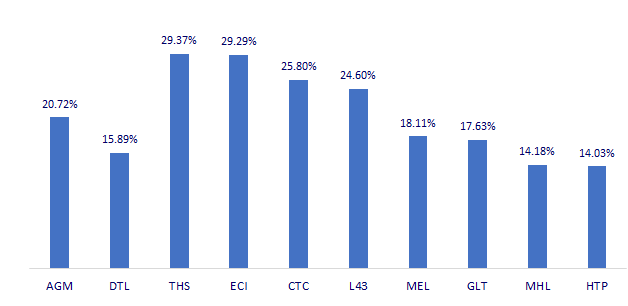

TOP INCREASES 3 CONSECUTIVE SESSIONS

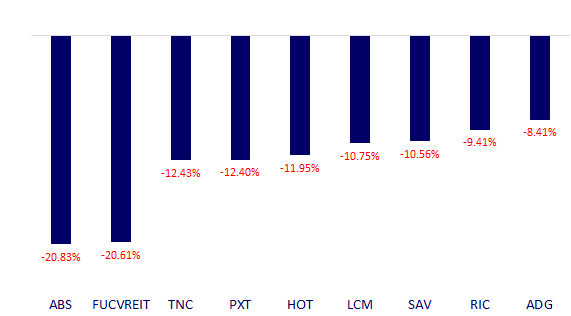

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.