Market Brief 21/06/2021

VIETNAM STOCK MARKET

1,372.63

1D -0.37%

YTD 24.84%

1,478.29

1D -0.20%

YTD 39.67%

316.24

1D -0.78%

YTD 60.45%

89.71

1D -0.57%

YTD 21.51%

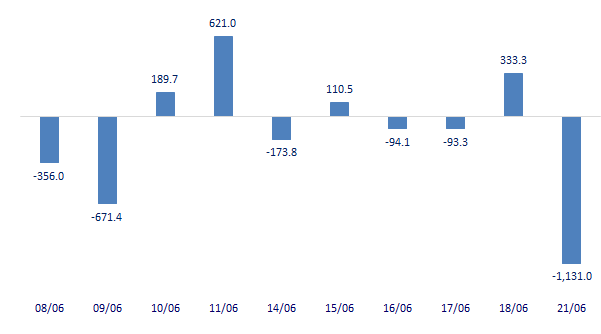

-1,130.96

27,254.88

1D -5.73%

YTD 58.89%

- Foreign investors traded negatively again when they sold strongly in the session of June 21. In general, they bought 26.8m shares, worth 1,284.6b VND, while selling 53.7m shares worth 2,399b VND. Total net selling volume was at 26.9m shares, corresponding to a net selling value of over 1,130b dong. NVL, HPG were the 2 biggest net sellers with the value of 362b dong and 336b dong.

ETF & DERIVATIVES

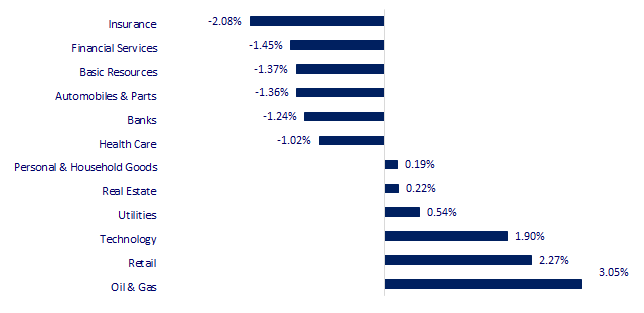

CHANGE IN PRICE BY SECTOR

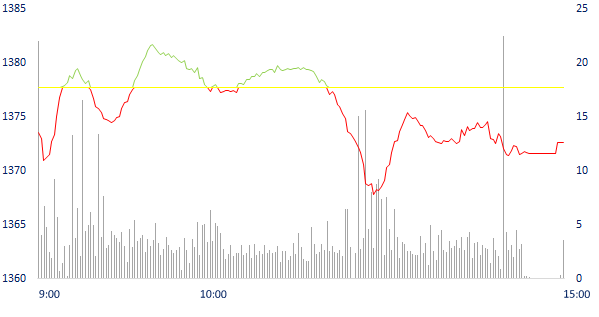

INTRADAY VNINDEX

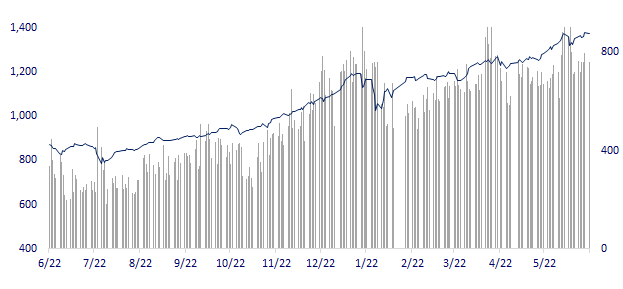

VNINDEX (12M)

GLOBAL MARKET

28,010.93

1D 0.00%

YTD 2.07%

3,529.18

1D 0.12%

YTD 3.36%

3,240.79

1D -0.83%

YTD 12.78%

28,478.00

1D 0.10%

YTD 4.90%

3,153.47

1D 0.00%

YTD 9.91%

1,601.13

1D -0.73%

YTD 10.47%

71.44

1D -0.74%

YTD 47.91%

1,783.15

1D 0.69%

YTD -6.33%

- Asian shares were mixed, with South Korea's Kospi index falling 0.83%. Mainland China market was in the opposite direction with Shanghai Composite up 0.12%, Shenzhen Component up 0.395%. Hong Kong's Hang Seng rose 0.1%.

VIETNAM ECONOMY

0.99%

1D (bps) 4

YTD (bps) 86

5.60%

YTD (bps) -20

1.15%

1D (bps) -1

YTD (bps) -7

2.13%

YTD (bps) 10

23,121

1D (%) 0.09%

YTD (%) -0.25%

28,194

1D (%) 0.32%

YTD (%) -3.12%

3,629

1D (%) -0.17%

YTD (%) 1.57%

- According to the State Bank of Vietnam, in the week from June 7 to June 11, the transaction turnover on the interbank market in VND reached approximately VND 694,551 billion, an average of VND 138,910 billion/day, an increase of VND 22,686 billion VND/day compared to the previous week.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Businesses are worried that Ho Chi Minh City will collect seaport fees

- Banks increase borrowing, but interest rates decrease

- Textile not worry about lack of orders

- China investigates spot market, iron ore prices plunge

- US threatens to impose more sanctions on Russia

- Moody's Analytics: Inflation may cause US stocks to correct 10-20%

VN30

BANK

106,600

1D -1.75%

5D 4.51%

Buy Vol. 2,541,700

Sell Vol. 3,543,300

45,000

1D -2.49%

5D 0.22%

Buy Vol. 6,236,400

Sell Vol. 6,468,100

50,300

1D -1.76%

5D -4.19%

Buy Vol. 18,211,000

Sell Vol. 18,619,600

50,400

1D -1.18%

5D -4.36%

Buy Vol. 27,868,700

Sell Vol. 22,208,500

66,500

1D 0.00%

5D -6.21%

Buy Vol. 22,264,300

Sell Vol. 24,150,800

40,650

1D 0.25%

5D 3.44%

Buy Vol. 36,597,100

Sell Vol. 32,560,400

33,650

1D -1.75%

5D -1.32%

Buy Vol. 5,332,900

Sell Vol. 5,454,900

35,250

1D -0.70%

5D -2.89%

Buy Vol. 5,446,000

Sell Vol. 6,459,000

29,850

1D 0.67%

5D -3.08%

Buy Vol. 46,237,500

Sell Vol. 42,530,100

- On June 18, the State Bank approved for Tien Phong Commercial Joint Stock Bank (TPB) to increase its charter capital by 1,000 billion VND, bringing the total charter capital of the bank to more than 11,716 billion VND.

REAL ESTATE

109,000

1D 5.83%

5D 4.91%

Buy Vol. 13,984,900

Sell Vol. 7,114,600

22,800

1D -2.98%

5D 2.70%

Buy Vol. 9,254,500

Sell Vol. 13,251,900

37,350

1D 0.00%

5D 1.22%

Buy Vol. 3,866,300

Sell Vol. 3,452,700

90,500

1D -1.74%

5D -0.98%

Buy Vol. 5,274,200

Sell Vol. 5,216,100

- PDR: announced to contribute 51% capital, equivalent to nearly 86 billion VND to establish a subsidiary - Phat Dat Real Estate Business and Service Joint Stock Company. This company has an initial charter capital of VND 168 billion.

OIL & GAS

93,000

1D 0.32%

5D 3.91%

Buy Vol. 1,485,000

Sell Vol. 2,148,500

12,500

1D 1.63%

5D 2.46%

Buy Vol. 32,345,800

Sell Vol. 36,813,300

58,600

1D 3.72%

5D 6.55%

Buy Vol. 11,604,400

Sell Vol. 10,222,800

- PLX: ENEO has completed the purchase and match order of 25m shares of PLX previously registered, thereby increasing the ownership rate to 4.87%, equivalent to 63m shares.

VINGROUP

117,400

1D 0.00%

5D -2.17%

Buy Vol. 2,159,600

Sell Vol. 2,680,100

112,000

1D -0.44%

5D 1.91%

Buy Vol. 5,022,100

Sell Vol. 7,032,800

31,800

1D -2.15%

5D -0.47%

Buy Vol. 6,225,400

Sell Vol. 8,176,600

- VRE: At the coming AGM, the BoDs will submit a plan for 2021 with net revenue of about 9,000b dong, profit after tax of about 2,500b dong, up 8% and 5% compared to the results of 2020.

FOOD & BEVERAGE

90,600

1D -1.63%

5D -2.05%

Buy Vol. 5,541,000

Sell Vol. 6,943,300

108,700

1D 2.07%

5D 1.68%

Buy Vol. 2,986,800

Sell Vol. 3,295,300

22,300

1D -2.19%

5D 4.69%

Buy Vol. 10,950,400

Sell Vol. 11,713,700

- VNM was among the top stocks that were net sold by foreign investors in today's session with a value of 95 billion dong.

OTHERS

114,000

1D -1.72%

5D -1.47%

Buy Vol. 833,800

Sell Vol. 1,026,600

59,700

1D -2.13%

5D -0.50%

Buy Vol. 2,388,500

Sell Vol. 3,138,100

85,600

1D 2.15%

5D 2.15%

Buy Vol. 6,322,000

Sell Vol. 7,026,500

145,800

1D 3.40%

5D 5.58%

Buy Vol. 2,263,700

Sell Vol. 1,620,300

98,100

1D 0.10%

5D 1.13%

Buy Vol. 684,700

Sell Vol. 1,191,700

58,200

1D -2.51%

5D 4.86%

Buy Vol. 1,059,500

Sell Vol. 1,302,000

49,000

1D -2.97%

5D -5.77%

Buy Vol. 17,708,300

Sell Vol. 21,853,500

51,200

1D -1.73%

5D -4.48%

Buy Vol. 38,570,500

Sell Vol. 38,059,300

- PPNJ: in May, the company recorded a net revenue of 1,593 billion (+56.5% yoy) and profit after tax of 85 billion (+58.6%). Gross profit margin in May 2021 reached 18.6% compared to 19.5% in the same period in 2020 due to the increase in the proportion of revenue from gold bars.

Market by numbers

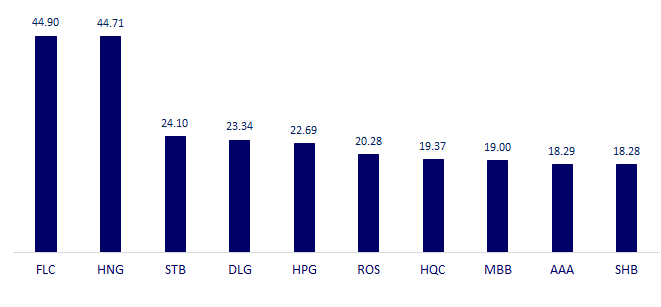

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

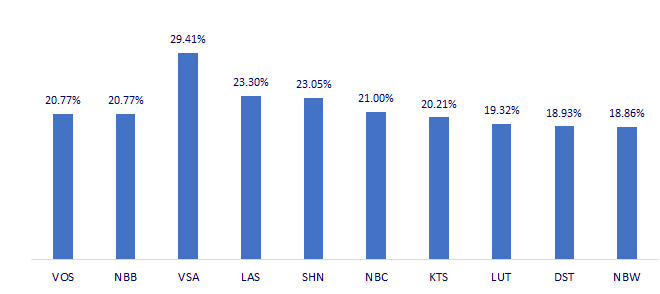

TOP INCREASES 3 CONSECUTIVE SESSIONS

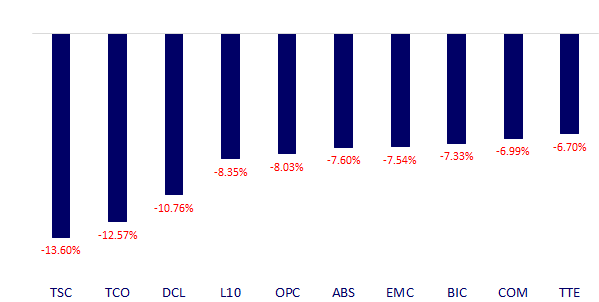

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.