Market Brief 28/05/2021

VIETNAM STOCK MARKET

1,320.46

1D 1.30%

YTD 20.10%

1,458.78

1D 1.49%

YTD 37.83%

310.46

1D 1.97%

YTD 57.51%

86.11

1D 2.41%

YTD 16.63%

28.20

30,450.04

1D 4.74%

YTD 77.52%

- In the last trading session of the week on May 28, bank stock price continued to make a strong breakthrough with 100% of stocks traded on 3 exchanges, HNX, HSX and UPCoM gaining in price, of which many stocks hit the ceiling price. The stocks that hit the ceiling were BVB, NAB, VBB, SGB LPB, STB...

ETF & DERIVATIVES

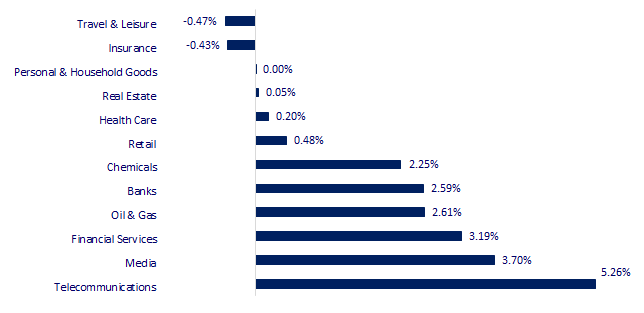

CHANGE IN PRICE BY SECTOR

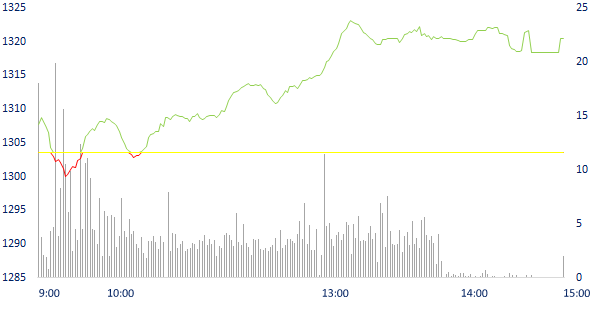

INTRADAY VNINDEX

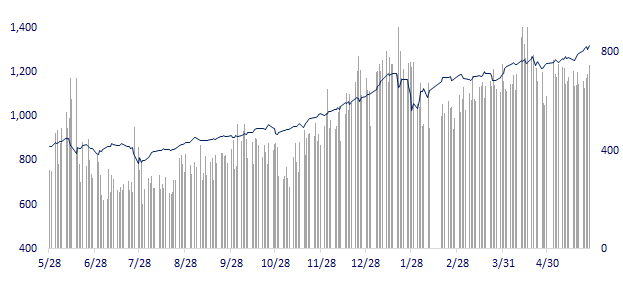

VNINDEX (12M)

GLOBAL MARKET

29,149.41

1D 0.15%

YTD 6.21%

3,600.78

1D -0.22%

YTD 5.46%

3,188.73

1D 0.73%

YTD 10.97%

29,135.37

1D -0.29%

YTD 7.32%

3,178.50

1D 0.43%

YTD 10.78%

1,581.98

1D -0.06%

YTD 9.15%

67.23

1D -0.03%

YTD 39.19%

1,893.40

1D -0.09%

YTD -0.54%

- Asian stocks mixed. In Japan, the Nikkei 225 gained 0.15%. In the Chinese market, the Shanghai Composite fell 0.22% and the Shenzhen Component fell 0.297%. Hong Kong's Hang Seng fell 0.29%. South Korea's Kospi index rose 0.73%.

VIETNAM ECONOMY

1.46%

1D (bps) 11

YTD (bps) 133

5.60%

YTD (bps) -20

1.32%

1D (bps) -2

YTD (bps) 10

2.16%

1D (bps) 1

YTD (bps) 13

23,145

1D (%) 0.00%

YTD (%) -0.14%

28,891

1D (%) 0.05%

YTD (%) -0.73%

3,691

1D (%) 0.30%

YTD (%) 3.30%

- Japanese investor sponsored 25 million USD for the first wind power project in Vietnam. The wind power project with a capacity of 144MW in Quang Tri is financed in the form of a loan from JICA in Vietnam and is the first large-scale wind power project in Vietnam invested by a Japanese enterprise.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The prospect of credit rating gives Vietnam more advantages to attract FDI

- Japanese investor sponsors 25 million USD for the first wind power project in Vietnam

- The Ministry of Foreign Affairs advises on traveling abroad to get Covid-19 vaccine

- Shanghai Exchange monitors unusual transactions, iron ore prices plummet

- Central banks are signaling a change in monetary policy

- Container shipping charges from Asia to Europe increased by nearly 500% after 1 year

VN30

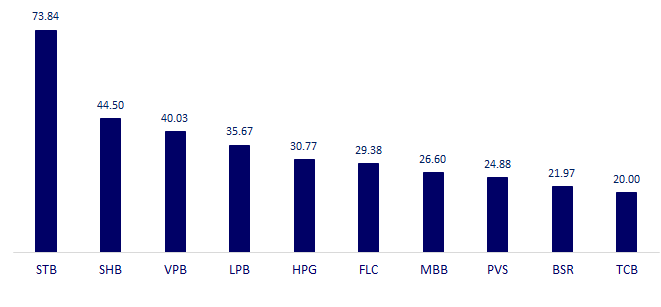

BANK

99,600

1D 0.91%

5D 2.89%

Buy Vol. 3,838,400

Sell Vol. 4,485,800

47,150

1D 3.85%

5D 5.36%

Buy Vol. 16,068,800

Sell Vol. 14,496,800

51,200

1D 1.99%

5D 6.11%

Buy Vol. 32,231,100

Sell Vol. 31,714,100

53,000

1D 3.11%

5D 4.33%

Buy Vol. 39,145,900

Sell Vol. 30,665,000

68,600

1D 1.93%

5D 1.18%

Buy Vol. 64,125,100

Sell Vol. 59,911,700

37,700

1D 3.29%

5D 8.80%

Buy Vol. 57,416,600

Sell Vol. 46,068,000

32,850

1D 2.66%

5D 2.98%

Buy Vol. 12,093,400

Sell Vol. 13,112,400

36,100

1D 2.85%

5D 9.39%

Buy Vol. 13,532,300

Sell Vol. 11,023,600

31,850

1D 6.88%

5D 10.40%

Buy Vol. 132,056,300

Sell Vol. 90,419,700

- HDB: Hoang Anh Gia Lai Joint Stock Company (HAG) has just announced the purchase of 328 billion dong of bonds before the issuance date of December 29, 2016. Previously, HAG issued 930 billion dong of bonds at par value. The bondholder is HDBank. The bond volume before redemption at par value is VND 735 billion. Thus, after completing this bond buyback before maturity, the remaining bond volume at par value is VND 407 billion.

REAL ESTATE

134,900

1D -0.81%

5D -1.75%

Buy Vol. 4,045,300

Sell Vol. 2,615,800

22,500

1D 1.81%

5D 0.00%

Buy Vol. 12,394,200

Sell Vol. 11,618,400

39,000

1D 0.00%

5D 4.28%

Buy Vol. 5,456,000

Sell Vol. 6,047,900

77,800

1D 0.39%

5D 2.37%

Buy Vol. 5,864,100

Sell Vol. 5,183,300

- NVL: is the unit with a remarkable plan to increase capital this year. At the beginning of the year, the company successfully offered nearly 77.6 million shares to existing shareholders at the price of 59,200 VND/share, earning 4,600 billion VND.

OIL & GAS

82,000

1D 2.37%

5D 1.23%

Buy Vol. 1,439,000

Sell Vol. 1,401,500

11,700

1D 0.43%

5D 0.00%

Buy Vol. 20,577,300

Sell Vol. 25,870,000

54,800

1D 1.67%

5D -4.53%

Buy Vol. 7,401,000

Sell Vol. 6,836,800

- POW: Because there are still many projects to be implemented in 2021 while the development investment fund is limited, the company decided to pay a dividend at the rate of 2%.

VINGROUP

119,800

1D -0.42%

5D -2.20%

Buy Vol. 2,968,400

Sell Vol. 3,209,600

104,600

1D 0.19%

5D 0.67%

Buy Vol. 7,941,900

Sell Vol. 7,328,300

30,550

1D -0.65%

5D 0.66%

Buy Vol. 11,309,500

Sell Vol. 12,490,300

- VIC: Bondholders will receive 59 million VIC shares at a conversion price of nearly 115.00 VND/share

FOOD & BEVERAGE

91,100

1D 0.66%

5D 2.13%

Buy Vol. 5,876,200

Sell Vol. 6,590,600

112,500

1D 2.27%

5D 0.54%

Buy Vol. 4,297,800

Sell Vol. 3,428,200

19,700

1D 3.14%

5D -1.01%

Buy Vol. 4,515,200

Sell Vol. 4,871,900

- MSN: Expected to issue 5,851,446 ESOP shares (accounting for 0.498% of outstanding shares). The number of shares will be restricted to transfer within 1 year from the end of the issuance.

OTHERS

112,000

1D -0.88%

5D -0.62%

Buy Vol. 730,500

Sell Vol. 730,000

55,500

1D -1.07%

5D 4.13%

Buy Vol. 1,081,700

Sell Vol. 1,015,800

94,800

1D 1.07%

5D 1.07%

Buy Vol. 3,983,600

Sell Vol. 3,472,800

142,700

1D 0.21%

5D -1.86%

Buy Vol. 2,354,300

Sell Vol. 1,357,100

101,000

1D -0.59%

5D -0.79%

Buy Vol. 907,200

Sell Vol. 943,200

59,300

1D 0.17%

5D 2.24%

Buy Vol. 1,234,000

Sell Vol. 1,460,800

41,800

1D 5.56%

5D 7.18%

Buy Vol. 41,360,300

Sell Vol. 29,813,100

67,100

1D 0.45%

5D 2.29%

Buy Vol. 53,660,400

Sell Vol. 53,669,400

- HPG: Can Tho has just approved a document for Hoa Phat Group to survey, research and propose a project of a high-class commercial and service urban area in Binh Thuy district, with an area of about 452 hectares. The period of research and survey is 6 months from May 27.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

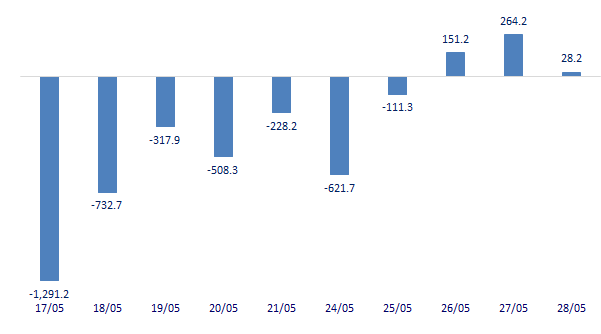

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

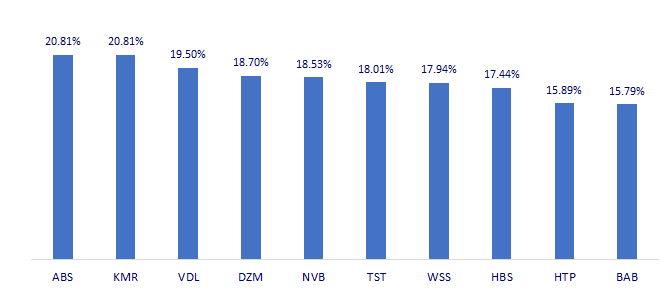

TOP INCREASES 3 CONSECUTIVE SESSIONS

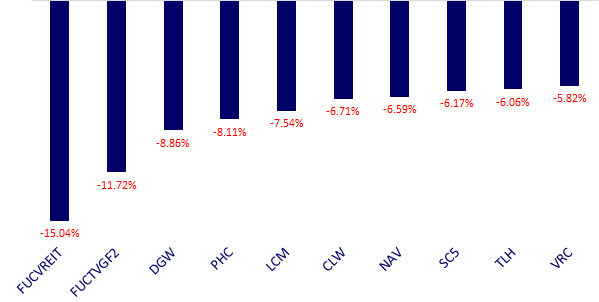

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.