Market Brief 26/05/2021

VIETNAM STOCK MARKET

1,316.70

1D 0.62%

YTD 19.76%

1,455.11

1D 0.77%

YTD 37.48%

304.86

1D 1.08%

YTD 54.67%

83.06

1D 0.18%

YTD 12.50%

151.22

25,570.58

1D 0.83%

YTD 49.07%

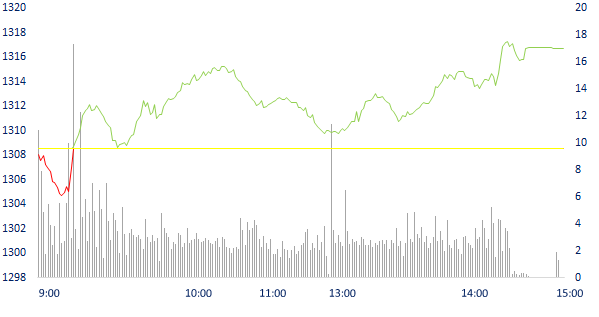

- VnIndex increased by 8 points at the end of the session to 1,316.7 points; HNX-Index increased 3.27 points to nearly 305 points. Liquidity on the two exchanges continued to be high with nearly 21,700 billion on HoSE and 3,100 billion on HNX. In the last few sessions, HoSE has been stuck again.

ETF & DERIVATIVES

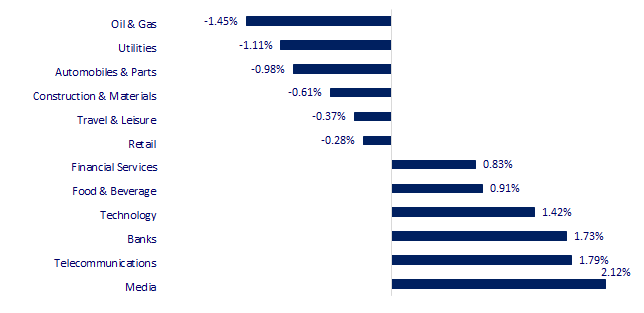

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

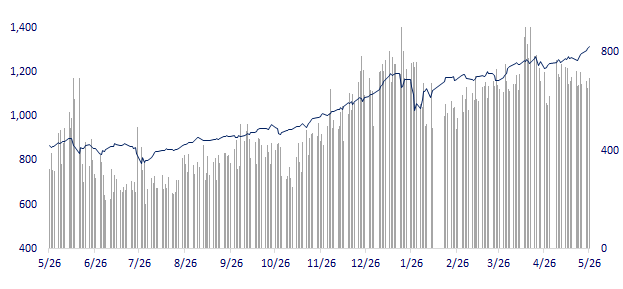

VNINDEX (12M)

GLOBAL MARKET

28,642.19

1D -0.04%

YTD 4.37%

3,593.36

1D 0.34%

YTD 5.24%

3,168.43

1D -0.09%

YTD 10.26%

29,156.00

1D 0.72%

YTD 7.40%

3,146.09

1D 0.00%

YTD 9.65%

1,568.58

1D 0.00%

YTD 8.23%

65.87

1D -0.23%

YTD 36.38%

1,907.70

1D 0.22%

YTD 0.21%

- Asian stocks mixed, many Southeast Asian markets on holiday. In Japan, the Nikkei 225 fell 0.04%. The Chinese market all rose with the Shanghai Composite up 0.34%. Hong Kong's Hang Seng rose 0.72%. South Korea's Kospi index fell 0.09%.

VIETNAM ECONOMY

1.35%

1D (bps) 10

YTD (bps) 122

5.60%

YTD (bps) -20

1.22%

1D (bps) 4

2.29%

1D (bps) 3

YTD (bps) 26

23,152

1D (%) -0.01%

YTD (%) -0.11%

29,011

1D (%) -0.09%

YTD (%) -0.32%

3,676

1D (%) 0.27%

YTD (%) 2.88%

- Transactions on May 25 showed that the average interbank interest rate offered in VND increased sharply by 0.06 - 0.15 percentage points in all terms from 1 month or less compared to the previous session. . Overnight rates were recorded to 1.38%, 1 week 1.48%, 2 weeks 1.54% and 1 month 1.6%/year. In particular, the overnight interest rate has broken out of the fluctuation range around 1.2% about a week ago.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Interbank interest rates tend to increase again

- Bac Giang plans to re-production for blocked industrial zones

- Shrimp exports continue to overcome difficulties, forecast to increase by more than 20% in the second quarter

- China's economy gradually lost its recovery momentum because of rising commodity prices

- Central banks' ability to support the economy in Asia is challenged

- Fed official insists 'it's still too early' to tighten monetary policy

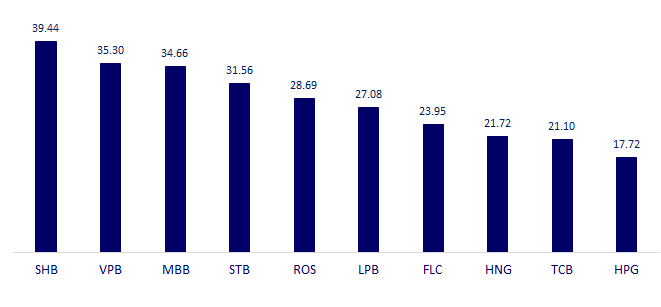

VN30

BANK

100,400

1D 0.60%

5D 6.70%

Buy Vol. 3,962,000

Sell Vol. 5,591,000

46,650

1D -0.11%

5D 14.06%

Buy Vol. 13,948,500

Sell Vol. 13,581,500

51,500

1D 0.78%

5D 7.29%

Buy Vol. 26,178,500

Sell Vol. 22,248,000

52,800

1D 2.33%

5D 5.39%

Buy Vol. 32,479,200

Sell Vol. 25,598,600

67,600

1D 1.20%

5D 0.15%

Buy Vol. 57,372,000

Sell Vol. 65,254,800

37,500

1D 4.75%

5D 8.70%

Buy Vol. 72,419,600

Sell Vol. 61,303,500

32,800

1D 0.92%

5D 4.29%

Buy Vol. 9,950,200

Sell Vol. 10,476,000

35,950

1D 2.42%

5D 9.27%

Buy Vol. 13,409,400

Sell Vol. 12,544,500

29,500

1D 0.51%

5D 3.51%

Buy Vol. 59,597,200

Sell Vol. 57,540,800

- CTG: Announcement of the 4th auction of collateral for debt recovery. Collateral includes all assets attached to the land of the Dong Phu high-quality spinning factory project built on a land plot of 32,000m2 in Tan Dan commune, Khoai Chau district, Hung Yen province. The second asset to be auctioned is the entire equipment, machinery and accessories associated with the Dong Phu High Quality Spinning Factory project. The starting price of the auction is 94.8 billion VND. - TCB: will issue more than 6m ESOP shares at 10,000 VND/share

REAL ESTATE

133,500

1D -1.48%

5D -5.99%

Buy Vol. 2,662,000

Sell Vol. 2,290,100

23,000

1D -2.13%

5D 5.26%

Buy Vol. 7,469,400

Sell Vol. 15,039,200

37,100

1D 0.13%

5D 3.63%

Buy Vol. 5,583,900

Sell Vol. 5,429,800

74,800

1D -1.32%

5D 6.55%

Buy Vol. 3,536,500

Sell Vol. 3,634,900

- KDH: Vietnam Ventures Limited Fund, managed by VinaCapital, sold 7.7m shares on May 20 by put-through method, reducing the number of shares held by the whole group to 20.52m equivalent units. 3.67% shares and is no longer a major shareholder.

OIL & GAS

81,900

1D -1.21%

5D 0.37%

Buy Vol. 652,200

Sell Vol. 946,300

11,650

1D -2.10%

5D -0.43%

Buy Vol. 18,450,600

Sell Vol. 25,864,900

55,300

1D -1.60%

5D 2.03%

Buy Vol. 6,507,900

Sell Vol. 9,101,500

- PLX: Foreign investors continued to be the strongest net buyers of PLX with 136.5 billion dong in today's session.

VINGROUP

121,700

1D -0.49%

5D 1.33%

Buy Vol. 2,494,900

Sell Vol. 3,014,000

105,700

1D 1.05%

5D 5.28%

Buy Vol. 9,247,900

Sell Vol. 10,074,100

31,250

1D 0.16%

5D 6.47%

Buy Vol. 8,989,500

Sell Vol. 13,016,300

- VHM and VRE were also net bought by foreign investors today at 84.5 billion dong and 69 billion dong respectively.

FOOD & BEVERAGE

91,000

1D 0.55%

5D 4.00%

Buy Vol. 8,631,000

Sell Vol. 10,047,000

113,600

1D 0.00%

5D 5.19%

Buy Vol. 2,119,000

Sell Vol. 2,634,200

19,350

1D -1.78%

5D -1.53%

Buy Vol. 5,108,300

Sell Vol. 4,862,300

- MSN leader said that he has successfully tested 4 Phuc Long kiots in HCMC in the past 3 months and is confident to complete the goal of 1,000 Phuc Long kiots in the next 18-24 months.

OTHERS

113,000

1D -0.26%

5D 2.73%

Buy Vol. 651,000

Sell Vol. 706,500

55,500

1D 0.54%

5D 4.32%

Buy Vol. 1,695,500

Sell Vol. 2,019,700

95,300

1D 1.60%

5D 4.96%

Buy Vol. 4,291,900

Sell Vol. 3,991,800

144,900

1D -0.75%

5D 2.26%

Buy Vol. 2,354,300

Sell Vol. 1,444,400

101,800

1D -0.10%

5D 8.88%

Buy Vol. 1,195,800

Sell Vol. 1,331,600

59,100

1D 0.00%

5D 7.45%

Buy Vol. 967,900

Sell Vol. 1,109,100

40,950

1D 0.12%

5D 13.75%

Buy Vol. 23,923,600

Sell Vol. 24,913,600

67,800

1D 0.59%

5D 2.57%

Buy Vol. 29,306,300

Sell Vol. 27,864,600

- REE: According to information from IFC - a member of the World Bank Group, IFC and MCPP managed by this organization will provide a funding package worth 57m USD for Thuan Binh Wind Power Joint Stock Company (TBW), a subsidiary of REE Corporation - FPT: Dragon Capital group net bought nearly 2.4m FPT shares, raising the holding volume to 40m units, equivalent to 5.071%. The transaction date is May 21.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

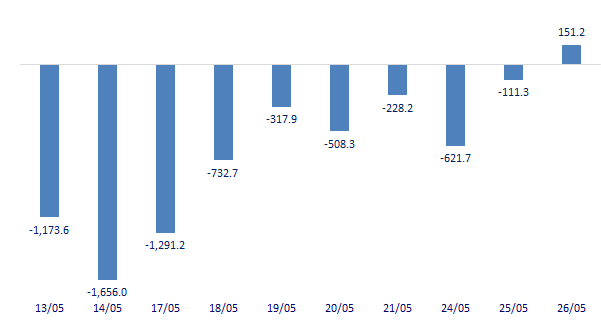

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

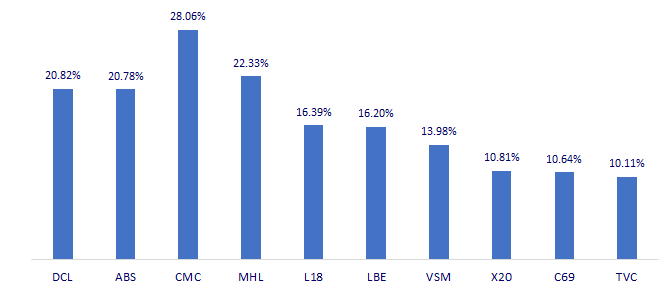

TOP INCREASES 3 CONSECUTIVE SESSIONS

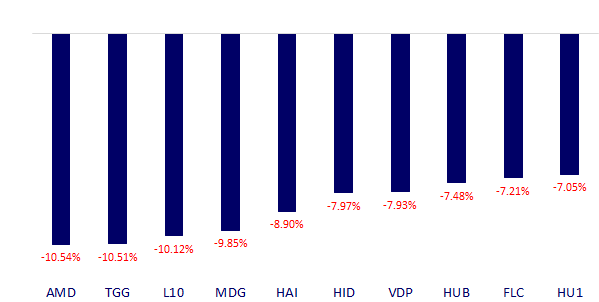

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.