Market Brief 28/06/2021

VIETNAM STOCK MARKET

1,405.81

1D 1.13%

YTD 27.86%

1,521.41

1D 1.41%

YTD 43.75%

323.10

1D 1.53%

YTD 63.93%

89.80

1D 0.36%

YTD 21.63%

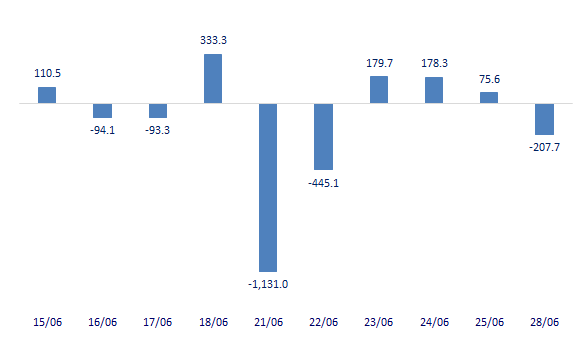

-207.68

1D 0.00%

YTD 0.00%

27,674.57

1D 19.04%

YTD 61.34%

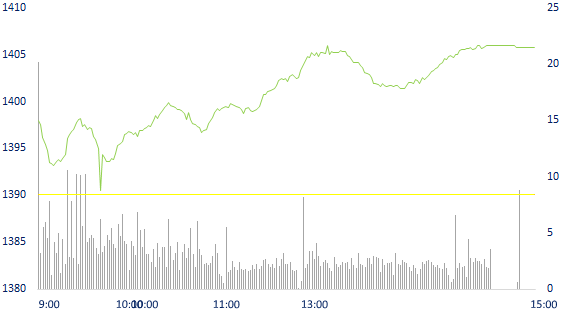

- VN-Index surpassed 1,400 points, VN30-Index surpassed the peak. Liquidity increased strongly compared to the last session of last week. The total trading value of the whole market reached VND27,670b, of which, order matching transactions accounted for VND25,800b, HoSE alone was VND21,500b.

ETF & DERIVATIVES

25,600

1D 1.35%

YTD 36.17%

17,930

1D 2.11%

YTD 43.10%

21,700

1D 0.93%

YTD 37.34%

22,890

1D 2.42%

YTD 67.69%

25,380

1D 1.24%

YTD 47.56%

19,020

1D 1.49%

YTD 36.34%

1,496

1D 0.00%

YTD 0.00%

1,496

1D 0.00%

YTD 0.00%

1,499

1D 0.00%

YTD 0.00%

1,505

1D 0.00%

YTD 0.00%

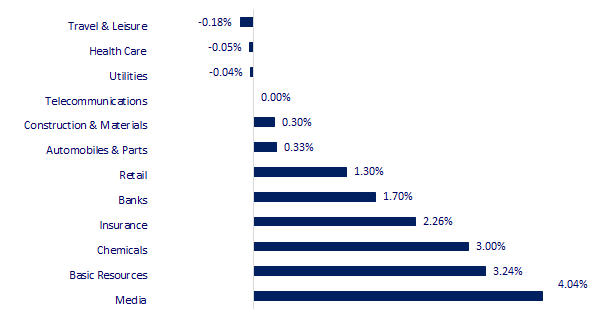

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

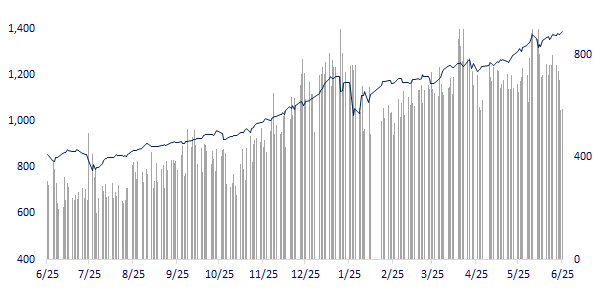

VNINDEX (12M)

GLOBAL MARKET

29,048.02

1D 0.01%

YTD 5.84%

3,606.37

1D -0.03%

YTD 5.62%

3,301.89

1D -0.03%

YTD 14.91%

29,281.00

1D -0.07%

YTD 7.86%

3,126.88

1D 0.17%

YTD 8.98%

1,579.17

1D -0.22%

YTD 8.96%

73.99

1D -0.18%

YTD 53.19%

1,774.85

1D 0.21%

YTD -6.77%

- Asian stocks mixed, Hong Kong market closed the morning session because of the storm. In Japan, the Nikkei 225 gained 0.01%. The Chinese market was mixed from the start with the Shanghai Composite down 0.03% and the Shenzhen Component up 0.975%. South Korea's Kospi index fell 0.03%.

VIETNAM ECONOMY

1.21%

YTD (bps) 108

5.60%

YTD (bps) -20

1.26%

1D (bps) -2

YTD (bps) 4

2.00%

1D (bps) -6

YTD (bps) -3

23,125

1D (%) 0.06%

YTD (%) -0.23%

28,298

1D (%) 0.09%

YTD (%) -2.77%

3,636

1D (%) 0.06%

YTD (%) 1.76%

- According to the Asian Bond Monitoring report released by the Asian Development Bank (ADB), along with China and Indonesia, interest rates on both short-term and long-term Vietnamese government bonds decreased in the first quarter of this year. Meanwhile, South Korea, Malaysia and the Philippines increased slightly.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- ADB: Vietnam's local currency bond market fell slightly

- Anti-dumping review for galvanized steel from China and Korea

- The railway has a heavy loss, the risk of stopping operation

- IMF approves plan to allocate $650 billion to help poor countries

- Boston Fed President: The US can't stand a 'boom and bust cycle' in the housing market

- UK bans world's largest cryptocurrency exchange

VN30

BANK

112,600

1D 0.00%

5D 5.63%

Buy Vol. 2,607,200

Sell Vol. 2,468,000

46,900

1D 2.96%

5D 4.22%

Buy Vol. 10,499,400

Sell Vol. 10,980,800

54,400

1D 1.12%

5D 8.15%

Buy Vol. 22,378,800

Sell Vol. 23,696,600

53,600

1D 3.88%

5D 6.35%

Buy Vol. 41,783,900

Sell Vol. 43,734,800

68,000

1D -0.29%

5D 2.26%

Buy Vol. 23,945,900

Sell Vol. 26,162,000

43,100

1D 2.38%

5D 6.03%

Buy Vol. 29,404,900

Sell Vol. 32,552,000

36,000

1D 1.98%

5D 6.98%

Buy Vol. 7,488,100

Sell Vol. 9,006,500

37,650

1D 4.87%

5D 6.81%

Buy Vol. 18,520,100

Sell Vol. 16,097,100

30,200

1D 2.37%

5D 1.17%

Buy Vol. 38,655,700

Sell Vol. 38,722,900

- VPB: Bank union registered to buy 557,044 shares. Before the transaction, the Bank's Union owned 1,775,257 shares (the rate of 0.07%). The transaction is expected to take place from June 30 to July 29, 2021.

REAL ESTATE

120,000

1D 0.76%

5D 10.09%

Buy Vol. 4,161,100

Sell Vol. 4,763,300

22,050

1D 0.00%

5D -3.29%

Buy Vol. 7,913,500

Sell Vol. 7,680,800

37,150

1D 0.13%

5D -0.54%

Buy Vol. 3,358,200

Sell Vol. 2,328,500

94,600

1D -0.42%

5D 4.53%

Buy Vol. 6,476,000

Sell Vol. 6,033,400

- TCH: TCH may be excluded from the list of VN30 index because it does not meet the ranking criteria for market capitalization to enter VN30.

OIL & GAS

95,000

1D 0.00%

5D 5.38%

Buy Vol. 1,653,700

Sell Vol. 2,327,500

12,150

1D 0.00%

5D -2.80%

Buy Vol. 16,311,500

Sell Vol. 18,132,100

57,100

1D 1.06%

5D -0.52%

Buy Vol. 7,133,300

Sell Vol. 4,771,400

- Gas prices today, natural gas prices in this morning's delivery session continued to increase due to reports of demand recovery in the market.

VINGROUP

116,700

1D -0.68%

5D -0.60%

Buy Vol. 2,451,600

Sell Vol. 2,544,300

115,500

1D 3.03%

5D 3.13%

Buy Vol. 10,134,700

Sell Vol. 9,839,200

31,800

1D 0.63%

5D 0.00%

Buy Vol. 5,025,800

Sell Vol. 7,044,800

- VinFast will give 100% of the registration fee to customers who deposit enough VND 50 million and with conditions

FOOD & BEVERAGE

89,200

1D -0.56%

5D -1.55%

Buy Vol. 3,229,900

Sell Vol. 3,941,300

108,900

1D 2.35%

5D 0.18%

Buy Vol. 2,241,300

Sell Vol. 2,861,500

21,500

1D 2.87%

5D -3.59%

Buy Vol. 7,096,900

Sell Vol. 6,838,800

- VNM: In today's trading session, Vinamilk's market capitalization dropped to 8th place with VND 187,051 billion. Closing the session, VNM dropped 0.6% to 89,200 dong/share.

OTHERS

115,500

1D -0.35%

5D 1.32%

Buy Vol. 645,200

Sell Vol. 736,500

115,500

1D -0.35%

5D 1.32%

Buy Vol. 645,200

Sell Vol. 736,500

85,700

1D 0.59%

5D 0.12%

Buy Vol. 3,005,400

Sell Vol. 3,782,200

145,500

1D 1.25%

5D -0.21%

Buy Vol. 1,101,300

Sell Vol. 912,200

98,100

1D 0.72%

5D 0.00%

Buy Vol. 445,200

Sell Vol. 446,600

57,300

1D 1.42%

5D -1.55%

Buy Vol. 1,019,600

Sell Vol. 1,019,400

53,900

1D 0.37%

5D 10.00%

Buy Vol. 15,832,000

Sell Vol. 20,569,400

52,400

1D 3.35%

5D 2.34%

Buy Vol. 67,997,700

Sell Vol. 61,908,000

- MWG: The Mobile World Shelter has registered to sell all 105,000 shares. The transaction is expected to take place from June 30 to July 29, 2021. - MWG: After the first 5 months of the year, MWG recorded consolidated net revenue of VND 51,830b (up 9% YoY) and profit after tax (EAT) of VND 2,172b (up 26%). With this result, MWG has fulfilled 41% of the revenue target and 46% of the year's NPAT target.

Market by numbers

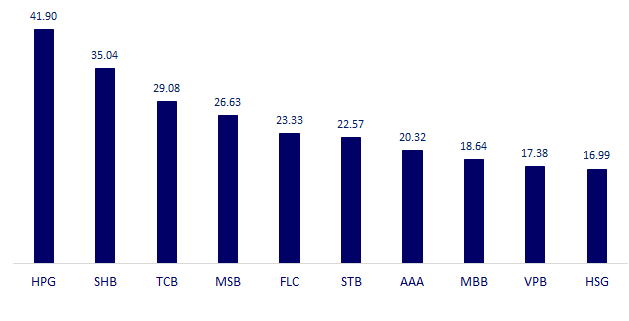

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

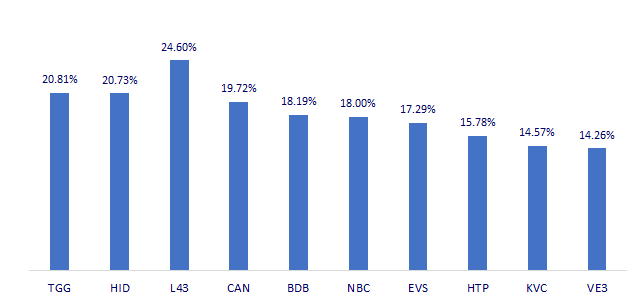

TOP INCREASES 3 CONSECUTIVE SESSIONS

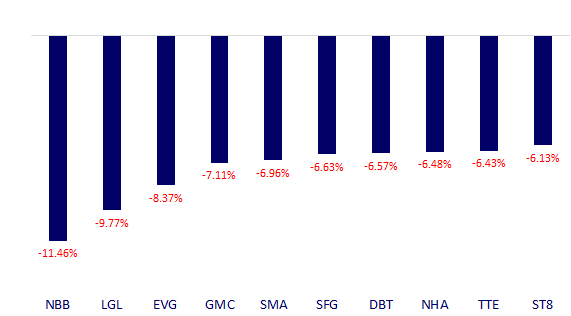

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.