Market Brief 13/05/2021

VIETNAM STOCK MARKET

1,261.99

1D -0.56%

YTD 14.78%

1,370.18

1D -0.72%

YTD 29.46%

287.03

1D 1.66%

YTD 45.63%

81.17

1D -0.37%

YTD 9.94%

-1,173.62

1D 0.00%

YTD 0.00%

24,987.67

1D 6.57%

YTD 45.67%

- Foreign investors' trade was not really active when they were net sellers on all 3 exchanges with a total value of nearly 1,173b dong. This is also the second time foreign investors have net sold over 1,000b dong since the beginning of May. Foreign investors' selling focused on Bluechips like CTG (-397.6b dong), HPG (-230.3b dong), NVL (-130b dong), VJC (-75.2b dong)…

ETF & DERIVATIVES

23,000

1D -0.39%

YTD 22.34%

16,130

1D 0.31%

YTD 28.73%

17,170

1D 0.70%

YTD 28.81%

19,900

1D 0.00%

YTD 25.95%

19,600

1D 1.55%

YTD 43.59%

22,600

1D 0.00%

YTD 31.40%

17,400

1D 0.81%

YTD 24.73%

1,367

1D -0.15%

YTD 0.00%

1,360

1D 1.95%

YTD 0.00%

1,360

1D -1.31%

YTD 0.00%

1,364

1D -1.32%

YTD 0.00%

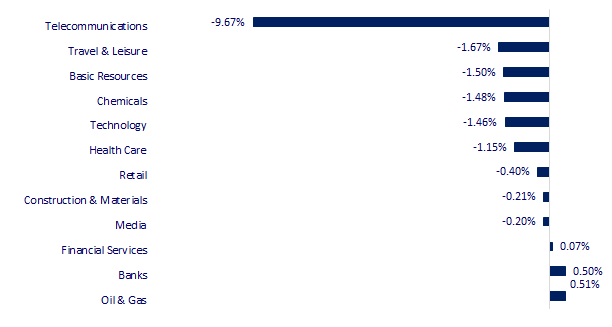

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,448.01

1D -0.69%

YTD 0.01%

3,429.54

1D -0.96%

YTD 0.44%

3,122.11

1D -1.25%

YTD 8.65%

27,715.37

1D -0.75%

YTD 2.09%

3,123.26

1D 0.00%

YTD 8.85%

1,548.13

1D -1.51%

YTD 6.82%

64.19

1D -2.42%

YTD 32.90%

1,812.85

1D -0.52%

YTD -4.77%

- Asian stocks 'red on fire' after Wall Street's plunge. In Japan, the Nikkei 225 fell 0.69%. The Chinese market fell with the Shanghai Composite down 0.96% and the Shenzhen Component down 1%. Hong Kong's Hang Seng fell 0.75%. South Korea's Kospi index fell 1.25%.

VIETNAM ECONOMY

1.23%

1D (bps) -1

YTD (bps) 110

5.60%

YTD (bps) -20

1.38%

1D (bps) 13

YTD (bps) 16

2.27%

1D (bps) -5

YTD (bps) 24

23,147

1D (%) 0.00%

YTD (%) -0.13%

28,412

1D (%) -0.11%

YTD (%) -2.37%

3,639

1D (%) 0.00%

YTD (%) 1.85%

- According to the SBV branch in Ho Chi Minh City, the total capital mobilization of credit institutions in the area as of April 30 is estimated at 2.92m billion VND, up 0.4% over the previous month and up 0.65. % compared to the end of the previous year. In which, savings deposits of residential customers were estimated at 1.13m billion VND, accounting for 39% and increasing by 1.57% compared to the end of last year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Low deposit interest rate, idle money still returns to the bank

- More than 17 billion USD in remittances to Vietnam, ranking in the top 9 in the world

- There are 3,300 apartments in inventory nationwide, no tourist villas have been tested

- Container shipping companies reported increased fees again

- The global chip crisis could last until 2023

- The US budget deficit reached a record high of $1.9 trillion

VN30

BANK

96,800

1D -0.51%

5D -2.52%

Buy Vol. 3,320,200

Sell Vol. 3,034,800

42,600

1D -0.12%

5D 3.27%

Buy Vol. 6,318,300

Sell Vol. 9,131,200

46,500

1D 3.33%

5D 8.39%

Buy Vol. 66,198,700

Sell Vol. 53,818,300

48,000

1D -2.54%

5D 1.91%

Buy Vol. 30,337,800

Sell Vol. 33,156,700

65,100

1D 1.72%

5D 5.34%

Buy Vol. 42,349,800

Sell Vol. 33,110,500

32,950

1D -0.75%

5D 4.27%

Buy Vol. 49,970,700

Sell Vol. 46,804,300

30,300

1D 0.33%

5D 5.21%

Buy Vol. 14,904,000

Sell Vol. 16,988,100

31,500

1D -1.41%

5D 11.90%

Buy Vol. 14,260,900

Sell Vol. 16,273,800

26,300

1D -0.19%

5D 7.79%

Buy Vol. 86,856,700

Sell Vol. 89,672,500

- STB: As of March 31st, the total assets of Sacombank were at VND 497,428 billion, an increase of 1% compared to the end of the previous year. Loans to customers increased by nearly 5% to 356,975 billion dong. However, bad debt decreased by 8.4% to VND5,292 billion, bad debt ratio decreased from 1.7% to 1.48%. NPL coverage ratio increased from 94% to 106%.

REAL ESTATE

134,000

1D 3.08%

5D -1.25%

Buy Vol. 3,589,900

Sell Vol. 3,178,700

22,000

1D -1.35%

5D -3.08%

Buy Vol. 8,637,800

Sell Vol. 11,922,600

36,700

1D -1.08%

5D 0.69%

Buy Vol. 5,325,400

Sell Vol. 5,155,200

71,100

1D -2.07%

5D -0.97%

Buy Vol. 4,505,500

Sell Vol. 4,197,300

- NVL: expected to issue 385.9 million shares, ratio 555:198 from share premium. Thereby, charter capital increased from 10,728 billion dong to 14,587 billion dong. Implementation time in 2021.

OIL & GAS

85,600

1D -0.93%

5D 0.82%

Buy Vol. 1,074,900

Sell Vol. 1,678,300

12,200

1D -2.01%

5D -0.81%

Buy Vol. 22,172,400

Sell Vol. 33,303,800

54,000

1D 1.31%

5D 6.30%

Buy Vol. 5,178,200

Sell Vol. 4,076,900

- The price of US WTI crude oil fell 0.79% to 65.53 USD/barrel at 7:10 am (GMT) on May 13. Brent crude oil price for July delivery also fell 0.28% to $68.75/barrel.

VINGROUP

126,500

1D -2.54%

5D -4.53%

Buy Vol. 2,651,100

Sell Vol. 2,570,400

97,000

1D -0.72%

5D -1.72%

Buy Vol. 7,446,300

Sell Vol. 6,550,000

30,900

1D -0.96%

5D -0.96%

Buy Vol. 7,786,300

Sell Vol. 9,104,700

- VHM: Contrary to yesterday's strong net selling session, today foreign investors net bought VHM with a value of 15 billion dong.

FOOD & BEVERAGE

90,500

1D -1.42%

5D 1.00%

Buy Vol. 6,929,000

Sell Vol. 7,128,600

103,000

1D -0.96%

5D 7.74%

Buy Vol. 3,468,600

Sell Vol. 4,165,200

20,750

1D -3.26%

5D 4.53%

Buy Vol. 6,147,600

Sell Vol. 8,093,900

- MSN: According to Bloomberg, Masan Group wants to raise 1 billion USD for the animal feed segment

OTHERS

117,000

1D -1.68%

5D -4.10%

Buy Vol. 607,800

Sell Vol. 774,400

117,000

1D -1.68%

5D -4.10%

Buy Vol. 607,800

Sell Vol. 774,400

84,000

1D -1.64%

5D 1.57%

Buy Vol. 4,198,700

Sell Vol. 4,026,000

140,000

1D 0.36%

5D -1.41%

Buy Vol. 1,654,200

Sell Vol. 1,545,200

94,300

1D -1.57%

5D -1.77%

Buy Vol. 582,400

Sell Vol. 819,000

55,000

1D -0.54%

5D -0.18%

Buy Vol. 942,000

Sell Vol. 1,171,400

35,050

1D 0.72%

5D 6.70%

Buy Vol. 36,716,700

Sell Vol. 45,998,200

61,500

1D -1.91%

5D 3.54%

Buy Vol. 36,646,600

Sell Vol. 44,717,900

- MWG: MWG wants to turn 30,000 small stores in Vietnam into sales collaborators. Customers who buy mobile phones and electronics products through these retailers will still be served by Mobile World, and agents will receive a discount of 5-20%, depending on the item.

Market by numbers

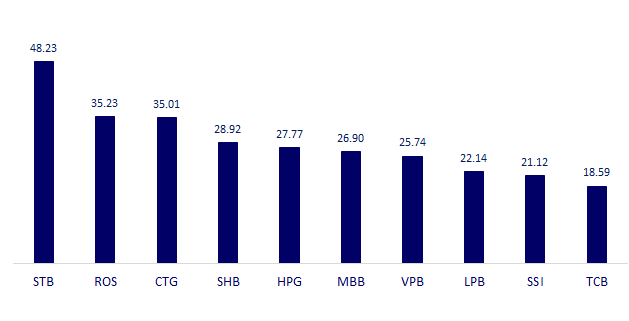

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

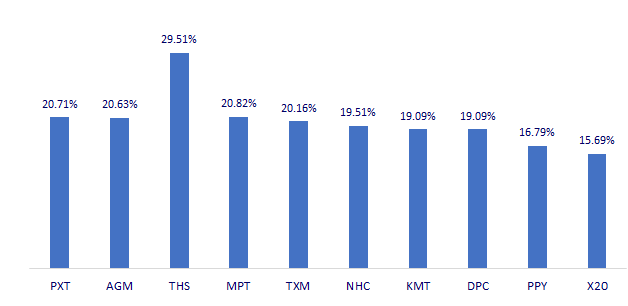

TOP INCREASES 3 CONSECUTIVE SESSIONS

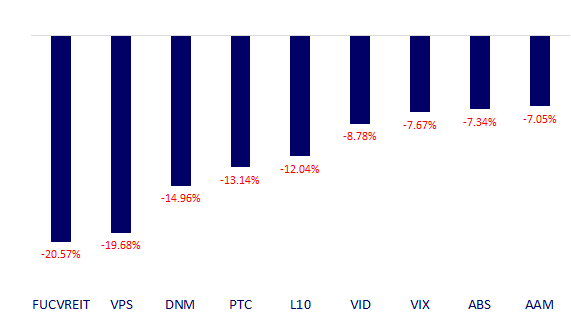

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.