Market Brief 31/05/2021

VIETNAM STOCK MARKET

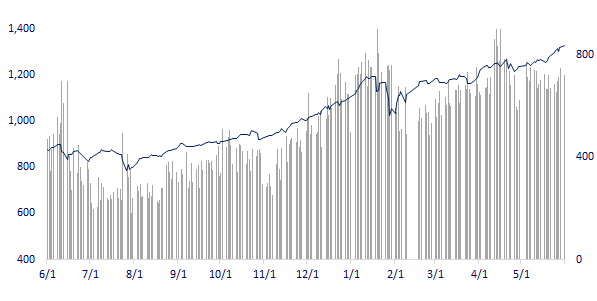

1,328.05

1D 0.57%

YTD 20.79%

1,474.78

1D 1.10%

YTD 39.34%

317.85

1D 2.38%

YTD 61.26%

88.77

1D 3.09%

YTD 20.24%

-1,718.09

1D 0.00%

YTD 0.00%

31,719.97

1D 4.17%

YTD 84.92%

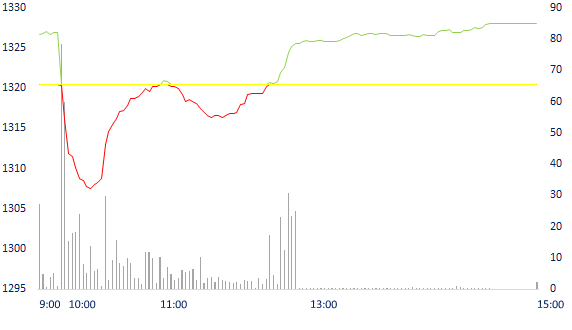

- Matching value on all 3 exchanges set a record, VN-Index reached a new high. In general, the total trading volume reached more than 1.03 billion shares, equivalent to a trading value of nearly 32,000 billion dong. Matching value set a record according to each exchange, HoSE was 23,840 billion dong, HNX was 4,360 billion dong and UPCoM was 1,898 billion dong.

ETF & DERIVATIVES

24,690

1D 0.86%

YTD 31.33%

17,300

1D 1.65%

YTD 38.07%

18,190

1D 0.72%

YTD 36.46%

21,000

1D 0.48%

YTD 32.91%

22,150

1D 2.26%

YTD 62.27%

24,470

1D 0.41%

YTD 42.27%

18,290

1D 0.00%

YTD 31.11%

1,465

1D 1.09%

YTD 0.00%

1,472

1D 1.36%

YTD 0.00%

1,474

1D 1.16%

YTD 0.00%

1,480

1D 1.16%

YTD 0.00%

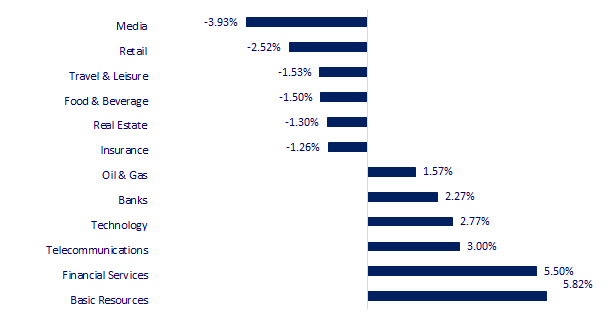

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,860.08

1D -0.24%

YTD 5.16%

3,615.48

1D 0.41%

YTD 5.89%

3,203.92

1D 0.48%

YTD 11.50%

29,143.87

1D 0.58%

YTD 7.36%

3,164.28

1D -0.45%

YTD 10.28%

1,593.59

1D 0.73%

YTD 9.95%

67.06

1D 0.75%

YTD 38.84%

1,905.65

1D -0.19%

YTD 0.11%

- China releases manufacturing PMI, Asian stocks mixed. In Japan, the Nikkei 225 fell 0.24%. The Chinese market rose with Shanghai Composite up 0.41%, Shenzhen Component up 0.966%. Hong Kong's Hang Seng rose 0.58%. South Korea's Kospi index rose 0.48%.

VIETNAM ECONOMY

1.42%

1D (bps) -4

YTD (bps) 129

5.60%

YTD (bps) -20

1.34%

1D (bps) 2

YTD (bps) 12

2.15%

1D (bps) -1

YTD (bps) 12

23,144

1D (%) 0.00%

YTD (%) -0.15%

28,897

1D (%) -0.04%

YTD (%) -0.71%

3,688

1D (%) -0.03%

YTD (%) 3.22%

- The State Bank, Deposit Insurance, and Policy Bank are the organizations that will grant special loans with 0% interest to specially controlled credit institutions that satisfy the following conditions. The ratio of loans to collateral is not lower than 170%, according to the draft new circular.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- 0% interest loans to weak credit institutions: The ratio of collateral is not less than 170%

- Nikkei: Vietnam and Taiwan rush to protect the supply chain

- Smuggled sugar is still rampant on the Vietnamese market

- China yuan exchange rate to the highest level in 5 years

- China faces the risk of a COVID-19 outbreak in Guangdong

- China supply chain under huge pressure of raw material costs

VN30

BANK

98,600

1D -1.00%

5D 1.23%

Buy Vol. 4,046,500

Sell Vol. 5,441,500

48,700

1D 3.29%

5D 5.87%

Buy Vol. 11,123,600

Sell Vol. 10,298,000

53,100

1D 3.71%

5D 3.71%

Buy Vol. 35,244,800

Sell Vol. 25,112,300

53,700

1D 1.32%

5D 5.50%

Buy Vol. 32,778,800

Sell Vol. 26,035,600

69,200

1D 0.87%

5D 3.75%

Buy Vol. 57,022,300

Sell Vol. 45,403,600

38,000

1D 0.80%

5D 9.35%

Buy Vol. 60,218,700

Sell Vol. 49,283,600

33,800

1D 2.89%

5D 6.46%

Buy Vol. 17,919,000

Sell Vol. 15,914,300

37,450

1D 3.74%

5D 12.29%

Buy Vol. 11,149,900

Sell Vol. 5,456,400

33,800

1D 6.12%

5D 16.96%

Buy Vol. 76,821,000

Sell Vol. 65,565,600

- CTG: VietinBank plans to issue 1,082,375,087 shares, equivalent to 29,0695% of outstanding shares to pay dividends. The expected implementation time is in the third - fourth quarter of 2021. After the issuance, the charter capital of VietinBank will increase from VND 37,234 billion to VND 48,057 billion.

REAL ESTATE

134,600

1D -0.22%

5D -0.30%

Buy Vol. 3,224,400

Sell Vol. 2,458,400

22,300

1D -0.89%

5D -5.11%

Buy Vol. 8,743,900

Sell Vol. 11,908,700

39,450

1D 1.15%

5D 5.34%

Buy Vol. 7,945,500

Sell Vol. 6,927,900

77,000

1D -1.03%

5D 0.79%

Buy Vol. 4,182,600

Sell Vol. 4,525,400

- NVL: Expected to issue nearly 386 million shares to increase charter capital, with the ratio 555:198, Ex-rights date 09/06/2021

OIL & GAS

82,600

1D 0.73%

5D 0.73%

Buy Vol. 1,427,700

Sell Vol. 1,496,100

11,750

1D 0.43%

5D -0.42%

Buy Vol. 22,614,100

Sell Vol. 24,798,800

54,600

1D -0.36%

5D -3.02%

Buy Vol. 5,997,900

Sell Vol. 5,666,300

- On the world market, crude oil prices were mixed in this morning session after rising more than 5% last weekend on forecasts of increased demand during the driving season.

VINGROUP

117,500

1D -1.92%

5D -3.77%

Buy Vol. 3,403,500

Sell Vol. 3,750,900

102,600

1D -1.91%

5D -3.21%

Buy Vol. 9,044,100

Sell Vol. 9,228,500

29,400

1D -3.76%

5D -4.70%

Buy Vol. 13,294,700

Sell Vol. 15,485,400

- VIC: Vinpearl is expected to transfer nearly 59.2 million VIC shares (1.72%). After the transaction, Vinpearl will hold more than 49.7 million VIC shares (1.44%).

FOOD & BEVERAGE

90,500

1D -0.66%

5D -0.77%

Buy Vol. 5,086,800

Sell Vol. 6,930,200

110,100

1D -2.13%

5D -1.70%

Buy Vol. 1,861,000

Sell Vol. 2,136,800

19,900

1D 1.02%

5D -0.25%

Buy Vol. 3,651,400

Sell Vol. 4,267,800

- MSN: just approved the plan to advance 10% cash dividend. With more than 1.17 billion shares outstanding, the amount spent in this phase is 1,175 billion dong.

OTHERS

110,000

1D -1.79%

5D -3.08%

Buy Vol. 752,100

Sell Vol. 741,500

110,000

1D -1.79%

5D -3.08%

Buy Vol. 752,100

Sell Vol. 741,500

97,900

1D 3.27%

5D 4.71%

Buy Vol. 7,720,700

Sell Vol. 4,721,000

138,500

1D -2.94%

5D -5.14%

Buy Vol. 2,422,600

Sell Vol. 2,244,400

100,900

1D -0.10%

5D -0.98%

Buy Vol. 754,900

Sell Vol. 1,116,700

58,200

1D -1.85%

5D -1.52%

Buy Vol. 883,000

Sell Vol. 1,256,400

44,400

1D 6.22%

5D 11.56%

Buy Vol. 31,011,200

Sell Vol. 21,325,200

52,700

1D 6.83%

5D 9.60%

Buy Vol. 117,371,700

Sell Vol. 78,040,700

- HPG: Hoa Phat becomes the owner of Roper Valley iron ore project with estimated reserve of 320 million tons and mining capacity of 4 million tons/year. Hoa Phat Group said that it is still researching to invest in buying some new iron mines in Australia, in order to ensure a long-term supply of at least 50% of the group's iron ore demand (equivalent to 10 million tons/per year).

Market by numbers

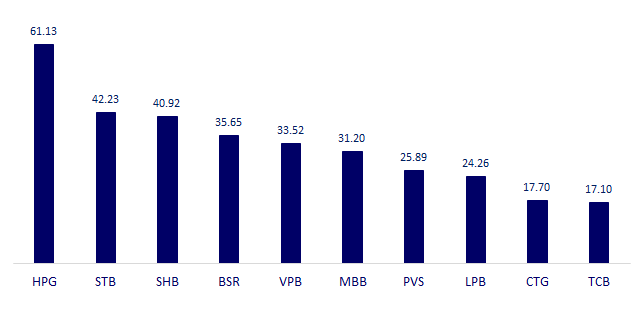

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

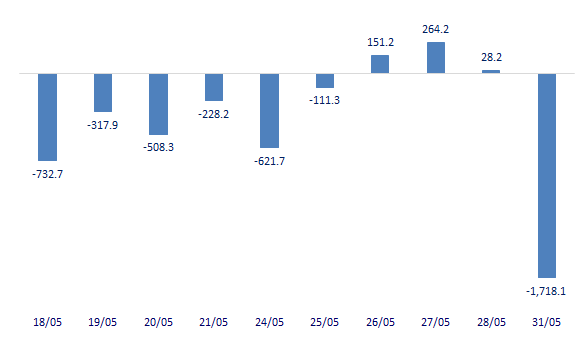

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

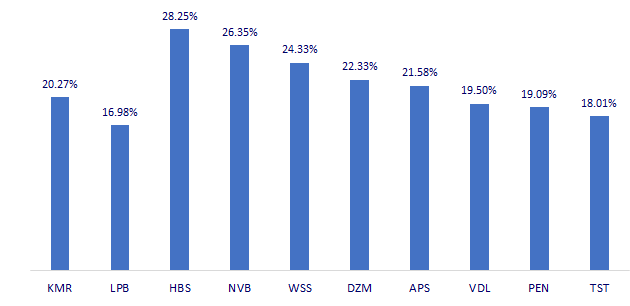

TOP INCREASES 3 CONSECUTIVE SESSIONS

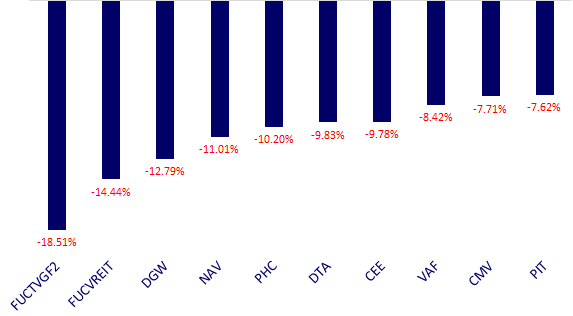

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.