Market Brief 14/05/2021

VIETNAM STOCK MARKET

1,266.36

1D 0.35%

YTD 15.18%

1,380.02

1D 0.72%

YTD 30.39%

294.72

1D 2.68%

YTD 49.53%

81.00

1D -0.21%

YTD 9.71%

-1,656.03

1D 0.00%

YTD 0.00%

26,526.65

1D 6.16%

YTD 54.65%

- Session 14/5: Foreign investors continued to net sell 1,656 billion dong, selling the most in 4 months. Foreign investors' selling focused on stocks like HPG (-411.6 billion dong), CTG (-158.9 billion dong), VIC (-144.5 billion dong), MBB (-129.5 billion dong).…

ETF & DERIVATIVES

23,000

1D 0.00%

YTD 22.34%

16,340

1D 1.30%

YTD 30.41%

17,200

1D 0.17%

YTD 29.03%

19,750

1D -0.75%

YTD 25.00%

19,650

1D 0.26%

YTD 43.96%

22,830

1D 1.02%

YTD 32.73%

17,380

1D -0.11%

YTD 24.59%

1,368

1D 0.07%

YTD 0.00%

1,363

1D 0.23%

YTD 0.00%

1,369

1D 0.67%

YTD 0.00%

1,374

1D 0.74%

YTD 0.00%

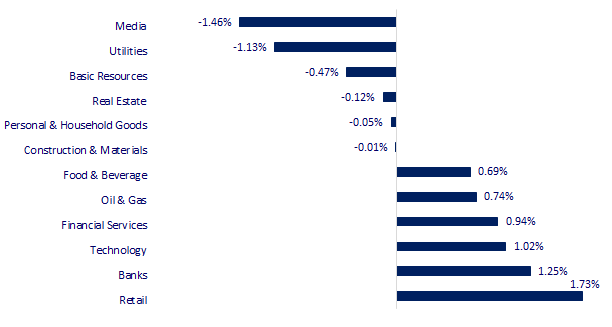

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,084.47

1D 0.86%

YTD 2.33%

3,490.38

1D 1.77%

YTD 2.22%

3,153.32

1D 1.00%

YTD 9.74%

28,010.00

1D 0.52%

YTD 3.18%

3,055.02

1D -2.18%

YTD 6.48%

1,549.48

1D 0.09%

YTD 6.91%

64.38

1D 1.19%

YTD 33.29%

1,834.00

1D 0.53%

YTD -3.66%

- Asian stocks rose, many markets recovered after a deep drop. In Japan, Nikkei 225 gained 0.86%. The Chinese market was up from the start with the Shanghai Composite up 1.77% and the Shenzhen Component up 2.092%. Hong Kong's Hang Seng rose 0.52%. South Korea's Kospi index rose 1%.

VIETNAM ECONOMY

1.23%

YTD (bps) 110

5.60%

YTD (bps) -20

1.43%

1D (bps) 5

YTD (bps) 21

2.30%

1D (bps) 3

YTD (bps) 27

23,146

1D (%) 0.00%

YTD (%) -0.14%

28,711

1D (%) 0.97%

YTD (%) -1.35%

3,650

1D (%) 0.22%

YTD (%) 2.16%

- As of March 31, 2021, the two banks with the largest loan balances, BIDV and VietinBank, both had credit growth at a lower rate than the average, increasing by 1.59% and 0.18% respectively to higher than average. 1.23 million billion and nearly 1.02 million billion. Vietcombank was next with 871,938 billion dong, up 3.83%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Industrial production in Ho Chi Minh City recovered strongly

- Khanh Hoa proposes to add 2 LNG projects with more than 27 billion USD to Van Phong economic zone

- Many resettlement areas in Dong Nai have not been able to start construction due to capital congestion

- Iron ore prices dropped by nearly 10% not long after reaching historic peaks

- US unemployment rate is lowest since the beginning of the pandemic

- Korea invests 450 billion USD with the ambition to become a chip power

VN30

BANK

96,900

1D 0.10%

5D -0.10%

Buy Vol. 2,324,100

Sell Vol. 2,764,000

42,350

1D -0.59%

5D 4.18%

Buy Vol. 4,812,400

Sell Vol. 7,133,500

47,000

1D 1.08%

5D 7.31%

Buy Vol. 37,171,100

Sell Vol. 31,003,000

48,650

1D 1.35%

5D 3.40%

Buy Vol. 26,953,600

Sell Vol. 25,506,400

66,600

1D 2.30%

5D 8.29%

Buy Vol. 72,243,600

Sell Vol. 56,631,000

33,000

1D 0.15%

5D 4.43%

Buy Vol. 39,615,900

Sell Vol. 43,385,800

31,200

1D 2.97%

5D 4.00%

Buy Vol. 15,310,900

Sell Vol. 14,932,100

31,950

1D 1.43%

5D 9.79%

Buy Vol. 10,986,000

Sell Vol. 16,262,200

26,400

1D 0.38%

5D 10.00%

Buy Vol. 64,957,600

Sell Vol. 81,543,700

- VPB: A group of investors under Dragon Capital has just announced that it will become a major shareholder of VPBank. Accordingly, this group owned 5,1236% of VPBank shares after buying 3.15 million more shares. Particularly, the value of VPBank shares held by Dragon Capital group is about 8,376 billion VND (more than 362 million USD).

REAL ESTATE

134,100

1D 0.07%

5D -1.25%

Buy Vol. 3,626,700

Sell Vol. 3,271,100

22,500

1D 2.27%

5D 2.74%

Buy Vol. 9,306,300

Sell Vol. 8,838,900

37,250

1D 1.50%

5D 2.62%

Buy Vol. 8,506,300

Sell Vol. 8,204,700

72,000

1D 1.27%

5D 1.55%

Buy Vol. 3,647,300

Sell Vol. 3,395,000

- TCH: Two Korean funds, Shinhan Bank Co.,Ltd and Shinhan – Core Trend Global Fund 1 want to convert bonds to own 15 million TCH shares.

OIL & GAS

84,100

1D -1.75%

5D 0.12%

Buy Vol. 2,079,700

Sell Vol. 1,447,600

12,250

1D 0.41%

5D 1.24%

Buy Vol. 33,974,000

Sell Vol. 37,802,600

54,800

1D 1.48%

5D 8.09%

Buy Vol. 6,641,600

Sell Vol. 4,398,200

- POW: Total revenue in April was estimated at VND 2,871b, reaching 94% of the monthly plan and growing 5% over the same period last month.

VINGROUP

125,300

1D -0.95%

5D -5.08%

Buy Vol. 3,802,500

Sell Vol. 4,022,100

97,200

1D 0.21%

5D 0.10%

Buy Vol. 6,073,900

Sell Vol. 6,477,700

30,650

1D -0.81%

5D -1.13%

Buy Vol. 7,724,800

Sell Vol. 10,129,400

- VIC: continued to be the focus of foreign investors' net selling in today's session with a value of more than 144 billion dong.

FOOD & BEVERAGE

89,500

1D -1.10%

5D 2.87%

Buy Vol. 6,806,200

Sell Vol. 7,788,500

108,100

1D 4.95%

5D 13.79%

Buy Vol. 7,266,400

Sell Vol. 6,816,500

20,200

1D -2.65%

5D 4.39%

Buy Vol. 6,164,500

Sell Vol. 6,935,100

- VNM: With a total rate of 68.15% owning at MCM, it is estimated that the group of shareholders related to VNM will receive more than VND112b in dividends from MCM.

OTHERS

117,900

1D 0.77%

5D -1.34%

Buy Vol. 941,500

Sell Vol. 860,100

117,900

1D 0.77%

5D -1.34%

Buy Vol. 941,500

Sell Vol. 860,100

84,800

1D 0.95%

5D 2.17%

Buy Vol. 3,564,800

Sell Vol. 3,715,600

142,500

1D 1.79%

5D 1.64%

Buy Vol. 1,633,300

Sell Vol. 1,668,300

94,200

1D -0.11%

5D -1.36%

Buy Vol. 543,900

Sell Vol. 1,005,600

56,000

1D 1.82%

5D -0.18%

Buy Vol. 998,600

Sell Vol. 1,362,900

35,300

1D 0.71%

5D 7.95%

Buy Vol. 23,269,700

Sell Vol. 32,285,100

61,400

1D -0.16%

5D 0.99%

Buy Vol. 55,190,800

Sell Vol. 55,288,200

- MWG: MWG wants to take 20% of the traditional channel market share, through cooperation with 30,000 retail stores. Currently, MWG accounts for about 50% of the retail technology market share. Other chain retailers account for 30%, with the remainder divided among about 30,000 brick-and-mortar stores.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.