Market Brief 12/05/2021

VIETNAM STOCK MARKET

1,269.09

1D 1.04%

YTD 15.43%

1,380.17

1D 1.54%

YTD 30.40%

282.33

1D 0.92%

YTD 43.24%

81.47

1D 0.49%

YTD 10.35%

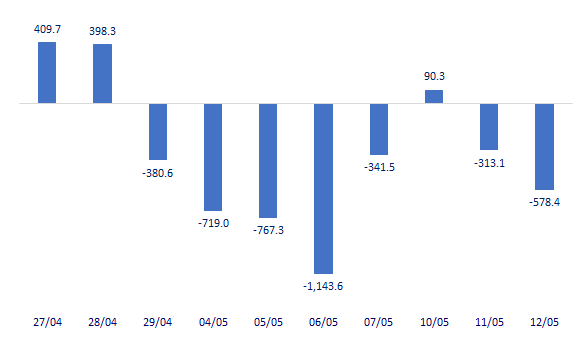

-578.37

1D 0.00%

YTD 0.00%

23,446.68

1D -8.13%

YTD 36.69%

- Despite the market's rally, foreign investors still net sold 578 billion dong in session 12/5. The selling focused on Bluechips like HPG (-229.6 billion dong), NVL (-142.8 billion dong), VIC (-102.2 billion dong), MSN (-53.9 billion dong) …

ETF & DERIVATIVES

23,090

1D -0.60%

YTD 22.82%

16,080

1D 2.62%

YTD 28.33%

17,050

1D 0.00%

YTD 27.91%

19,900

1D 0.51%

YTD 25.95%

19,300

1D 1.53%

YTD 41.39%

22,600

1D 0.80%

YTD 31.40%

17,260

1D -0.17%

YTD 23.73%

1,369

1D 2.70%

YTD 0.00%

1,334

1D -1.62%

YTD 0.00%

1,378

1D 2.29%

YTD 0.00%

1,382

1D 2.37%

YTD 0.00%

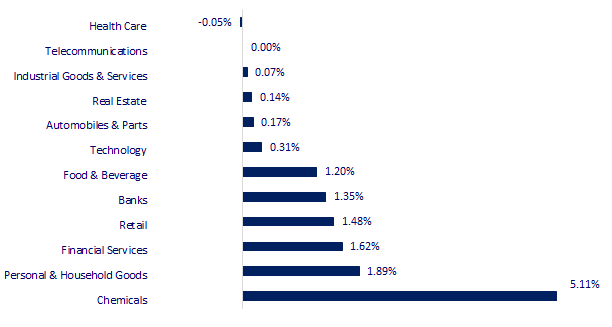

CHANGE IN PRICE BY SECTOR

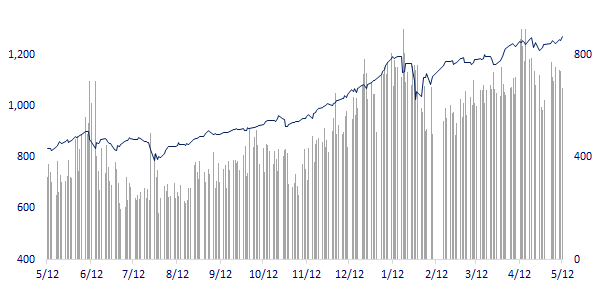

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,147.51

1D -1.03%

YTD 2.56%

3,462.75

1D 0.61%

YTD 1.41%

3,161.66

1D -1.49%

YTD 10.03%

28,185.12

1D 0.66%

YTD 3.82%

3,123.26

1D -0.67%

YTD 8.85%

1,571.85

1D -0.45%

YTD 8.45%

66.06

1D 1.13%

YTD 36.77%

1,834.95

1D 0.23%

YTD -3.61%

- Investors are cautious about inflation, a series of Asian stock markets are mixed. In Japan, the Nikkei 225 decreased by 1.03%. The Chinese market moved up towards the end of the session with the Shanghai Composite up 0.61% and the Shenzhen Component up 0.7%. Hong Kong's Hang Seng increased by 0.67%. South Korea's Kospi index fell 1.49%.

VIETNAM ECONOMY

1.24%

YTD (bps) 111

5.60%

YTD (bps) -20

1.25%

1D (bps) -12

YTD (bps) 3

2.32%

1D (bps) 11

YTD (bps) 29

23,147

1D (%) -0.02%

YTD (%) -0.13%

28,574

1D (%) -0.38%

YTD (%) -1.82%

3,649

1D (%) -0.19%

YTD (%) 2.13%

- According to the General Statistics Office, industrial production price index in April 2021 increased by 0.38% over the previous month and by 2.41% over the same period last year. 0.8%. In which, PPI of metal products group in April 2021 increased by 2.25% over the previous month and by 11.18% over the same period in 2020; average 4 months increased by 7.7%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Remittances to Ho Chi Minh City are expected to set a new record this year

- The cargo market exploded, with the hiring of bulk carriers increasing by 700% over a year

- Raw material price escalated, steel enterprises had difficulty

- The EIA forecasts a further decline in US crude production in 2021

- The US agrees to remove Xiaomi from the blacklist

- WHO: The new strain of corona virus in India is a global health hazard

VN30

BANK

97,300

1D -0.61%

5D -3.85%

Buy Vol. 2,781,600

Sell Vol. 2,148,200

42,650

1D 1.31%

5D 1.79%

Buy Vol. 6,416,000

Sell Vol. 6,125,200

45,000

1D 1.81%

5D 3.81%

Buy Vol. 38,911,300

Sell Vol. 29,861,100

49,250

1D 4.79%

5D 7.18%

Buy Vol. 44,200,500

Sell Vol. 35,420,700

64,000

1D 1.59%

5D 5.61%

Buy Vol. 51,135,600

Sell Vol. 42,436,300

33,200

1D 1.53%

5D 4.73%

Buy Vol. 38,764,200

Sell Vol. 34,112,000

30,200

1D 0.67%

5D 3.96%

Buy Vol. 16,247,400

Sell Vol. 16,512,500

31,950

1D 3.06%

5D 11.52%

Buy Vol. 15,488,200

Sell Vol. 14,191,900

26,350

1D 6.90%

5D 6.68%

Buy Vol. 132,933,400

Sell Vol. 96,208,100

- BID: BIDV announced to choose an auction unit for a debt of nearly 126 billion dong of Imex Cuu Long, secured by a series of land use rights in Vinh Long and Dong Thap provinces with a total area of nearly 2 hectares.

REAL ESTATE

130,000

1D 1.17%

5D -2.26%

Buy Vol. 3,016,900

Sell Vol. 2,466,600

22,300

1D 0.90%

5D -0.89%

Buy Vol. 6,076,300

Sell Vol. 5,925,300

37,100

1D 0.82%

5D 1.50%

Buy Vol. 6,663,400

Sell Vol. 5,148,200

72,600

1D 4.46%

5D 0.41%

Buy Vol. 6,203,000

Sell Vol. 5,445,500

- NVL: Converted 92.6 international convertible bonds with the conversion rate of 75,910 shares/bonds into shares of No Va Real Estate Group JSC.

OIL & GAS

86,400

1D 1.29%

5D 1.05%

Buy Vol. 1,246,600

Sell Vol. 1,525,700

12,450

1D 1.22%

5D -1.97%

Buy Vol. 22,807,400

Sell Vol. 21,463,400

53,300

1D 0.57%

5D 4.72%

Buy Vol. 4,689,400

Sell Vol. 3,496,900

- The price of Brent crude for July delivery rose 0.29% to $68.89/barrel. Gasoline futures ended the session with an increase of 0.3% to $2.14/gallon

VINGROUP

129,800

1D -0.92%

5D -2.92%

Buy Vol. 2,365,200

Sell Vol. 2,249,700

97,700

1D -0.31%

5D -1.91%

Buy Vol. 7,843,600

Sell Vol. 7,189,300

31,200

1D 0.65%

5D -1.27%

Buy Vol. 7,842,000

Sell Vol. 7,251,100

- VIC: In the top net selling of foreign investors today with a value of 102 billion dong

FOOD & BEVERAGE

91,800

1D 0.66%

5D -0.22%

Buy Vol. 6,437,500

Sell Vol. 6,446,700

104,000

1D 2.46%

5D 8.33%

Buy Vol. 4,133,300

Sell Vol. 4,813,600

21,450

1D 6.45%

5D 7.52%

Buy Vol. 10,917,100

Sell Vol. 7,918,100

- MSN: In the first quarter, Masan Group only opened 12 new stores of VinMart + and at the same time continued to close 31 inefficient mini-supermarkets.

OTHERS

119,000

1D 0.00%

5D -4.42%

Buy Vol. 730,300

Sell Vol. 661,200

119,000

1D 0.00%

5D -4.42%

Buy Vol. 730,300

Sell Vol. 661,200

85,400

1D 0.23%

5D 3.02%

Buy Vol. 3,663,100

Sell Vol. 3,038,300

139,500

1D 1.45%

5D -0.99%

Buy Vol. 1,574,100

Sell Vol. 1,355,400

95,800

1D 1.91%

5D -1.24%

Buy Vol. 420,400

Sell Vol. 663,900

55,300

1D 0.73%

5D 4.73%

Buy Vol. 720,700

Sell Vol. 909,600

34,800

1D 1.75%

5D 3.57%

Buy Vol. 19,087,400

Sell Vol. 21,270,700

62,700

1D 1.13%

5D 5.73%

Buy Vol. 51,690,300

Sell Vol. 47,164,100

- MWG: Inventory value at the end of Q1 increased from 19,422b dong to 23,253b dong. Most notably, mobile phone inventory was over 5,639b dong, up from 3,509b dong at the beginning of the year; electronic equipment increased 1,350b VND to 8,385b VND. The sharp increase in inventories made MWG's cash flow from operating activities in the first quarter of 2021 negative VND 1,859b, while the same period last year was positive VND 3,829b.

Market by numbers

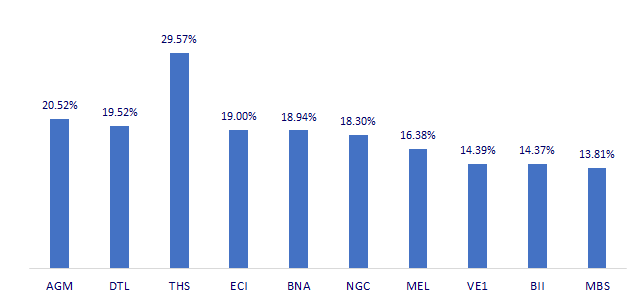

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

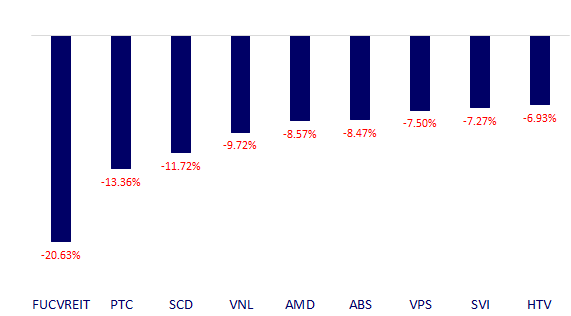

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.