Market Brief 27/05/2021

VIETNAM STOCK MARKET

1,303.57

1D -1.00%

YTD 18.56%

1,437.38

1D -1.22%

YTD 35.81%

304.45

1D -0.13%

YTD 54.46%

84.08

1D 1.23%

YTD 13.88%

264.16

29,071.20

1D 13.69%

YTD 69.48%

- Trading session today with a series of large stocks such as FPT, HPG, MSN, VIC, VNM, SAB, HVN, PLX, PNJ, VRE, BCM... sunk in red, had a great influence on the overall market. The positive point is that some big stocks such as BVH, EIB, REE, STB, NVL... upstream gained, even EIB hit the ceiling, helping VN-Index not to fall too deeply and keep the 1,300 point.

ETF & DERIVATIVES

GLOBAL MARKET

28,549.01

1D 0.48%

YTD 4.03%

3,608.85

1D 0.43%

YTD 5.69%

3,165.51

1D -0.09%

YTD 10.16%

29,113.37

1D 0.04%

YTD 7.24%

3,164.82

1D 0.60%

YTD 10.30%

1,582.96

1D 0.92%

YTD 9.22%

65.53

1D -0.71%

YTD 35.67%

1,895.50

1D 0.03%

YTD -0.43%

- China announced April industrial profits, Asian stocks mixed. In Japan, the Nikkei 225 rose 0.48%. The Chinese market rose with the Shanghai Composite up 0.43% and the Shenzhen Component up 0.7%. Hong Kong's Hang Seng rose 0.04%. South Korea's Kospi index fell 0.09%.

VIETNAM ECONOMY

1.35%

YTD (bps) 122

5.60%

YTD (bps) -20

1.34%

1D (bps) 12

YTD (bps) 12

2.15%

1D (bps) -14

YTD (bps) 12

23,144

1D (%) -0.04%

YTD (%) -0.15%

28,931

1D (%) 0.12%

YTD (%) -0.59%

3,685

1D (%) 0.27%

YTD (%) 3.13%

- Prime Minister Pham Minh Chinh requested the highest priority, the whole country put all efforts to support Bac Ninh and Bac Giang to repel and prevent the epidemic as soon as possible in the coming days, ensuring production and business, not letting supply chain disruption, especially in industrial zones.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- In the first 5 months of the year, more than 96,000 billion VND of economic violations were discovered

- Foxconn confirmed the factory is back in operation in Bac Giang

- The Prime Minister requested all efforts to support Bac Ninh and Bac Giang to fight the epidemic and develop the economy

- The recovery momentum of the Chinese economy shows signs of being weaker

- Fed upbeat about US economic growth outlook

- US - China telegraph for the first time under Biden

VN30

BANK

98,700

1D -1.69%

5D -0.30%

Buy Vol. 2,521,100

Sell Vol. 3,825,500

45,400

1D -2.68%

5D 8.48%

Buy Vol. 10,043,100

Sell Vol. 11,705,200

50,200

1D -2.52%

5D 2.66%

Buy Vol. 33,040,300

Sell Vol. 36,094,500

51,400

1D -2.65%

5D 2.39%

Buy Vol. 26,838,800

Sell Vol. 28,713,300

67,300

1D -0.44%

5D 0.75%

Buy Vol. 61,506,800

Sell Vol. 63,298,700

36,500

1D -2.67%

5D 5.80%

Buy Vol. 48,120,100

Sell Vol. 59,405,100

32,000

1D -2.44%

5D 0.00%

Buy Vol. 9,640,500

Sell Vol. 12,718,800

35,100

1D -2.36%

5D 6.36%

Buy Vol. 10,997,300

Sell Vol. 13,745,400

29,800

1D 1.02%

5D 1.36%

Buy Vol. 94,000,900

Sell Vol. 77,486,000

- VCB: The credit rating agency S&P Global Ratings (S&P) has just announced that it has upgraded Vietcombank's credit outlook from stable to positive. Assessment of long-term issuer rating and short-term issuer rating have not changed compared to Vietcombank's ranking results from 2012 to 2020 and continue to be among the highest among banks in Vietnam.

REAL ESTATE

136,000

1D 1.87%

5D -3.55%

Buy Vol. 3,089,400

Sell Vol. 2,118,000

22,100

1D -3.91%

5D 0.68%

Buy Vol. 8,598,600

Sell Vol. 13,582,500

39,000

1D 5.12%

5D 6.85%

Buy Vol. 16,036,700

Sell Vol. 12,292,100

77,500

1D 3.61%

5D 6.16%

Buy Vol. 6,354,200

Sell Vol. 5,561,200

- NVL: announced that June 10 is the last registration date to make a list to distribute 385.9 million bonus shares to existing shareholders, the rate of 35.68%. After the issuance, charter capital increased from VND 10,817 billion to VND 14,676 billion.

OIL & GAS

80,100

1D -2.20%

5D -0.87%

Buy Vol. 1,099,800

Sell Vol. 1,379,700

11,650

1D 0.00%

5D 1.75%

Buy Vol. 18,123,200

Sell Vol. 24,858,400

53,900

1D -2.53%

5D -0.92%

Buy Vol. 5,115,400

Sell Vol. 7,805,200

- POW: At the General Meeting of Shareholders, PV Power said that EVN still holds VND 834 billion of the difference in the exchange rate of the Ca Mau project's capacity fee.

VINGROUP

120,300

1D -1.15%

5D -2.12%

Buy Vol. 3,069,100

Sell Vol. 3,243,400

104,400

1D -1.23%

5D 2.35%

Buy Vol. 9,114,700

Sell Vol. 10,583,100

30,750

1D -1.60%

5D 4.24%

Buy Vol. 6,921,400

Sell Vol. 12,605,300

- VIC: According to Reuters, the IPO of VinFast may be slower than expected. VinFast is working with consultants, including Deutsche Bank and JPMorgan, on a plan to list in the US.

FOOD & BEVERAGE

90,500

1D -0.55%

5D 2.84%

Buy Vol. 4,790,700

Sell Vol. 7,783,500

110,000

1D -3.17%

5D -3.17%

Buy Vol. 3,204,100

Sell Vol. 3,205,200

19,100

1D -1.29%

5D -1.04%

Buy Vol. 3,195,500

Sell Vol. 3,249,100

- MSN: Expected to issue 5,851,446 ESOP shares (accounting for 0.498% of outstanding shares). The number of shares will be restricted to transfer within 1 year from the end of the issuance.

OTHERS

113,000

1D 0.00%

5D 1.80%

Buy Vol. 669,100

Sell Vol. 564,600

56,100

1D 1.08%

5D 6.25%

Buy Vol. 2,584,500

Sell Vol. 2,007,400

93,800

1D -1.57%

5D -1.78%

Buy Vol. 2,821,000

Sell Vol. 3,980,400

142,400

1D -1.73%

5D -5.07%

Buy Vol. 2,089,700

Sell Vol. 1,780,600

101,600

1D -0.20%

5D 2.32%

Buy Vol. 596,800

Sell Vol. 830,900

59,200

1D 0.17%

5D 1.37%

Buy Vol. 1,581,900

Sell Vol. 2,221,900

39,600

1D -3.30%

5D 2.86%

Buy Vol. 31,071,500

Sell Vol. 34,553,100

66,800

1D -1.47%

5D 0.30%

Buy Vol. 30,503,300

Sell Vol. 39,569,700

- HPG: Vice Chairman Tran Tuan Duong sold 12 million units of HPG, reducing the holding rate to 2.31%. Mr. Duong's 3 children also bought 12 million HPG shares, 4 million shares each.

Market by numbers

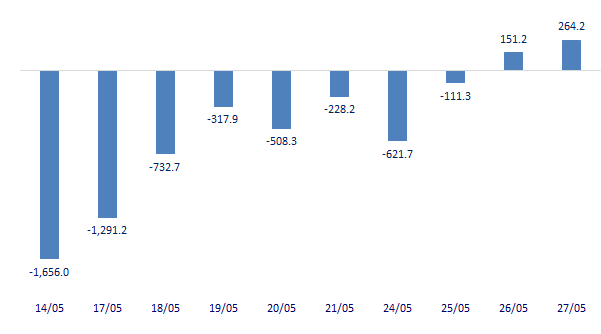

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

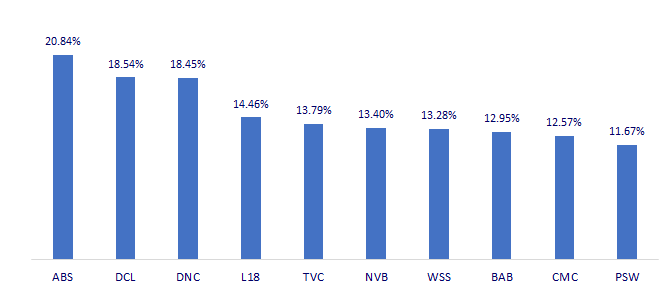

TOP INCREASES 3 CONSECUTIVE SESSIONS

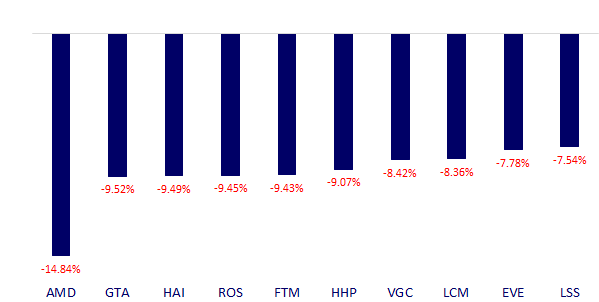

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.